Adani Ports and Special Economic Zone Ltd. in on course to report strong volume, revenue and earnings before interest, taxes, depreciation, and amortisation or Ebitda growth along with good cash flows in the fourth quarter of the financial year gone by, according to Citi Research.

The expectation of strong performance in the fourth-quarter results clubbed with reasonable valuation has meant that the research firm has put the company on a 90 days positive catalyst watch.

"We are pencilling in 4QFY24E port cargo volume at 109 million tonne (+31% year-on-year), rail container volume at about 1,60,000 twenty-foot equivalent units, and GPWIS volume at 5.3 million tonne," Citi said in an April 1 note.

Strong volume growth should push core port Ebitda to grow at 29% year-on-year and consolidated Ebitda and profit-before-tax year-on-year growth of 27% and 24%, respectively.

Citi has maintained a 'buy' rating on the stock, with the target price increased to Rs 1,758 apiece from Rs 1,564 apiece earlier.

Adani Port remains Citi's top pick in this sector.

Adani Port has only emerged stronger following a short-seller report last year, with strong business momentum, reduced leverage and increased market dominance.

Further, valuations, despite strong stock performance, still seem reasonable at 30 times P/E and 19 times EV/Ebitda on FY25E estimates.

"We believe these valuations leave ample room for upside given the quality and scale of the underlying business. As a result, we open a 90-day positive catalyst watch," Citi Research said.

Increasing Market Dominance

Adani Port announced acquisition of 95% equity stake in Gopalpur Port for a cash consideration of Rs 1,350 crore. The acquisition was done at EV of Rs 3,080 crore, Citi said.

The valuation appears reasonable with Rs 3,080 crore EV implying EV/Ebitda of 13 times on FY24E and 10 times on FY25E on company estimates, the research firm noted.

Given reasonable valuations, possibility to increase both volume and capacity and increase in margin (from current 45% Ebitda margin), Citi view the acquisition as incrementally positive.

"Adani Ports has updated that its FY24 port cargo volume has reached 420 million tonne and has comfortably exceeded not only its original guidance (370-390 million tonne) but also the revised guidance," the note said.

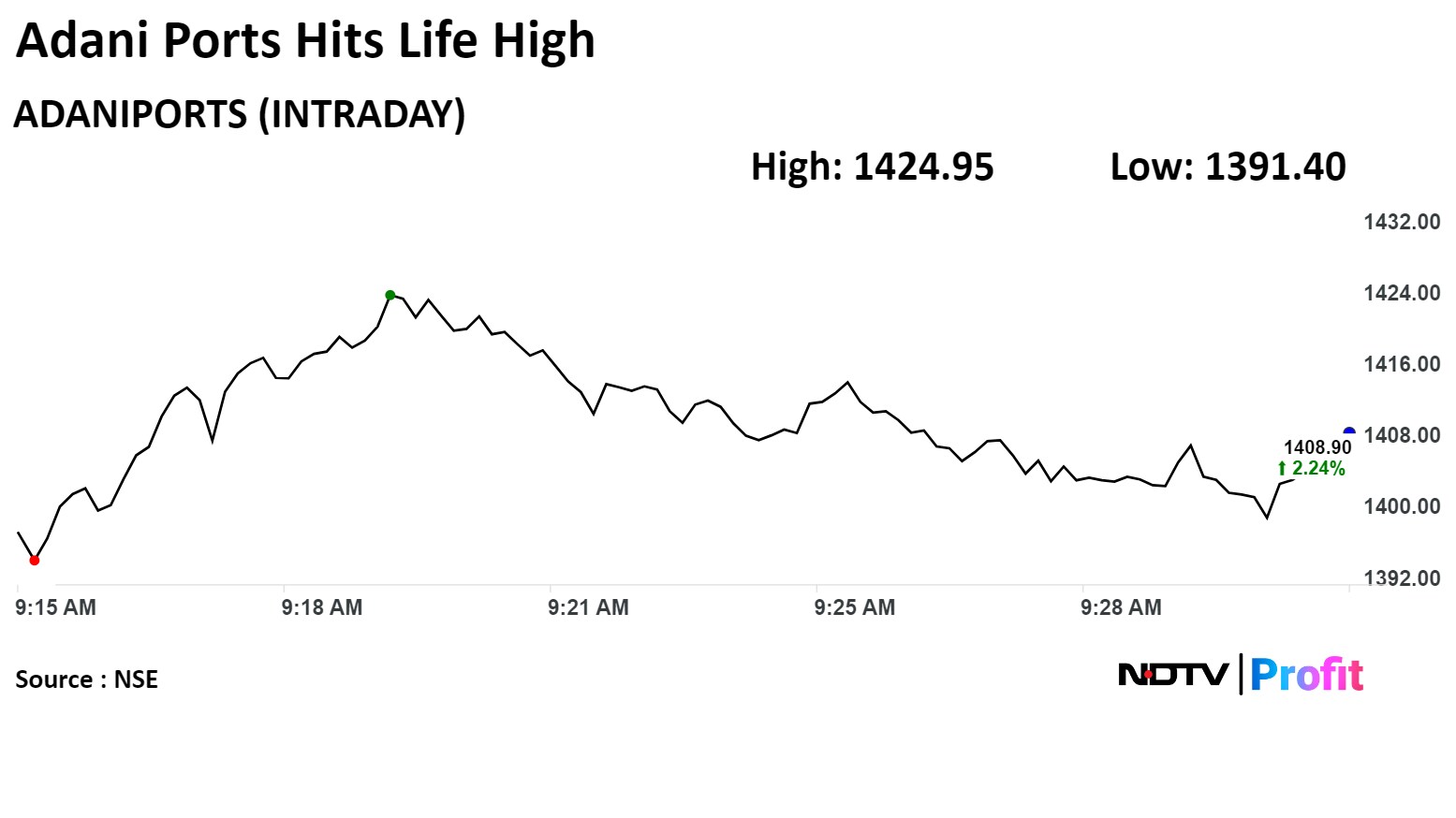

Shares of Adani Ports rose as much as 3.56% to hit a record high of Rs 1,424.95 apiece. The stock pared gains to trade 2.03% higher at Rs 1,403.80 apiece, compared to 0.7% decline in NSE Nifty 50 index as of 9:32 am.

The stock has risen 123.61% in past 12 months. The relative strength index was at 68.

Out of 22 analysts tracking the company, 20 maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.1%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.