Shares of Dr. Reddy's Laboratories Ltd. fell even as analysts maintained their bullish outlook on the company's growth outlook despite multiple one-offs hurting profitability in the first quarter.

The Hyderabad-based drugmaker's net profit stood at Rs 1,189 crore in the three months ended June, up 2.1 times over the previous year, according to its exchange filing. That compares with the Rs 699-crore consensus estimate of analysts tracked by Bloomberg.

Dr. Reddy's Q1 FY23 Highlights (YoY)

Revenue rose 6% to Rs 5,233 crore (Estimate: Rs 5,389 crore)

Ebitda was up 2.5% at Rs 941 crore (Estimate: Rs 1,116 crore)

Margin stood at 18% vs 18.6% (Estimate: 20.7%)

Several one-offs such as currency headwinds, higher commodity prices, inventory-led disruption and the outsourcing of Cidmus impacted margins negatively in Q1, according to analysts.

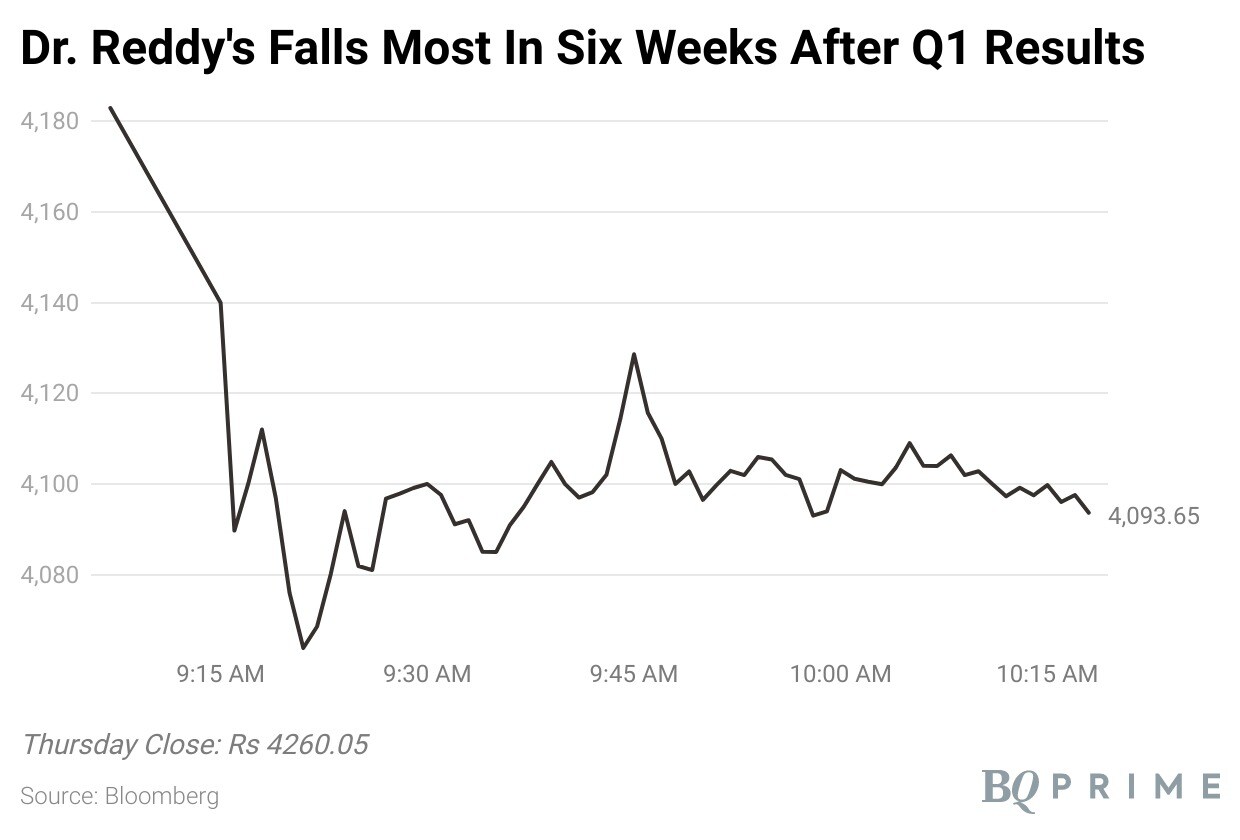

Shares of the company fell nearly 5%, the worst since June 17. Trading volume is more than eight times the 30-day average. The stock closed 4% lower on Friday.

Of the 42 analysts tracking the company, 37 maintain 'buy' and five suggest 'hold'. The return potential of the stock is 21.5%. Since the company's earnings, about 14 analysts have reiterated 'buy' while three retained 'hold' or 'neutral' recommendations.

Here's what brokerages made of Dr. Reddy's Q1 results:

Kotak Institutional Equities

Maintains 'add' with an unchanged fair value of Rs 4,520, implying a potential upside of over 6%.

In a quarter marred by one-offs, Dr. Reddy's delivered a weak margin performance. Excluding gRevlimid, FY2023/24 U.S. growth remains a concern. Nevertheless, Dr. Reddy's stays on the right course with efficient execution of its strategy of boosting ex-U.S. growth.

Higher domestic sales partially offset weakness in the U.S., Russia CIS, Europe and pharma and active ingredients segment.

Adjusted for various positive and negative one-offs, Q1 gross margins were in the 51-54% range. Dr. Reddy's expects gross margins to improve led by new launches, internal sourcing for acquired brands like Cidmus and cost improvement programs.

On a positive note, Kotak notes Dr. Reddy's views of not witnessing further deterioration in the U.S. generics pricing are largely in sync with Teva's recent comments.

Given Dr. Reddy's core margin outlook remains healthy given continued traction in branded markets, Kotak keeps our FY2024/25 estimates largely unchanged.

Dolat Capital

Maintains 'buy' rating with revised target price of Rs 5,130 (earlier Rs 5,165), implying a potential upside of 20%.

Launched seven new products and guided 25 product launches including gRevlimid in September which will have meaningful impact on earnings.

Adjusted for one-offs and Covid base, India growth was in healthy double digits. Downgrades Ebitda estimates by 10.5%/0.9% in FY23/FY24 assuming lower-than-expected gross margins on high input cost and U.S. price erosion.

Key risks are higher-than-expected price erosion in the U.S., regulatory issues related to its facilities, National Pharmaceutical Pricing Authority price control on drugs in India, high input cost.

Jefferies

Maintains 'buy' rating with a target price of Rs 5,224 (earlier Rs 5,245), implying a potential upside of 22%.

Revenue was in line, Ebitda 15% below the brokerage's estimates. India revenue growth was offset by higher competition in key U.S. molecules.

One-time legal settlement income boosted bottom line. Lower U.S. revenue, forex movement and higher commodity costs led to margin compression.

Dr. Reddy's to launch gRevlimid from September and will be the key growth driver in U.S.

Major cost headwinds have stabilised and should not pose major risks to margins.

Prabhudas Lilladher

Maintains 'buy' rating, cuts target price to Rs 4,750 from Rs 4,900, implying a potential upside of 7.2%.

Profitability adjusted for one-time divestment income was weak impacted by lower GMs and U.S. sales.

Expect margins to improve with easing of commodity and as revenue scale up with new launches in U.S. like gRevlimid.

Delay in key ANDA approvals and prolonged inflationary environment of raw material prices are key risks to our call.

Yes Securities

Maintains 'buy' rating, cuts target price to Rs 5,120 from Rs 5,350, implying a potential upside of 20.2%.

Weak numbers with disappointment in U.S. sales overshadowing one-off income from India/settlement; margin was far from much touted 25% though gross margin had one-offs due to forex and higher commodity costs.

Russia business is tracking much below our FY23 estimate which has resulted in revenue cuts to the entire Russia/CIS geographies.

Management reiterated 25% margin guidance which would put a lot of burden on Revlimid over next 12-18 months to deliver.

Motilal Oswal

Maintains 'buy' rating at a target price of Rs 5,000, implying a potential upside of 17%.

Maintains FY23/FY24 EPS estimates and expect 16% earnings CAGR over FY22-24 backed by limited competition product launches (such as gRevlimid in 2HFY23), steady industry outperformance in DF/Russia segment, revival in PSAI segment (through new launches/catering newer markets) and better outlook in Russia business.

Multiple non-recurring factors (currency headwinds, elevated commodity prices, inventory-led disruption and reduced business further dragging operating leverage) adversely affected margins. Even outsourcing of ‘Cidmus' (product acquired from Novartis) impacted margins negatively in Q1.

Nirmal Bang

Maintains 'buy' rating at a target price of Rs 5,587, implying a potential upside of 31%.

Dr. Reddy's came out with stellar results for Q1 on the back of solid performance on all parameters, except for the topline. The beat on our estimates was aided by investment of brands to other entities which was included in the topline; proceeds from Indivior as full and final settlement of claims relating to patent infringement allegation amount which was included in other income.

PSAI business performance was weak and in line with the broader market trend, mostly on account of higher base in Q1FY22 due to Covid-related product sales.

Had already baked in a ramp-up in revenue on account of gRevlimid launch; however, Nirmal Bang fine-tunes its numbers to account for exceptional gains on account of one-offs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.