The Ministry of Finance on Sunday debunked "misleading information related to the new tax regime" in a post on X, formerly Twitter.

The post by Finance Ministry read:

"It has come to notice that misleading information related to the new tax regime is being spread on some social media platforms. It is therefore clarified that:

There is no new change which is coming in from 01.04.2024.

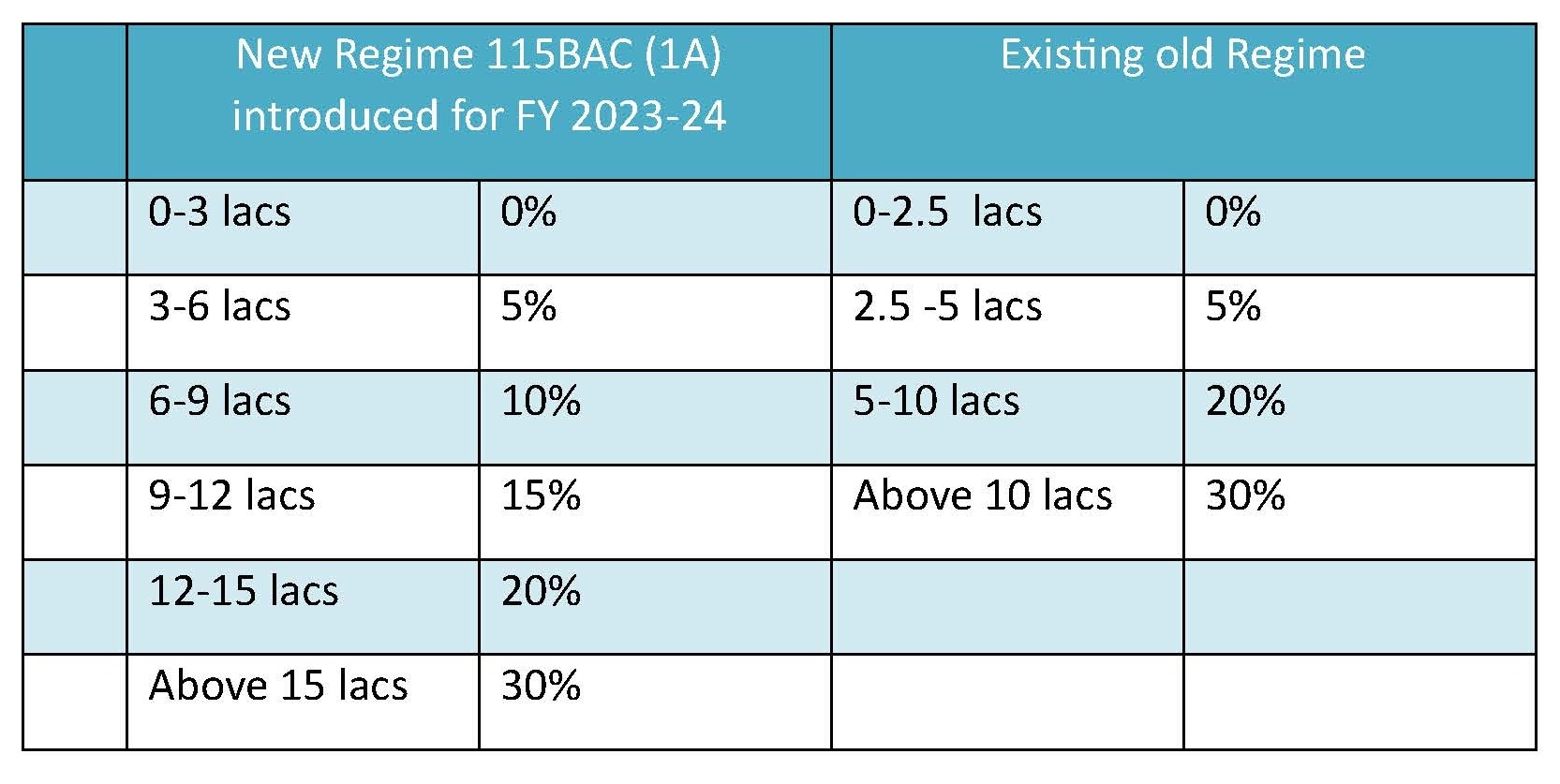

The new tax regime under section 115BAC(1A) was introduced in the Finance Act 2023, as compared to the existing old regime (without exemptions) (see image below)

The new tax regime is applicable for persons other than companies and firms, is applicable as a default regime from the Financial Year 2023-24 and the Assessment Year corresponding to this is AY 2024-25.

Under the new tax regime, the tax rates are significantly lower, though the benefit of various exemptions and deductions (other than the standard deduction of Rs. 50,000 from salary and Rs. 15,000 from family pension) is not available, as in the old regime.

The new tax regime is the default tax regime, however, taxpayers can choose the tax regime (old or new) that they think is beneficial to them.

Option for opting out from the new tax regime is available till the filing of return for the AY 2024-25. Eligible persons without any business income will have the option to choose the regime for each financial year. So, they can choose a new tax regime in one financial year and an old tax regime in another year and vice versa."

Under the revamped concessional tax regime, which will be effective from the next fiscal, no tax would be levied on income up to Rs 3 lakh. Income between Rs 3-6 lakh would be taxed at 5 percent; Rs 6-9 lakh at 10 percent, Rs 9-12 lakh at 15 percent, Rs 12-15 lakh at 20 percent and income of Rs 15 lakh and above will be taxed at 30 percent. However, no tax would be levied on annual income of up to Rs 7 lakh.

Sitharaman in her Budget proposed to extend the Rs 50,000 standard deduction benefit to persons opting for the new tax regime.

What Finance Minister Said...

On February 2024, Finance Minister Nirmala Sitharaman said the new tax regime will benefit the middle class as it will leave more money in their hands. She said it is not necessary to induce individuals to invest through government schemes but give them an opportunity to make a personal decision regarding investments.

This measure of the government was purely to reduce the tax burden on the middle class and is aligned to the promise which was made a couple of years ago of simplifying direct taxation, she said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.