An auction of benchmark Indian government bonds failed to go through completely amid rising interest rates. Bonds maturing in 2032 were being auctioned for the first time on Friday.

Rs 13,000 crore in 2032 bonds were up for auction.

Bids for Rs 7,557 crore accepted at a cut-off yield of 6.54%.

Rs 5,442 crore in 2032 bonds devolved on primary dealers.

Rs 4,000 crore in floating rate bonds and Rs 7,000 crore in 2061 bonds sold at auction.

An auction of the new benchmark bond typically sees strong demand as most investors want to hold it in the portfolio. This drives up prices and pulls down yields, which move inversely. Typically, a new 10-year bond is issued at a coupon rate well below the existing benchmark.

Bids accepted for the 2032 bond were 4 basis points below the prevailing 10-year yield of 5.58%.

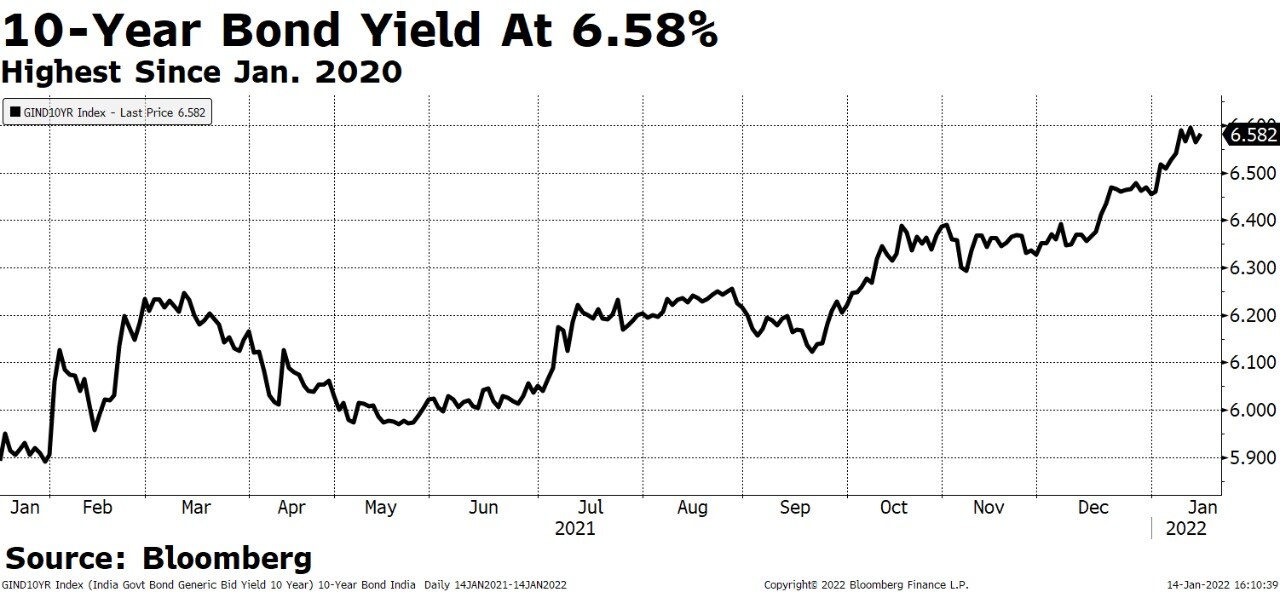

Bond yields have consistently risen over the past few months due to a confluence of factors.

Rising global inflation and higher global yields, alongside an expectation of normalisation of monetary policy have pushed up interest rates. In addition, sporadic sales of bonds by the Reserve Bank of India in the secondary markets has led to speculation of the central bank normalising liquidity conditions. In addition, government borrowings in the upcoming budget are also set to remain elevated.

"Upward pressure on government security yields will persist with rising global yields as the Fed has turned decidedly more hawkish," said IDFC First Bank in a note dated Jan.6. "Domestically, the RBI's liquidity management (variable rate reverse repo auctions) will maintain upward pressure on short-end yields. The rise in 10-year government bond yields is likely to be capped at 6.6% till March 2022, but only with the RBI intervention," the note added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.