Adani Ports and Special Economic Zone Ltd.'s stake acquisition in Gopalpur Port Ltd. is seen incrementally positive and will help it grow its market share faster, according to Citi Research.

The Adani Group company will acquire 95% stake in Gopalpur Port for Rs 1,349 crore, to strengthen its eastern presence, according to an exchange filing.

Adani Ports entered into a definitive agreement to purchase shares from existing shareholders; 56% stake from SP Port Maintenance Pvt. and 39% from Orissa Stevedores, the filing said.

The enterprise value of the acquisition is Rs 3,080 crore, with a contingent consideration of Rs 270 crore, estimated to be payable after 5.5 years.

Post acquisition, Orissa Stevedores will continue as a joint venture with a 5% stake.

"Given reasonable valuations, possibility to increase both volume and capacity and increase in margin, we view the acquisition as incrementally positive," the research firm said.

"Adani Port remains our top pick."

Logistics Business Growing

Adani Ports' strong and dominant competitive position in India's port industry continues to improve. Market share gains are visible and balance sheet remains healthy. Further, logistics business is now becoming sizable and growing fast with healthy margins, Citi said.

The research firm has a 'buy' rating on the stock, with a target price of Rs 1,564 apiece.

The company's dominance in the port sector continues to increase with strong cash flows. Recent results also show strong traction in the logistics business, with 12% market share in container train operations. Rail container volume grew 17% year-on-year and bulk volume grew 55% year-on-year in Q3 FY24, it said.

Due to strong performance in April-December, Adani Ports had increased its FY24 cargo guidance to 400 million tonne from 370-390 million tonne and Ebitda guidance to Rs 15,000 crore, Citi noted.

Adani Ports expects to continue on the growth trajectory seen over the past three years and is confident of 20-25% growth in rail volumes. Adani logistics has 13% market share in container logistics now and is confident of growing its market share at a fast pace, Citi said.

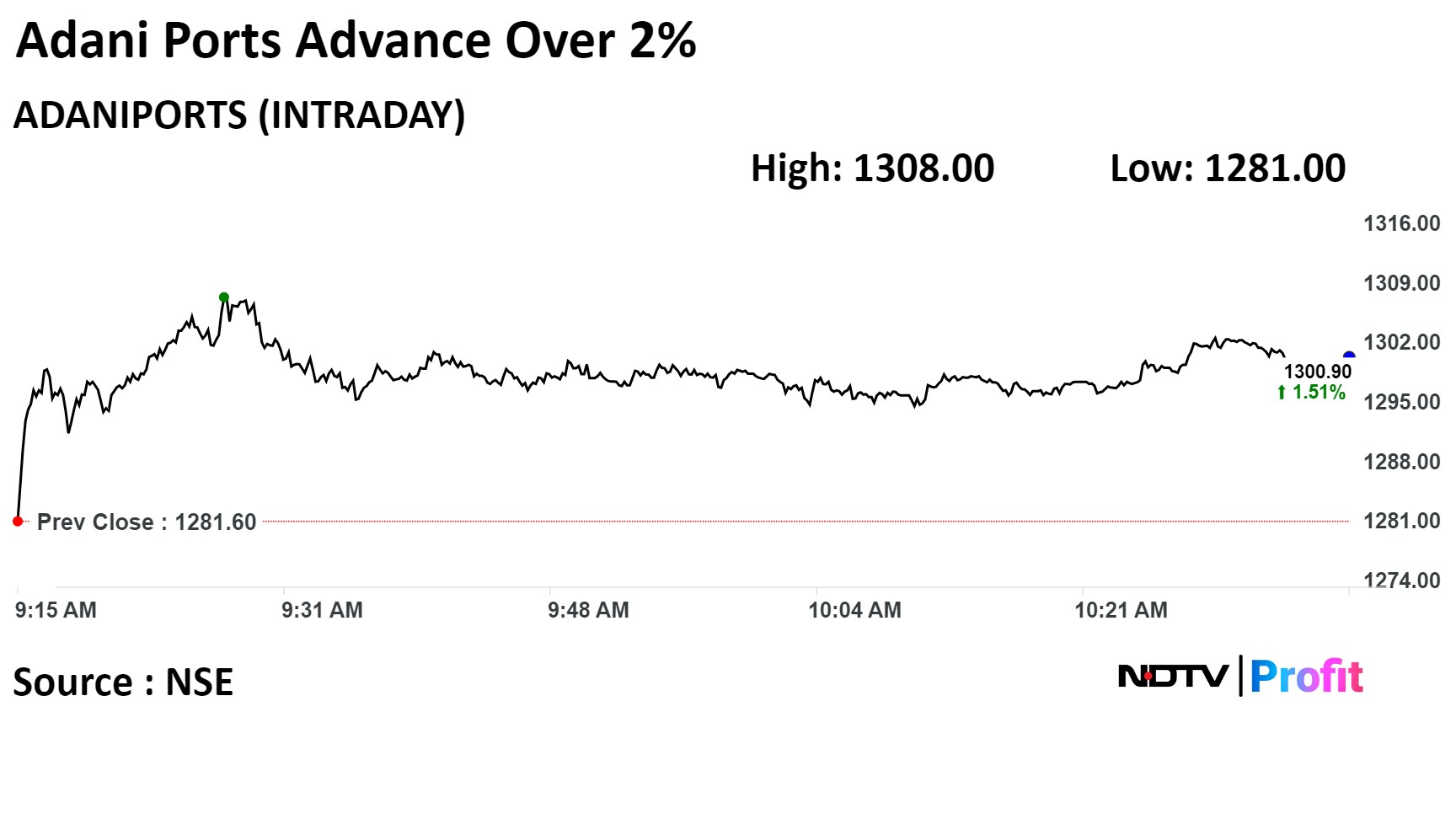

Shares of Adani Ports rose 2.06% before paring gains to trade 1.63% higher as of 10:29 a.m., compared to 0.32% decline on NSE Nifty 50.

The stock has risen 107.03% in the past 12 months. The relative strength index was at 54.

Of the 22 analysts tracking the company, 20 maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 7.6%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.