Poor rural demand, high prices and supply-chain issues continued to hurt Indian auto sales in February, according to analysts.

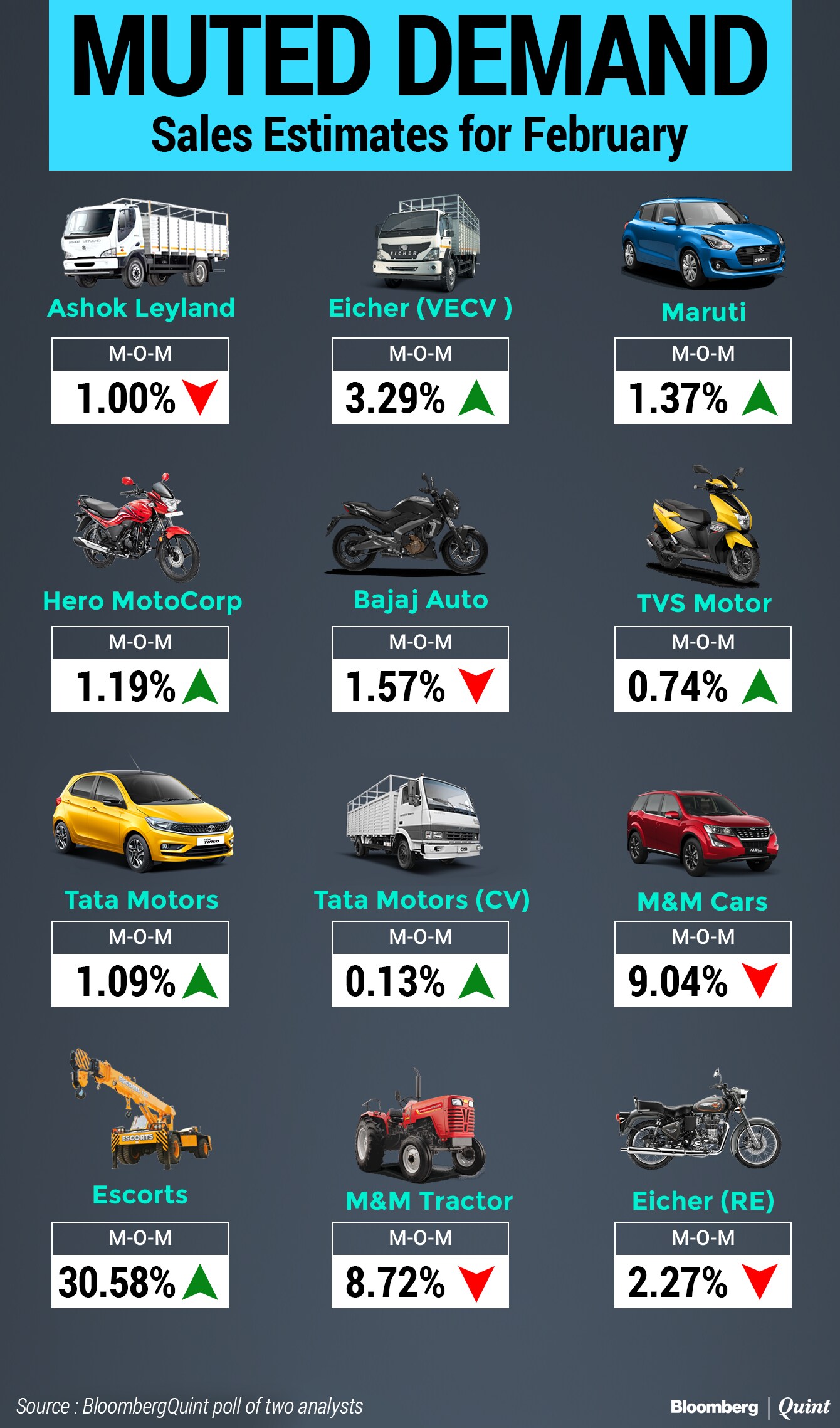

Factory-gate shipments of most automakers either fell or rose marginally month-on-month in February, according to data compiled from research reports of Emkay Global and Dolat Capital. While wholesales rose over a year earlier, that came on a low base.

"The automobile sector dispatches were expected to be muted in February 2022 across segments due to weak rural demand, increase in vehicle prices and supply-side challenges," analysts at Dolat Capital wrote in a note.

Indian automakers' business has been on a decline in the years leading to the Covid-19 pandemic. While the lockdown caused a fall in sales last year, the global shortage of chips—that control everything from vehicle steering to emissions—further stalled the nascent recovery.

Analysts expect some improvement in sales for most passenger vehicle makers, except Mahindra & Mahindra Ltd., on month-on-month basis. Yet, they anticipate the supply-chain issues to get prolonged due to disruptions caused by the Russia-Ukraine crisis, and a rise in oil and gas prices.

The underlying demand remains strong with sustained enquiries and bookings, especially for the recently launched models like the Mahindra XUV 700 and Tata Motors Ltd.'s Punch.

Two-wheeler sales remained under stress from poor rural demand, particularly for entry-level motorcycles, because of higher prices and financial stress caused by the pandemic.

Higher system inventory continues to be a concern as well, according to Dolat Capital. Increasing demand for electric two-wheelers (non-registered vehicles) is "cannibalising industry volume", especially in the scooter segment, they said.

Commercial vehicles, however, rose, driven by improvement in chip supplies for light commercial vehicles, greater demand for intermediate commercial vehicles, and the push for infrastructure, construction and mining activities, according to the analysts.

The upward momentum in CVs should persist in February as indicated by the channel checks, said Emkay Global . Commercial vehicle makers, barring Ashok Leyland Ltd., saw a growth of more than 3% month-on-month.

Tractor demand, however, didn't recover. Dolat Capital said that higher channel inventory and rising tractor prices are key factors for the lag. Some revival can be seen in the southern region, it said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.