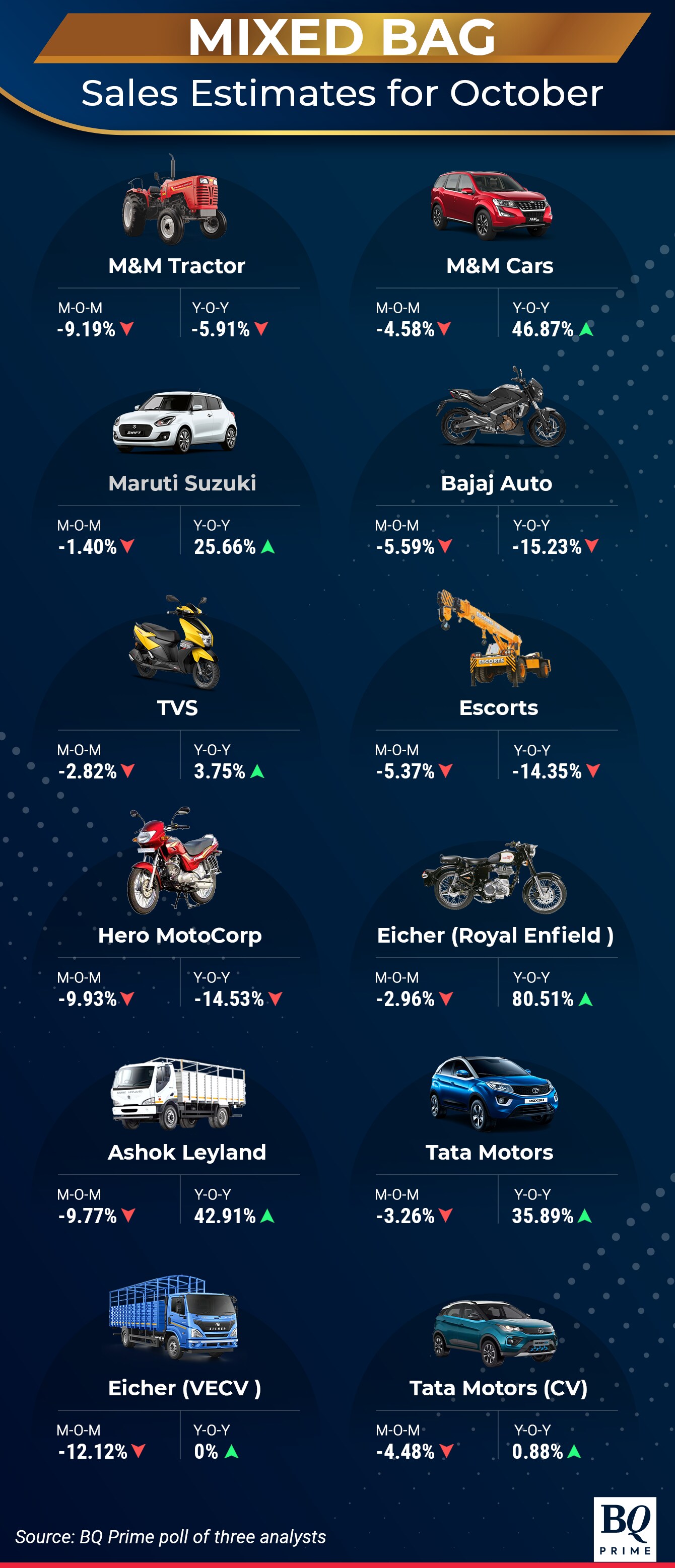

India's auto sales in October are expected to be a mixed bag as a festival booster failed to lift buyer sentiment in rural markets, while the passenger vehicle segment continued to stride ahead.

Strong demand for high-end passenger vehicles and premium two-wheelers was offset by muted sales of entry-level cars, bikes and scooters, along with a moderation in volumes of commercial vehicles, according to research reports from Dolat Capital Market Pvt., Emkay Global Financial Services Ltd. and Nomura Financial Advisory and Securities India Pvt.

“Although urban and semi-urban sales are strong, rural demand is still under stress due to erratic rainfall in many parts of the country causing impact on yield of crops like soya, paddy and pulses,” Dolat Capital said in a report. People, it said, are deferring their purchases due to high inflation.

Analysts said the demand for scooters outperformed that for motorcycles.

Even in the passenger vehicle category, the factor of festival demand had a limited role to play as most automakers witnessed decline in sales month-on-month, an average of estimates from the three brokerages showed.

The sales were, however, significantly higher compared with last year as a severe shortage of semiconductors had curbed production in the comparable period.

Strong production volume due to better supply-chain management by companies and large order book aided sales in the month, analysts said.

According to Nomura, mass-segment car sales remained slow and auto makers may have to reduce production or raise discounts to clear inventory.

The brokerage expects strong freight rates to help sustain fleet operators' profitability at high levels. Demand for medium and heavy commercial vehicles is likely to have remained strong, driven by replacement demand, Dolat Capital said.

Analysts see Ashok Leyland gaining market share due to aggressive pricing and increased demand for higher-tonnage vehicles.

Tractor dispatches are expected to decline as companies sought to reduce inventory with dealers. However, retail demand improved on account of strong rainfall in the last two months with festive demand providing a boost, Dolat Capital said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.