The broader indices underperformed its larger peers with S&P BSE MidCap losing 0.4% and S&P BSE SmallCap shedding over 0.5%. Thirteen of the 19 sectoral indices compiled by BSE Ltd. advanced with S&P BSE Power, Bankex ad Energy rising 1%.

The market breadth as skewed in the favour of bears. About 1,178 stocks advanced, 2,331 declined and 155 remained unchanged.

HCL Technologies has been selected to provide global service desk and on-site support to Novo Nordisk. HCL Tech will implement a multilingual and omnichannel digital workplace solution for Novo Nordisk. It will support over 48,000 end-users in 20 languages, across 58 countries and offer on-site I.T. services in the U.S., Asia and Europe.

Source: Exchange Filing

Shree Cement has started commercial production at its Clinkersation unit in Raipur in Chhattisgarh.

The facility has a production capacity of 12,000 tonnes per day.

Source: Exchange Filing

IndusInd Bank: InCred Earnest Innovation Partners initiated coverage of the stock with a recommendation of 'add'; price target set at Rs 1,250.

Godrej Consumer: Ambit Capital Pvt initiated coverage of the stock with a recommendation of 'buy'; price target set at Rs 848.

Source: Bloomberg

Radico Khaitan slipped for sixth straight day, on track for the longest losing streak in nearly 18 months since Sept. 24, 2020. The stock has shed 8.2% during the streak compared to Sensex which fell 0.7%.

Union Bank of India shares declined for the seventh straight day, ont rack for the longest losing streak in 18 months since Sept. 25, 2020.

Shares of NHPC is lower for the seventh straight day, on track for the longest losing streak in a year since Mar. 18, 2021.

Source: Bloomberg

Shares of Ruchi Soya Industries fell nearly 10% on the last day of the company's follow-on public offer.

Subscription Details: Day 3

The offer was subscribed 2.44 times on 2.28 p.m. on Monday.

Qualified Institutional Buyers: 1.13 times

Non Institutional Investors: 8.15 times

Retail Individual Investors: 0.73 times

Employees: 6.88 times

Source: NSE

The three-day initial public offer of Kolkata-based agri-products' wholesaler and distributer Uma Exports opened for subscription from today.

The offer was subscribed 1.66 times as of 2:28 p.m.

Qualified Institutional Buyers: 0 times

Non Institutional Investors: 0.32 times

Retail Investors: 2.27 times.

IPO Details

Price range: Rs 65-68

Issue size: Rs 60 crore

Issue Period: March 28-March 30

Bid lot: 220 equity shares and in multiples thereof.

Source: NSE

Shopee, the e-commerce arm of Southeast Asia’s Sea is closing down its India operations “in view of global market uncertainties.”

The Singapore-based internet and tech group launched in India in October 2021.

Sea’s popular gaming app ‘ Garena Free Fire’ was banned in India last month.

Source: Bloomberg

The government has recovered Rs 95.8 crore including penalties from various crypto exchanges.

Source: Parliament reply by MoS Finance Pankaj Chaudhary

BLOOMBERG EXCLUSIVESri Lanka is discussing more aid from New Delhi during India's Foreign Minister S Jaishankar's ongoing visit to the island nation.

Details of the package are yet to be finalised.

Sri Lanka is discussing more aid from New Delhi during India's Foreign Minister S Jaishankar's ongoing visit to the island nation.

Details of the package are yet to be finalised.

Source: People familiar with the matter

The broader indices underperformed their larger peers with both the S&P BSE SmallCap and S&P BSE MidCap shedding nearly 0.5%. Twelve of the 19 sectoral indices compiled by BSE Ltd. declined with S&P BSE Consumer Durables shedding 1%. On the flipside, S&P BSE Metal index gained 1%.

The market breadth was skewed in the favour of bears. About 1,163 stocks advanced, 2,224 declined and 154 remained unchanged.

Live: Indian Rupee Pares Most Of The Losses

India Asks Power Firms to Import Coal on Electricity Demand

India’s GDP growth forecasted at 8.9% in FY22 and 7.8% for FY23.

The third wave of COVID infections ended earlier and should cause only limited economic damage.

However, the Russia-Ukraine conflict will likely weigh on the country's economy. The risks to growth are tilted to the downside.

Source: S&P Global Ratings

Indian bonds decline tracking a global debt selloff and higher sales by states on Tuesday. Authorities are scheduled to meet on Wednesday to discuss the fiscal first-half borrowing program.

10-year yields rise 3bps to 6.84%

USD/INR up 0.1% to 76.2950

Source: Bloomberg

The three-day initial public offer of Kolkata-based agri-products' wholesaler and distributer Uma Exports opened for subscription from today.

The offer was subscribed 0.45 times as of 11:05 a.m.

Qualified Institutional Buyers: 0 times

Non Institutional Investors: 0.06 times

Retail Investors: 0.62 times.

IPO Details

Price range: Rs 65-68

Issue size: Rs 60 crore

Issue Period: March 28-March 30

Bid lot: 220 equity shares and in multiples thereof.

Source: NSE

Most yields along the India sovereign yield curve rose, with 5-year bonds moving the most in Monday morning trading.

The 2-year yield was little changed at 5%

The 10-year yield rose 3.1bps to 6.843%

The 18-year yield remained unchanged at 7.18%

The 2-year-10-year yield spread was 184.3bps, vs previous close 180.8bps

The Agreement covers Trade in Goods, Rules of Origin, Trade in Services, Technical Barriers to Trade, Sanitary and Phytosanitary measures, Dispute Settlement, Movement of Natural Persons, Telecom, Customs Procedures, Pharmaceutical products, Government Procurement, IPR, Investment, Digital Trade and Cooperation in other Areas.

It covers almost all the tariff lines dealt in by India (11,908 tariff lines) and the UAE (7581 tariff lines) respectively.

The agreement will come into effect starting 1 May, 2022.

India will benefit from preferential market access provided by the UAE especially for all labour-intensive sectors.

India has offered market access to UAE in 100 sub-sectors, while Indian service providers will have access to around 111 sub-sectors.

11 broad service sectors that India will access to include business services, communication services, construction and related engineering services, distribution services, educational services, environmental services, financial services, health related and social services, tourism and travel related services, recreational cultural and sporting services and transport services.

Source: Trade document available on Commerce Ministry's website

Shares of Ruchi Soya Industries fell nearly 6.4% on the last day of the company's FPO.

Subscription Details: Day 3

The offer was subscribed 1.34 times on 11 a.m. on Monday.

Qualified Institutional Buyers: 0.87 times

Non Institutional Investors: 3.91 times

Retail Individual Investors: 0.50 times

Employees: 5.36 times

Source: NSE

Morgan StanleyMaintains 'underweight/attractive' on Multi Commodity Exchange of India Ltd. with the target price kept unchanged at Rs 1,300; an implied downside of 9.92%

SEBI has allowed exchanges to introduce options on commodity indices, to increase the product suite in the commodity derivatives market.

Introduction of a new product is a good mean, but executive issues remain a challenge.

Believes it is premature to be optimistic about adoption of options on index futures.

Maintains 'underweight/attractive' on Multi Commodity Exchange of India Ltd. with the target price kept unchanged at Rs 1,300; an implied downside of 9.92%

SEBI has allowed exchanges to introduce options on commodity indices, to increase the product suite in the commodity derivatives market.

Introduction of a new product is a good mean, but executive issues remain a challenge.

Believes it is premature to be optimistic about adoption of options on index futures.

Source: Morgan Stanley note

The three-day initial public offer of Kolkata-based agri-products' wholesaler and distributer Uma Exports will be open for subscription from today.

Price range: Rs 65-68

Issue size: Rs 60 crore

Issue Period: March 28-March 30

Bid lot: 220 equity shares and in multiples thereof.

Source: NSE

(Issue size has been corrected to Rs 60 crore)

BLOOMBERG EXCLUSIVEOfficials from the RBI and the Ministry of Finance are scheduled to meet March 30 to decide the government's borrowing programme for the first half of the fiscal year starting April 1.

Officials from the RBI and the Ministry of Finance are scheduled to meet March 30 to decide the government's borrowing programme for the first half of the fiscal year starting April 1.

Source: People with the knowledge of the matter.

A Finance Ministry spokesperson could not be immediately reached for a comment.

Source: Bloomberg

The broader indices outperformed their larger peers with S&P BSE MidCap rising 0.3% and S&P BSE SmallCap gaining 0.2%. Fifteen of the 19 sectoral indices rose with S&P BSE Oil Gas adding 1.8% and S&P BSE Energy advancing 1.4%.

The market breadth was skewed in the favour of bulls. About 1,385 stocks advanced, 1,194 declined and 123 remained unchanged.

Former Comptroller and Auditor General of India, Vinod Rai to be appointed as chairman of Kalyan Jewellers India.

TS Kalyanaraman will continue as the managing director.

Rai has held various positions within the Indian government as well as in state governments, including as Chairman of the Banks Board Bureau.

Source: Exchange filing

Motherson Sumi Wiring India is the domestic wiring harness arm of erstwhile Motherson Sumi.

ICICI Direct expects the entity to command premium valuations with fair value pegged at Rs 70 per shre.

The record date the demerger was Jan. 7.

Source: ICICI Direct note

India Asks Power Firms to Import Coal on Electricity Demand

Indian bonds may open lower tracking the sharp rise in U.S. yields and higher sales of bonds by states on Tuesday. Traders are awaiting on the fiscal first-half borrowing calendar due this week.

Banking services may be partially hit on Monday and Tuesday as a section of bank employees union has supported the two-day nationwide general strike call by trade unions, Press Trust of India reported.

USD/INR fell 0.2% to 76.2063 on Friday

10-year yields fell 2bps to 6.81% on Friday

Overseas funds sold Rs 1,510 crore of local stocks Friday, as per NSE data

They sold Rs 384 crore of sovereign bonds under limits available to foreign investors, and added Rs 46 crore of corporate debt

State-run banks sold Rs 589 crore of sovereign bonds on March 25: CCIL data. Foreign banks sold Rs 1,960 crore of bonds.

Source: Bloomberg

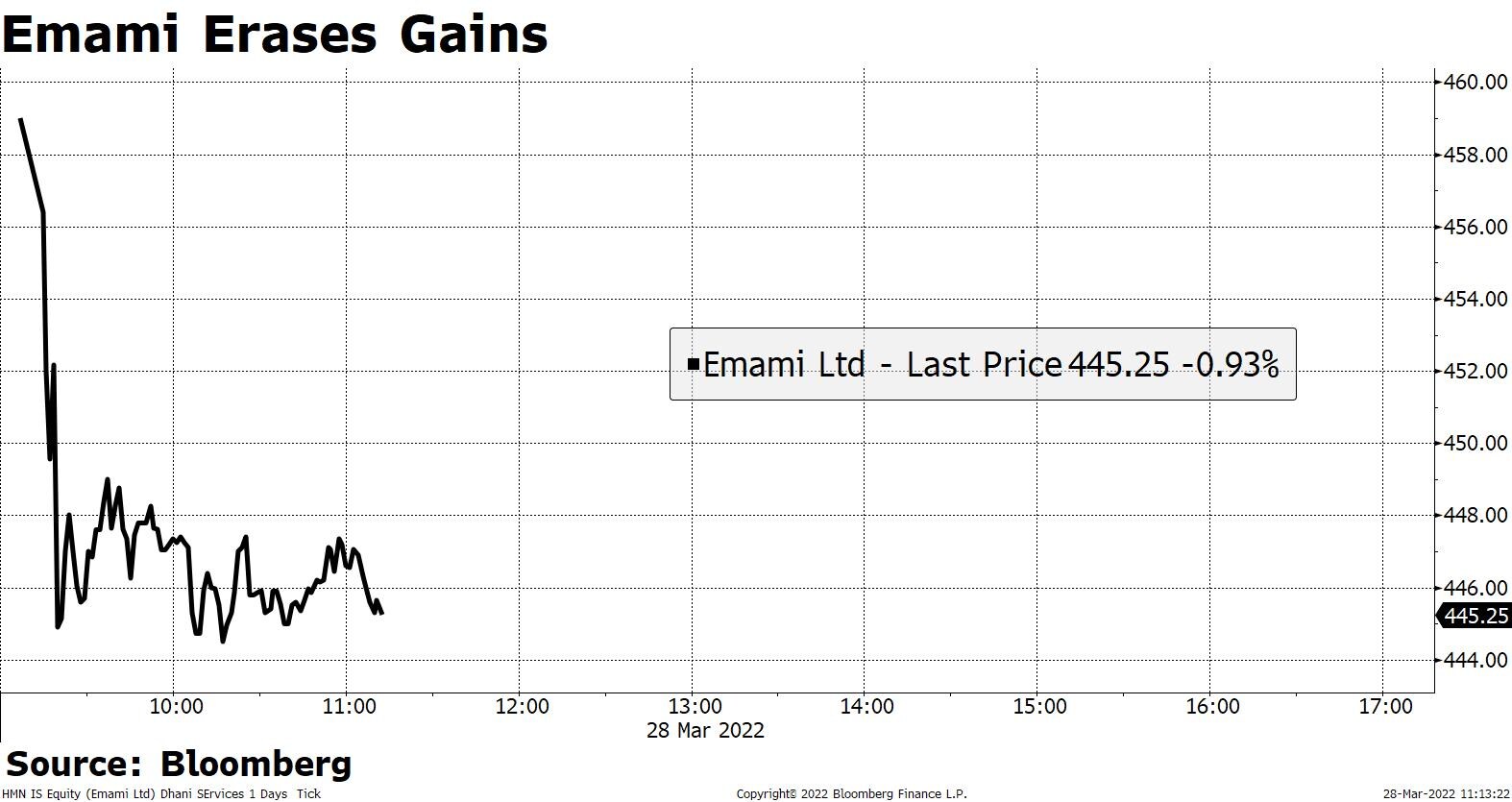

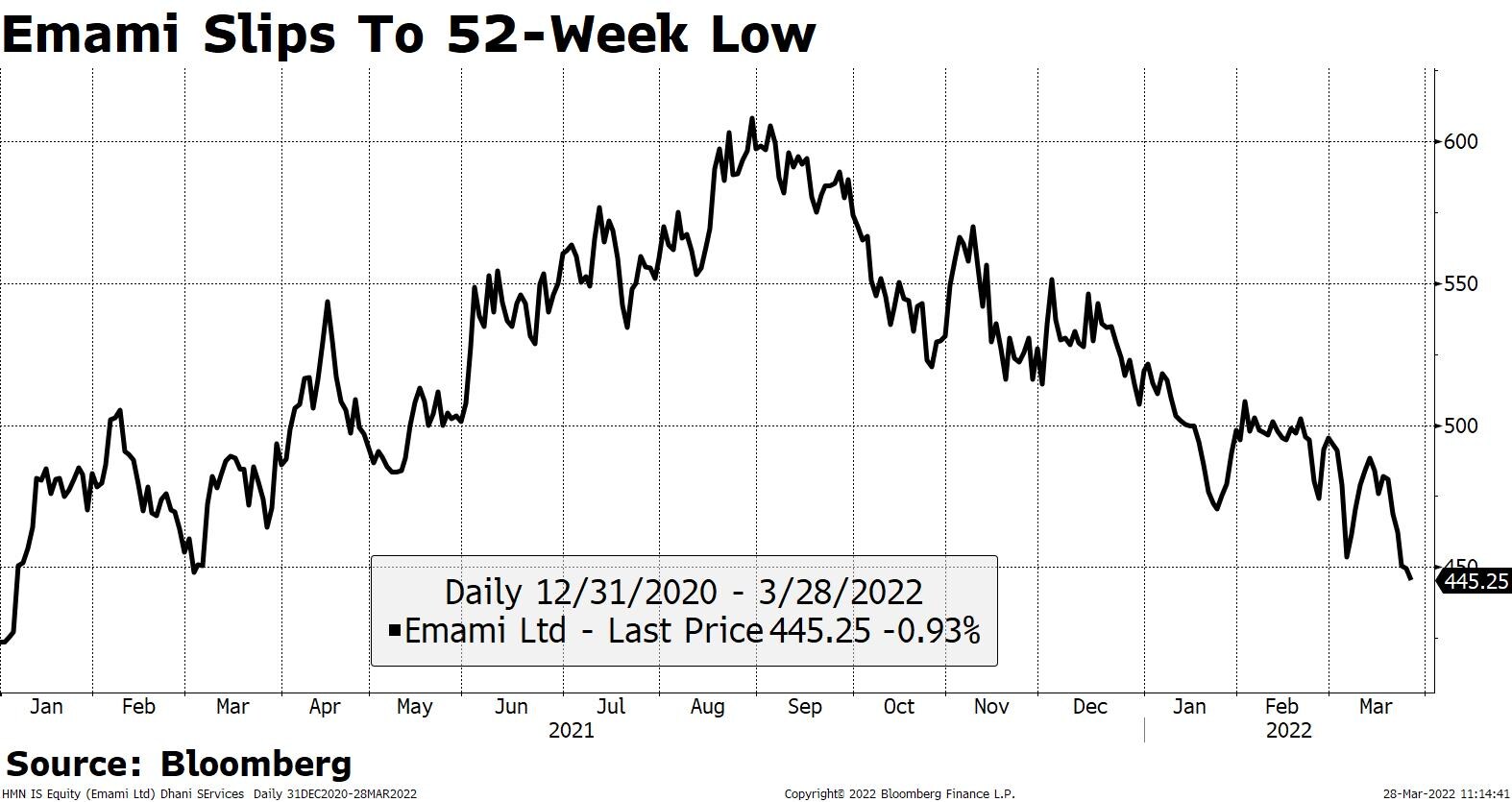

Emami Acquires Dermicool Brand From Reckitt For Rs 432 Crore

Godrej Properties enters into an agreement to develop a 33 acres land parcel in the residential market in South Bengaluru.

The land parcel in Bannerghatta Road is in close proximity and well connected to Bannerghatta Main Road, Electronic City

MD & CEO of Godrej Properties, Mohit Malhotra said that this agreement is in-line with the company's 'strategy of deepening presence in key micro markets across India's leading cities'.

Source: Exchange Filing

RITES, a leading transport infrastructure consultancy and engineering company, and Mineral Exploration Corporation Ltd. entered into a MoU.

According to the MoU, the two firms will jointly bid and execute work regarding geotechnical investigations for civil engineering infrastructure projects.

RITES and MECL will collaborate for technical services, knowledge sharing and R&D activities.

Source: Exchange Filing

The board and management of BharatPe, one India’s fastest growing fintech unicorns, is planning to list the company in the next 18 to 24 months, its chairman Rajnish Kumar said in an interview with Business Standard.

The company’s transition from an individual driven private firm to a board driven listed public one will be carried out in a well-thought through and well executed manner: Report

Petrol and diesel prices have been raised by 30 paise per litre, the sixth hike in the last seven days.

Price of petrol and diesel in Delhi at Rs 99.41 a litre and Rs 90.77 a litre respectively.

In Mumbai, petrol and diesel prices per litre are at Rs 114.19 and Rs 98.5, respectively.

Cumulative hike now stands at around Rs 4 a litre.

Source: ANI

PVR: The multiplex operator has approved a merger with Inox Leisure. Shareholders will get three shares of PVR for every 10 shares held in Inox. PVR now operates the largest multiplex network in India with 871 screens at 181 properties in 73 cities (India and Sri Lanka).

Vedanta: The board of Vedanta approved capital expenditure of $687 million in Cairn Oil & Gas to increase near-term volume. It earmarked a capex of $466 million towards Zinc International’s Gamsberg Phase 2 project. Further, it has set aside $348 million for an expansion project at its subsidiary ESL Steel.

Larsen & Toubro: The Ministry of Defence has signed a contract with Larsen & Toubro for acquisition of two multipurpose vessels for Indian Navy at an overall cost of Rs 887 crore.

Emami: The company has acquired Dermicool category from Reckitt Benckiser Group Plc for Rs 432 crore.

Bharti Airtel: Bharti Airtel to buy 4.7% stake in Indus Towers for Rs 2,388.06 crore.

Adani Enterprises: The company's two units, Mahanadi Mines and Minerals and MP Natural Resources, have won a coal block each in Odisha and Madhya Pradesh.

GAIL India: To consider buyback of its shares on March 31.

Wipro: Approved interim dividend of Rs 5 per equity share for FY22.

PTC India Financial: Gets income tax refund of Rs 50.97 crore.

Indiamart Intermesh: To acquire 51.09% stake in Finlite Technologies (Livekeeping) for Rs 45.98 crore. The acquisition is expected to be completed in 60 days.

Sun Pharma: The company has presented Phase 3 Data for WINLEVI (clascoterone) cream 1% for the Topical Treatment of Acne Vulgaris at the AAD Annual Meeting.

Exide Industries: Exide Industries incorporated a wholly owned subsidiary, Exide Energy Solutions Ltd., to set up a a green field multi-gigawatt Lithium-ion cell manufacturing facility in India with an initial authorised and paid-up equity share capital of Rs 100,000.

Responsive Industries: Mrunal Shetty has resigned as director and chief financial officer. The company has accepted his resignation and relieved him of his responsibilities with effect from March 24, 2022.

Bank of Baroda: The bank has acquired 10 lakh equity shares of Open Network for Digital Commerce.

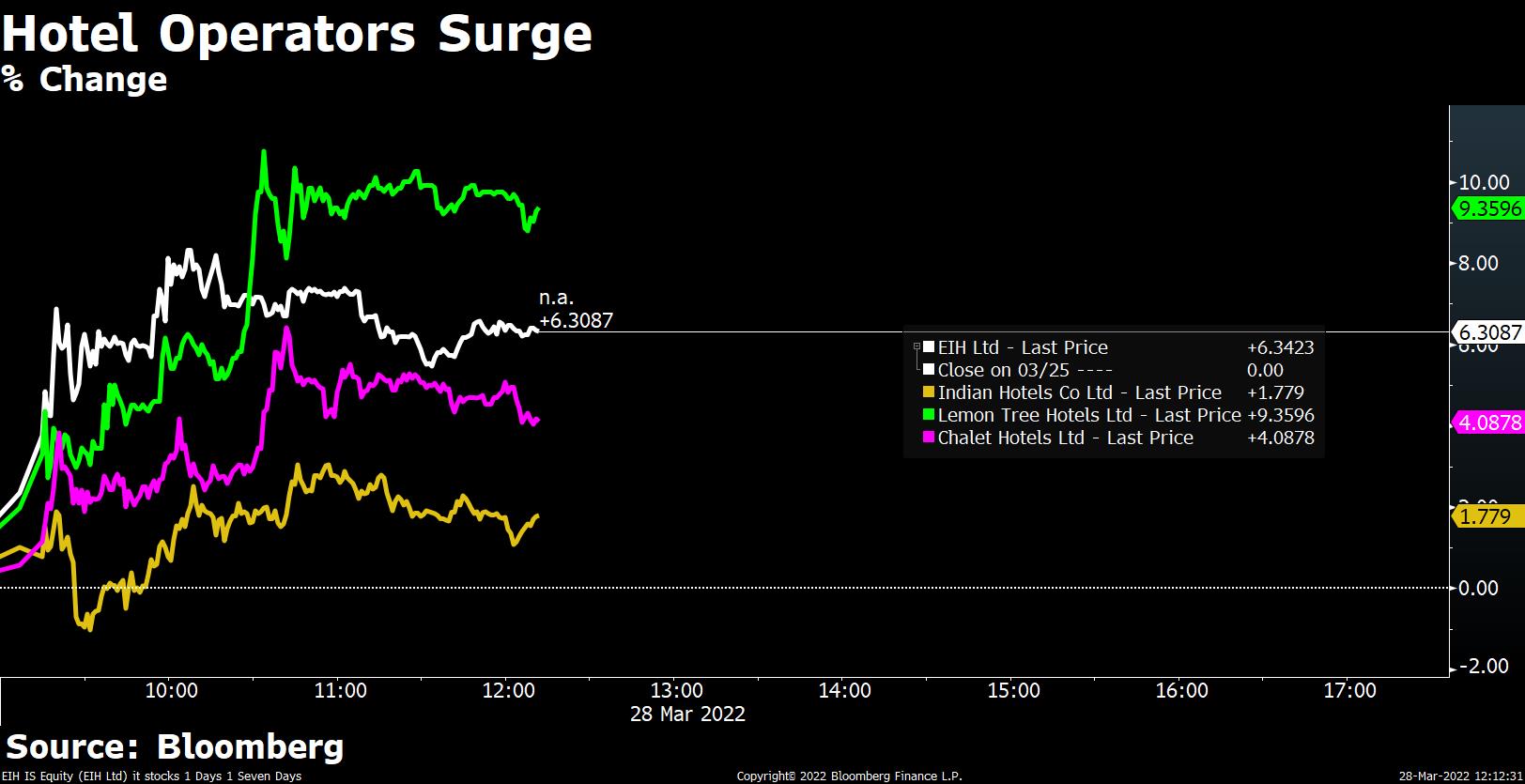

Indian Hotels: The board announced closure of the QIP launched on March 22. The issue price had been fixed at Rs 202 per share.

Stock Market Today: All You Need To Know Going Into Trade On March 28