"Domestic equities ended lower, following sluggishness across global markets. Moreover, news on the Russia-Ukraine war, rise in bond yields and further supply disruptions due to increasing COVID infections in China, continue to perturb market sentiments. In addition, Fed is preparing to take a more rigid monetary policy stance and shrink its balance sheet in an attempt to curb inflation. On the other hand, India’s central bank has kept the repo-rates unchanged at 4% despite fears of rising inflationary pressures, whilst also downgrading the growth forecasts to 7.2% for FY23", Mitul Shah, Head of Research at Reliance Securities wrote in a note. He added "the unprecedented economic damage due to the Russia-Ukraine crisis is likely to dictate the near-term market sentiment".

Ola's Bhavish Aggarwal To Focus On New Projects, CFO Arun Kumar To Manage Daily Operations

The June-September monsoon season is expected to be normal this year, New Delhi-based private forecaster Skymet Weather Services says Tuesday.

Rains are likely to be 98% of the long-term average of 880.6mm, the company says on its website

Rajasthan, Gujarat, Nagaland, Manipur, Mizoram and Tripura states could be at risk of receiving below-normal rains throughout the season

Punjab, Haryana, Uttar Pradesh and some areas of Maharashtra and Madhya Pradesh may witness above-normal rainfall during the monsoon period

The occurrence of El Nino is ruled out this year

Source: Bloomberg

The sales growth was driven by East India (23%), followed by North India (18%) and South India (8%).

West India, however, has not surpassed pre-Covid levels with sales dropping 1%.

Consumer durables and electronics, food and grocery led the gains in spending.

Beauty and personal care sales dropped 11% compared with March 2019, while footwear sales declined 2%.

The rise witnessed last month marks a growth of 28% compared to March 2021.

Source: Retailers Association of India

Biba Fashion’s IPO comprises fresh share sale worth Rs 90 crore and an offer for sale of 2.77 crore equity shares.

Promoter Meena Bindra will offload up to 37.52 lakh shares.

Private equity investors Warburg Pincus and Faering Capital will sell up to 1.84 crore and 55.86 lakh shares respectively.

Source: Draft red herring prospectus.

Balkrishna cut to 'sell' from 'accumulate' at Nirmal Bang; price target set at Rs 2,150, implied upside of 2.4%.

Eicher Motors cut to 'sell' from 'accumulate' at Nirmal Bang; price target set at Rs 2,940, implied upside of 17%.

Ceat cut to 'accumulate' from 'buy' at Nirmal Bang; price target set at Rs 1,450, an implied upside of 29%.

Source: Bloomberg

The export oriented companies are poised to benefit from the rupee fall. While the Rupee has been range bound, it recently posted 31 paisa depreciation to touch 75.89. This fall is expected to continue owing to Russia-Ukraine war and the expected hike in US interest rates. The export oriented industry especially the IT sector are in the better position with their earnings forecast. This fall in rupee offers them the much needed respite on earnings pressureAmit Khosla, Founder, Valtrust Capital

BLOOMBERG EXCLUSIVEIndia is planning to boost shipments to Russia by an additional $2 billion.

India, Russia are working out a payment system in local currencies to continue bilateral trade amid sanctions of Russia for invading Ukraine.

PM Modi's administration is in talks with Moscow to liberalise market access for several Indian-made products.

India looks to export products supplied by countries who have halted shipments after U.S. and its allies imposed sanctions on Russia, reports Bloomberg.

On India's exports list are pharmaceutical products, plastics, organic and inorganic chemicals, home furnishings, rice, beverages like tea and coffee, milk products and bovine products.

India is planning to boost shipments to Russia by an additional $2 billion.

India, Russia are working out a payment system in local currencies to continue bilateral trade amid sanctions of Russia for invading Ukraine.

PM Modi's administration is in talks with Moscow to liberalise market access for several Indian-made products.

India looks to export products supplied by countries who have halted shipments after U.S. and its allies imposed sanctions on Russia, reports Bloomberg.

On India's exports list are pharmaceutical products, plastics, organic and inorganic chemicals, home furnishings, rice, beverages like tea and coffee, milk products and bovine products.

Source: People with the knowledge of the matter

Commerce Ministry spokesperson did not immediately respond to an email seeking comment

Source: Bloomberg

The broader indices underperformed their larger peers with both S&P BSE MidCap and S&P BSE SmallCap shedding 2%. All the 19 sectoral indices compiled by BSE Ltd. declined with S&P BSE Metal losing nearly 4.5%.

The market breadth was skewed in the favour of bears. About 987 stocks advanced, 2,371 declined and 103 remained unchanged.

TRAI seeks stakeholder feedback on-

Media ownership: Need for monitoring cross-media ownership/control

Common mechanism to monitor ownership of print, television, radio, internet-based news media

Need for an authority, besides SEBI & CCI, to monitor takeovers, acquisitions of media/news companies

KEC International has 1.06 million shares change hands in a large trade.

Details of buyers, sellers are not known immediately.

Source: Bloomberg

Uber has announced a 12% hike in fares in Delhi-NCR. The price hike was taken to “cushion drivers from the impact of the spike in fuel prices,” the company said.

Uber had earlier raised fares in Mumbai by 15%.

Source: Company statement

Sri Lanka Default Looms as Debt Payments Halted to Save Dollars

Mahindra Lifespace Developers Ltd., the real estate and infrastructure development arm of the Mahindra Group, announced the launch of what it claims to be India’s first net zero energy residential project in Bengaluru.

The project, Mahindra Eden, is certified by the Indian Green Building Council. "The unique design features of this residential development are together expected to save over 18 lakh kWh electricity annually, equivalent to powering over 800 homes. The remaining energy demand for the project will be met from renewable sources through both on-site solar and wind energy systems, and purchase of green energy from the grid," it said.

Source: Exchange filing

Canada Pension Plan Investment Board, or CPPIB, will invest Rs 2,600 crore to acquire 49% stake in Tata Realty and Infrastructure Ltd.'s two premium commercial office projects at Chennai and Gurugram.

Their joint venture plans to further invest Rs 2,000 crore to buy land and completed assets for future growth.

Source: PTI

SpiceJet Settles Winding-Up Case; Maran Dispute Pending

Indigo Paints rated new 'reduce' with target price at Rs 1,693.

Asian Paints rated new 'buy' with target price at Rs 3,715.

Berger Paints rater new 'add' with target price at Rs 790.

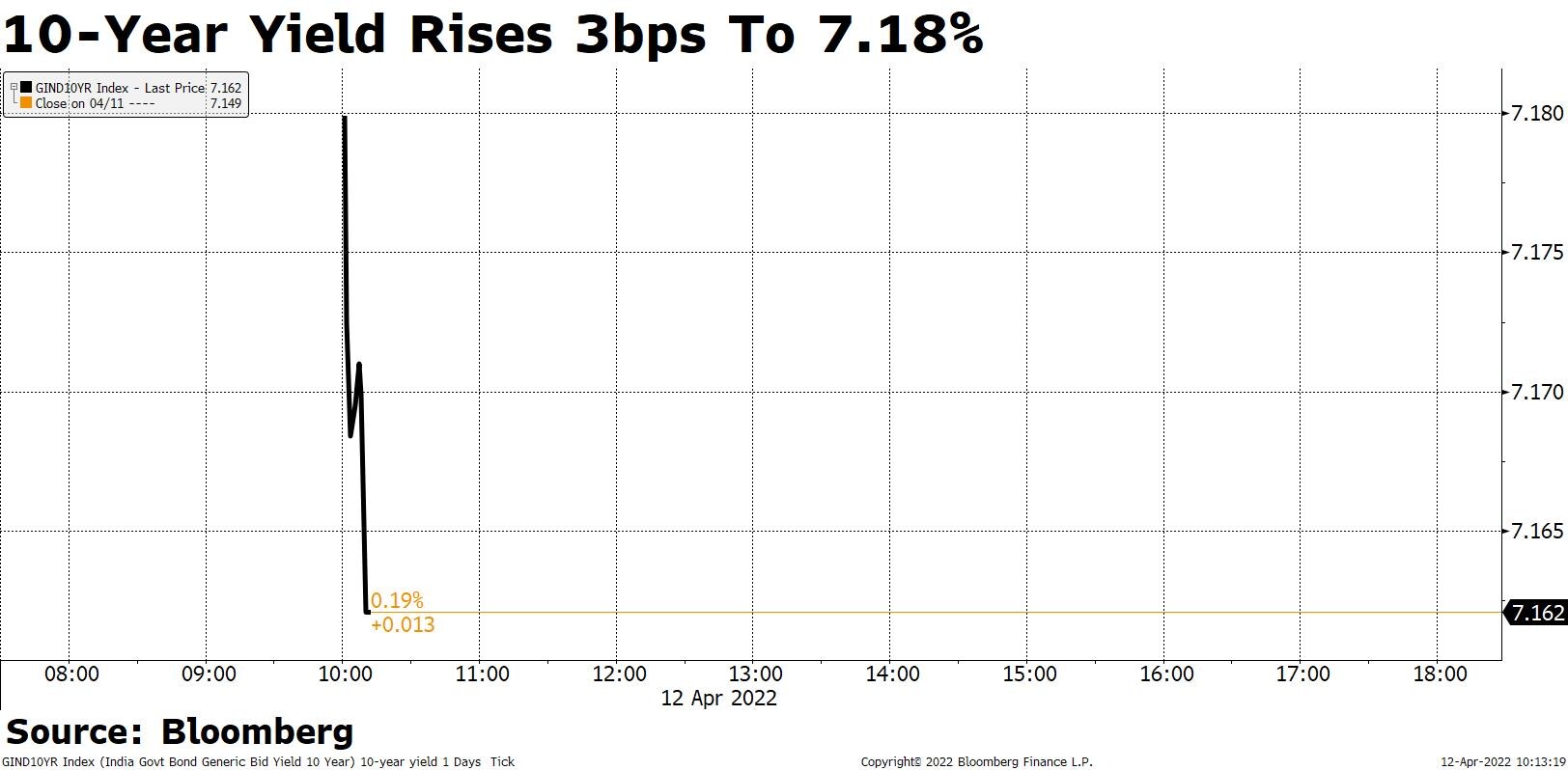

Most yields along the India sovereign yield curve rose, with 2-year bonds moving the most in Tuesday morning trading.

The 1-year yield rose 4.1bps to 4.891%

The 10-year yield rose 0.9bps to 7.158%

The 19-year yield remained unchanged at 7.25%

The 2-year-10-year yield spread was 191.7bps, vs previous close 196.2bps

Punjab National Bank has 1.3 million shares change hands in a large trade.

Details of buyers, sellers are not known immediately.

Source: Bloomberg

ITC has 1.56 million shares change hands in a large trade.

Details of buyers, sellers are not known immediately.

Source: Bloomberg

TCS Q4 Review: Deal Wins, Headcount Addition Buoy Demand Outlook, Say Analysts

The S&P BSE MidCap almost mirrored its larger peers, while S&P BSE SmallCap outperformed Sensex and Nifty, shedding 0.3%. Sixteen of the 19 sectoral indices compiled by BSE Ltd. declined with S&P BSE Metal shedding over 1.3%. On the flipside, S&P BSE Utilities and Power indices rose nearly 2%.

The market breadth was skewed in the favour of bears. About 1,134 stocks advanced, 1,530 declined and 97 remained unchanged.

Infosys cut to 'hold' from 'buy' at HSBC; price target set at Rs 2,040, an implied return of 15%.

ICICI Prudential: Axis Capital initiated coverage of the stock with a recommendation of 'buy'; price target set at Rs 650, an implied return of 21%.

Source: Bloomberg

Indian bond traders will focus on Rs 34,000 crore of ($4.5b) Treasury-bill sale Tuesday as yields climbed to the highest in almost three years. Retail inflation data is also on the agenda.

CPI index probably rose 6.40% in March YoY from 6.07% gain in February, according to a Bloomberg survey ahead of data due after close of market hours.

USD/INR fell 0.1% to 75.9600

Global funds sell net Rs 1,150 crore of India stocks Monday: NSE

They sold Rs 202 crore of sovereign bonds under limits available to foreign investors, and withdrew Rs 261 crore of corporate debt

State-run banks sold Rs 125 crore of sovereign bonds on April 11: CCIL data. Foreign banks bought Rs 900 crore of bonds.

Source: Bloomberg

Motilal OswalReiterates 'buy' and raises target price to Rs 4,240 from Rs 4,150, an implied return of 14.71%.

Record headcount addition implies demand visibility.

Strong deal wins suggest robust revenue growth outlook for FY23.

Factors in a revenue growth of 13.9% YoY in constant currency terms in FY23, aided by higher visibility on cloud-led spending and strong demand.

Expects TCS to see some benefit in overall cost in FY23 from its fresher intake of 1,00,000 in FY22.

Expects margin to continue to remain under pressure.

Expects current supply-side challenges to normalise over the next two quarters.

Firms is well positioned to leverage anticipated industry growth, led by cloud migration and digital transformation deals.

Consistent market leadership, best in-class execution provides the company with ample room to maintain industry-leading margin and superior return ratios.

Reiterates 'buy' and raises target price to Rs 4,240 from Rs 4,150, an implied return of 14.71%.

Record headcount addition implies demand visibility.

Strong deal wins suggest robust revenue growth outlook for FY23.

Factors in a revenue growth of 13.9% YoY in constant currency terms in FY23, aided by higher visibility on cloud-led spending and strong demand.

Expects TCS to see some benefit in overall cost in FY23 from its fresher intake of 1,00,000 in FY22.

Expects margin to continue to remain under pressure.

Expects current supply-side challenges to normalise over the next two quarters.

Firms is well positioned to leverage anticipated industry growth, led by cloud migration and digital transformation deals.

Consistent market leadership, best in-class execution provides the company with ample room to maintain industry-leading margin and superior return ratios.

Source: Motilal Oswal note

Sunteck Realty has logged pre-sales of Rs 503 crore, up 36% YoY (and 43% QoQ) in Q4FY2021-22

Firm clocked pre-sales of Rs 1,303 crore in FY2021-22, up 27% YoY, one of the best annual sales ever.

Collections rose 26% YoY to Rs 404 crore in Q4

Collections rose 35% YoY to Rs 1,053 crore for FY2021-22

Collections efficiency for FY2021-22 stood at 81% compared to 76% in FY2020-21.

New project launches shall lead to growth momentum in pre-sales and cash flows of the company and aid market share growth.

Source: Exchange Filing

Asian agriculture and food stocks may move after wheat futures rose for the second consecutive day with worries about short-term supply and adverse weather for crops.

In Focus: Wheat flour manufacturer ITC, biscuit maker Britannia Industries, grain processor Kovilpatti Lakshmi Roller Flour Mills and Adani Wilmar

Source: Bloomberg

Asian energy-related shares may fall after oil retreated as China’s largest Covid-19 outbreak in two years stokes worries about demand from the world’s biggest crude importer.

West Texas Intermediate slumped 4% to settle just over $94 a barrel on Monday, the lowest level since late February.

In Focus: Reliance Industries, HPCL, BPCL, Indian Oil, ONGC, Oil India.

Source: Bloomberg

Anand Rathi Wealth,

Hathway Cable & Datacom,

Tinplate Company of India

JSW Steel: The company’s wholly owned subsidiary JSW Utkal Steel received the environmental clearance to set up a greenfield integrated steel plant with a production capacity of 1.32 crore tonnes per annum. The capital expenditure for the project is expected to be Rs 65,000 crores including associated facilities.

Wipro: The company acquired Convergence Acceleration Solutions, a U.S.-based consulting and program management firm that specialises in driving large-scale business and technology transformation. The firm will pay $50 million upfront for the deal and $30 million over the next three years.

JSW Energy (Barmer): The company has received a notice from its JV and lignite supplier, Barmer Lignite Mining Co. Ltd., 51% owned by Rajasthan State Mines and Minerals Ltd., intimating that BLMCL has been directed by RSMML to stop mining operations at the two lignite mines (Kapurdi and Jalipa) in Rajasthan within 15 days. However, RSMML has been directed by the Rajasthan government to ensure uninterrupted lignite supply to the power plant. The company is in discussions with Rajasthan government to ensure no impact on the power plant operations.

UltraTech Cement: The firm was declared as the preferred bidder for Diggaon Limestone Block in an e-auction conducted by the Karnataka government. The block is situated in Tehsil Chittapur, District Kalburgi, Karnataka adjacent to its Rajashree unit and has total cement grade geological resources of 530 million tonnes of limestone.

Kesoram Industries: The company has appointed Rohit Shah as chief financial officer, effective April 11, after Suresh Kumar Sharma tendered his resignation. It also reappointed P Radhakrishnan as the chief operating officer for a period of three years. The company, in principle, considered the proposal of demerging its rayon, transparent paper and chemical business carried out by the company directly and through its wholly owned subsidiary Cygnet Industries and has constituted a committee to evaluate the proposal.

Nestle India: The company approved interim dividend of Rs 25 per equity share of Rs 10 each.

Reliance Capital: The company appointed Aman Gudral as chief financial officer effective April 12, after Vijesh Thota resigned.

Shiva Texyarn: The company has received an order from the Ministry of Defence for supply of 35,000 bags for defence personnel for Rs 11.9 crore.

Info Edge (India): The company has invested about Rs.3.7 crores in Terralytics Analysis for 20.5% stake.

Vipul Organics: Announced bonus shares in the ratio of 1:4.

Adani Transmission: Added 1,104 CKMS to transmission in FY22; distribution operations grew 11.2% year-on-year in the previous fiscal.

Intellect Design: In pact with VPBank for Vietnam Banking Services.

John Cockerill India: Greenko, John Cockerill sign JV pact for making electrolyzers.

Delta Corp. Q4 FY22 (Consolidated, QoQ)

Revenue fell 12% at Rs 218.32 crore vs Rs 252.2 crore

Net profit fell 32% at Rs 48.11 crore vs Rs 70.38 crore

Ebitda fell 35.6% at Rs 69 crore vs Rs 107.19 crore

Ebitda margin at 31.6% vs 43.3%

Declared final dividend of Rs 1.25 per share

Company approved scheme of amalgamation of Daman Entertainment and Daman Hospitality with the company.

Kesoram Industries Q4 FY22 (Consolidated, YoY)

Revenue up 20% at Rs 1,031.78 crore vs Rs 861.56 crore

Net loss of Rs 46.14 crore vs net profit of Rs 96.41 crore

Ebitda fell 15% at Rs 97.78 crore vs Rs 115.17 crore

Ebitda margin at 9.48% Vs 13.37%

Stock Market Today: All You Need To Know Going Into Trade On April 12