ICICI Bank Ltd. delivered strong earnings for the fourth quarter with profits and core income rising, alongside steady asset quality.

India's second-largest private lender's net profit rose 260.5% year-on-year to Rs 4,402 crore in the January-March period, according to its exchange filing. A year ago, the bank has stepped up provisions against standard assets, which had depressed profits.

- Net interest income, or core income of the bank, rose 16.8% over a year ago to Rs 10,431 crore.

- Other income fell to Rs 4,111.35 crore from Rs 4,255 crore.

ICICI Bank's gross non-performing asset ratio stood at 4.96% compared with 5.42% in the October-December quarter. Net NPA ratio improved 12 basis points sequentially to 1.14% in the fourth quarter.

Here's what brokerages had to say about the bank's quarterly earnings:

CLSA

- ICICI Bank delivered strong Q4 FY21 results with a big beat on core pre-provisioning operation profit, which rose 22% year-on-year.

- Segmental disclosure indicated corporate net slippage was negligible. Retail slippage increased to 2.4% in FY21 vs 1.4% in FY20, which is manageable given the pandemic.

- The key positive was the strong pick-up in domestic loan growth to 18%, which looks sustainable.

- With an end to the past five-six-year intense corporate credit cycle, its improving granularity of earnings and potentially ICICI Bank being the new growth leader among large banks, “we expect its rerating cycle to continue. We increase our target price from Rs 800 to Rs 825 apiece.”

Macquarie

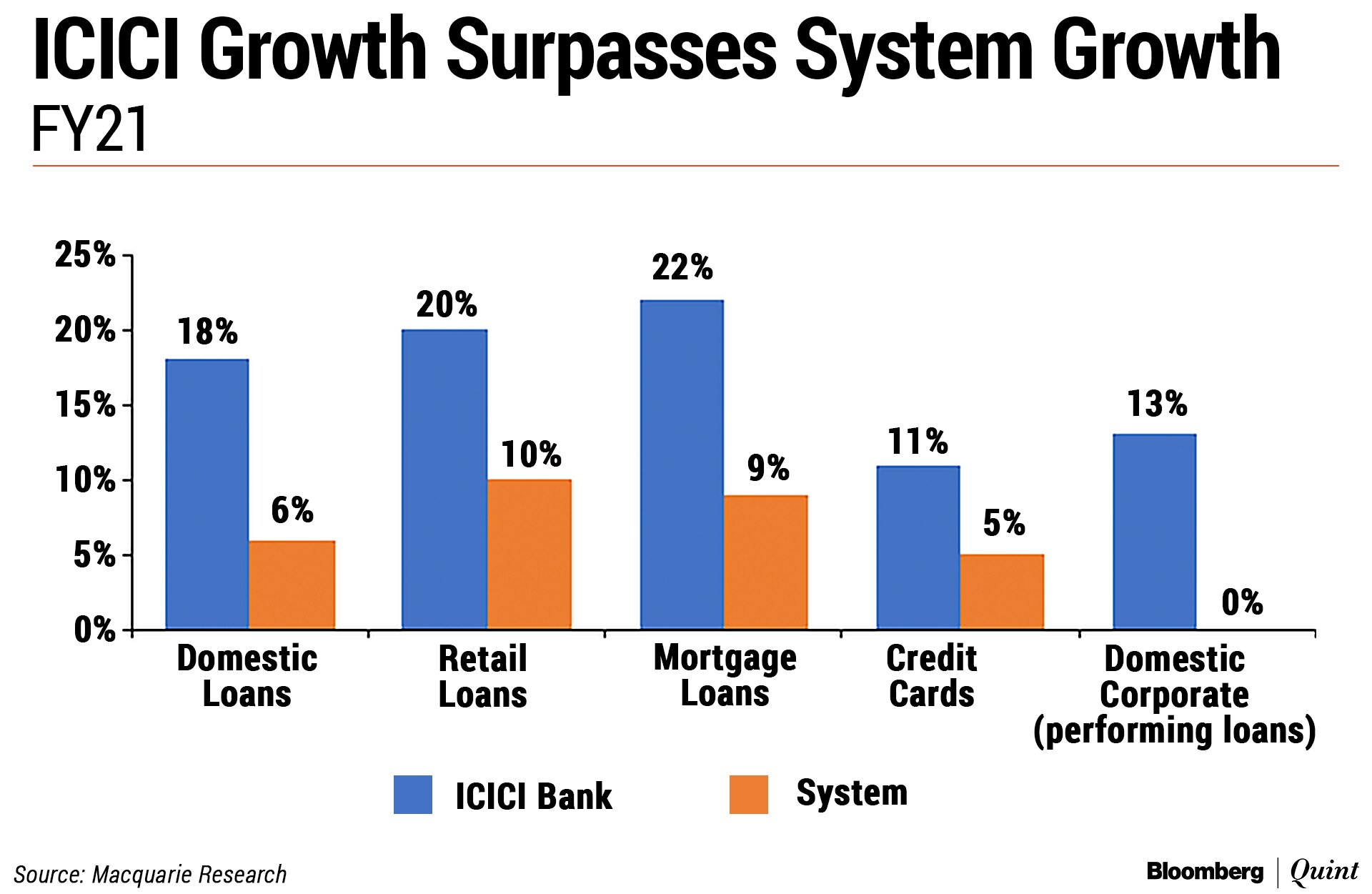

- For the first time in several years, ICICI Bank's loan growth was above HDFC Bank's loan growth.

- Retail loan growth at 20% year-on-year has been double the system retail loan growth and overall domestic loan growth of 18% year-on-year (6% quarter-on-quarter) has been ~3x that of system loan growth and ~400 basis points above its closest peer HDFC Bank.

- Is ICICI Bank back to its old days of aggressive lending considering such a strong loan growth has happened during a very tough year? We do believe that ICICI Bank has been cautious in this cycle largely lending to secured assets and well rated corporate loans and has ensured that loan book has been granular.

- Mortgage loans which form ~50% of the retail loan book has grown 22% year-on-year while unsecured loans including two-wheeler loans which form ~14% of the loan book have grown just 9%.

- Strong growth in corporate book has been driven by working capital loans to PSU companies and well rated corporates. Share of A- and above rated corporates has gone up from 56% in FY17 to ~73% in FY21.

- So, they have focused more on safer assets and grown the balance sheet. A lot is more different compared to the ICICI that we have seen in the past.

- In the past asset quality cycles, margins were very low at sub 3% and provision coverage ratio (PCR) was low at around ~50% vs. ~3.7% margins and PCR of ~78% today.

Jefferies

- ICICI Bank's profit for Q4 FY21 was below estimate as buffer provisions and lower treasury offset a healthy operating profit growth of 21%.

- “We are encouraged to see 20% year-on-year growth in retail loans and average CASA growth of 24%.”

- Asset quality is manageable and buffer provision is at 1.2% of loans. Covid has affected business, but management feels it's early to assess.

- “We tweak our earnings estimates to factor in results and some impact from the surge in Covid cases that is affecting business on ground. Still, we believe that core operating results and asset quality trends are faring well and hence we see drivers of falling volatility in earnings in place.”

- ICICI Bank is well placed to see re-rating in valuations with healthy growth and lower volatility. “We maintain our ‘Buy' call with a target price of Rs 780.”

Morgan Stanley

- ICICI showed strong asset quality performance despite the Covid wave and built in significant contingency buffers that are among the best of Indian banks.

- “FY21, in our view, also showcased strong digital capabilities at ICICI, as reflected in strong CASA growth. This helped the bank maintain margins despite increased liquidity on the balance sheet, strong market share gains in loans/payments.”

- The second Covid wave appears manageable; “our earnings estimates are essentially unchanged as we build offset from high excess provisions.”

- Maintains ‘overweight' rating with a target price of Rs 850 per share.

Emkay

- ICICI delivered a standout performance in Q4 with healthy credit growth, strong core profit and thus beat on profit.

- Gross NPA ratio dipped sharply to about 5% in Q4 vs pro forma NPA of 5.4% in Q3. It maintains healthy specific provision coverage ratio of 78% of NPAs and contingent buffer at 1% of loans.

- Retail growth remained strong at 20% year-on-year, with its share now at a high of 67%, mainly driven by strong traction in mortgages, auto and business loans.

- “We believe that strong retail growth and back-end support from corporate will help the bank deliver healthy growth in FY22-24, thus strengthening its core net interest margins/profitability further.”

Shares of ICICI Bank jumped as much as 6.2% to Rs 605.5 apiece on Monday morning compared with a 1.4% gain in the Nifty 50.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.