At 3:50 p.m., futures contract of Dow Jones was up 77% to 43,966.00, that of S&P 500 was also 16.50% up at 5,979.75, and Nasdaq 100 futures contract was 83.5% up at 21,003.00.

Rupee strengthened by 15 paise to close at 87.36 against the US Dollar. It closed at 87.51 a dollar on Friday.

Source: Bloomberg

IRCTC, IRFC Receive 'Navratna' Status

Maintain Buy, target price of Rs 7,219 (+56% upside).

Co good play on power transmission which has the highest capex growth.

Power capex to rise 2.5x to USD300 bn+ over FY24-30E vs FY17-23.

Expect fixed costs as a % of sales declining to 10-11%.

Operating leverage to boost EBITDA margin to 16.5-17% vs 13.6% in FY24.

Believes demerger of Energy division to unlock further value.

Energy demerger could potentially add 8-21% to CMP.

Shares of Orient Technologies Ltd. and Exicom Tele-Systems Ltd. hit the lower circuit on Monday, after their respective shareholder lock-in periods came to an end. Similarly, companies like Dr. Agarwal's Healthcare Ltd., Ecos (India) Mobility Ltd. and Vishnu Prakash R Punglia Ltd. also witnessed an over 5% drop in their stock.

Read full story here.

HUDCO to consider second interim dividend for financial year 2025 on Mar. 10.

The shares of the company rose as much as 1.85% during trade so far on Monday.

Over 1 million shares of Jio Finacial were traded via a block deal on Monday. The share of the company fell as much as 4.32% to Rs 198.6 apiece.

I-T Probes promoters, anchor investors OFS transactions ahead of public listing

Total 216 OFS deals under examination, 86 in FY’24 alone

Investigating OFS share sales between FY’21–FY’24 and subsequent capital gains

Suspect inflated acquisition costs to reduce capital gains tax

CBDT roll out special drive to probe IPO/OFS share sales nationwide

Leveraging Data from NSE/BSE in the probe under Section 55(2)(ac) of I-T Act

Notices sent to investors/promoters for discrepancies in revised returns

NDTV profit reviews CBDT Feb 3 letter & Cos Went for OFS

CBDT circulates data with tax sleuths for detailed examination

Those OFS transaction under radar includes ---24 companies went for OFS in FY’21, FY’22 (56), FY23 ( 50) and FY’24 ( 86)

Source: Tax sources

Read full story here.

Info Edge: Feb Naukri Jobspeak

Jobspeak Index at multi-month highs, up 4% year-on-year and up 13% month on month.

Jobspeak Index at 2,890 versus 2,780 year-on-year and versus 2,550 month on month.

10 of 16 sectors register growth while 5 have seen a decline.

IT sector sees a sharp uptick from Jan level.

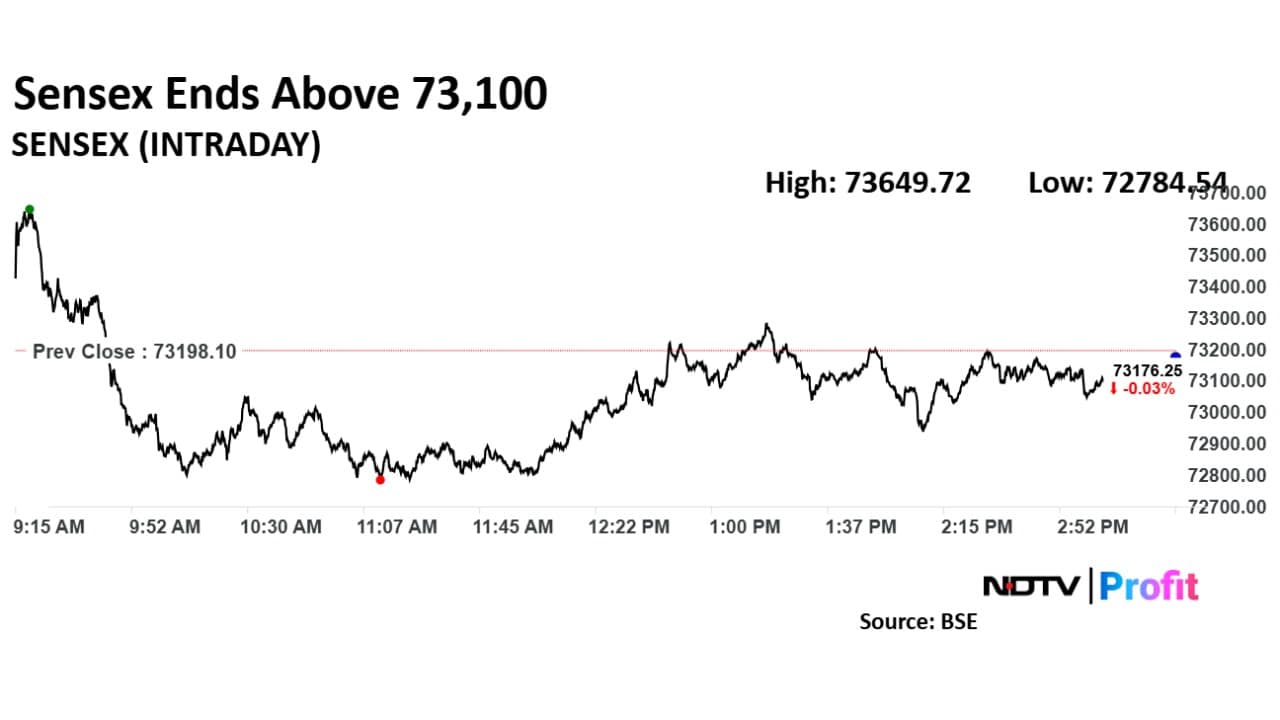

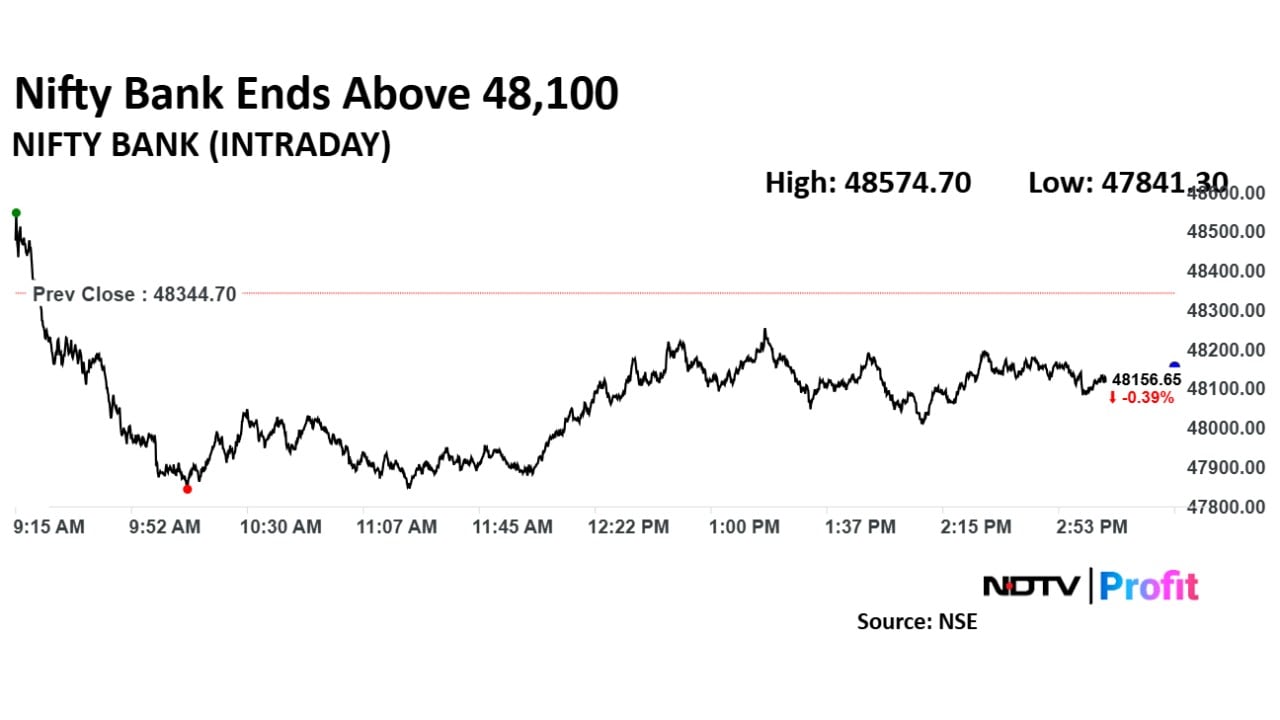

Indian equities was trading flat with Nifty 50 trading nearly 0.01% higher at 22,127.5 and Sensex was trading 53.61 points lower at 73,144.4.

Intraday, Nifty fell over 0.54% and Sensex fell as much as 0.56%.

Broader indices were trading lower. Nifty Midcap fell 1.33%; Nifty Smallcap was trading 0.65% lower.

Most sectoral indices fell, led by Nifty Oil & Gas. While Nifty IT led gains followed by Nifty Metal.

The Nifty 50 was led by Infosys, Bharti Airtel, ICICI Bank, L&T and Bharat Electronics along with others. RIL, HDFC Bank, Axis Bank and Coal India continued to drag the index.

Ola Electric Said To Cut Over A Thousand Jobs To Stem Losses

Jindal Worldwide board approves allotment of bonus shares in the ratio of 4:1, according to an exchange filing.

The sell of is cyclical and almost looks like an annual sale. Even like a big sale that happens every three years, according to Samit Vartak, founding partner and chief investment officer of SageOne Investment Managers.

The last correction in December 2021, continued till probably half of the year. Three years down the line, there was a peak in September.

Now we are already five-six months into this, according to Vartak. Generally, the duration of correction is six to nine months, the faster it corrects the shorter is the duration, he added.

Coal India Share Price Up On Announcement Of Additional Charge; Brokerages Bullish

Nifty Small Cap 250 hit 52-week low. As of 11:45 a.m. on Monday, the index was 2.67% down or trading 366.2 points lower.

The small caps had fallen around 3% on Friday and the market cap loss of the index since life high is recorded at over Rs 12 lakh crore.

Ola Electric Says 25,000 Scooters Sold In February But Only A Third Registered

BSE Trading Volume To Take A Hit Due To SEBI's New OI Calculation Rules

The Nifty Has Lost Around 4200 Points Since Sept 27, 2024

RIL Has Dragged The Benchmark By 544 Points; 13% Of Total Point Fall

ITC Has Dragged The Benchmark By 258 Points; 6% Of Total Point Fall

TCS Has Dragged The Benchmark By 184 Points; 4% Of Total Point Fall

Market Cap Loss Since Life High

Large Caps: Almost Rs 60 Lakh Crore

Mid Caps: Over Rs 19 Lakh Crore

Small Caps: Over Rs 12 Lakh Crore

Stocks That Lost The Most Value Since Nifty Highs

Large Caps:

RIL: Around Rs 4.88 Lakh Crore

TCS: Around Rs 2.92 Lakh Crore

Mid Caps:

Jai Balaji: Around Rs 88,600 Crore

Suzlon Energy: Around Rs 45,200 Crore

Small Caps:

Motisons: Around Rs 28,700 Crore

NAVA: Around Rs 23,000 Crore

Angel One Share Price Hits Six-Month Low After Data Breach

Nifty 50, Sensex hit intraday low of over 0.5%

Nifty Midcap 150 falls as much as 1.9%

Nifty Smallcap 250 falls as much as 2.7%

Nifty Indices Hit 52 Week Lows Today: Nifty Realty, Nifty PSU Bank, Nifty Oil & Gas, Nifty Energy, Nifty FMCG, Nifty Media

Total market cap loss of around Rs 3.6 Lakh Crore

Large Caps Lose Over Rs 1.08 Lakh Crore In Value

Mid Caps Lose Over Rs 99,000 Crore In Value

Small Caps Lose Over Rs 69,000 Crore In Value

IGI India Gets 'Overweight' From MS On Strong Potential In Lab-Grown Diamond Market

Paytm Parent One97 Communications Under ED Scrutiny For Alleged FEMA Rule Violations

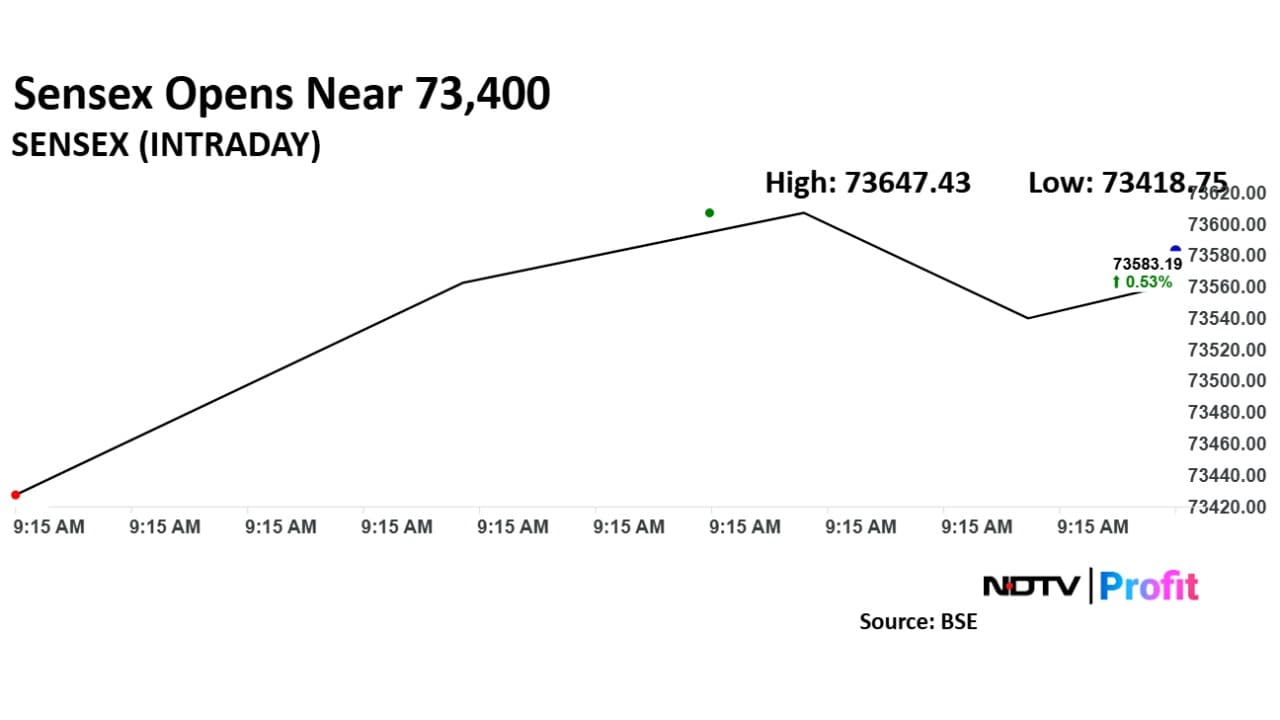

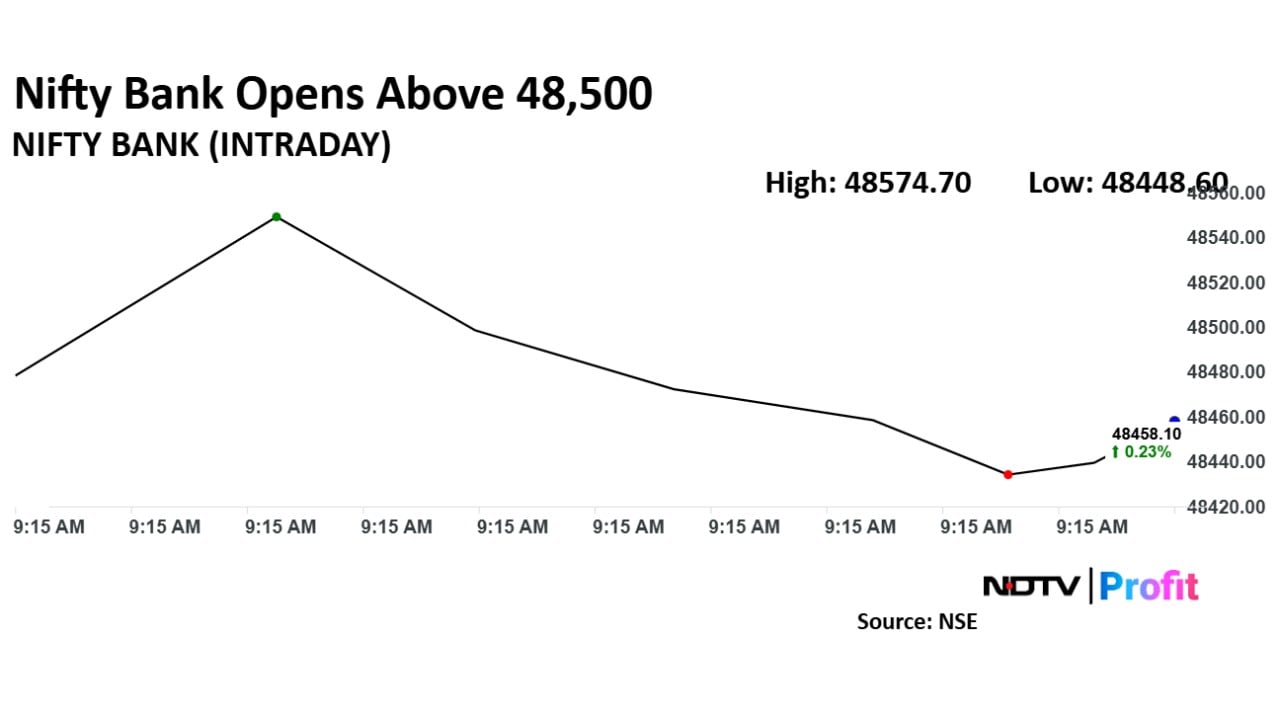

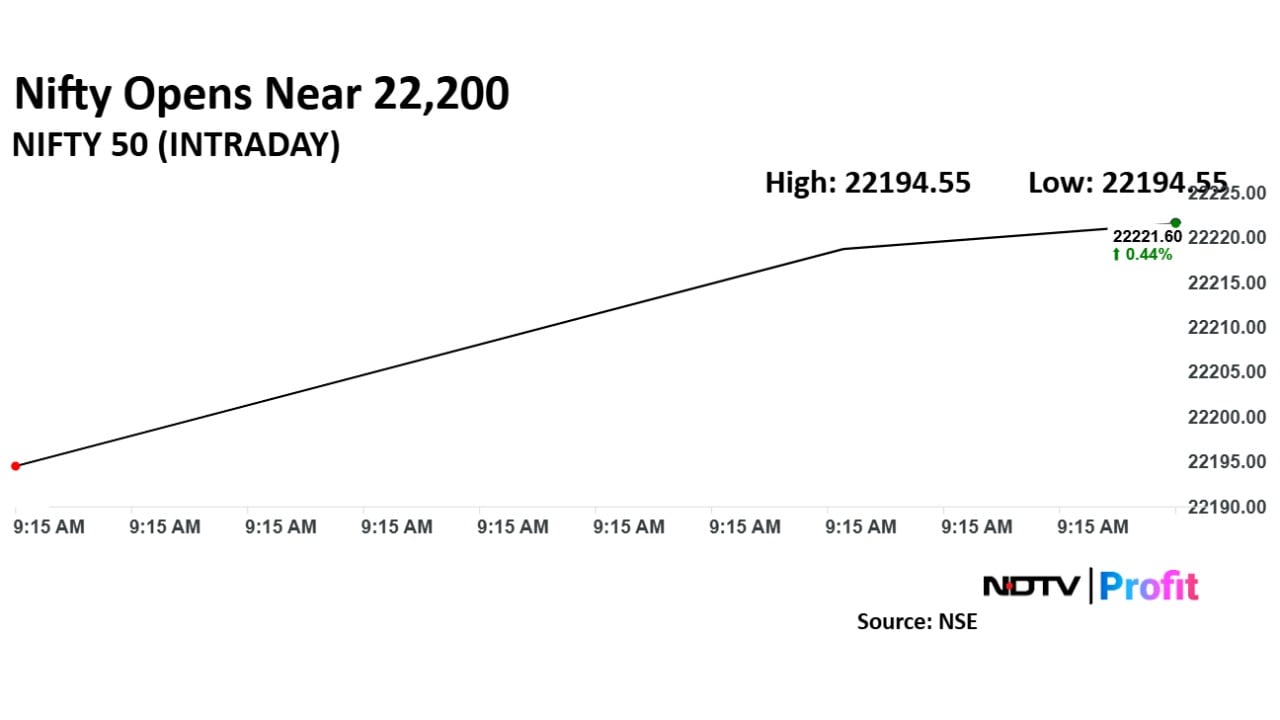

At pre-open, the NSE Nifty 50 was trading 69.85 points or 0.32% higher at 22194.55. The BSE Sensex was 0.32% or 229.5 higher at 73429.47.

Rupee strengthened by 17 paise to open at 87.34 against the US Dollar. It closed at 87.51 a dollar on Friday.

Source: Bloomberg

Nifty March futures down by 1.81% at a premium of 155.35 points.

Nifty March futures open interest up by 6.86%.

Nifty Options March 06 Expiry: Maximum Call open interest at 22500 and Maximum Put open interest at 20800

Securities in ban period: Nil

The US Dollar index is down 0.37% at 107.21.

Euro was down 0.15% at 0.9597.

Pound was up 0.17%% at 1.2606.

Yen was down 0.25% at 150.35.

Stocks in the Asia-Pacific region opened higher on Monday, shrugging off concerns about tariffs on Canada, Mexico and China, while European leaders pledged support for Ukraine.

Japan's Nikkei rose 0.71%, or 276 points to 37,423, while Australia's S&P ASX 200 was up 0.17% at 8,186 as of 6:28 a.m. Future contracts in China and Hong Kong hinted at a negative start.

Stocks in China will face a renewed test as top officials will meet to discuss economic priorities, with hopes running high for further stimulus. The yuan has gained by 0.6% this year, while a gauge of the nation’s equities has jumped more than 12%, according to Bloomberg.

Stocks on Wall Street ended the volatile session higher while treasuries extended February’s rally. The S&P 500 rose 1.59%, while the Nasdaq 100 advanced 1.63%. The Dow Jones Industrial Average rose by 1.39% on Friday.

Stock Market Today: All You Need To Know Going Into Trade On March 3