CG Power signs pact with supply and servicing of railway products with Kinet Railway Solutions. It gets order ranging between Rs 400-500 Crore to supply products for 10 Vande Bharat Trainsets.

Source: Exchange filing

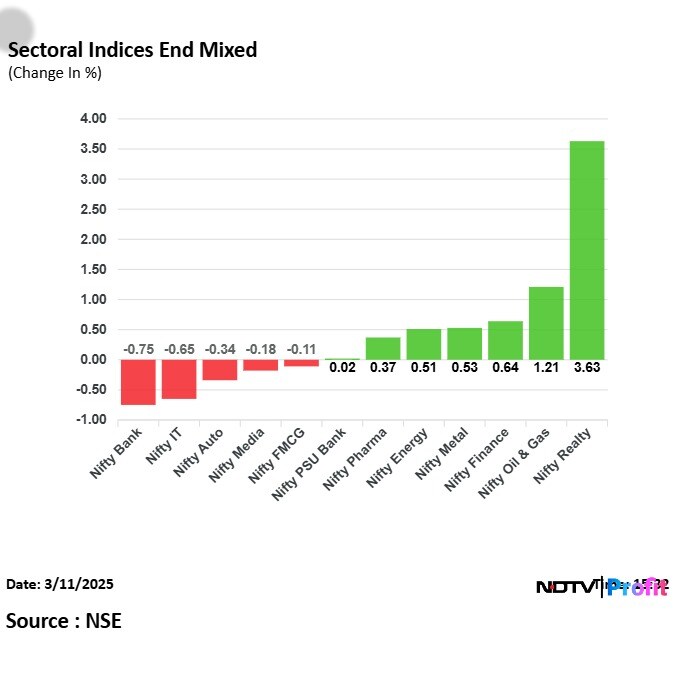

The shares of real estate companies recorded gains on Tuesday pushing the Nifty Realty Index to end its three-day losing streak. The index rose over 3%, the highest percentage change for Nifty Realty in over 12 sessions. Read the full article here.

Shares of IndusInd Bank Ltd. plunged in trade on Tuesday, hitting an intraday low of 25.91% at Rs 667.15 apiece. This steep fall led to the stock seeing as much as Rs 18,100-crore market capitalisation wiped off. Read the full article here.

Over 2.98 million shares of Infosys were traded via a block deal on Tuesday. The share of Infosys fell as much as 2.54% to Rs 1,656.95 apiece.

IndusInd Bank Stock Crash — Check SEBI Rules On F&O Price Band Revision

Total Insurance Premium degrew 11.6% to Rs 29,985 crore versus Rs 33913 crore.

LIC degrew 22% to Rs 15,513 cr from Rs 19,896 cr.

SBI Life degrew 17.9% to Rs 2,174 cr from Rs 2,648 cr

Kotak Mahindra Life degrew 33.9% to Rs 741 cr from Rs 1,122 cr

ICICI Pru Life grew 5.3% at Rs 1,857 crore versus Rs 1,763 crore.

HDFC Life grew 23.5% to Rs 3,213 cr from Rs 2602 cr

Bajaj Alliance grew 2.9% to Rs 1,080 cr from Rs 1,050 cr

Aditya Birla Sun Life Insurance grew 13.3% to Rs 1,029 cr to Rs 909 cr

Axis Max Life Insurance degrew 6% to Rs 1,031 cr from Rs 1,097 cr

Source: Life Insurance Council Website

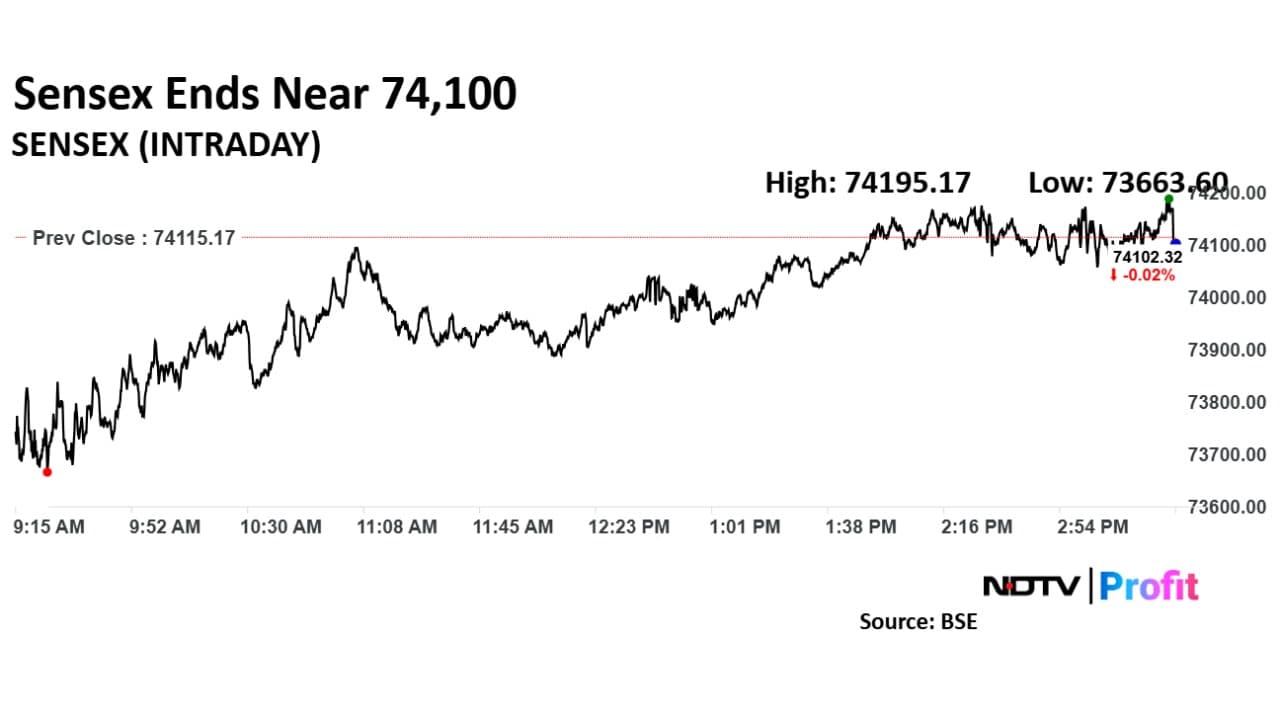

Indian equities were trading lower after opening. Nifty was flat around 12 p.m. it rose nearly 0.01% at 22,463.90 and Sensex fell over 90 points at 74,037.10.

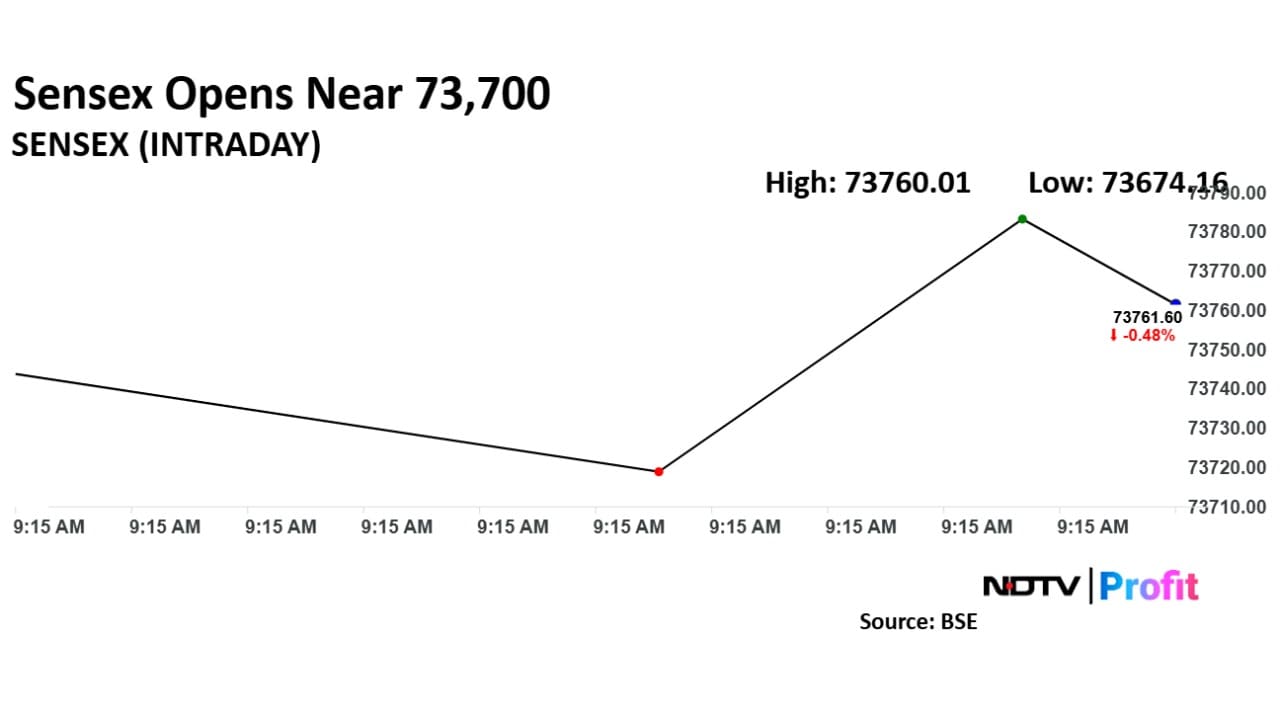

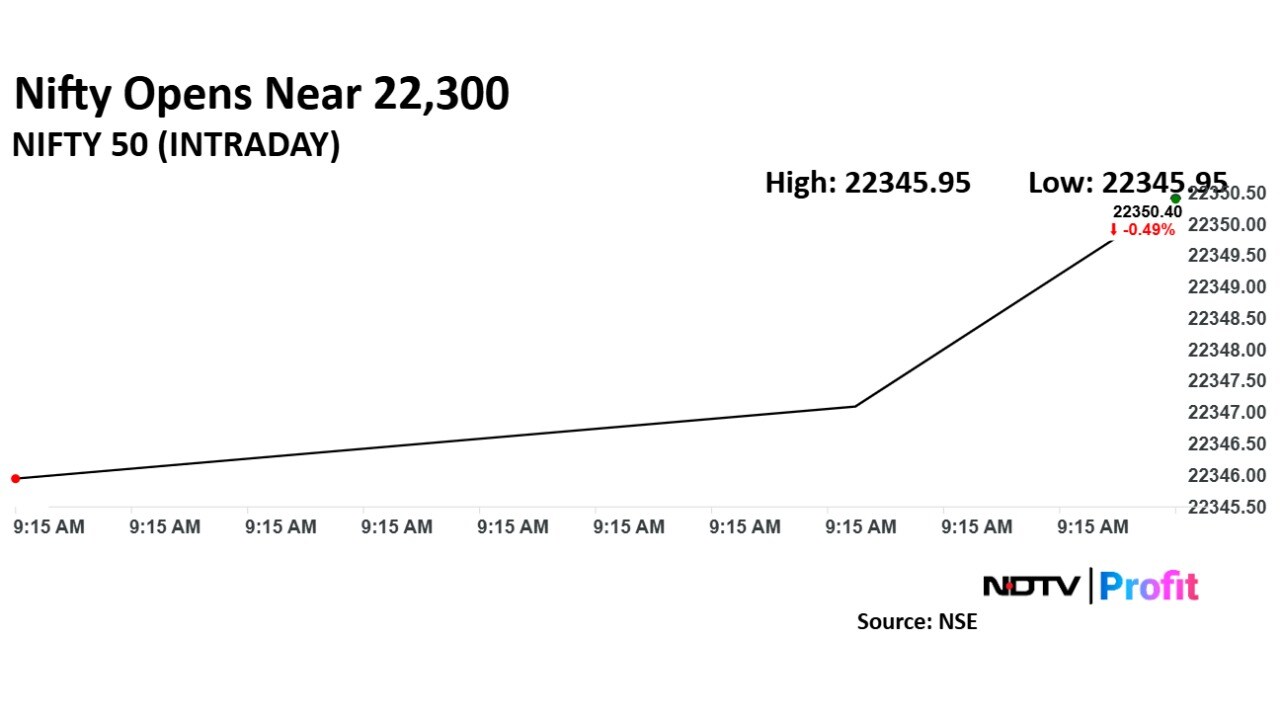

Intraday, both Nifty and Sensex fell over 0.60%.

Nifty fell 0.65% to 22,314.70.

Sensex fell 0.61% to 73,663.60.

Broader indices were trading lower. Nifty Midcap 150 fell 0.07%; Nifty Smallcap 250 was trading 0.92% lower.

Most sectoral indices rose, led by Nifty realty and Nifty oil and gas.

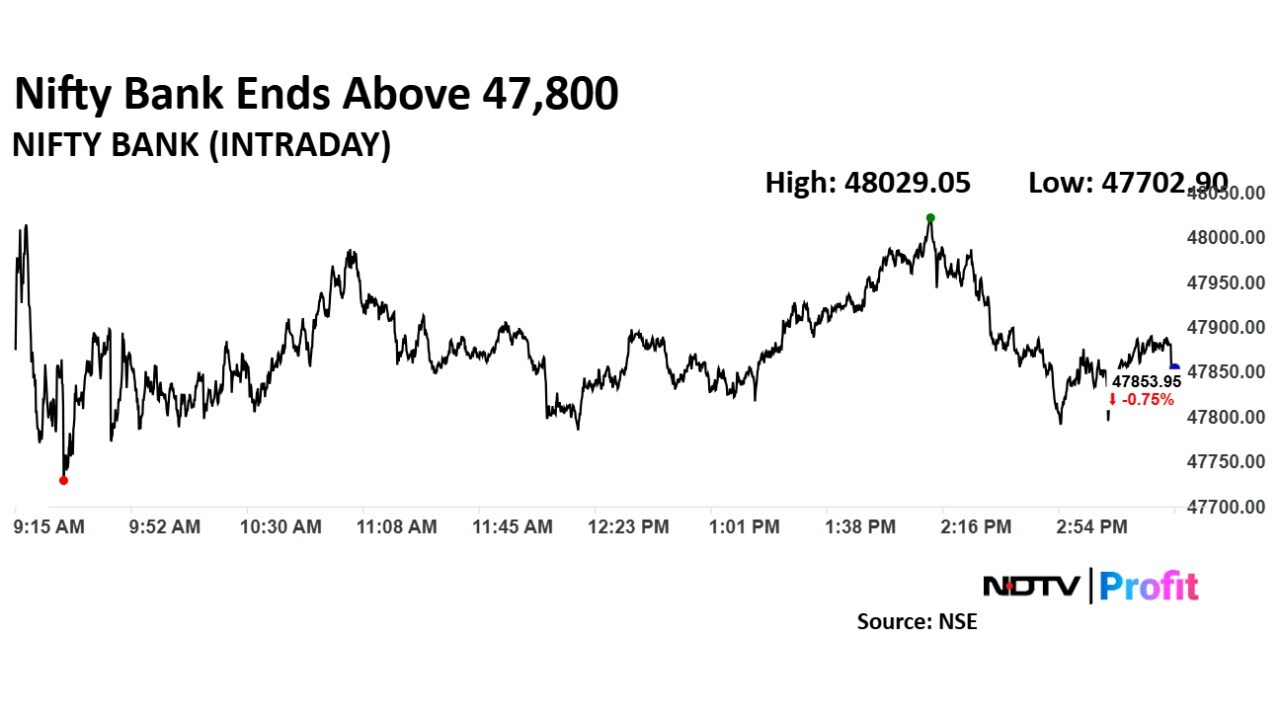

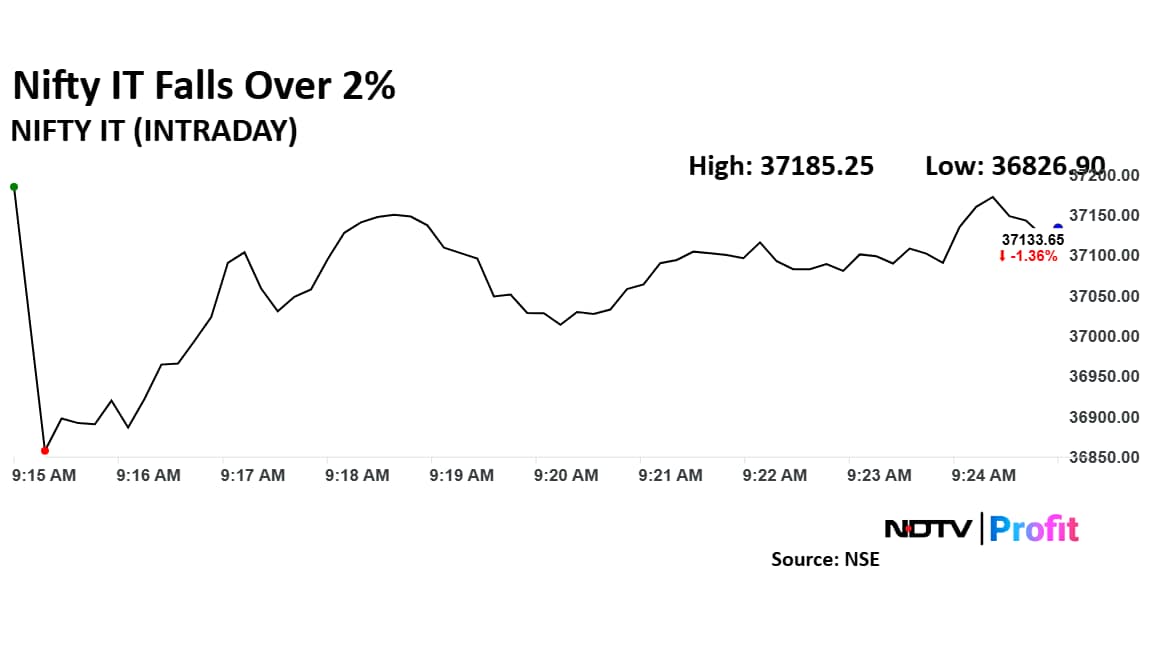

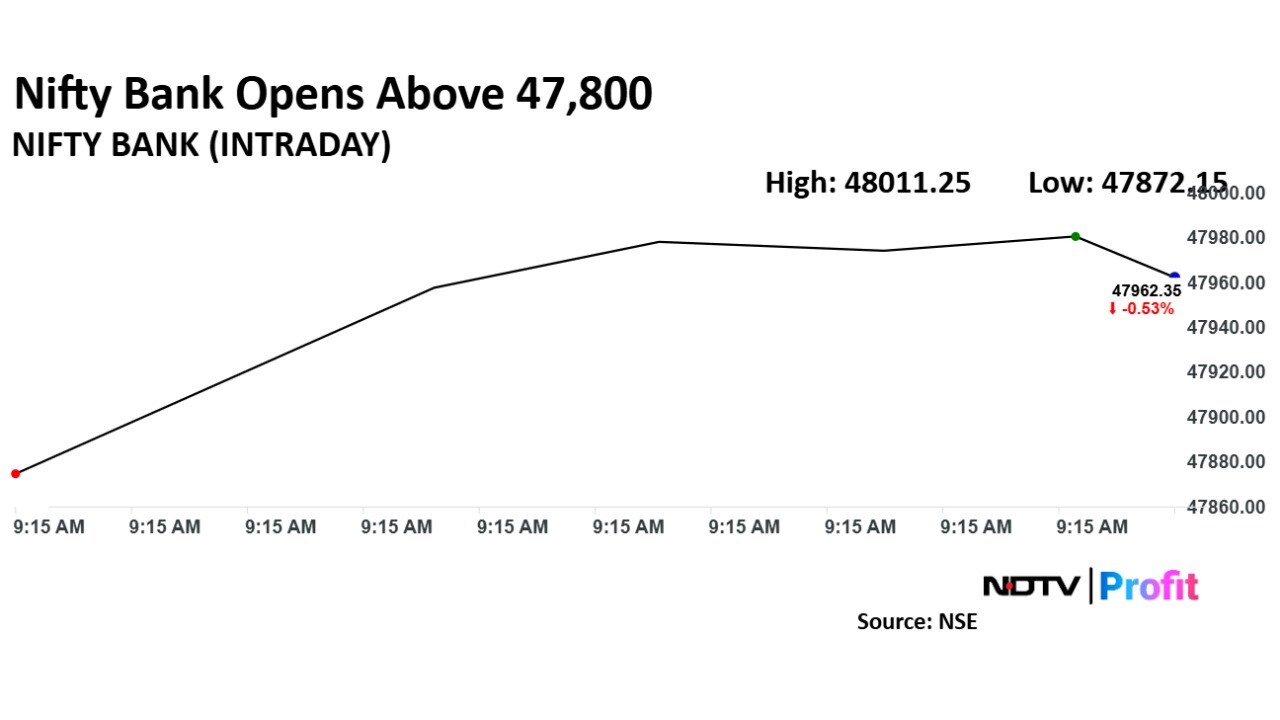

Nifty Bank fell 0.67%, Nifty IT was down 1.30%.

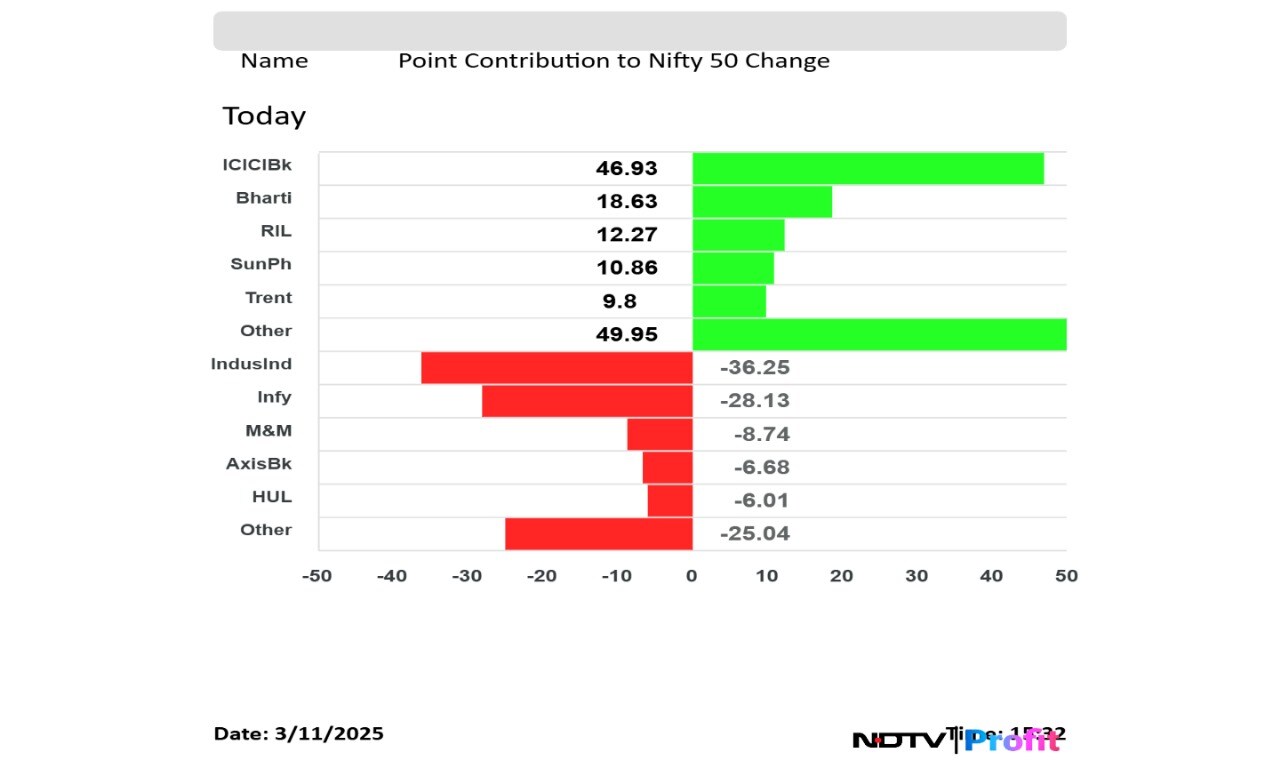

ICICI Bank, Bharti Airtel, Sun Pharma, Trent and Reliance Industries were top Nifty gainers.

Infosys, IndusInd Bank, Mahindra & Mahindra, HDFC Bank and TCS were top Nifty losers.

IIFL Capital on Tuesday received administrative warning regarding debt issues from SEBI.

Alert: SEBI Inspected Debt Issues From April 2022 To April 2024 .

European investors expressed the most interest in HDFC Bank Ltd., ICICI Bank Ltd., and Kotak Mahindra Bank Ltd. in the latest meeting with Macquarie. In the non-banking financial space, they prefer to hold Bajaj Finance Ltd. noting the recent rally, while their initial interest in Shriram Finance Ltd. rose.

Read full story here.

IndusInd Bank Target Price Cut With Derivative Discrepancies Impact On Credibility, Earnings

At pre-open, the NSE Nifty 50 was trading 114.35 points or 0.51% lower at 22,345.95. The BSE Sensex was 0.49% lower at 73,750.66.

Rupee opened 4 paise lower at 87.37 against the US Dollar. It closed at 87.33 on Monday.

Source: Bloomberg

The dollar index is 0.13% lower at 103.80. Brent crude was flat at $69.28.

The US Dollar index is down 0.19% at 103.73.

Euro was down 0.18% at 0.9211.

Pound was down 0.09% at 0.7758.

Yen was down 0.19% at 146.99.

The financial markets should be ready for more volatility Sonal Varma, Managing Director and Chief Economist (India and Asia ex-Japan) Nomura told NDTV Profit. She further said that there could be weaker global growth in the next one year.

The US is likely to see weaker growth if it does implement the tariffs on April 2, added Varma. However, she said the administration is ready to take on some short term pain. This could likely lead to disinflation in emerging markets.

Talking about India she said that global supply chains shifting from China in the medium term would benefit us.

Stocks in the Asia Pacific region extend fall for the third consecutive sessions on Tuesday taking cue from the meltdown in US stocks and amid fear that tariffs and government firing will stall economic growth in US.

South Korea's Kospi fell 2.08%, or 53.38 points, to 2,517.01 while Australia's S&P / ASX 200 was down 1.60% at 7,834.60 as of 7:10 a.m. Markets in Japan and Hong Kong fell on Tuesday, while the benchmark index in China were relatively flat.

This comes after S&P 500 fell 2.7% on Monday, while the Nasdaq Composite slipped over 3% making it the worst day for the index since 2022. The Dow Jones Industrial Average fell over 2% on Monday.

Stocks To Watch Today: IndusInd Bank, BEL, Bajaj Consumer, NTPC, HEG, Premier Explosives