Indian banks may have to take a haircut worth Rs 2.4 lakh crore to settle 50 large stressed assets which form over half of the country's total bad loans, according to Crisil Ratings.

A haircut is the difference between the loan amount and the actual value of the asset used as collateral. It reflects the lender's perception of the risk of fall in the value of assets.

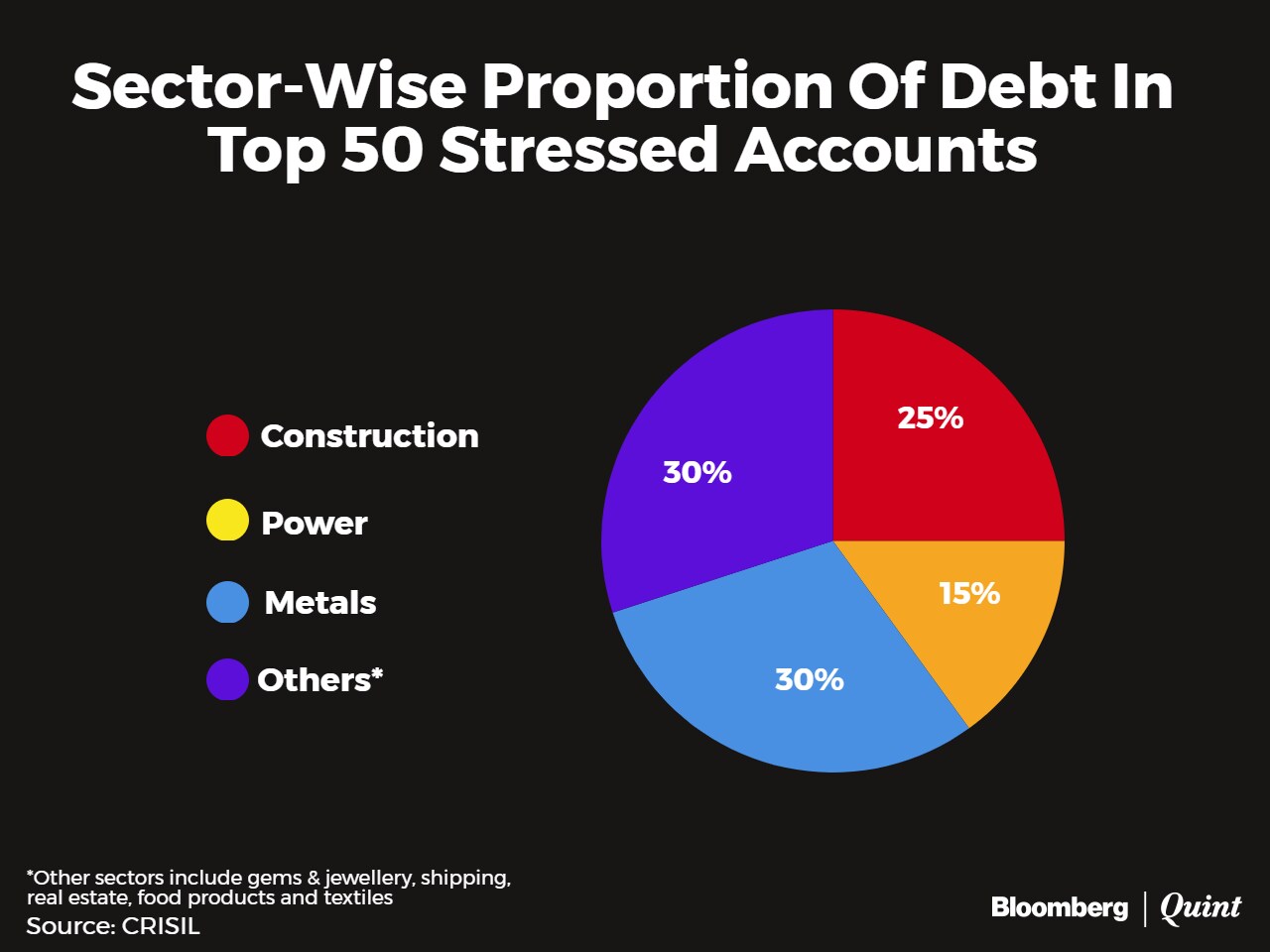

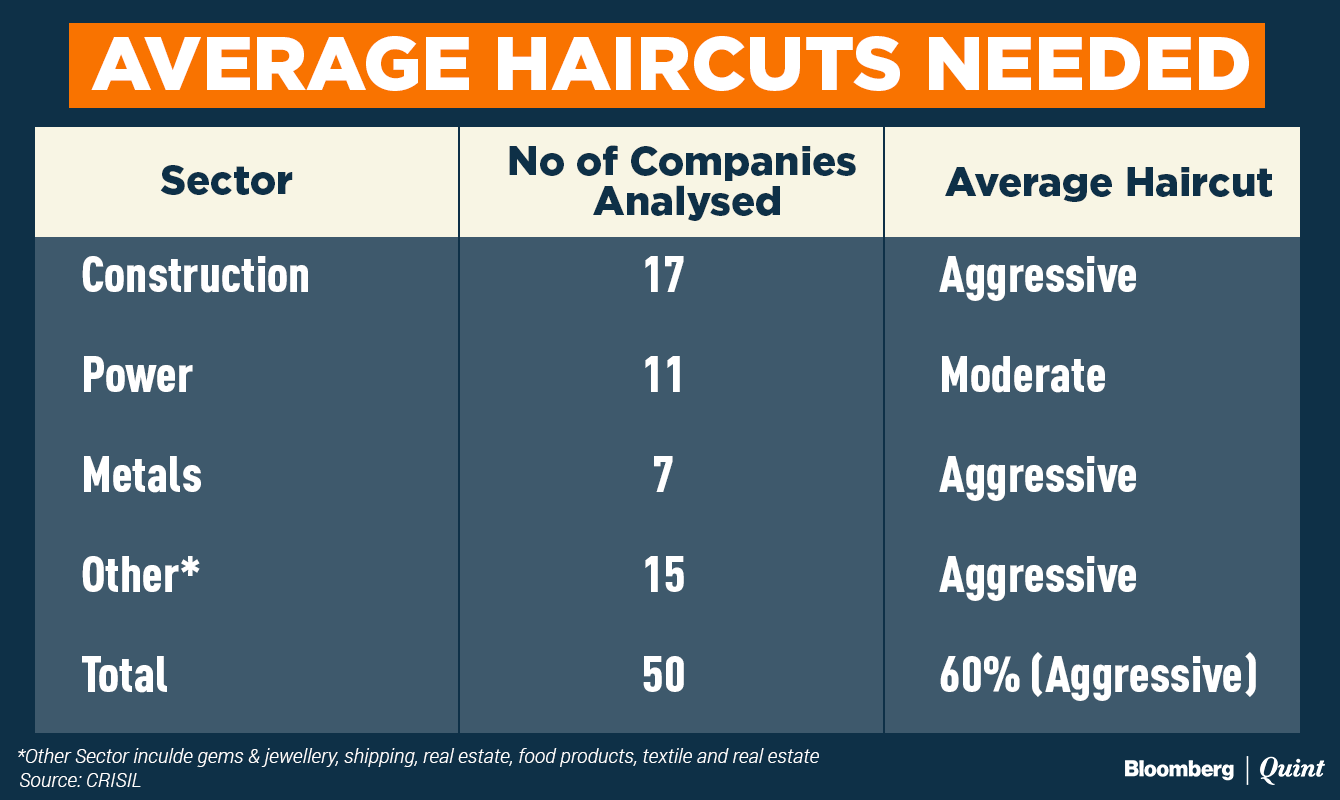

The 50 large accounts analysed by Crisil have a debt of Rs 4.3 lakh crore and banks will have to take a 60 percent cut to arrive at a sustainable level of debt, the ratings agency said in a report on Wednesday. Crisil estimates that banks have provisioned for around 40 percent of their exposure to these stressed assets.

The concentration of bad debt in these 50 accounts remained confined largely to the construction, power and metals sector.

Power sector companies would require moderate haircuts, while those from metals and constructions sector would need aggressive ones, said Pawan Agarwal, chief analytical officer at Crisil Ratings, in a media statement.

Indian banks have been saddled with bad debt of over Rs 8 lakh crore as of March. Failure to get resolution going with mechanisms like corporate debt restructuring and strategic debt restructuring, as the banks were not ready to take large haircuts, led the government to empower the Reserve Bank of India for issuing directives to settle these accounts quickly.

The central bank has identified 12 large accounts for resolution and asked its lenders to refer them for insolvency proceedings.

The unwillingness of banks to take it on the chin through haircuts has meant the can been kicked down the road, which has, in turn, resulted in debt ballooning to unsustainable levelsCRISIL Ratings report

Many of these assets, Crisil said, may not be viable anymore and thus "cosmetic restructuring" would not be enough. The report estimates that an incremental 20 percent provisioning would be required by banks, for which banks will need enough capital. That in turn could fuel credit growth which has lagged at historic lows this year, the report said.

Also Read: Banks To Take A Minimum Hit Of Rs 18,000 Crore For 12 NPA Accounts: India Ratings

Other Highlights

- Majority of the stressed assets in the power sector are thermal power plants with 48 percent of the debt in projects that are under construction. The eleven power companies have around Rs 68,000 crore of debt.

- The metal sector has been hit by low capacity utilisation. Around 81 percent of the metal companies' debt is in plants that have capacity utilisation of 40-60 percent. The other 19 percent is with companies that have utilisation less than 40 percent.

- The 17 construction companies have an aggregate debt of Rs 1.1 lakh crore. Order books of these companies shrank due to a slowdown in the sector and constrained execution capability. The interest cover ratio of these companies is was at 0.2 in FY16.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.