Shares of BPCL, Hindustan Petroleum Corp. and Indian Oil Corp. all dropped in trade. Motilal Oswal, in a note said prices of auto fuels and LPG will lead to massive underrecoveries for the state-run refiners.

It estimated that the companies will post a combined loss of Rs 12,100 crore till March this year, selling auto fuels at unchanged prices since early November and LPG cylinders at subsidized prices since the same month.

"Lack of transparency in LPG pricing, related underrecoveries and inventory gains/losses have unnerved the investors and weighed on their interests in these companies," it said.

It downgraded BPCL to neutral and maintained its neutral rating on HPCL because of multiple headwinds. It maintained 'buy' on IOCL due to its attractive valuations and high dividend yield.

Shares of ITC traded 1.5% lower after 17.9 lakh shares of the company changed hands in a bunched trade.

Shares of Suprajit Engineering Ltd. are lower for the tenth day in a row, on track for the longest losing streak since 2003. The scrip has lost a total of 25% during the streak while the S&P BSE Sensex fell 1.2%.

Shares of Bharat Petroleum Corp. fell 5.2% to Rs 349.65 apiece, lower than any close since Nov. 4, 2020.

The stock was the worst performer among peers.

Newswire AFP said the European Union will adopt sanctions today against Russia over its recognition of Ukrainian separatist regions and further deployment of troops.

It cited EU's foreign policy chief Josep Borrell.

Source: AFP

Shares of Indiabulls Real Estate Ltd. gained as much as 15% after the company clarified that it is not related to the Enforcement Directorate's investigation.

"The ED has sought some information from Indiabulls Housing Finance regarding certain of their clients and it is understood that the necessary data has been provided. The said ED investigation did not pertain to Indiabulls Real Estate and has no bearing on the business and operations of the company," it said in an exchange filing.

Shares of Indiabulls Housing Finance also rose as much as 4.6%, the most since Feb. 9.

The current volatility in markets because of geopolitical issues linked to Russia and Ukraine should not last long, according to Naveen Kulkarni, chief investment officer at Axis Securities.

"Chances of a major flare-up look small while sanctions on Russia are expected not to be as strong as the ones against Iran, as no one wants crude prices to stay at elevated levels on the back of already high inflation," he said.

The NSE Nifty 50 falling below 17,000 offers a good risk-reward tradeoff, and one should use this correction to gradually increase equity exposure by investing in quality companies, he added.

The Reserve Bank of India, in a press release, said it has come to its notice that sRide, a Gurgaon-based carpooling app, is operating a semi-closed prepaid wallet without obtaining the required authorisation under law.

"Any person dealing with sRide Tech Pvt. Ltd. will be doing so at their own risk," the RBI said.

India RBI Deploys FX Tool to Manage Liquidity Before LIC IPO

India's demand for LPG, diesel, petrol and aviation fuel is seen jumping 5.5% year-on-year to 214.5 million tons in the fiscal year starting April 1, according to the Oil Ministry's Petroleum Planning and Analysis Cell.

The revised estimate for fuel consumption in the current fiscal is 203.2 million tons, down 5.6% from the earlier estimate.

The new owners of Jet Airways have appointed former SriLankan Airlines CEO Vipula Gunatilleka as the carrier’s CFO.

Source: Bloomberg

Most maturities along the India sovereign yield curve were little changed, while 10-year yields rose in Tuesday morning trading.

The 3-year yield rose 1.7bps to 5.552%

The 10-year yield rose 3.5bps to 6.728%

The 14-year yield rose 1.2bps to 6.997%

The 3-year-10-year yield spread was 117.6bps, vs previous close 115.8bps

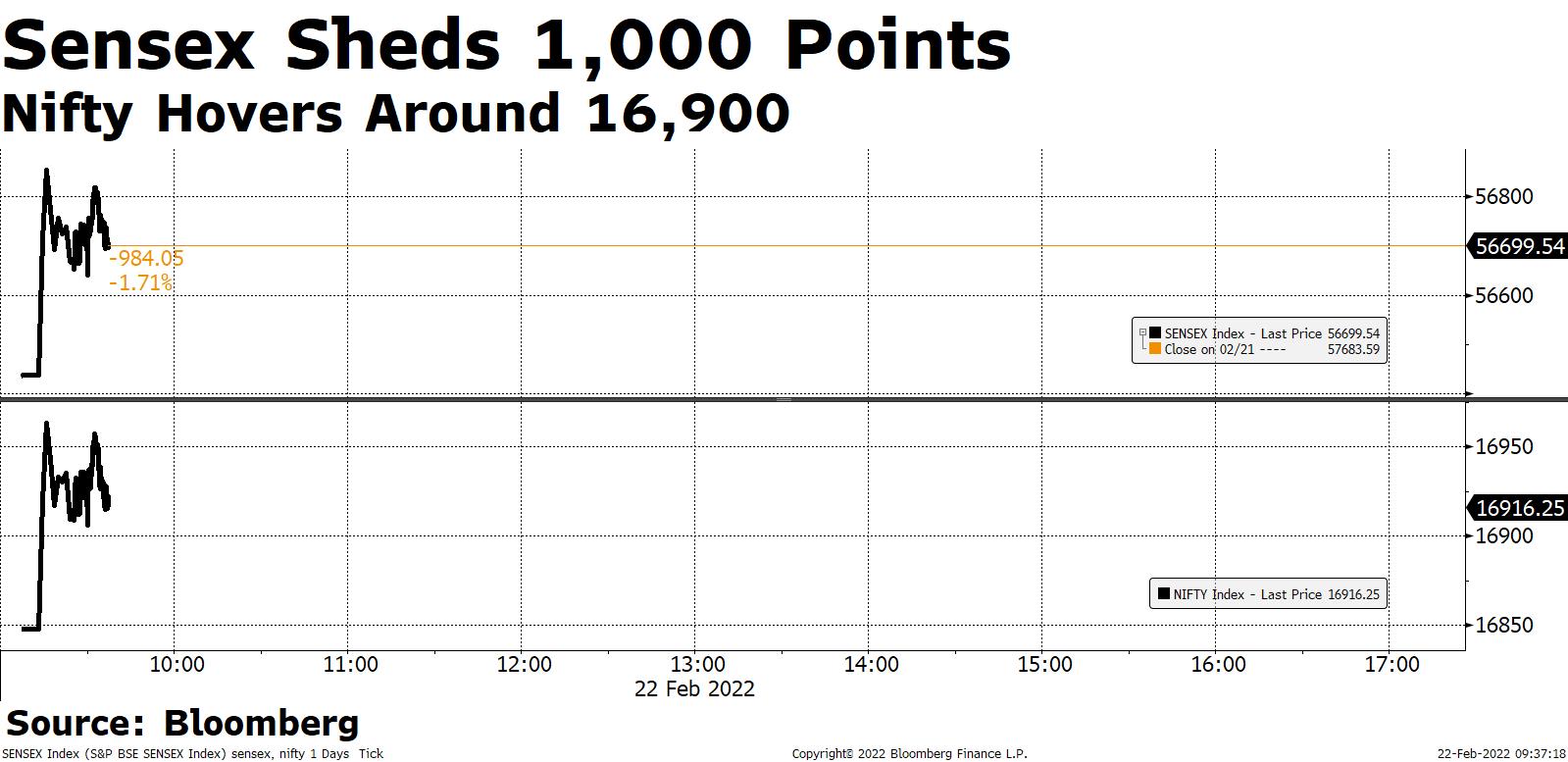

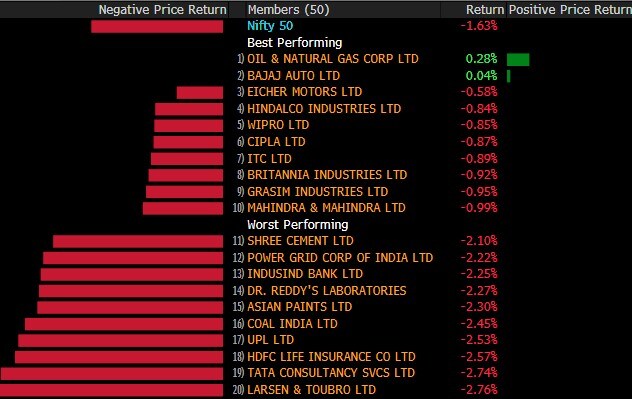

The NSE Nifty 50 Index fell 1.3%

Source: Bloomberg

Godrej Properties raised to 'add' from 'reduce' at HDFC Securities; price target set at Rs 1,804.

Brigade Enterprises raised to 'buy' from 'add' at HDFC Securities; price target set at Rs 619.

Oberoi Realty raised to 'buy' from 'add' at HDFC Securities; price target set at Rs 1,143.

Source: Bloomberg

Sobha raised to 'buy' from 'add' at HDFC Securities; price target set at Rs 1,000.

Prestige Estates raised to 'buy' from 'add' at HDFC Securities; price target set at Rs 633.

Source: Bloomberg

The Indian rupee and bonds opened lower as the geopolitical standoff over Ukraine bolstered oil prices. An auction announcement for the current week is also hurting debt.

USD/INR up 0.3% to 74.7625

Yield on 10-year bond rises 4bps to 6.73%

Source: Bloomberg

The broader indices almost mirrored their larger peers with S&P BSE MidCap losing 1.8% and S&P BSE SmallCap falling over 2.2%. All the 19 sectoral indices compiled by BSE Ltd. declined with S&P BSE Utilities, Power losing over 2%.

The market breadth was skewed in the favour of bears. About 310 stocks advanced, 2,207 declined and 59 remained unchanged.

Tata Vs Mistry: Supreme Court Agrees To Consider Review Petition

Housing Development Finance Corp has 7.1 million shares change hands in a pre-market trade.

Details of buyers, sellers are not immediately known.

Source: Bloomberg

Shares of firms linked to edible oil production may move after refiners said they are cutting retail prices to stem food inflation.

Mills will immediately reduce prices by Rs 3 to Rs 5 per kilograme, according to the Solvent Extractors' Association of India.

This is the third price cut in four months.

In Focus: Adani Wilmar, ITC, Godrej Agrovet, Ruchi Soya, Gujarat Ambuja Exports, Gokul Agro Resources, Vijay Solvex

Source: Bloomberg

Eris Lifesciences' Shares Lagged Despite Better Margins. Analysts Expect That To Change

Dwarikesh Sugar: Systematix Shares & Stocks initiated coverage on the stock with a 'buy' recommendation

Kotak Mahindra raised to 'buy' at Nirmal Bang; Price target set at Rs 2,240.

United Spirits raised to 'buy' at Nirmal Bang; Price target set at Rs 965.

Here is the gist of Motilal Oswal's views on the two stocks United Breweries and United Spirits, in light of the Ukraine situation and rise in crude prices.

Motilal Oswal

Packaging costs for alcobev companies account for large part of total RM costs (64% for United Breweries and 34% for United Spirits, respectively).

Barley cost accounts for 30% of RM costs.

United Breweries was largely unscathed by the impact of steep rise in barley price over FY22 since it procured barley in February-March before the onset of inflation.

United Breweries could be hurt by significant RM inflation due to rise in barely prices, Ukraine crisis.

UBL's bottle procurement system will allow the company to offset due to impact from crude-led inflation, as it relies on recycled bottles to meet 75% of its bottling requirements.

United Spirits is less reliant on recycle bottles and is vulnerable to higher bottle acquisition costs, directly correlated to crude prices.

Alcobev price increases, outside of free pricing states like Maharashtra, are 'granted' by state governments, which is a time-consuming process. Hence, the margins of these firms remain impacted.

Another major raw material cost for United Spirits is Extra Neutral Alcohol (ENA), whose prices have started rising as OMCs offered price increases to ethanol producers. The ripple effect of this could adversely impact margins.

Risk of excise increases in state budgets in FY23 and expensive valuations are also other key reasons for the cautious view on the sector.

Indian rupee traders will weigh the impact of central bank’s move to announce a $5b dollar rupee sell-buy swap against the negative geopolitical cues.

USD/INR forward premiums are set to rise on RBI’s swap move, traders say

USD/INR fell 0.2% to 74.5150 on Monday

10-year yields rose 3bps to 6.69%

Foreign investors bought Rs 285 crore of sovereign bonds under limits available to foreign investors, and withdrew Rs 69 crore of corporate debt

State-run banks bought Rs 300 crore of sovereign bonds on Feb. 21: CCIL data. Foreign banks bought Rs 111 crore of bonds.

Source: Bloomberg

Stocks of television and entertainment companies in India may move after RIL is said to form a consortium to bid for broadcasting rights for Indian Premier League.

In Focus: TV18 Broadcast, Network 18 Media, Zee Entertainment, Sun TV Network, TV Today Network.

Source: Bloomberg

Stocks To Watch: Adani, Tata Power, ICICI, Hero MotoCorp, Hindalco, IDFC First Bank

All You Need To Know Going Into Trade On February 22