"Broadly speaking 21,500-22,500 is a strong long term support zone for Nifty. And the index could attempt a pause and revival from this zone," said Khush Bohra.

Kranthi Bathini, director of equity strategy at WealthMills Securities Pvt. also expects 22,500 to be the next support.

"Nifty 50 is now looking for support level between 22,400-2800 levels with resistance at 22,800 levels," added Rajesh Bhosale, Technical Analyst at Angel One.

Rupee ended flat at 86.71 against US dollar.

Source: Bloomberg

India Inc.'s revenue growth is likely to be sharper in the January-March period, as compared to the previous quarter, as urban demand has shown signs of improvement, according to ICRA Ltd.

Read full story here.

Dow Jones Industrial Average futures rose 0.7% or more than 300 points at 3:00 p.m. India time. This comes after the Friday's 1.7% decline at market close.

Bharat Forge electronics division of Arm Kalyani Powertrain collaborates with Advanced Micro Devices to Strengthen India’s Server Ecosystem.

Source: Exchange Filing

Cairn Oil Plans Rs 5,220-Crore Investments In Shale, Oil Recoveries, Sees North East As New Rajasthan

Fast food chain McDonald's is on an expansion spree, counting on coffee to give sagging sales a jolt.

More than 125 of McDonald’s 244 restaurants in the north and eastern regions of the country now serve McCafe lattes and cappuccinos. That's up from just five restaurants three years ago.

Read full story here.

Havells India Ltd. will enter the electric vehicle charging market in the next six months as the company eyes to tap into the lucrative sunrise sector set to buzz after the entry of Elon Musk's Tesla.

Read full story here.

IIFL Finance Ltd.'s near-term performance will be constrained led by weakening loan quality and narrower interest spreads, Fitch Ratings said in a report.

Read full report here.

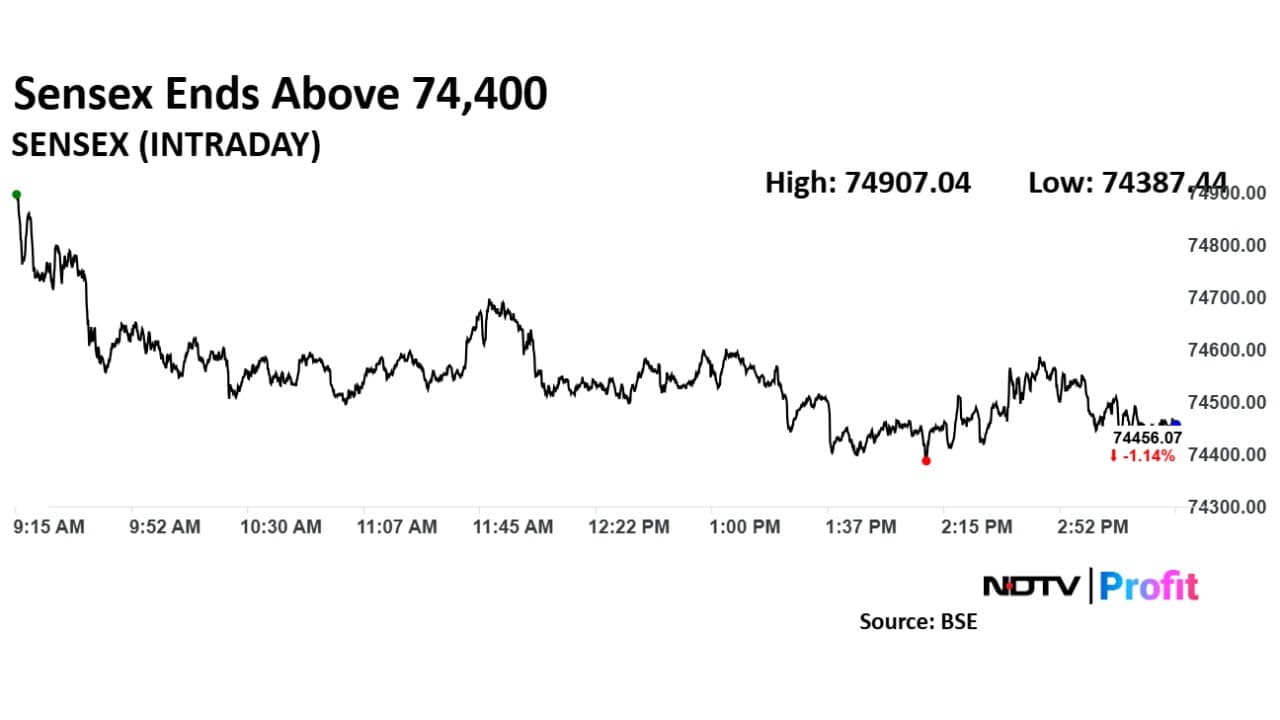

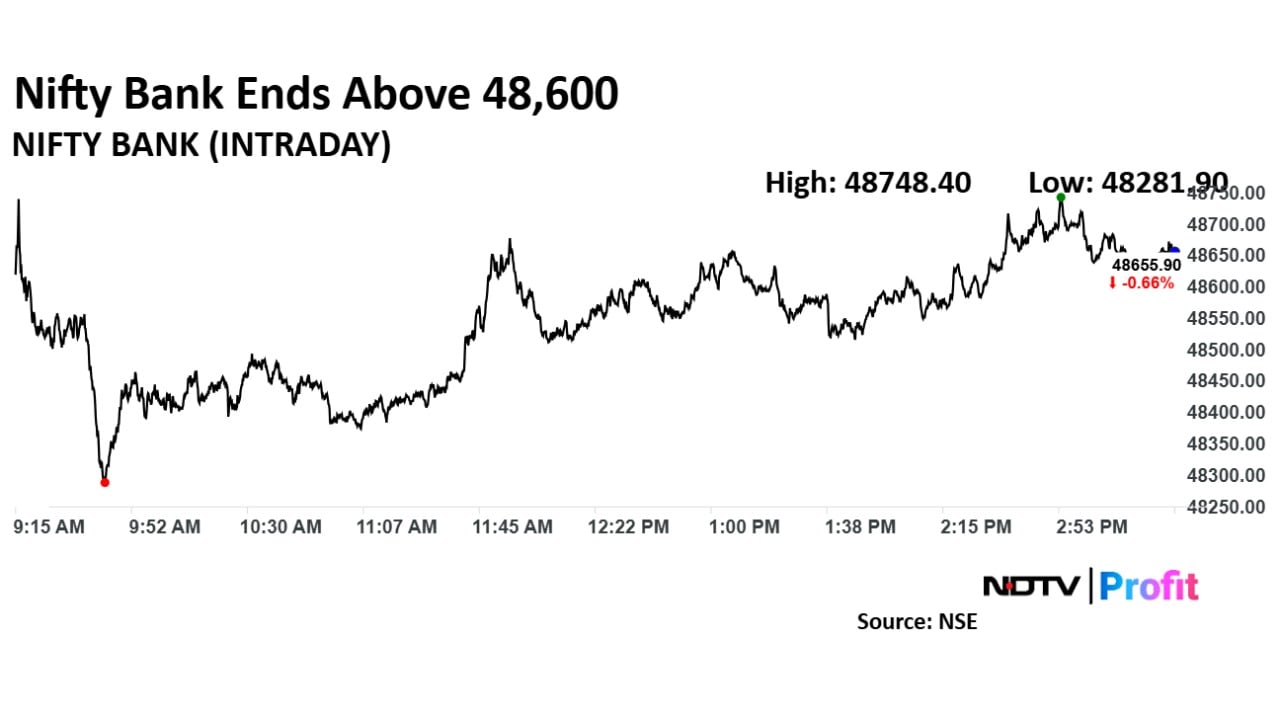

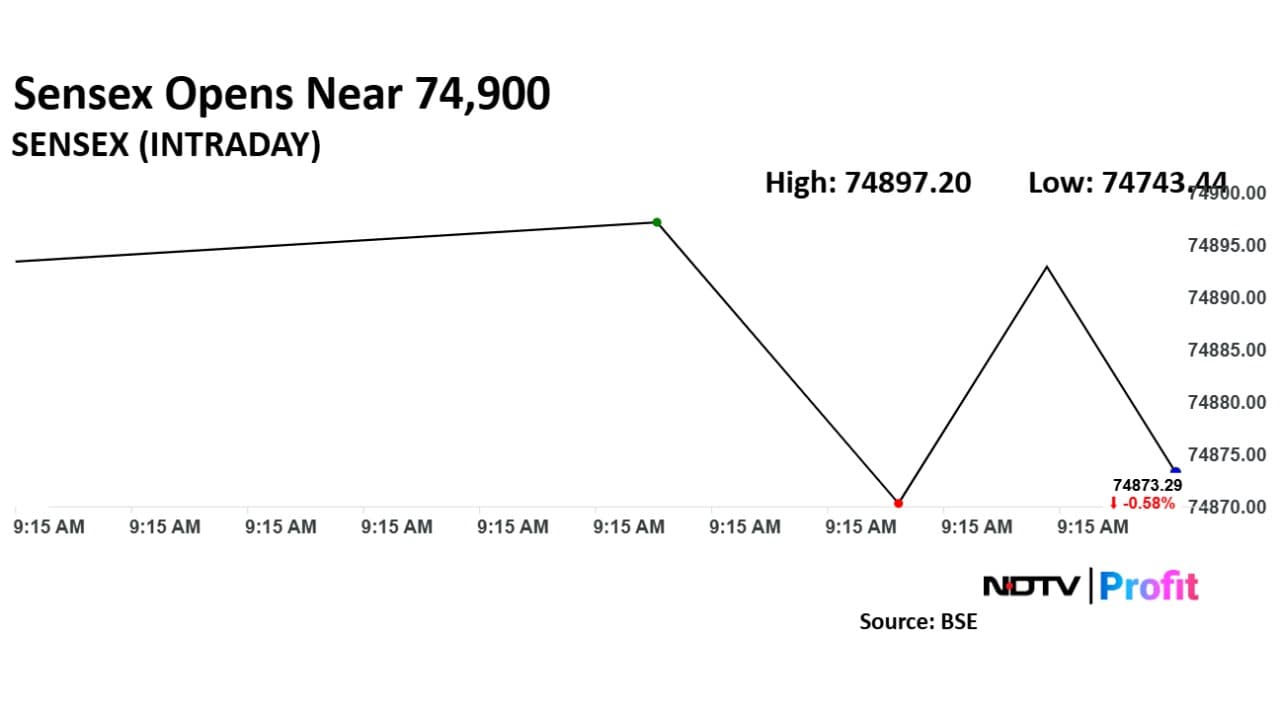

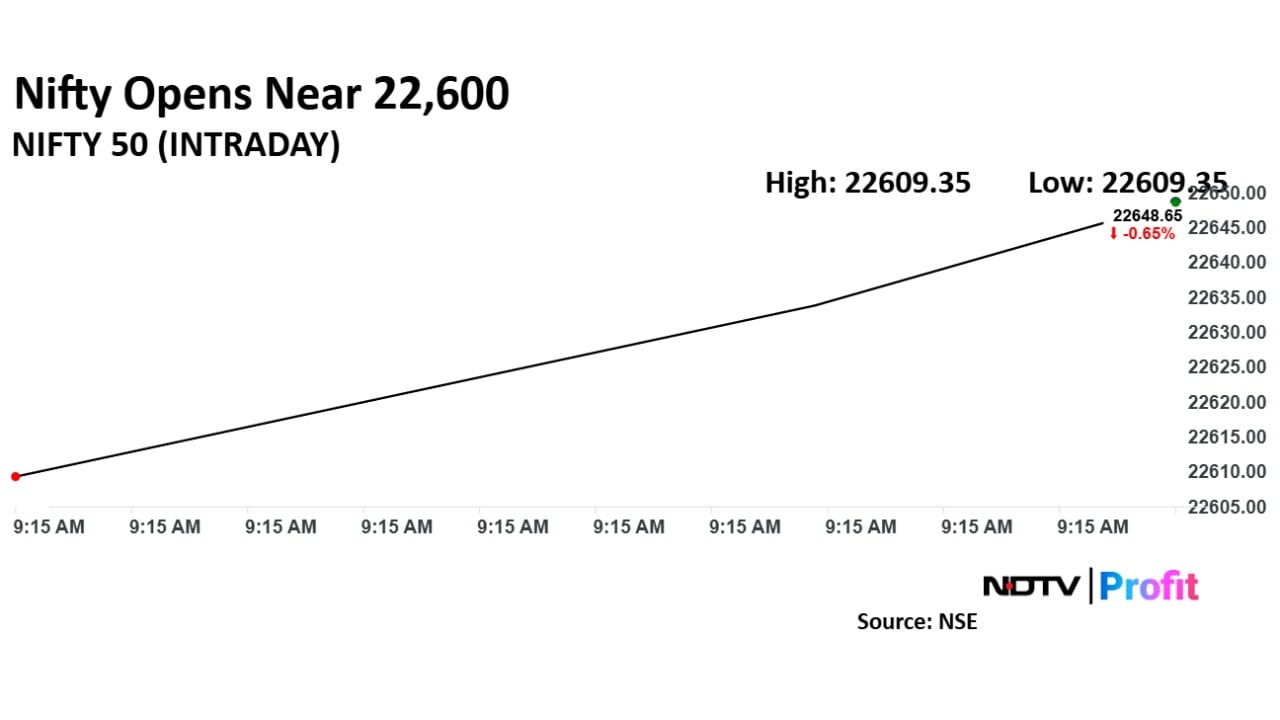

Indian equities were trading lower with Nifty falling over 1.04% at 22,558.25 and Sensex was trading 808.62 points lower at 74,497.

Intraday, both Nifty and Sensex fell over 1% hitting an eight-month low.

Nifty fell 1.09% to 22,548.35.

Sensex fell 1.08% to 74,493.97.

Broader indices were also lower. Nifty Midcap fell 0.83%; Nifty Smallcap was trading 0.69% lower.

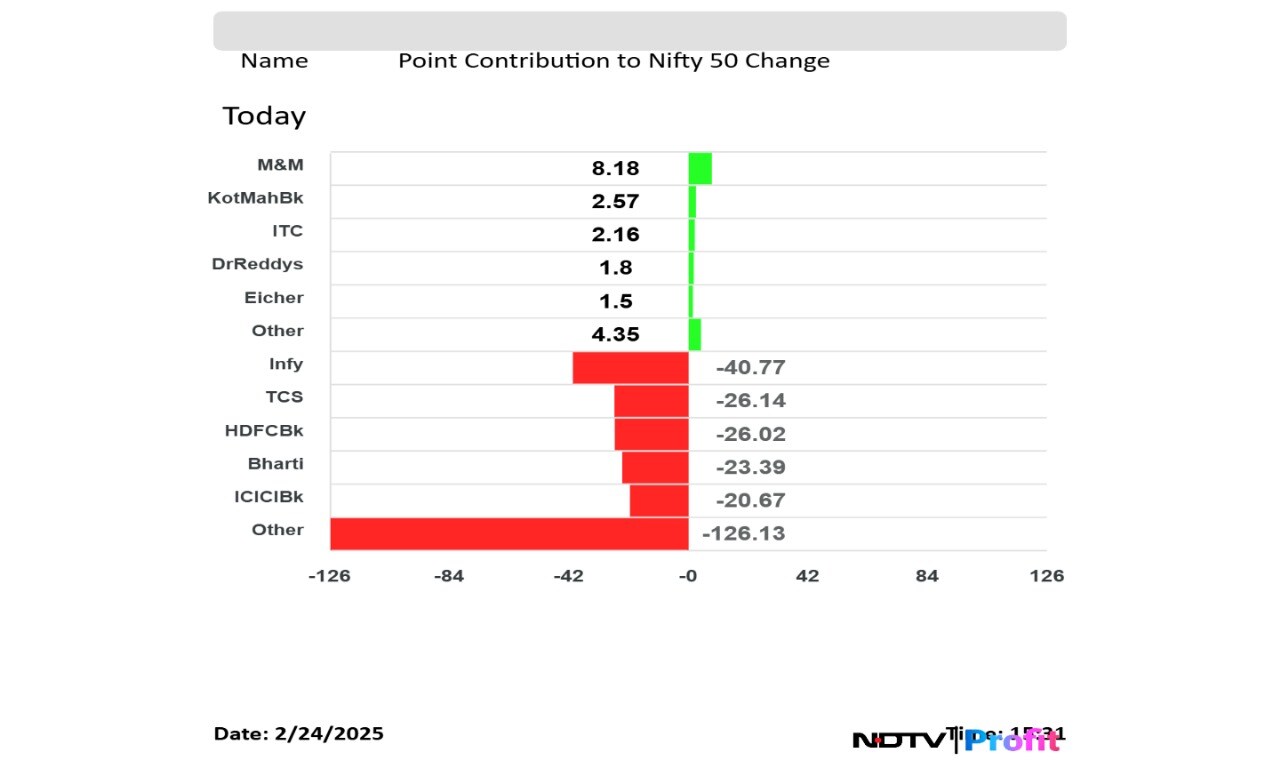

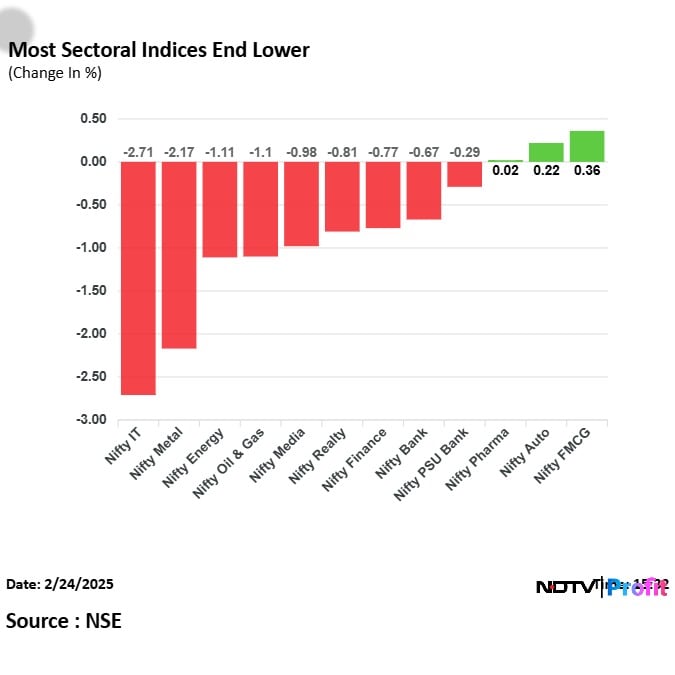

Most sectoral indices fell, led by Nifty IT.

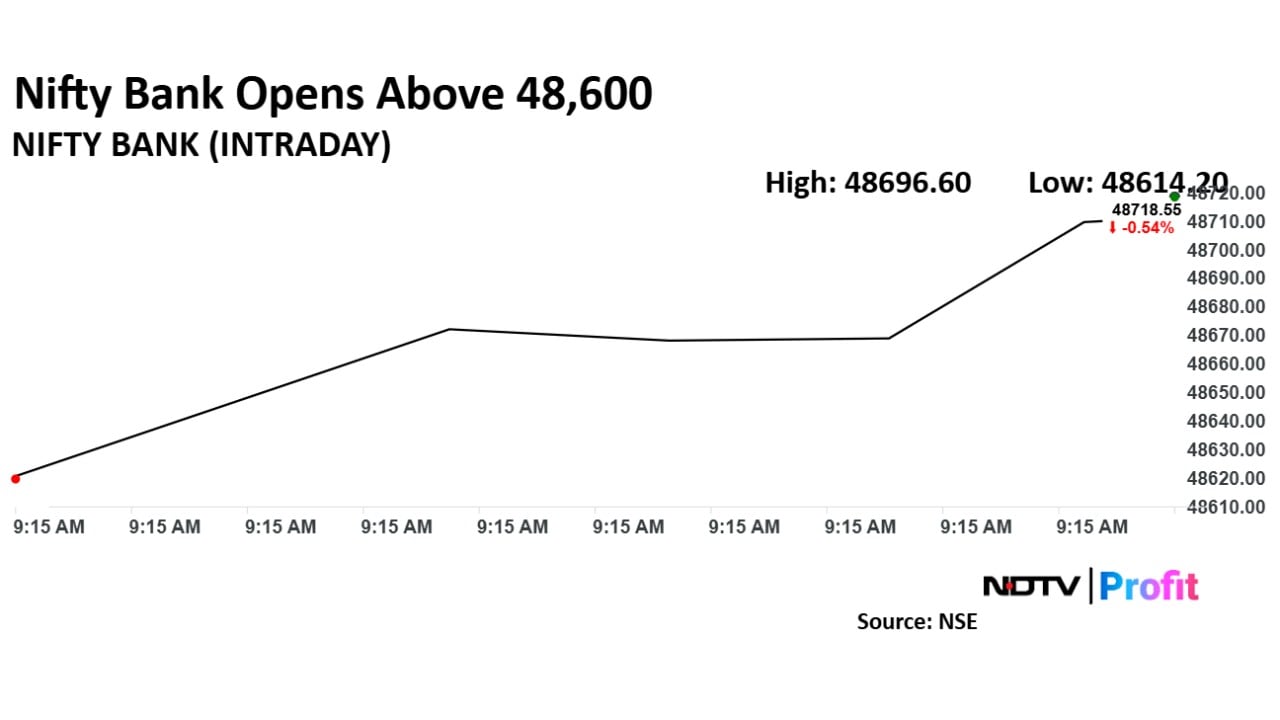

Nifty Bank fell 0.78%, Nifty IT was down 2.61%.

Mahindra & Mahindra, ITC and Dr. Reddy's were top Nifty gainers.

Infosys, HDFC Bank, Bharti Airtel and ICICI Bank were top Nifty losers.

As a relief to battered Indian stocks, Citi Research upgraded the outlook to 'overweight' with economic recovery in sight amid cooling valuations.

The brokerage assigned a December year-end target for the benchmark NSE Nifty 50 at 26,000, implying a 15% upside from the current level. India stocks' overall market cap has plunged nearly $1.2 trillion since the peak last year to $3.99 trillion, according to Bloomberg data.

Read full story here.

Over 1.02 million shares of Varun Beverages were traded via a block deal on Monday. The share of Varun Beverages rose as much as 1.96% to Rs 477.65 apiece.

Investors lost nearly Rs 77,000 crore in the first session of the truncated week as the NSE Nifty IT slumped to the lowest level in over six months. The market-cap of IT stocks fell Rs 76,975.04 crore to Rs 33.35 lakh crore as of 10:46 a.m.

Read full story here.

Broader market selloff continues for the second straight day with Nifty Midcap 100 and Nifty Smallcap 100 indices falling nearly 2% on Monday.

While Nifty Midcap has fallen 13.11% so far this year, Nifty Smallcap has been the worst hit with a 18.20% decline.

In this month Smallcap and Micap index have fallen 6.69% and 5.78% respectively.

Nifty 50 has fallen over 1% to hit a eight-month-low on Monday. Nifty was trading 1.09% lower at 22,548.35. This is the lowest since June 5, 2024. Similarly, BSE Sensex index fell over 1.08% to 74,493.97. This is the lowest since June 6, 2024.

Read why the markets are falling here.

On Feb. 10, US President Donald Trump announced 25% tariffs on all steel imports, without exceptions or exemptions.

While the direct impact of restrictions on Indian imports is limited due to our minimal steel exports to the US, the industry could face pressure from the re-direction of steel exports from other Asian suppliers like Japan and South Korea.

This makes the Indian steel industry's demand for safeguard duties against cheap steel imports all the more necessary.

Read full story here.

Lists at Rs 430 on NSE versus issue price of Rs 425.

Lists at a premium of 1.2% on NSE.

Lists at Rs 432.05 on BSE versus issue price of Rs 425.

Lists at a premium of 1.7% on BSE.

Read full story here.

Global uncertainties as US President Donald Trump has reiterated that his administration will soon impose reciprocal tariffs on India and China.

The Indian and Asian markets are tracking the worst decline for US stocks in 2025 amid fear over proposed US tariffs hurting the business sentiment and the raised inflationary concerns.

Relentless FPI selling.

Surge in Chinese stocks.

Over 2.09 million shares of Power Grid were traded via a block deal on Monday. The share of NMDC fell as much as 1.78% to Rs 257.25 apiece.

Broader markets were also trading lower, with the NSE Midcap indices trading 1.64% lower and underperforming the benchmark index. On the other hand, NSE Smallcap indices was trading 1.76% lower outperforming the benchmarks.

At pre-open, the NSE Nifty 50 was trading 186.55 points or 0.82% lower at 22,609.35. The BSE Sensex was 0.55% lower at 74,895.49.

Rupee opened 13 paise higher at 86.58 against the US Dollar. It closed at 86.71 on Friday.

Source: Bloomberg

The dollar index is 0.38% lower at 106.20. Brent crude is up 0.07% to $74.78.

Citi maintained 'buy' rating on operator InterGlobe Aviation Ltd. and raised target price to Rs 5,200 apiece from earlier Rs 5,100.

Open a 90-Day positive catalyst watch on IndiGo.

Sees pick-up in overall air traffic demand and IndiGo's strong market share.

Expects significant improvement in passenger load factors in the fourth quarter of fiscal 2025, a seasonally weak quarter.

Part of this increase in overall demand could also be attributed to Maha Kumbh.

Higher demand could manifest itself in better yields in the fourth quarter of fiscal 2025.

Shares of SBI Cards and Payment Services Ltd. will be in the spotlight on Monday, as the day marks the last session for investors to buy shares to qualify for receiving interim dividend before the stock goes ex-date.

Read full story here.

Jefferies India Strategy

With Nifty 50 down 13% from September 2024 high and broader markets down 20%, a short-term bounce is likely.

Jefferies continues to believe that the equities ready for a near-term bounce.

Jefferies runs valuation and growth visibility screens.

Four stocks screening well on both are – Adani Ports, Crompton Greaves Consumer, Shriram Finance and Apollo Hosp.

Predictable growth screens highlight M&M, TVS Motor, Indian Hotels, Amber and Housing Finance.

Valuation screeners flag SAMIL, Container Corp & VGuard among others.

Nifty Feb futures down by 0.62% to 22,822 at a premium of 27 points.

Nifty Feb futures open interest down by 8%.

Nifty Options Feb 27 Expiry: Maximum Call open interest at 24,000 and Maximum Put open interest at 22,000.

Securities in ban period: Manappuram Finance, Chambal Fertilizer.

The US Dollar index is down 0.38% at 106.20.

Euro was down 0.56% at 0.9507.

Pound was down 0.35% at 0.7889.

Yen was up 0.05% at 149.37.

The US dollar remained weak while the stocks got hammered on weaker-than-expected economic data and a surge in consumers’ long-run inflation view. The S&P 500 fell 1.7% while the Nasdaq 100 slipped 2.1%. The Dow Jones Industrial Average declined by 1.7% on Friday.

The dollar index — which tracks the greenback's performance against a basket of 10 leading global currencies — was 0.3% down at 106.29. The benchmark yield fell eight basis points to 4.43%.

Stocks in the Asia Pacific region slipped on Monday following Wall Street's worst session this year as investors were spooked by weak economic data and weakest consumer sentiment on inflation since 1995 on Friday.

South Korea's Kospi fell 0.98%, or 25 points, to 2,629 while Australia's S&P / ASX 200 was down 0.08% at 8,289 as of 6:28 a.m. Japanese markets are closed on Monday for a holiday.

Inflation data in Singapore and South Korea's retail sales data will be the key data points in Asia on Monday.

Future contracts in China hinted at a positive start, while those in Hong Kong were poised to open lower.

Stock Market Today: All You Need To Know Going Into Trade On Feb. 24