Biscuit makers are putting more cookies in your jar, throwing in everything from new flavours to sattu or gram flour. All this for a bigger share of your coffee table spread.

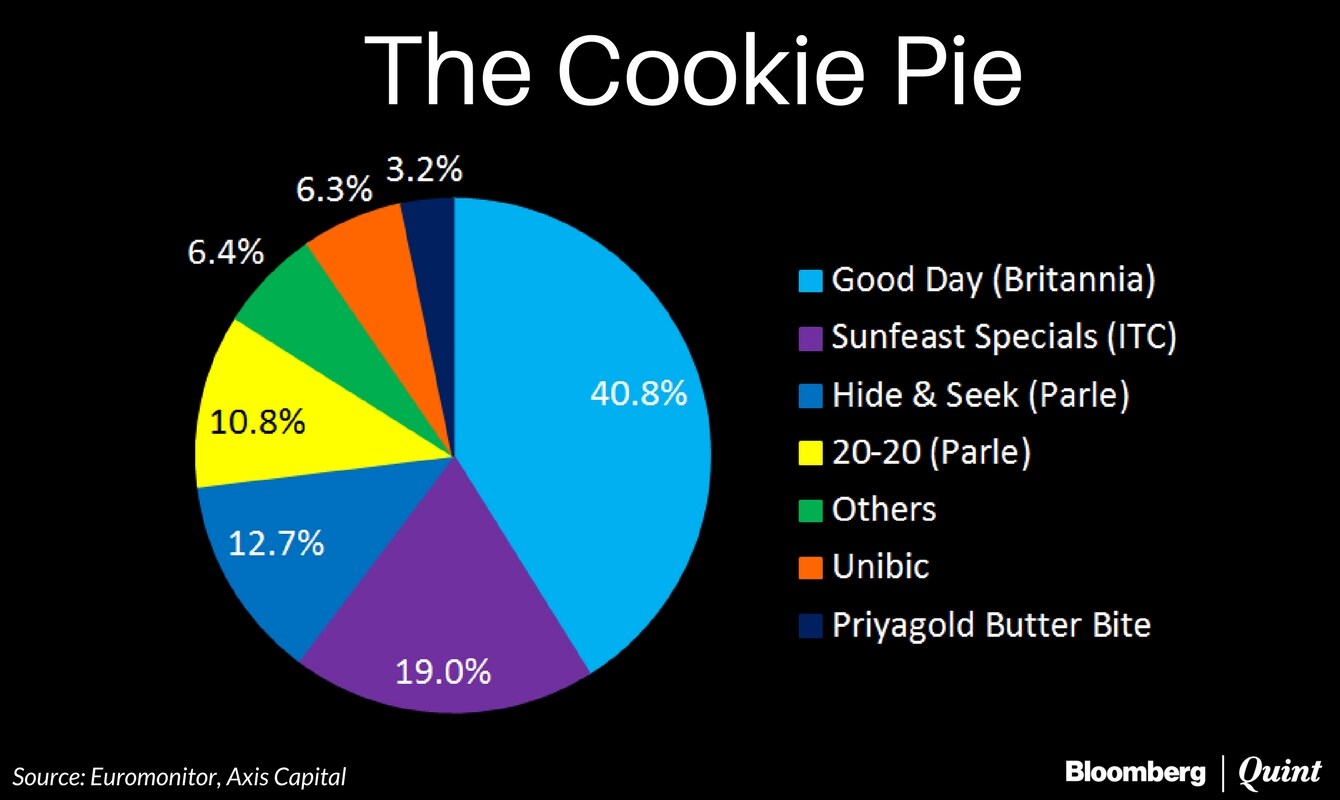

Britannia Industries Ltd., maker of the best-selling Good Day cookies, and second-placed Parle Products Ltd. face a challenge from ITC Ltd. The cigarettes-to-consumer goods major's sustained focus through the Moms Magic brand has started to pay off, Axis Capital said in a report. While the top two companies lost share in the past two years, ITC remained stable. And it's now getting aggressive.

What's aiding the shift in the Rs 9,900-crore market is changing consumer preferences. Long-time staple glucose biscuits like Britannia's Tiger and Parle-G are growing at 5 percent annually, about half the pace of cookies. Companies are betting on this premiumisation.

“There is an evolution from biscuits to cookies and more innovations will be the driver,” said Alpana Parida, managing director of brand strategist DY Works. “Britannia is synonymous with innovation in the cookie market. I think the battle for a larger share of the cookie pie has just begun.”

The Goods and Services Tax also helped. While initial disruption hurt volumes, total levies came down from 22-24 percent to 18 percent. The companies didn't cut prices; they added more cookies to the packs instead. Britannia offers 13-26 percent extra grammage on its Good Day brand, while ITC's Moms Magic has increased it by 21-25 percent. Parle Products added 25 percent weight, the report said.

ITC is marketing its products harder. It offers cash benefits over and above a 15 percent margin to retailers, said Sanjay Sheth, owner of Gayatri Dry Fruits and General Stores in Crawford Market in south Mumbai. In comparison, Britannia offers a 15 percent margin and Parle 10-12 percent, he said.

“We offer a choice to the customer with various pack sizes. We are increasing availability at the store level,” Hemant Malik, chief executive officer of ITC's foods division, told BloombergQuint.

ITC plans to improve its distribution by 5-10 percent from a network of 3.5 to 4 million outlets. It has a share of about 20 percent, according to the Axis Bank report. The objective is to boost it by up to 2 percentage points every year, Malik said.

That won't be easy. Other retailers in Mumbai BloombergQuint spoke to said it's Britannia that sells the most. The maker of Nutri Choice contributes half the biscuit sales for Jay Patel, owner of L2 Mini Mart in Dadar. The company is pushing to display its products at his storefront. Parle, with brands like Hide & Seek, has limited variants but flies off the shelves as well, he said. ITC and Unibic contribute only a tenth of his sales.

Junaid Khan, who runs two outlets in Mumbai, said ITC paid him to put up advertisements. Yet, consumers' first choice is Britannia or Parle.

The Kolkata-based company has unveiled new variants to attract customers. It launched a fruit-and-nuts variant of the Moms Magic brand and a five-grain product at Rs 20, Malik said. And a cookie made with sattu under the Farmlite brand.

Rivals won't cede ground easily. Parle targets to increase its share from 25 percent to 30 percent in the next one year, riding on Hide & Seek and Parle 20-20. Cookies is the fastest growing category, Mayank Shah, category head at Parle Products told BloombergQuint. “We are actively pursuing opportunities in the mid- and high-range cookie space.”

Britannia, which has a 40.8 percent share, declined to comment for the story. The maker of Bourbon and Pure Magic is betting on increasing its dominance through rural penetration, Gunjan Shah, vice-president (sales), told BloombergQuint recently. The company introduced lower-priced packs at Rs 5-10 each for its premium and mid-premium range including Treat, Choco-chip Cookies, Bourbon and VitaMarie. It also unveiled Good Day Wonderfulls in choco nut, butter almond, and berries and nuts flavours.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.