Shares of Bandhan Bank gained after analysts said the removal of pricing caps for microfinance loans was "positive".

The Reserve Bank of India issued master directions on Monday, saying all microfinance lenders have been mandated to set up a board-approved policy for pricing of loans.

Besides Bandhan Bank, NBFC-MFIs such as CreditAccess Grameen, Spandana Sphoorty Ltd. and Satin Credit Care Networks Ltd., and small finance banks are likely to benefit from the pricing flexibility and raising the limit on household income for availing MFI loans, analysts said.

The framework for microfinance loans announced by the RBI will help deepen penetration of micro-credit, CS Ghosh, managing director and chief executive officer at Bandhan Bank, told PTI. The microfinance firm-turned-lender, according to him, expects the revised norms to harmonise the regulatory frameworks of various types of lenders and ensure better risk mitigation and financial inclusion.

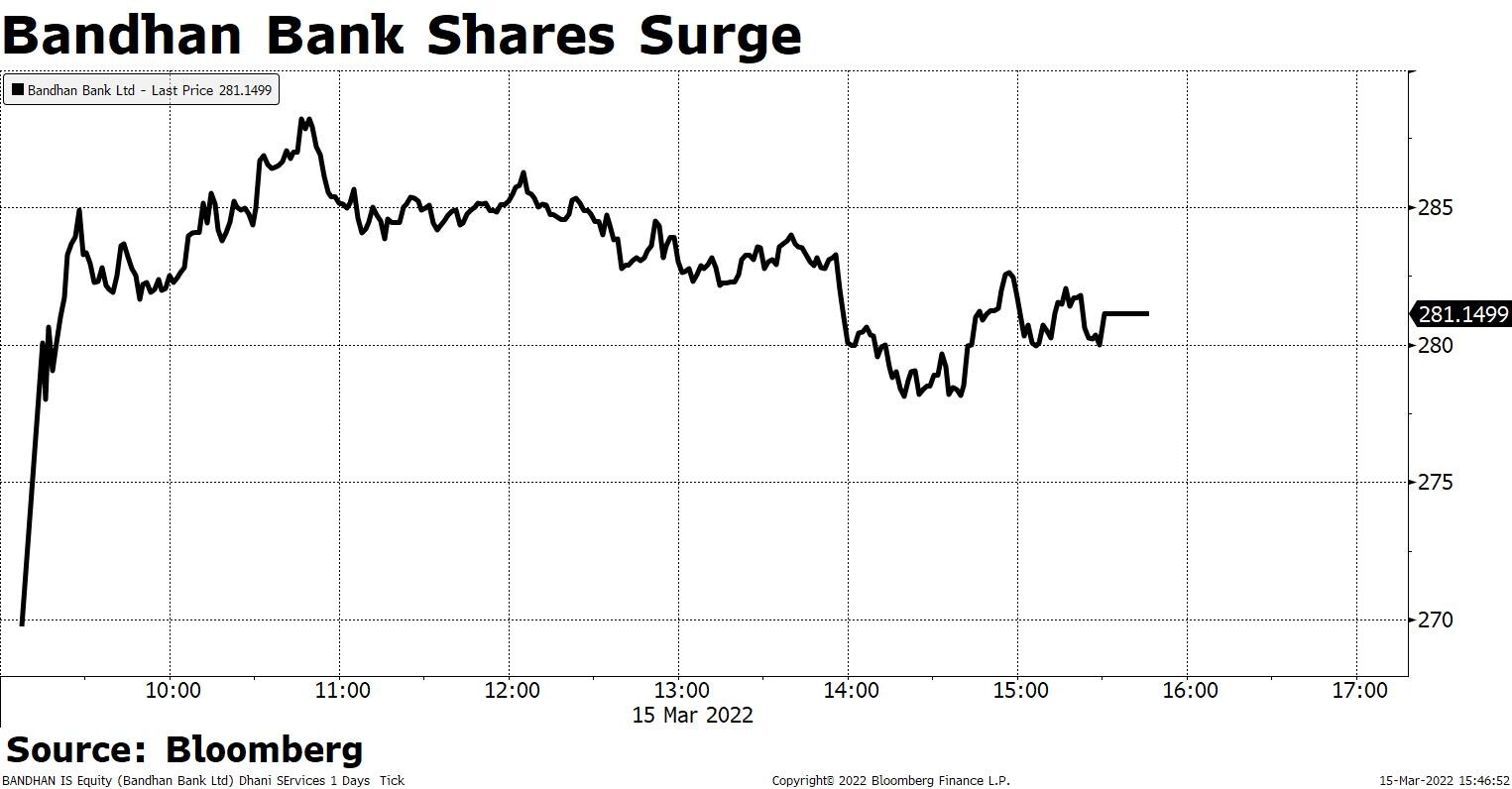

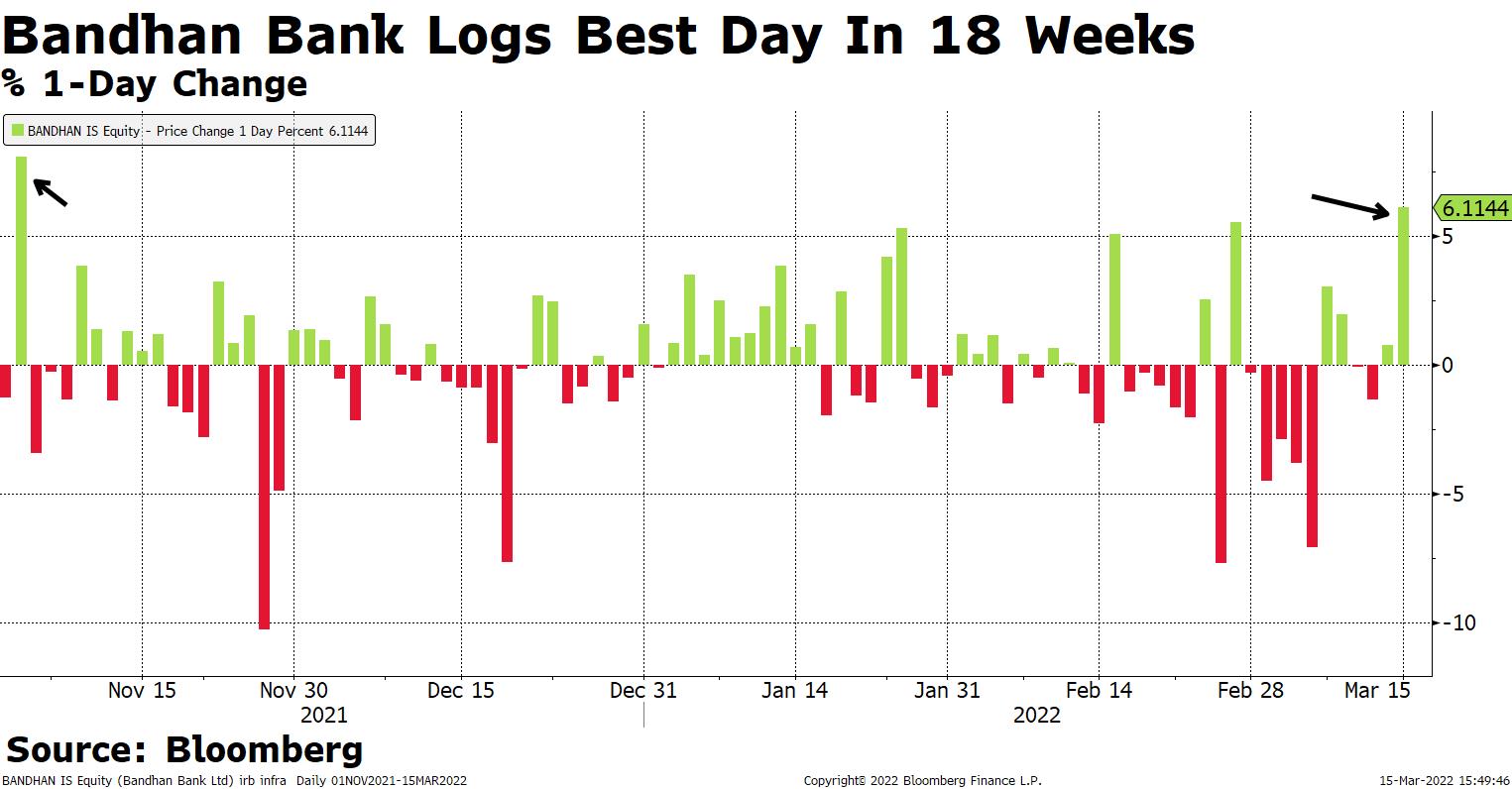

Shares of Bandhan Bank closed with 6.11% gains on Tuesday—the best in 18 weeks. The stock's trading volume was nearly five times the 30-day average when markets closed.

Of the 29 analysts tracking the company, 18 maintain a 'buy', five suggest a 'hold' and six recommend a 'sell', according to Bloomberg data. The 12-month consensus price target implies an upside of 19.8%.

Here's what analysts have to say about Bandhan Bank.

Nomura

Upgrades from 'neutral' to 'buy' with the target price raised to Rs 375 from Rs 330; an implied return of 33.38%.

Recent corrections have turned risk/reward favourable for Bandhan Bank.

Multiple reasons to turn positive on the stock such as the cyclical recovery in microfinance, sharp recovery in growth-disbursement, normalisation of collection trends and reduced competitive intensity.

Micro factors remains intacts for MFIs despite a weakening macro environment.

Sees upside risks to earnings estimates.

Do not rule out further re-rating of the stock to 3x book from 2.5x book.

Expects stress poll to start reducing sharply.

Any reversal in provisions can be used to build counter-cyclical buffers, which could trigger further re-rating.

Jefferies

The RBI's norms for micro-lending are most positive for NBFC-MFIs and mildly positive for banks like Bandhan Bank.

Allowing pricing flexibility to NBFC-MFIs and removing the cap on spreads will clear the earlier overhang on banks about any such cap.

Limiting monthly EMI to 50% of household income and raising the limit on household income to avail MFI loans to Rs 3,00,000 would ensure better risk mitigation.

Expects the regulation to aid listed NBFC-MFIs like CreditAccess Grameen, Spandana Sphoorty, Satin Credit Care Network and banks like Bandhan Bank and small finance banks.

Maintains 'buy' on Bandhan Bank with a target price of Rs 380—an implied return of 28.60%

Key risks for Bandhan Bank: Further deterioration of collections due to Omicron wave and weak economic recovery.

Kotak Institutional Equities Research

The RBI's new rules will have a positive impact on NBFC-MFIs relative to banks.

Needs to be seen if the norms lead to rules-based lending or bring in some element of risk-based underwriting.

Removal of spread cap helps smaller banks, as it levels the playing field.

Smaller lenders are likely to achieve better viability during downturns and lead to financial inclusion.

Pricing freedom is likely to result in more investments focused on improving penetration.

Views the idea of microfinance lending purely based on income assessment with caution.

Maintains 'add' with a target price at Rs 330—an implied return of 7.20%.

ICICI Securities

The harmonised regulatory regime will lead to level playing field for all incumbents and improve provision of credit to small borrowers in a transparent manner.

NBFC-MFIs stand to gain from the RBI's revised norms the most.

Prefers CreditAccess Grameen in the NBFC-MFI segment.

The impact of the revised regulation on small finance banks and banks are neutral to positive.

Maintains 'buy' on Bandhan Bank with a target price at Rs 390—an implied return of 31.98%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.