Rupee closed flat at 87.20 against US Dollar

Source: Bloomberg

Two large trades have occurred in CG Power stock. On the NSE, nearly 2.45 million shares changed hands in the first one. Another trade of 16.2 lakh shares took place on Thursday.

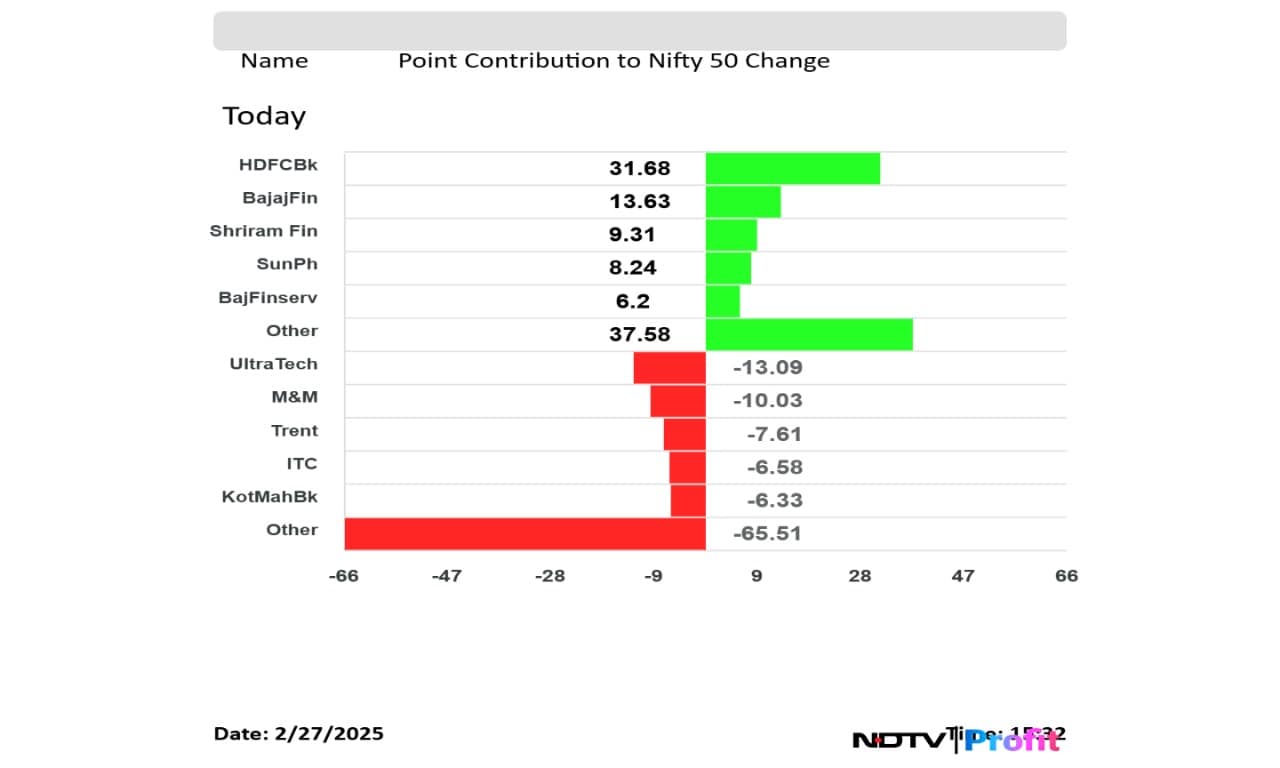

UltraTech Cement's latest announcement of its venture into the cable and wire industry on Tuesday led to the stock hitting an intraday low of 6.38% at Rs 10,264.4 on Thursday.

This caused the stock to lose a market capitalization as much as Rs 20,500 crores in a single trading sessions. Promoters lost Rs 12,000 crore.

The announcement also put heavy pressure on cable and wire companies- with top players like Polycab, KEI Industries, RR Kabel, Havells, Finolex Cables losing as much as Rs 35,500 crore in market capitalization.

Zydus Wellness Ltd. arm has received a show cause notice from the Directorate General of GST Intelligence regarding a GST demand order of Rs 56.33 crore. The demand order is dated Dec 25, 2024.

The unit is examining the GST demand order, the company said in the exchange filing.

ITC Ltd. had its 30.83 shares traded in two large trades. It's 0.02% of its outstanding equity.

ITC's shares were traded at the price range of Rs 401.55–401.95 apiece on NSE.

ITC has 1,251 crore shares outstanding as of Dec 31, 2024

Source: Cogencis

Signature Global Aims To Achieve Zero Net Debt In FY26 On Strong Sales, Says Chairman

Ikea has finally decided to enter the National Capital Region. The Swedish furniture giant announced the launch of its delivery services in the Delhi-NCR region, starting from March 1. The company has also promised same-day delivery within this zone, enhancing convenience for customers in the area.

Additionally, Ikea’s online delivery service will be available in nine North Indian cities: Agra, Prayagraj, Amritsar, Chandigarh, Jaipur, Kanpur, Lucknow, Ludhiana, and Varanasi.

Read full story here.

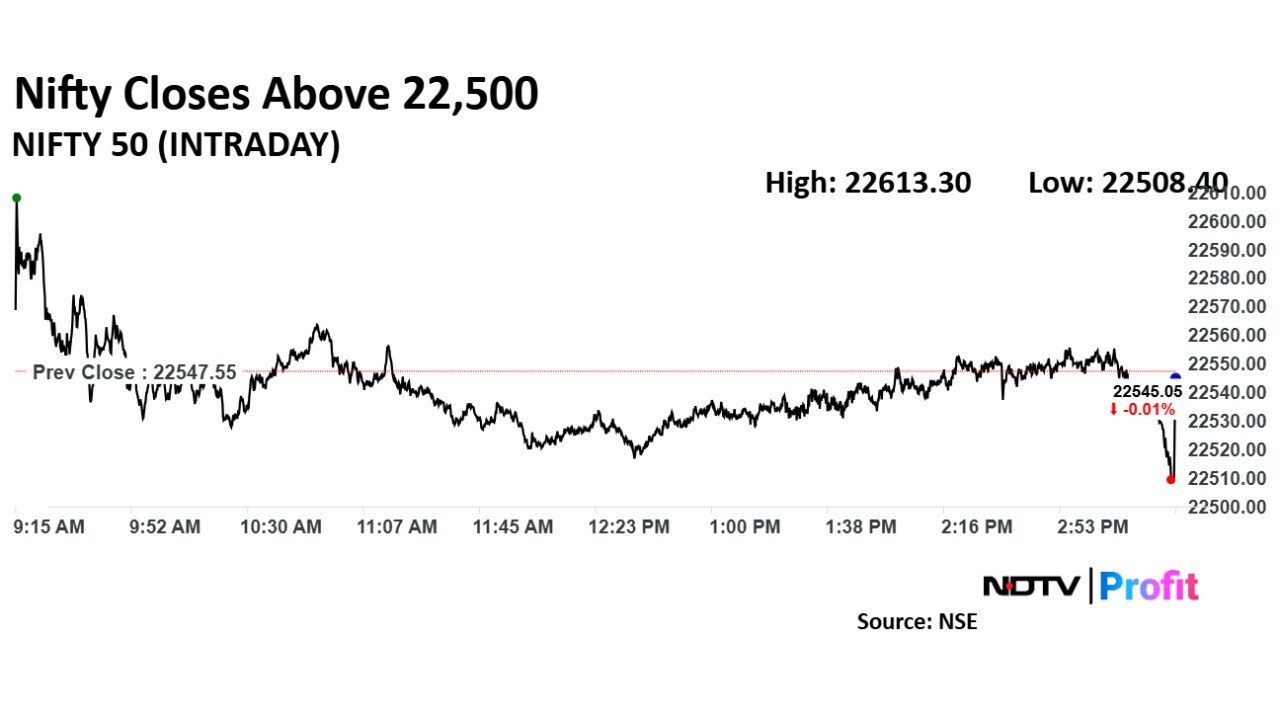

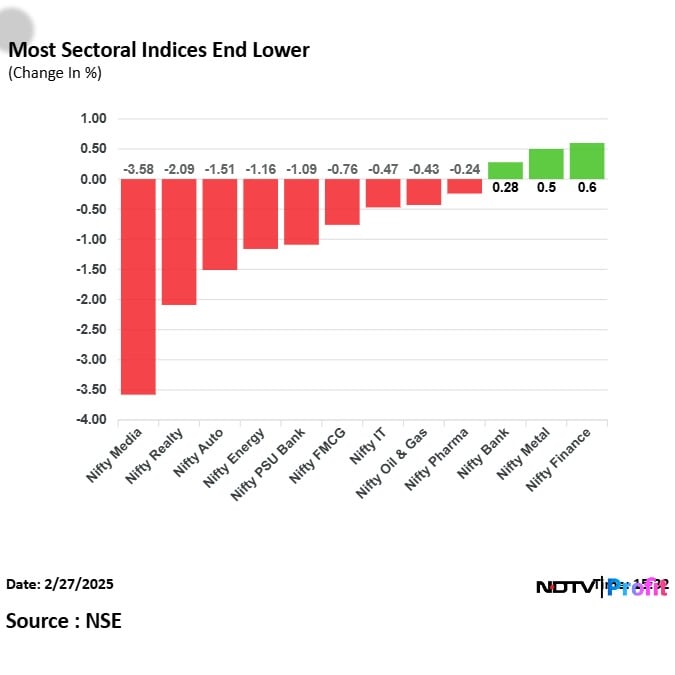

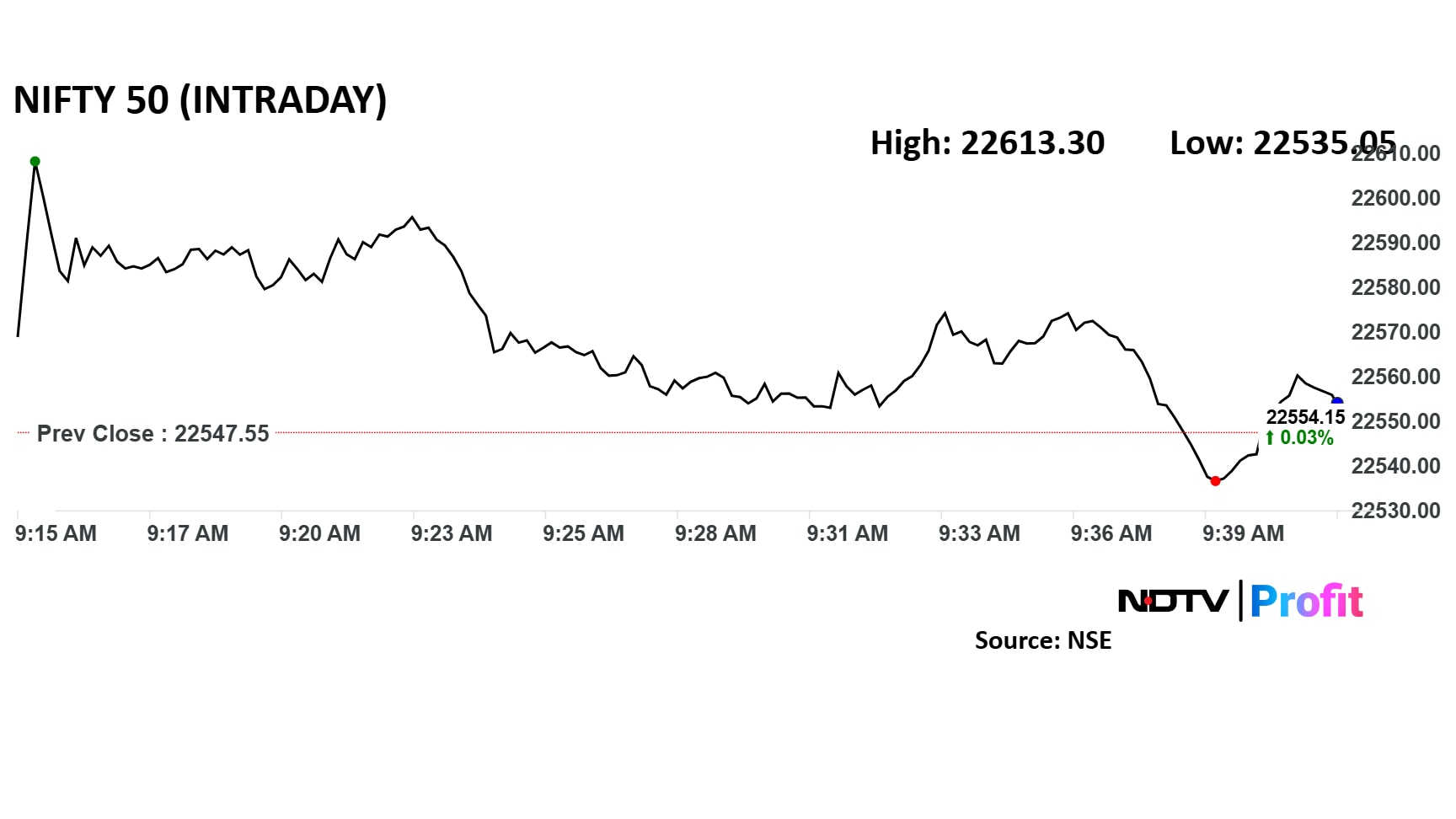

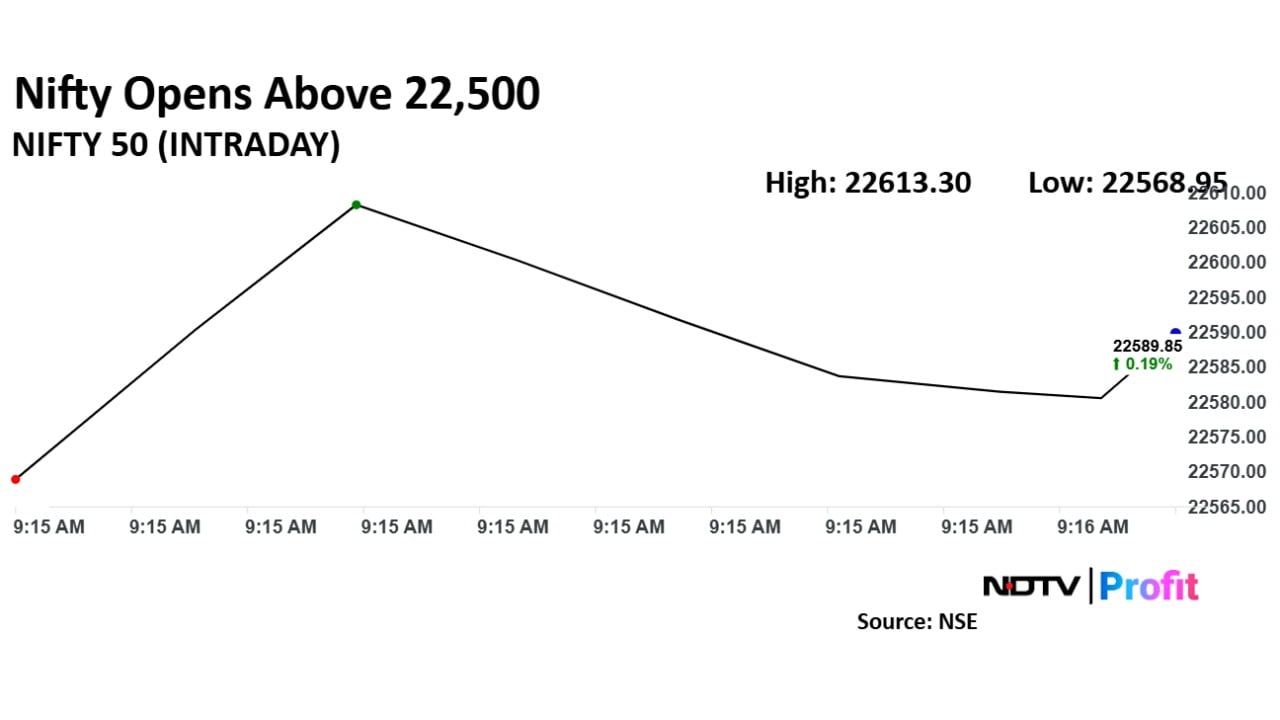

Nifty 50 down 0.1%; intraday high 0.3%

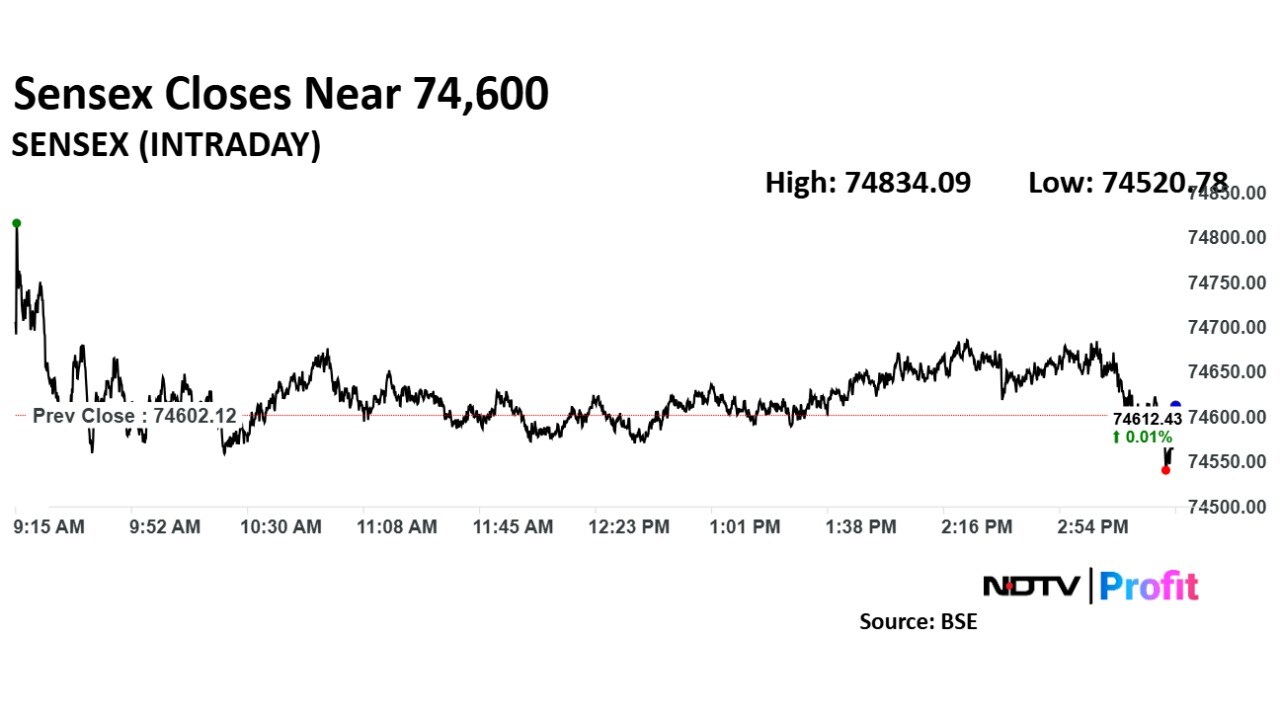

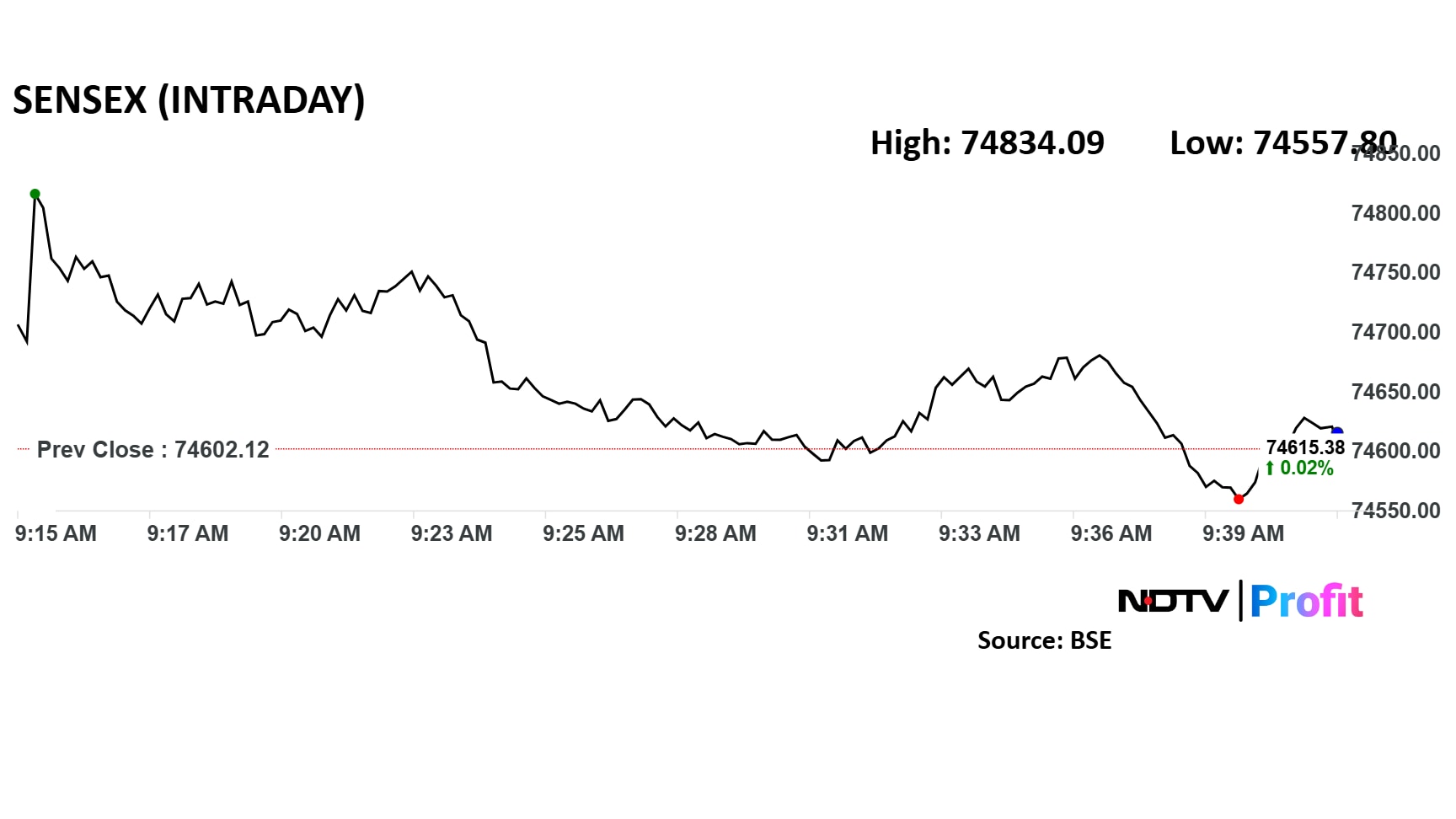

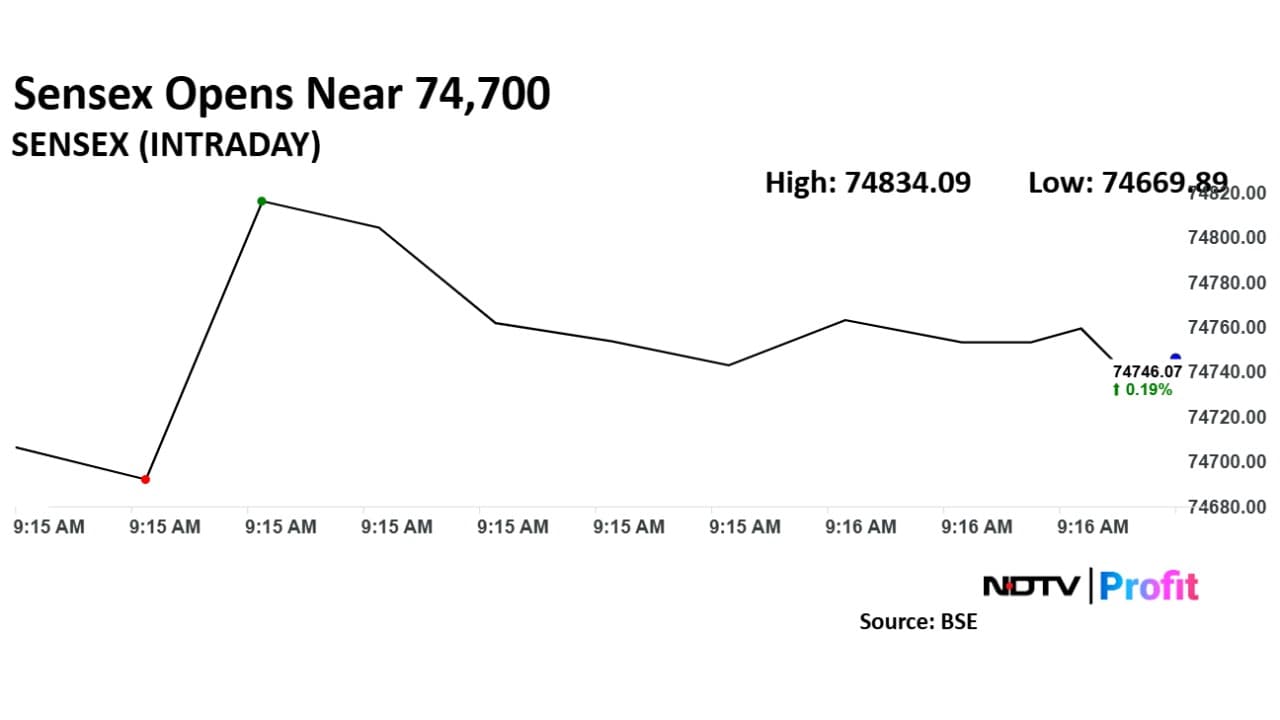

Sensex flat; intraday high 0.3%

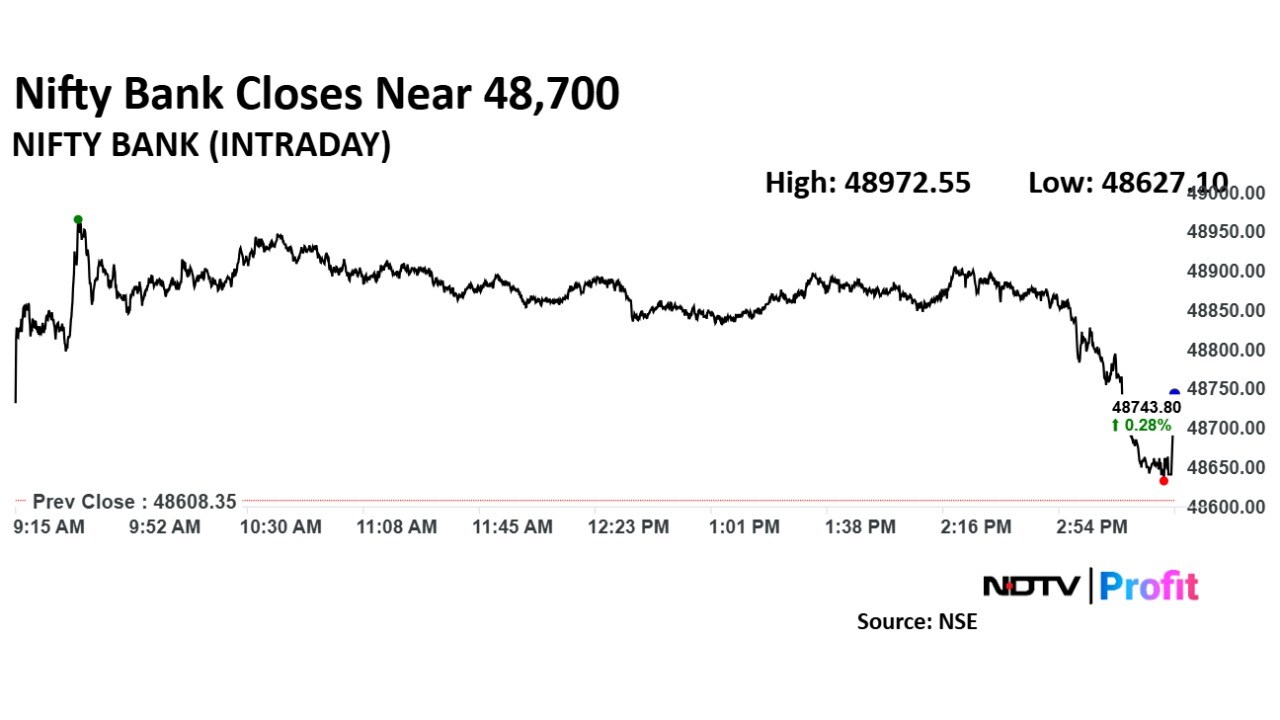

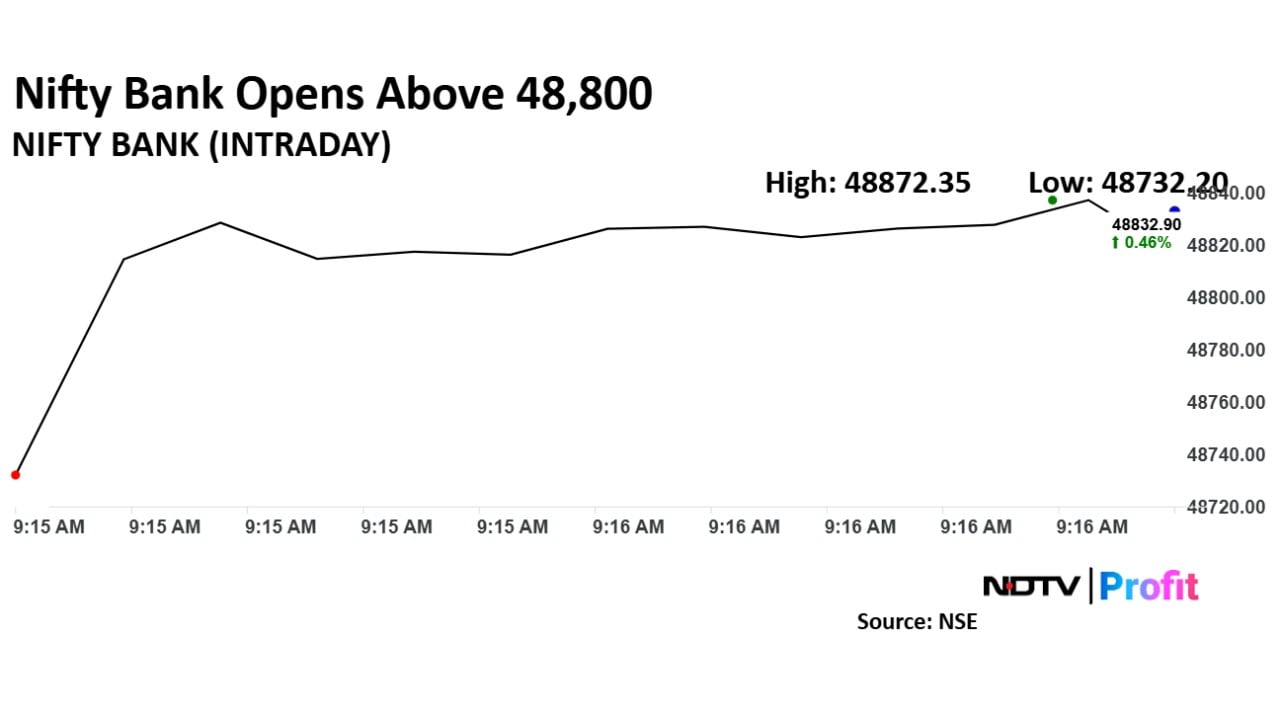

Nifty Bank up 0.6%; intraday high 0.75%

Nifty Midcap 150 down 1.4%

Nifty Smallcap 250 down 1.6%

Nifty Finance, Nifty Bank only sectoral gainers

Top Nifty Gainers: Bajaj Finance, Shriram Finance, Bajaj Finserv

Top Nifty Losers: UltraTech Cement, Trent, Hero MotoCorp

Top losers

UltraTech Cement: Around Rs 19,800 Crore

Polycab India: Around Rs 12,900 Crore

Hyundai Motors: Around Rs 9,800 Crore

Varun Beverages: Around Rs 9,300 Crore

Top gainers

Bajaj Finance: Around Rs 13,500 Crore

HDFC Bank: Around Rs 13,200 Crore

Bajaj Holdings: Around Rs 7,500 Crore

Bajaj Finserv: Around Rs 6,300 Crore

KEI Industries, Polycab, Havells Share Prices Go Haywire After UltraTech's Cables Entry Plan

KEI Industries, Polycab, Havells Share Prices Go Haywire After UltraTech's Cables Entry Plan

SpiceJet Q3 Results: Airline Back In Black With Net Profit Of Rs 25 Crore

IndusInd Bank, Bandhan Bank Could Gain As RBI Eases Risk Weights For Loans To NBFCs

UltraTech Will No Longer Be Just A Cement Company

Arm Jupiter Tatravagonka receiced an order worth Rs 255 crore from Braithwait & Co for supply of 9,140 wheelsets.

Source: Exchange Filing

Glenmark Pharma Inc launched Epinephrine injection USP and multiple-dose vial. According to sales data for 2024, the Epinephrine Injection USP achieved annual sales of approximately $42.7 million.

Source: Exchange Filing

The yield on the benchmark 10-year Indian government bond opened flat at 6.71%

Source: Bloomberg

Rupee opened 6 paise lower at 87.26 against US Dollar. It closed at 87.20 a dollar on Tuesday.

Source: Bloomberg

Muthoot Finance Receives RBI's Approval To Open 115 New Branches

FPIs Continue Selling Streak, Net Offload Stocks Worth Rs 3,529 Crore

Rupee Closes Below 87 For First Time In Two Weeks

Nifty Feb futures down by 0.21% at a premium of 34.6 points.

Nifty Feb futures open interest down by 33.86%.

Nifty Options Feb 27Expiry: Maximum Call open interest at 22700 and Maximum Put open interest at 22600

Securities in ban period: Manappuram Finance

The US Dollar index is up 0.08% at 106.60.

Euro was down 0.10% at 1.0473.

Pound was down 0.10% at 1.2263.

Yen was up 0.12% at 149.18.

Stocks in the Asia Pacific region were mixed on Thursday following new tariff announcements from US President Donald Trump on European Union. In addition, Nvidia Corp. earnings failed to rally stocks as the chipmaker drew a muted response from investors that are rather used to blowout results.

South Korea's Kospi fell 0.52%, or 13.72 points to 2,627.37, while Australia's S&P ASX 200 was up 0.35% at 8,269.70 as of 7:10 a.m. Japanese markets opened steady on Thursday.

While S&P 500 and Nasdaq 100 contracts were relatively flat, future contract in China hinted at a positive start and Hong Kong equity index futures indicated a lower open.

The US dollar remained flat, while the stocks were mixed on Thursday. The S&P 500 closed little changed while the Nasdaq 100 rose 0.26%. The Dow Jones Industrial Average closed 0.43% lower on Thursday.

Stock Market Today: All You Need To Know Going Into Trade On Feb. 27