"Domestic equities closed lower due to steep decline in financial sector. Nifty lost 0.5%, while broader markets outperformed the main indices with Nifty MidCap and Nifty SmallCap gaining 1.4% and 1.1% respectively", summarised Mitul Shah, Head of Research at Reliance Securities. In a note, he added, "Markets continue to remain jittery as investors try to gauge the effects of Russia-Ukraine war, whilst simultaneously mulling over the possibility of FED raising interest rates even further to curb inflation. Additionally, rising oil and commodity prices are threatening supply-chain and logistics by disrupting shipping and air freight. Over near-term, devastation due to the war and additional sanctions on the Russian economy, would have menacing effects on global and Indian equities".

Shares of Bharat Forge, Ramkrishna Forgings, MM Forgings advanced in today's session.

Ramkrishna Forgings bagged an export order worth Rs 135 crore today.

Bharat Forge approved the issuance of 2,000 listed, rated, unsecured, redeemable, NCDs of face value Rs 10 lakh, aggregating to Rs 200 crore, on a private placement basis on Saturday. The stock has risen over 3% over the last two days.

Source: Exchange Filing, Bloomberg

Zomato has 1.54 million shares change hands in a large trade.

Details of buyers, sellers are not known immediately.

Source: Bloomberg

Mindtree has made a strategic investment in U.S. healthcare consulting firm COPE Health Solutions.

COPE Health works with healthcare organisations across the U.S. to enable the transition to value-based care and payments.

Mindtree seeks to leverage the consulting, data analytics and management capabilities of COPE Health to expand its provider and payer footprint with this investment.

Mindtree will acquire 6.64% stake in COPE Health for $4.5 million. COPE Health had a turnover of $20.6 million in FY2020-21.

Shares of Mindtree rose over 2% in intraday trade.

Source: Bloomberg, Exchange filing

DCX Systems seeks to raise as much as Rs 500 crore ($66.4 million) via new shares while its founders will offer up to Rs 100 crore worth of shares in an initial public offering, according to a draft red herring prospectus available on issue manager Edelweiss Financial’s website.

Axis Capital and Saffron Capital Advisors are managing the issue.

Source: Bloomberg

Motilal OswalSees improvement in cement demand in most markets in March after sluggish demand in January and February.

Expects industry volumes to fall by 2% YoY in Q4FY22.

Expects volume growth for the industry to 8.7% YoY for FY2022.

Cement prices rose 2-3% MoM across regions in March. Expect cement companies to further increase the prices to mitigate the impact of rising raw material costs. Companies have hinted at a cumulative price increase of Rs 40-50 per bag across regions in April.

Expects a price hike of Rs 15-20 per bag to be announced in the first week of April.

Believes that the average spreads for the industry improved significantly in March.

Hike of Rs 30 per bag in April-May 2022 will have the industry achieve profitability in Q1FY2022-23, if current coal prices sustain.

Maintains positive view on the sector despite near-term headwinds on earnings.

Expects cement demand to improve led by government's push for infrastructure growth, low-cost housing schemes and uptick in real estate demand.

Any correction in fuel prices will help improve industry sentiment.

UltraTech Cement remains the top sectoral pick, followed by ACC.

Prefers Birla Corp in the mid-cap space.

Sees improvement in cement demand in most markets in March after sluggish demand in January and February.

Expects industry volumes to fall by 2% YoY in Q4FY22.

Expects volume growth for the industry to 8.7% YoY for FY2022.

Cement prices rose 2-3% MoM across regions in March. Expect cement companies to further increase the prices to mitigate the impact of rising raw material costs. Companies have hinted at a cumulative price increase of Rs 40-50 per bag across regions in April.

Expects a price hike of Rs 15-20 per bag to be announced in the first week of April.

Believes that the average spreads for the industry improved significantly in March.

Hike of Rs 30 per bag in April-May 2022 will have the industry achieve profitability in Q1FY2022-23, if current coal prices sustain.

Maintains positive view on the sector despite near-term headwinds on earnings.

Expects cement demand to improve led by government's push for infrastructure growth, low-cost housing schemes and uptick in real estate demand.

Any correction in fuel prices will help improve industry sentiment.

UltraTech Cement remains the top sectoral pick, followed by ACC.

Prefers Birla Corp in the mid-cap space.

Source: Motilal Oswal note

Zomato says that it will assist Competition Commission of India in their investigation on preferential listing of restaurant partners, pricing parity across platforms.

In an exchange filing, the company said that CCI had not found prima facie any concerns over independence on levy of commissions or alleged bundling of services.

Source: Exchange filing

Total vehicle retail sales for March declined 3% YoY

Total vehicle retail rose by 7% YoY for FY2022.

Three-Wheelers and CV sales rose 27% and 15% YoY, respectively.

Passenger vechicles and tractors sales decline YoY, due to slowdown in rural demand.

FADA expects auto industry to reach pre-pandemic levels by FY2023-24.

Source: Federation of Automobile Dealers Associations (FADA) press release

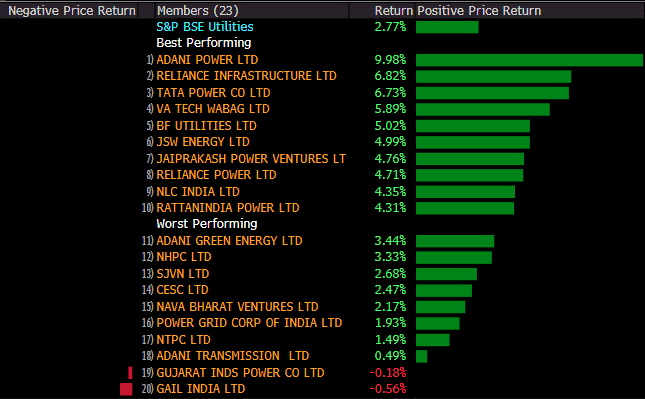

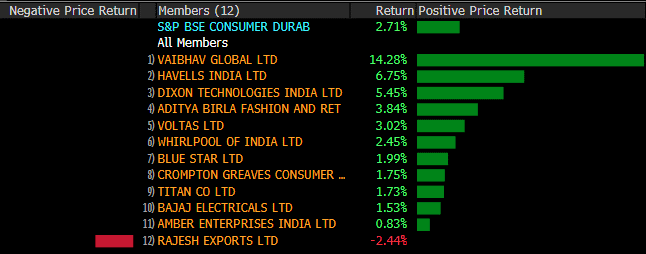

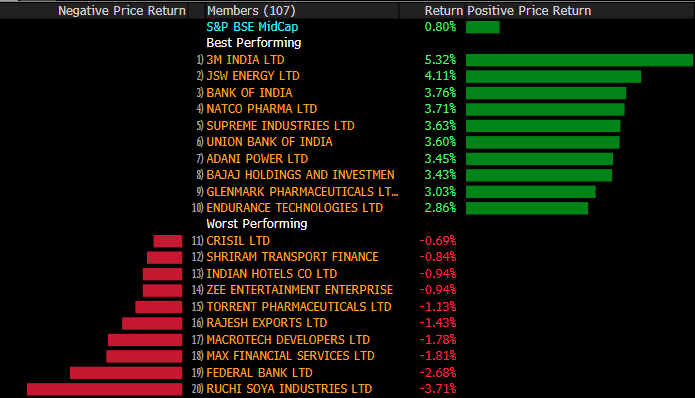

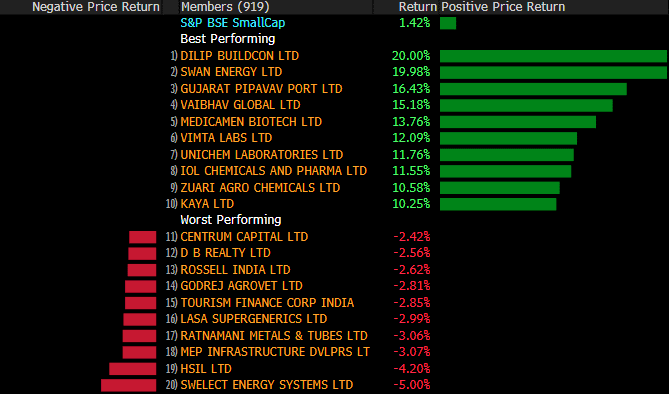

The broader indices outperformed their larger peers with S&P BSE MidCap adding 1.1% and S&P BSE SmallCap gaining 1.5%. Barring S&P BSE Finance and S&P BSE Bankex, all the other 17 sectoral indices advanced, with S&P BSE Consumer Durables rising nearly 2%.

The market breadth was skewed in the favour of bulls. About 2,384 stocks advanced, 919 declined and 117 remained unchanged.

Lupin entered into a licensing deal with Alvion Pharmaceuticals to commercialise medicines for cardiometabolic diseases in the Southeast Asia region.

This comes the company signed a definitive agreement on Friday to acquire a portfolio of brands from Anglo-French Drugs & Industries.

The acquisition is intended to strengthen the company's presence in Vitamins, Minerals & Supplements and CNS segments.

Source: Exchange Filings

HDFC Bank + HDFC — A Formidable #2

Sun Pharma To Cipla, How Indian Drugmakers Are Defying Pricing Pressure In U.S.

Nykaa: Axis Capital initiates coverage of the stock with a recommendation of 'add'; price target set at Rs 1,950.

HDFC Bank cut to 'accumulate' from 'buy' at Arihant Capital; price target set at Rs 1,910.

Source: Bloomberg

Live: Indian Rupee Extends Gains, Trades 0.19% Higher At 75.41/$

The transportation infrastructure business of Larsen & Toubro has secured significant orders.

L&T defines significant orders to be in the range of Rs 1,000 crore-Rs 2,500 crore.

Transportation business received a order from Tamil Nadu Road infrastructure corporation to construct the Chennai Peripheral Ring Road in the EPC mode.

The railways business unit won an order from Uttar Pradesh Metro Rail Corporation Ltd.

Shares of L&T rose over 0.8% in intraday trade. Of the 43 analysts tracking the company, 41 maintain 'buy', one suggests 'hold' and one maintains 'sell'. The return potential on the stock is at 23.9%.

Source: Exchange filing, Bloomberg

Yields along the India sovereign yield curve were mixed, with 12-year bonds moving the most in Tuesday morning trading.

The 1-year yield fell 0.5bps to 4.715%

The 10-year yield was little changed at 6.897%

The 19-year yield remained unchanged at 7.25%

The 2-year-10-year yield spread was 189.2bps, vs previous close 189.1bps

Source: Bloomberg

The broader indices outperformed their larger peers with S&P BSE MidCap rising 0.5% and S&P BSE SmallCap adding 0.7%. Barring S&P BS Finance, Bankex and Realty, all the other 16 sectoral indices compiled by BSE Ltd. advanced with S&P BSE Auto gaining over 1%.

The market breadth was skewed in the favour of bulls. About 1,944 stocks advanced, 653 declined and 102 remained unchanged.

India’s rupee and government bonds are expected to remain in relatively narrow ranges before the RBI’s policy announcement Friday with most traders avoiding placing large bets.

USD/INR fell 0.3% on Monday to 75.5450

India’s 10-year bond yields rose 6bps Monday to 6.90%

India march trade deficit widened 36.97% YoY at $18.69 billion, the ministry of commerce and industry said Monday

Global funds bought a net Rs 1,150 crore of Indian stocks Monday: NSE

They bought Rs 924 crore of sovereign bonds under limits available to foreign investors, the most in more than a month, and sold Rs 85 crore of corporate debt

State-run banks sold Rs 405 crore of sovereign bonds on April 4: CCIL data. Foreign banks bought Rs 900 crore of bonds.

Source: Bloomberg

SEBI has constituted ad-hoc committee to review and make recommendations to further strengthen the governance norms at Market Infrastructure Institutions (MIIs).

The terms of the reference of the committee include

making recommendations on steps to strengthen the role of governing boards and committees of MIIs,

reviewing the requirements related to appointment of directors on the board and Key Managerial Persons,

developing effective metrics to monitor the functioning of MIIs and KMPs,

enhancing accountability and transparency,

reviewing the policy on safekeeping and sharing of information help by MIIs,

revisiting the code of conduct and ethics for directors of the governing board and KMPs and

any other steps that the committee may find appropriate.

Source: SEBI Press Release

Morgan StanleyReiterates 'Overweight/Attractive' on the stock with the target price kept unchanged at Rs 8,750; an implied return of 16.81%

AUM growth exceeded forecasts in Q4FY2021-22.

New customer acquisitions declined 14% QoQ due to the impact of Omicron in January and February.

Customer franchise rose to 57.6 million while new loans rose to 6.3 million vs 5.5 million YoY.

Company has not opted for the deferment despite RBI's decision to defer the applicability of IRAC norms.

Key risks to upside: Sharper decline in cost of funds, rise in loan spreads, decline in underlying credit costs and significantly higher-than-expected growth in AUM and/or profitability.

Key risks to downside: No return to normalcy in business conditions due to deeper economic recession and risk in competition or fund issues, which will decelerate AUM growth and lead to NIM compression.

Reiterates 'Overweight/Attractive' on the stock with the target price kept unchanged at Rs 8,750; an implied return of 16.81%

AUM growth exceeded forecasts in Q4FY2021-22.

New customer acquisitions declined 14% QoQ due to the impact of Omicron in January and February.

Customer franchise rose to 57.6 million while new loans rose to 6.3 million vs 5.5 million YoY.

Company has not opted for the deferment despite RBI's decision to defer the applicability of IRAC norms.

Key risks to upside: Sharper decline in cost of funds, rise in loan spreads, decline in underlying credit costs and significantly higher-than-expected growth in AUM and/or profitability.

Key risks to downside: No return to normalcy in business conditions due to deeper economic recession and risk in competition or fund issues, which will decelerate AUM growth and lead to NIM compression.

Source: Morgan Stanley note

Adani Wilmar: Edelweiss Capital initiates coverage of the stock with a 'hold' recommendation; price target set at Rs 559, an implies upside of 1.2%.

CG Power & Industrial Solutions: Spark Capital Advisors reinstates coverage of the stock with a recommendation of 'add'; price target set at Rs 208; an implied upside of 7.8%

Source: Bloomberg

Motilal OswalSees improvement in cement demand in most markets in March after sluggish demand in January and February.

Expects industry volumes to fall by 2% YoY in Q4FY22.

Expects volume growth for the industry to 8.7% YoY for FY2022.

Cement prices rose 2-3% MoM across regions in March. Expect cement companies to further increase the prices to mitigate the impact of rising raw material costs. Companies have hinted at a cumulative price increase of Rs 40-50 per bag across regions in April.

Expects a price hike of Rs 15-20 per bag to be announced in the first week of April.

Believes that the average spreads for the industry improved significantly in March.

Hike of Rs 30 per bag in April-May 2022 will have the industry achieve profitability in Q1FY2022-23, if current coal prices sustain.

Maintains positive view on the sector despite near-term headwinds on earnings.

Expects cement demand to improve led by government's push for infrastructure growth, low-cost housing schemes and uptick in real estate demand.

Any correction in fuel prices will help improve industry sentiment.

UltraTech Cement remains the top sectoral pick, followed by ACC.

Prefers Birla Corp in the mid-cap space.

Sees improvement in cement demand in most markets in March after sluggish demand in January and February.

Expects industry volumes to fall by 2% YoY in Q4FY22.

Expects volume growth for the industry to 8.7% YoY for FY2022.

Cement prices rose 2-3% MoM across regions in March. Expect cement companies to further increase the prices to mitigate the impact of rising raw material costs. Companies have hinted at a cumulative price increase of Rs 40-50 per bag across regions in April.

Expects a price hike of Rs 15-20 per bag to be announced in the first week of April.

Believes that the average spreads for the industry improved significantly in March.

Hike of Rs 30 per bag in April-May 2022 will have the industry achieve profitability in Q1FY2022-23, if current coal prices sustain.

Maintains positive view on the sector despite near-term headwinds on earnings.

Expects cement demand to improve led by government's push for infrastructure growth, low-cost housing schemes and uptick in real estate demand.

Any correction in fuel prices will help improve industry sentiment.

UltraTech Cement remains the top sectoral pick, followed by ACC.

Prefers Birla Corp in the mid-cap space.

Source: Motilal Oswal note

HDFC Bank-HDFC Merger: Analysts React

Vedanta: The company achieved highest ever alumina production of 19.7 lakh tonnes while its aluminium output rose 15% year-on-year to 22.7 lakh tonnes, helped by operational efficiencies.

Reliance Industries: The company has received NCLT's approval for scheme of amalgamation of the company and Reliance Syngas.

Bajaj Finance: Reports 26% year-on-year growth in core assets under management in the fourth quarter of 2021-22. AUMs stood at Rs 1.97 lakh core as on March 31, 2022, compared to Rs 1.53 lakh crore a year ago. Core AUM, excluding IPO financing receivables, grew 26%.

Glenmark: The company approved repurchase of an aggregate principal amount of $75 million of bonds due in 2022 by way of on-market purchases at an early redemption amount plus accrued and unpaid interest.

SBI Card and Payment Services: Carlyle Group will raise up to Rs 2,560.60 crore ($339 million) by selling its sale in the company. It will sell 2.92 crore shares at Rs 851.50-876.75 each—a 2.9% discount to Monday’s closing price of Rs 876.75.

Zomato: Competition Commission of India will investigate Zomato and Swiggy after the National Restaurant Association of India complained of alleged contravention of rules by the two food-delivery companies. The CCI Director General will submit the report in 60 days.

Mindtree: To consider declaration of final dividend on April 18.

Moil: The company’s recorded a turnover of Rs 1,436 crore in FY22, a growth of 22% over the previous fiscal. That's marginally lower than the highest-ever turnover of Rs 1,441 crore in FY19.

BEML: The company’s provisional revenue from operations for FY22 crossed Rs 4,000 crore.

Muthoot Finance: To consider declaration of interim dividend on April 26.

Tata Consultancy Services: The company has entered into a strategic partnership with Payments Canada to facilitate real-time transactions in that country. The company has also signed a multi-year, cloud-computing contract with a large American company.

PCBL: Commissioned 7.3 MW power plant at Palei, Gujarat.

IndusInd Bank: The bank’s deposits rose 15% year-on-year to Rs 2.93 lakh crore in FY22. CASA ratio stood at 42.8% in FY22 against 41.8% in FY21. Net advances grew 13% to Rs 2.39 lakh crore.

Tata Elxsi: To consider declaration of final dividend on April 20.

Federal Bank: The bank’s customer deposits rose 8.9% year-on-year to Rs 1.63 lakh crore in FY22. CASA ratio stood at 37% in FY22 against 33.8% in FY21. Gross advances increased 9.5% to Rs 1.34 lakh crore.

Wockhardt: The company has appointed Pramod Gupta as the new chief financial officer with immediate effect after Deepak Madnani’s resignation.

Persistent: To consider declaration of final dividend on April 27.

Biocon: To consider declaration of final dividend on April 28.

Mahindra & Mahindra: Mahindra Electric introduces Alfa CNG Passenger, Cargo variants.

Hindustan Zinc: The company's mined metal output rose 3% year-on-year to 2,95,000 tonnes in the March quarter of FY22.

AU Small Finance Bank: Reports sharp jump in both advances and deposits. Firm logged deposit growth of 46%/19% YoY/QoQ to Rs 52,585 crore in Q4FY2021-22. CASA ratio at 37.1% vs 23%/39% YoY/QoQ.

M&M Financial Services: Disbursement at Rs 3,932 crore, up 66% YoY in March. The disbursement for FY2021-22 stands at approximately Rs 27,466 crore, up 45% YoY. Collection efficiency at 109% in March 2022.

The total increase in rates in the last two weeks stands at Rs 9.20 per litre.

Petrol in Delhi now costs Rs 104.61 per litre against Rs 103.81 earlier.

Diesel rates have risen to Rs 95.87 per litre against Rs 95.07 earlier.

This is the 13th increase in prices since March 22.

Source: ANI

Stock Market Today: All You Need To Know Going Into Trade On April 5