India's fiscal consolidation efforts make it “very difficult” to allocate more funds for capital expenditure in this fiscal, according to Goldman Sachs' India Economist Santanu Sengupta.

Read full story here.

V-Mart's scrip rose as much as 12.65% to Rs 3,775 apiece on the NSE. However, it pared much of the gains to trade 4.61% higher at Rs 3,510 apiece, as of 2:10 p.m. This compares to a 1.32% advance in the NSE Nifty 50 Index.

Read full story here.

The company clarified that the Income Tax department concluded its search at the company's offices, adding that any material developments will be disclosed.

Source: Exchange Filing

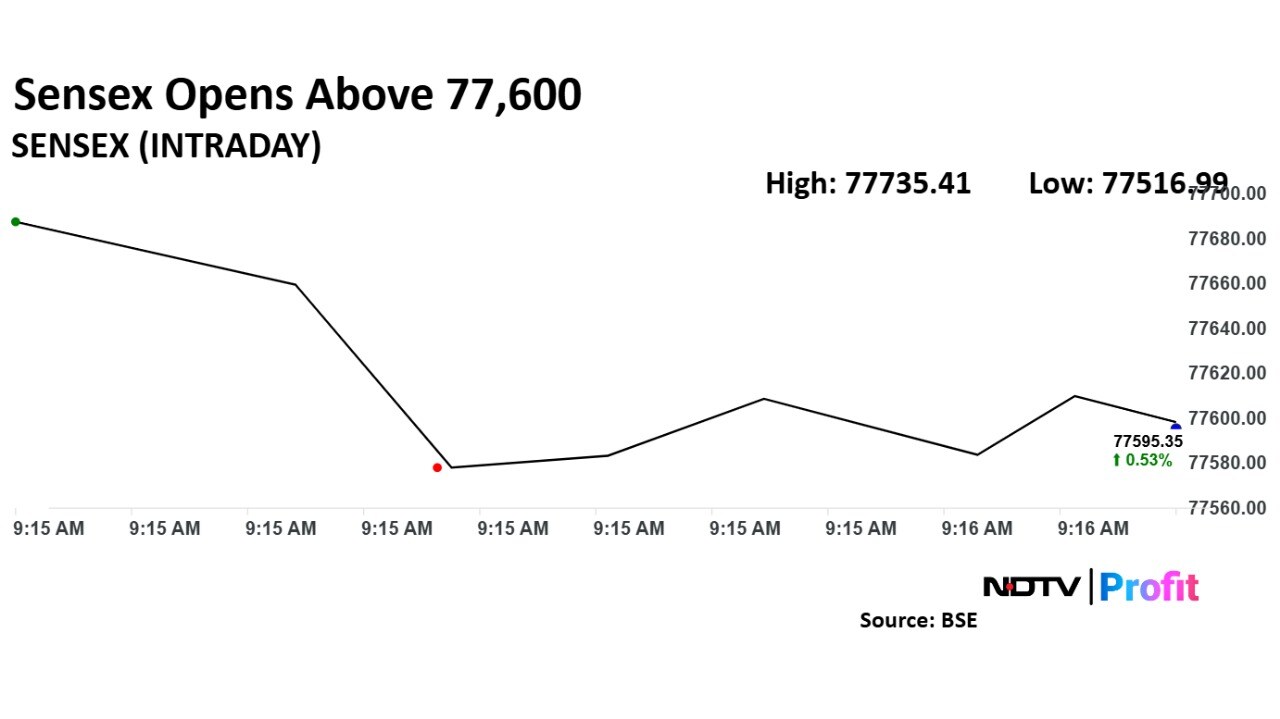

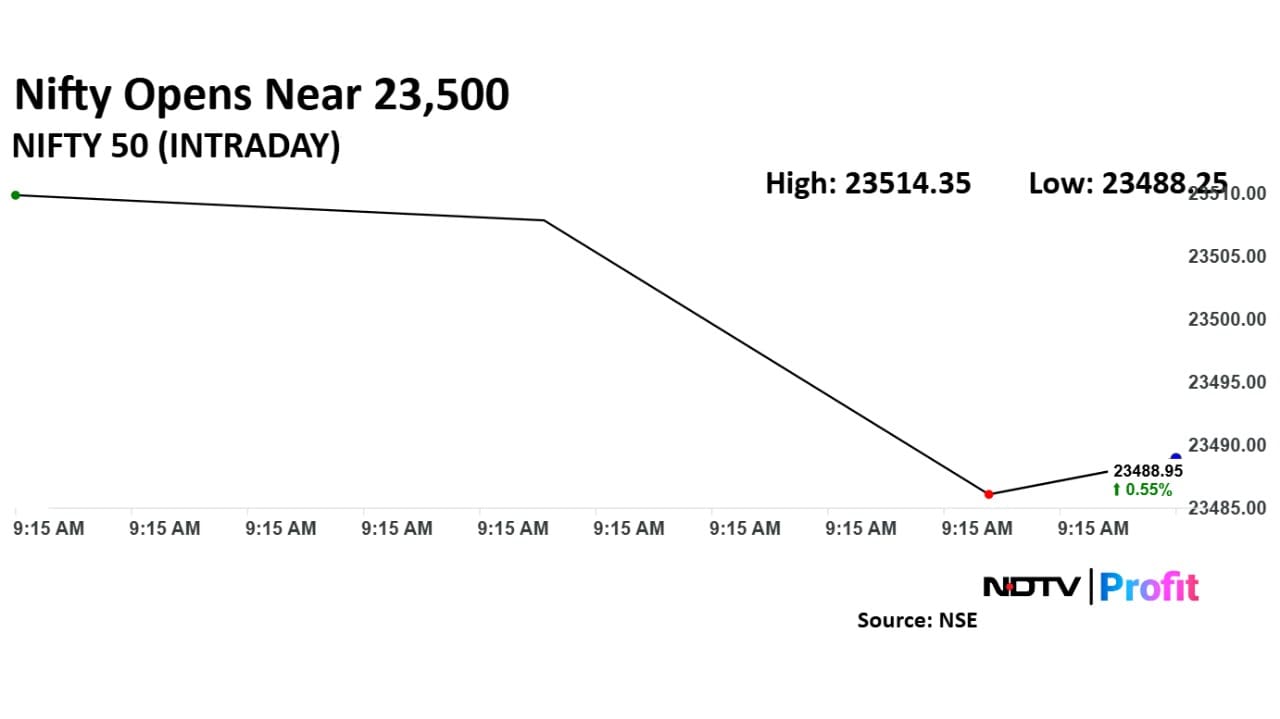

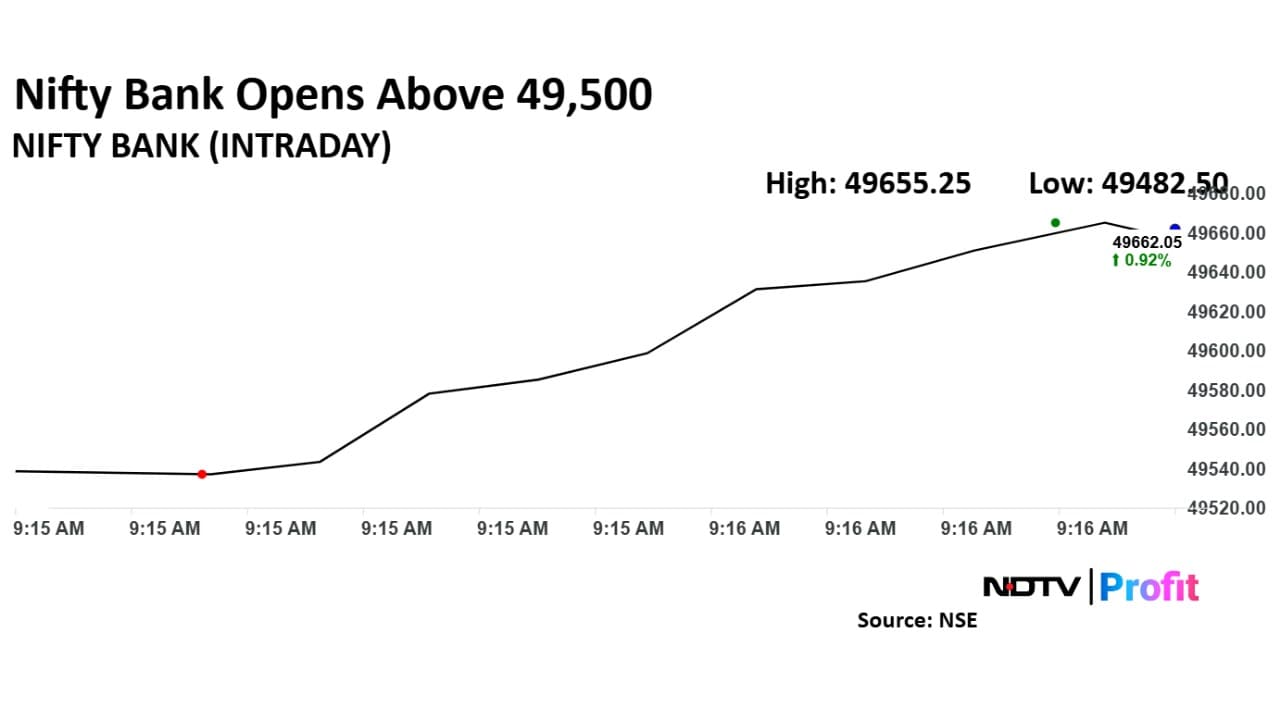

Indian equities were trading higher with Nifty rising over 0.87% at 23,569.15 and Sensex was trading 701.17 points lower at 77,885.

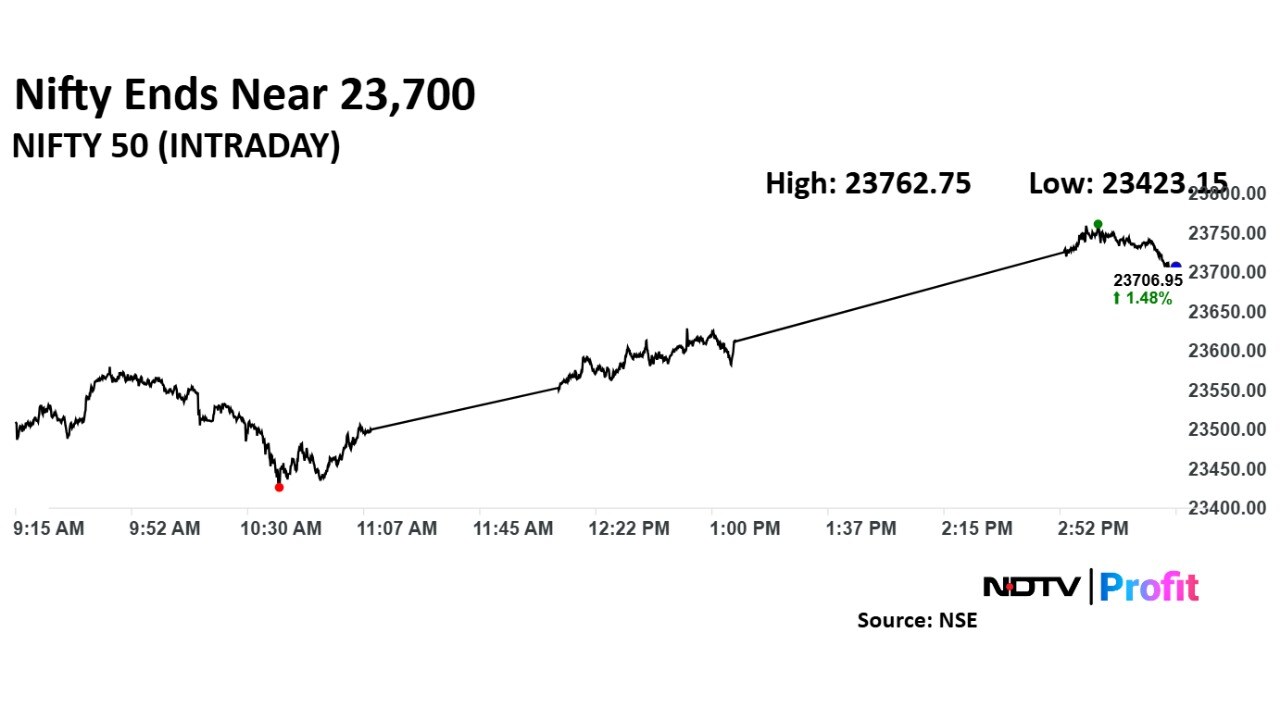

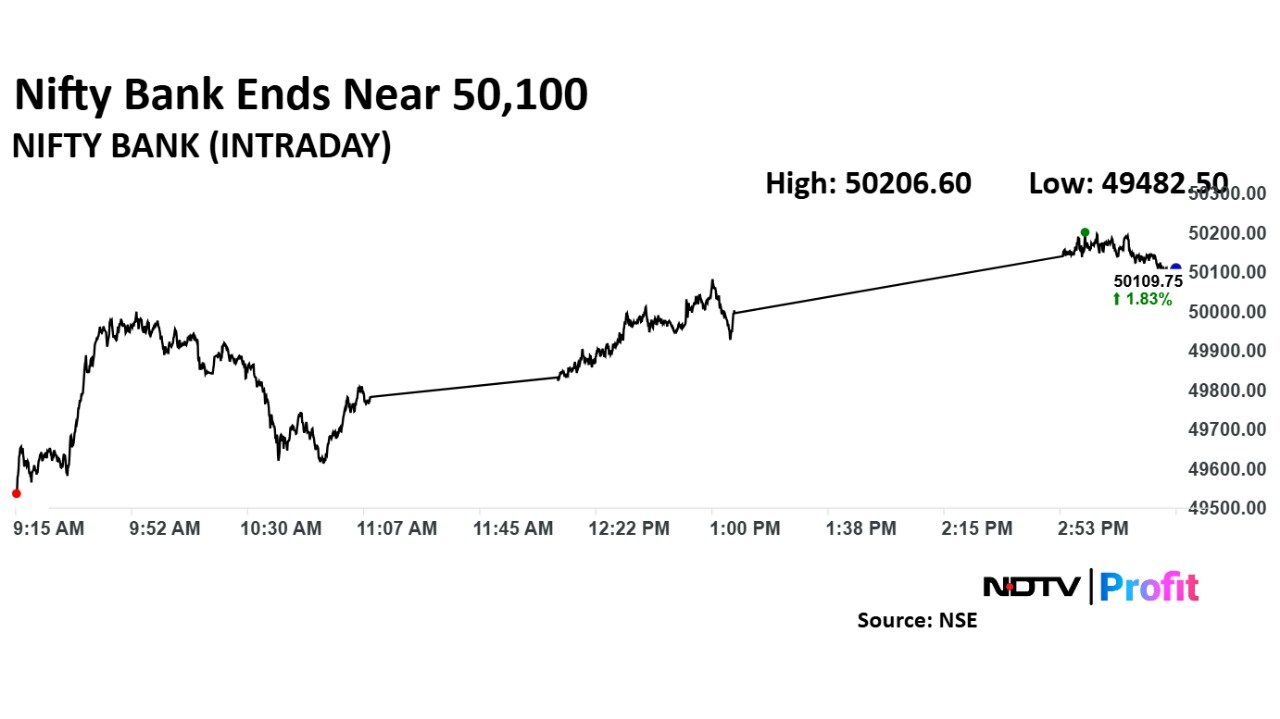

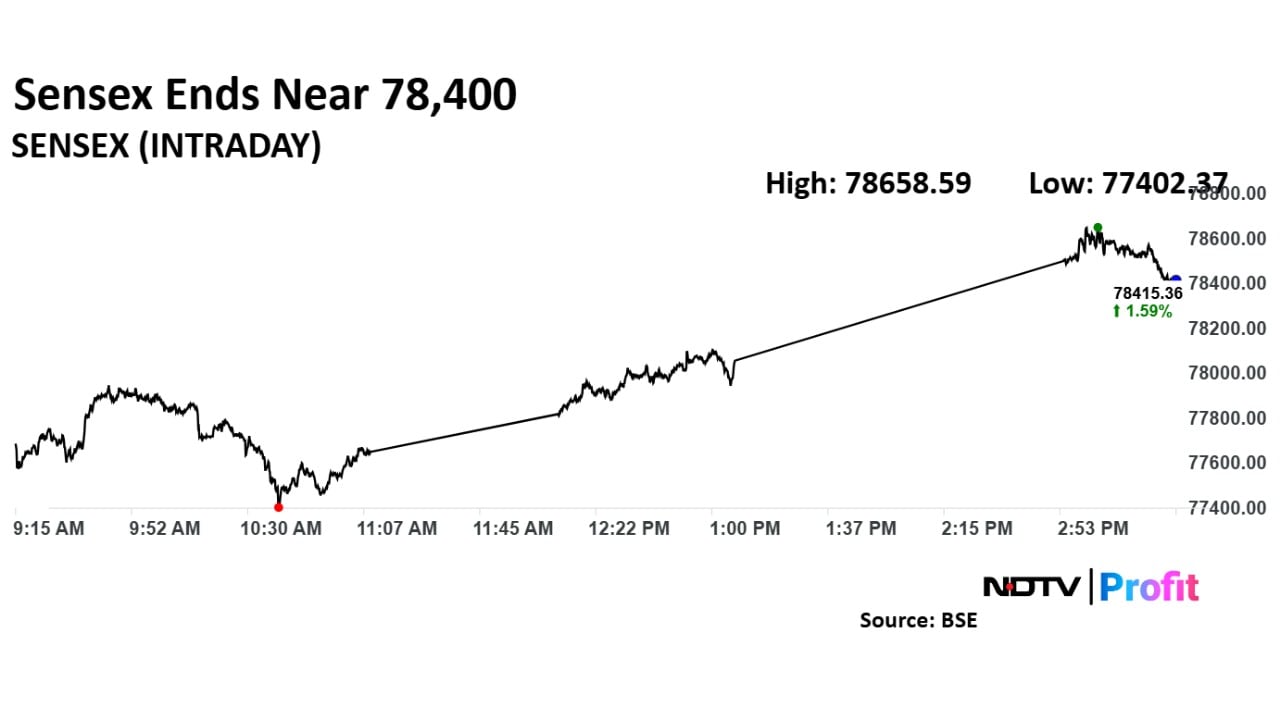

Intraday, both Nifty and Sensex rose over 1%.

Nifty rose 1.09% or 255.55 points at 23,616.60.

Sensex rose 1.12% or 861.92 points to 78,048.66.

Broader indices were also in the green. Nifty Midcap rose 1.01%; Nifty Smallcap was trading 0.49% higher.

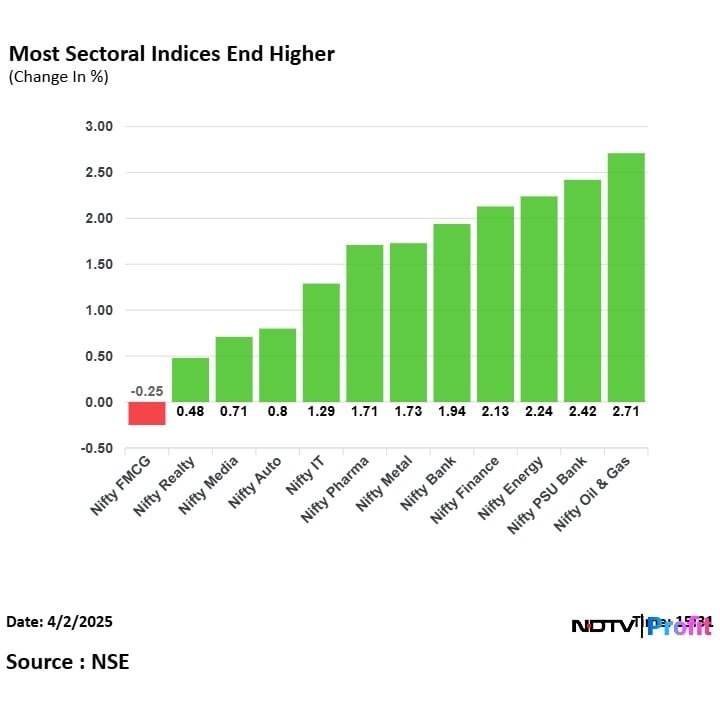

Most sectoral indices rose, led by Nifty Oil & Gas.

Nifty Bank rose 1.33%, Nifty IT was up 0.39%.

L&T, Tata Motors and BEL were top Nifty gainers.

Trent, ITC Hotels and Titan were top Nifty losers.

Hitachi Energy India expects its order inflow to grow at a high-single-digit rate quarter over quarter, following a strong performance in Q3, according to the company’s Managing Director and Chief Executive Officer, N. Venu.

Get full story here.

As many as 130 companies are scheduled to declare their financial results for the quarter ended Dec. 31, 2024, on Tuesday. These include Asian Paints, Titan, Tata Power, Godrej Properties and MobiKwik. Other big names announcing their third-quarter earnings on Tuesday include Thermax and Torrent Power Ltd.

Get live updates here.

EaseMyTrip launches swipe right travel sale with unbeatable discounts on flights hotels and more.

Source: Exchange Filing

ITC Hotels will be excluded from the BSE on Tuesday.

NSE exclusion date is still awaited

ITC Hotels to be excluded from the Sensex in the final 30 minutes of trading

According to Nuvama Alternative Research, the outflow is expected to be approximately $48 million

The exclusion will only be postponed if the stock hits the lower circuit before 2:00 PM today

Humour this: a company becomes profitable after a long list of loss-making quarters on the back of other income alone. The stock subsequently hits upper circuit two days straight in an apprehensive market. Market cap swells some Rs 260 crore to rise past Rs 5,500 crore since the results.

Read full story here.

Nifty and Sensex pared early gains after China announced retaliatory tariffs on US goods even as a deadline for imposing more tariffs on China passed without a deal.

The Nifty 50 was trading 0.43% up at 23,463.80, and the Sensex was up 0.47% at 77,547.40 as of 10:50 a.m.

Crude extends drop as China is set to impose 10% tariff on US oil. Brent crude is down 0.79% to $75.36.

Shares in the Asia-Pacific region pared gains after China announced retaliatory tariffs on US goods even as a deadline for imposing more tariffs on China passed without a deal.

Asian stocks gave up early gains after they rebounded in the morning. A gauge of Chinese stocks listed in Hong Kong, which jumped almost 4% earlier, trimmed their advance to 1%, according to Bloomberg. South Korea’s Kospi was up 2%, while Japan’s Nikkei was up 1.14%

Meanwhile, China announced a probe on Google soon and that sent Nasdaq 100 futures lower.

China in a retaliatory move will impose tax on coal, LNG, oil and agriculture machinery and other products imported from the US.

Source: Bloomberg

Dr. Agarwal's Health Care Ltd. shares were listed on the BSE at Rs 396.9 per share, a discount of 1.2% to the issue price of Rs 402 apiece. The shares debuted flat on the National Stock Exchange at Rs 402 per share.

Read full story here.

At pre-open, the NSE Nifty 50 was trading 148.85 points or 0.64% higher at 23,509.90. The BSE Sensex was 532.26 points or 0.69% higher at 77,719.

The yield on the 10-year bond opened flat at 6.67%.

It closed at 6.67% on Monday.

Source: Bloomberg

Rupee opened 16 paise higher at 87.03 against the US Dollar. It closed at 87.19 on Tuesday.

Source: Bloomberg

The dollar index is 0.25% higher at 108.69. Brent crude is down 0.51% to $75.57.

JPMorgan

Indian Metals and Mining stocks could trade choppy in the near term due to ongoing uncertainty around tariffs.

Budget kept basic customs duty on steel unchanged and lacked mention.

Industry anticipates a decision by Feb end on safeguard duties.

Capex growth underwhelming and lower than long term CAGR.

Believe 7% year-on-year steel consumption growth in financial year 2026-27 is a more realistic estimate now.

Could be positive implications of income tax exemptions on other steel consuming sectors like automobiles.

US tariffs on Canada, Mexico and China could drive near-term bearish pressure on LME base metal prices.

Believe the sharp appreciation of USD against INR could cushion a part of the impact.

JSW Steel is our preferred pick within the overall space.

Jefferies

Maintain 'Buy' with a target price of Rs 375.

Highlighted the strong production growth outlook over financial year 2025-28 from fields under development.

Its partnership with BP to revive production from its largest field.

SAED is unlikely to be reimposed if crude stays below $ 100.

Potential production recovery in Mumbai High poses upside risk to estimates.

Morgan Stanley

Maintain 'Underweight' with a target price of Rs 879

It's still tough.

Unit Ebitda across regions reflected weak pricing and higher opex.

Basic Chemistry EBITDA/t fell 20% quarter-on-quarter.

Expects to further raise volumes, sees limited pricing respite.

Sees increased supplies from Turkey, the US and start-up of China exports.

Jefferies

Maintain 'Underperform' rating but cut target price to Rs 1,350 from Rs 1,630.

Delivered another disappointing quarter with weak revenue growth in the base business.

Further drag from acquired Cenexi business.

Management expects base business to recover in fourth quarter.

Cenexi breakeven timelines have been pushed out by a year.

Execution remains weak and stock lacks near term catalysts

Lower FY25-27 EPS by 1-4%, building a slower Cenexi recovery.

Goldman Sachs

Maintain 'Buy' with target price of Rs 1,560.

Third quarter results were better than expectations.

Market share gains have also continued.

Logistics business continues to see healthy growth.

Recent correction has made risk-reward much more attractive.

Nifty February futures down by 0.49% to 23,440 at a premium of 82.95 points.

Nifty February futures open interest down by 0.51%.

Nifty Options Feb. 6 Expiry: Maximum call open interest at 23,500 and maximum put open interest at 22,000.

Securities in ban period: Nil.

The US Dollar index is up 0.23% at 108.66.

Euro was up 0.23% at 0.9690.

Pound was up 0.24% at 0.8051.

Yen was up 0.29% at 155.20.

Stocks in the Asia-Pacific region advanced after Monday's global rout as US President Donald Trump shelved his tariff plans by one month, easing the global trade war tensions.

Japan's Nikkei was up 580 points, or 1.52% at 39,105, while South Korea's Kospi rose 1.8%, or 46 points to 2,498 as of 7:15 a.m. Future contracts in Hong Kong and US hinted at a negative start for the stocks.

The dollar index — which tracks the greenback's performance against a basket of 10 leading global currencies — was 0.23% down at 108.73. Crude oil prices fell on the delay of a trade war.

Stocks on Wall Street declined on a potential trade war impact if the tariff measures were implemented. The S&P 500 and the tech-heavy Nasdaq Composite fell 0.76% and 0.28%, respectively. The Dow Jones Industrial Average slipped 1.20%.

The GIFT Nifty was trading above 23,500 early Tuesday. The futures contract based on the benchmark Nifty 50 rose 0.12% at 23,547 as of 6:45 a.m. indicating a positive start for the Indian markets after US president Donald Trump delayed tariffs on Canada and Mexico.

The NSE Nifty 50 and BSE Sensex settled in losses on Monday as risk-off sentiment drove money out of the domestic markets on fears of potential trade wars in the wake of tariff impositions by the US.