Adani Cement's current market share is at 14%.

Internal market share of the company at 20% for FY28.

Current capacity at 89 MTPA, including ongoing Penna acquisition.

Limestone reserves of 275 MT secured in Q1FY25.

Capacity growth from 89 to 140 MT to be met via internal accruals, operating cash flows.

4 MT clinkering, 6.4 MT cement capacity to be commissioned in FY25.

Q1 costs at Rs 4437/tonne, down 3%.

Uttar Pradesh grinding unit to be commissioned in Q1FY26.

Target capacity of 100 MT by Q2FY26, 112 MT by FY26.

Renewable energy investments to be commissioned by FY26, help reduce power cost by 90 per tonne by FY28.

64-65% of cement volumes from housing, 23-24% from infrastructure.

Aster DM Healthcare Q1 Highlights (Consolidated, YoY)

Revenue up 19.1% at Rs 1,002 crore versus Rs 841 crore (Bloomberg estimate: Rs 980.55 crore).

Ebitda up 34.1% at Rs 164 crore versus Rs 122 crore (Bloomberg estimate: Rs 162.4 crore).

Margin expands at 16.3% versus 14.5% (Bloomberg estimate: Rs 16.60%).

Net profit up at Rs 5,152 crore versus Rs 20 crore due to disposal of business operations at Rs 5,148 crore (Bloomberg estimate: Rs 63.95 crore).

Thomas Cook Q1 Highlights (Consolidated, YoY)

Revenue up 10.9% at Rs 2,106 crore versus Rs 1,899 crore (Bloomberg estimate: Rs 2,297.8 crore).

Ebitda up 9.9% at Rs 136 crore versus Rs 124 crore (Bloomberg estimate: Rs 152.4 crore).

Margin flat at 6.5% (Bloomberg estimate: Rs 6.60%).

Net profit up 3.1% at Rs 73 crore versus Rs 71 crore (Bloomberg estimate: Rs 94.3 crore).

Tata Investment Corporation Q1 Highlights (Consolidated, YoY)

Revenue down 6% at Rs 142 crore versus Rs 152 crore.

Ebitda down 8.4% at Rs 131 crore versus Rs 143 crore.

Margin contracted at 91.9% versus 94.3%.

Net profit down 11.3% at Rs 131 crore versus Rs 148 crore.

Sundaram Fasteners Q1 Highlights (Consolidated, YoY)

Revenue up 6.2% at Rs 1,498 crore versus Rs 1,411 crore (Bloomberg estimate: Rs 1,414 crore).

Ebitda up 9.2% at Rs 247 crore versus Rs 226 crore (Bloomberg estimate: Rs 223.8 crore).

Margin expanded at 16.5% versus 16% (Bloomberg estimate: Rs 15.80%).

Net profit up 10.8% at Rs 143 crore versus Rs 129 crore (Bloomberg estimate: Rs 135 crore).

Phoenix Mills Q1 Highlights (Consolidated, YoY)

Revenue up 11.5% at Rs 904 crore versus Rs 811 crore (Bloomberg estimate: Rs 981.12 crore).

Ebitda up 7.9% at Rs 531 crore versus Rs 492 crore (Bloomberg estimate: Rs 561.53 crore).

Margin contracted at 58.7% versus 60.7% (Bloomberg estimate: Rs 57.20%).

Net profit up 8.2% at Rs 313 crore versus Rs 290 crore (Bloomberg estimate: Rs 284.15 crore).

Net profit down 3.4% at Rs 307 crore versus Rs 318 crore.

Revenue up 10.8% at Rs 1,862 crore versus Rs 1,681 crore.

Ebitda up 51.2% at Rs 796 crore versus Rs 527 crore.

Margin at 42.8% versus 31.3%.

Revenue up 0.4% at Rs 21,282 crore versus Rs 21,187 crore

Net profit down 15% at Rs 217 crore versus Rs 255 crore

Ebitda down 11.5% at Rs 371 crore versus Rs 419 crore

Margin at 1.7% versus 2%

Revenue up 103% at Rs 658 crore versus Rs 323 crore

Net profit at Rs 14.8 crore versus loss of Rs 17.9 crore

Ebitda at Rs 130 crore versus Rs 63.7 crore

Margin at 19.8% versus 19.7%

JK Lakshmi Cement Q1 Highlights (Consolidated, YoY)

Revenue down 9.6% at Rs 1,564 crore versus Rs 1,730 crore (Bloomberg estimate: Rs 1,658.05 crore).

Ebitda up 13.3% at Rs 222 crore versus Rs 196 crore (Bloomberg estimate: Rs 274.59 crore).

Margin expanded at 14.2% versus 11.3% (Bloomberg estimate: Rs 16.60%).

Net profit down 15.3% at Rs 68 crore versus Rs 80 crore (Bloomberg estimate: Rs 120.9 crore).

Tata Steel Q1 Results: Profit Misses Estimates On Exceptional Item

Sonata Software Q1 Highlights (Consolidated, YoY)

Revenue up 15.3% at Rs 2,527 crore versus Rs 2,192 crore (Bloomberg estimate: Rs 2,347.93 crore).

Ebit up 22.2% at Rs 176 crore versus Rs 144 crore (Bloomberg estimate: Rs 161.53 crore).

Margin expanded at 7% versus 6.6% (Bloomberg estimate: Rs 6.88%).

Net profit up 4.3% at Rs 106 crore versus Rs 110 crore (Bloomberg estimate: Rs 111.18 crore).

PRICOL Q1 Highlights (Consolidated, YoY)

Revenue up 15.5% at Rs 603 crore versus Rs 522 crore (Bloomberg estimate: Rs 617.8 crore).

Ebitda up 28.1% at Rs 63.5 crore versus Rs 49.6 crore (Bloomberg estimate: Rs 79.1 crore).

Margin expanded at 10.5% versus 9.5% (Bloomberg estimate: Rs 12.80%).

Net profit up 42.6% at Rs 46 crore versus Rs 32 crore (Bloomberg estimate: Rs 41.9 crore).

Relaxo Footwears Q1 Highlights (Consolidated, YoY)

Revenue up 1.3% at Rs 748 crore versus Rs 739 crore (Bloomberg estimate: Rs 788.83 crore).

Ebitda down 8% at Rs 98.9 crore versus Rs 108 crore (Bloomberg estimate: Rs 122.67 crore).

Margin contracted at 13.2% versus 14.6% (Bloomberg estimate: Rs 15.60%).

Net profit down 21.2% at Rs 44.4 crore versus Rs 56 crore (Bloomberg estimate: Rs 62.97 crore).

Corporate loan pipeline looking strong.

Seeing strong demand from infra, renewables, data warehousing etc.

Will be able to achieve 10% corporate growth this year.

Source: Debadatta Chand, MD & CEO, Bank of Baroda

Don't expect large impact of LCR guidelines, if they come into effect

Looking to grow corporate loan book, but the bank will see higher retail growth

Cost of deposits is rising faster than advances yield

This has led to lower NII growth

Slippage ratio will be maintained at 1-1.25%

Source: Debadatta Chand, MD & CEO, Bank of Baroda

Targeting credit cost under 0.75% this year

Had earlier guided for a credit cost of less than 1%.

Aim to recover Rs 10,000 crore this year

Source: Debadatta Chand, MD & CEO, Bank of Baroda

Bank is consistently bringing down dependence on bulk deposits.

Corporate loans also grew slower at 6.2%.

Retail loan growth looking strong.

Sixth quarter of reporting quarterly profit worth over Rs 4,000 crore.

This is the eighth quarter of us delivering RoA of over 1%.

Operating profit dipped owing to lower treasury income and fee.

Source: Debadatta Chand, MD & CEO, Bank of Baroda

Coal India Q1 Highlights (Consolidated, YoY)

Revenue up 1.3% at Rs 36,464.6 crore (Bloomberg estimate: Rs 36,021.4 crore).

Ebitda up 5.6% at Rs 14,339 crore (Bloomberg estimate: Rs 10,172.9 crore).

Margin expanded at 39.3% (Bloomberg estimate: Rs 28.20%).

Net profit up 4.2% at Rs 10,943.5 crore (Bloomberg estimate: Rs 7,653.9 crore).

Bank of Baroda Q1 Highlights

Net profit up 9.5% to Rs 4,458.1 crore. (YoY).

Net interest income up 5.48% to Rs 11,600.1 crore. (YoY).

Gross NPA at 2.88% versus 2.92% (QoQ).

NNPA at 0.69% versus 0.68% (QoQ).

Net profit at Rs 134.5 crore versus Rs 28.2 crore

Revenue up 33.6% at Rs 958 crore versus Rs 718 crore

Ebitda at Rs 182 crore versus Rs 51 crore

Ebitda margin at 19% versus 7.1%

Total income up 38.1% at Rs 302 crore versus Rs 218 crore.

Net profit up 20.3% at Rs 30 crore versus Rs 25 crore. (Bloomberg estimate: Rs 47.3 crore)

Team Lease Services Q1 Highlights (YoY)

Revenue up 6.1% at Rs 2,580 crore versus Rs 2,432 crore (Bloomberg estimate: Rs 2,515.67 crore).

Ebit up 60.4% at Rs 9.1 crore versus Rs 23.1 crore (Bloomberg estimate: Rs 30.62 crore).

Margin contracted at 0.3% versus 0.9% (Bloomberg estimate: Rs 1.22%).

Net profit down 31.1% at Rs 19.4 crore versus Rs 28 crore (Bloomberg estimate: Rs 26.2 crore).

Adani Power Q1 Highlights (Consolidated, YoY)

Revenue up 35.9% at Rs 14,956 crore versus Rs 11,006 crore.

Ebitda up 76.3% at Rs 6,194 crore versus Rs 3,514 crore.

Margin expanded at 41.4% versus 31.9%.

Net profit (ex-other income) at Rs 3,394 crore versus Rs 1,656 crore.

Crompton Greaves Q1 Highlights (Consolidated, YoY)

Revenue up 13.9% at Rs 2,138 crore versus Rs 1,877 crore (Bloomberg estimate: Rs 2,125.53 crore).

Ebitda up 25.2% at Rs 232 crore versus Rs 185 crore (Bloomberg estimate: Rs 225.02 crore).

Margin expanded at 10.9% versus 9.9% (Bloomberg estimate: Rs 10.60%).

Net profit up 24.6% at Rs 152 crore versus Rs 122 crore (Bloomberg estimate: Rs 146.69 crore).

Mankind Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 12.2% at Rs 2,893 crore versus Rs 2,579 crore (Bloomberg estimate: Rs 2,927.43 crore).

Ebitda up 4.3% at Rs 682 crore versus Rs 654 crore (Bloomberg estimate: Rs 753.52 crore).

Margin contracted at 23.6% versus 25.4% (Bloomberg estimate: Rs 25.70%).

Net profit up 9.9% at Rs 543 crore versus Rs 494 crore (Bloomberg estimate: Rs 569.5 crore).

Five-Star Business Finance Q1 Highlights (YoY)

Total Income up 38.7% at Rs 666 crore versus Rs 480 crore.

Net Profit up 37% at Rs 252 crore versus Rs 184 crore.

Greenply Industries Q1 Highlights (Consolidated, YoY)

Revenue up 35.7% at Rs 584 crore versus Rs 430 crore.

Ebitda at Rs 57.9 crore versus Rs 27.1 crore.

Margin expanded at 9.9% versus 6.3%.

Net profit at Rs 33.2 crore versus Rs 81 lakh.

Electrosteel Castings Q1 Highlights (Consolidated, YoY)

Revenue up 19.4% at Rs 2,012 crore versus Rs 1,685 crore.

Ebitda at Rs 354 crore versus Rs 160 crore.

Margin expanded at 17.6% versus 9.5%.

Net profit at Rs 226 crore versus Rs 74.9 crore.

Lakshmi Machines Q1 Highlights (Consolidated, YoY)

Revenue down 43.5% at Rs 673 crore versus Rs 1,191 crore.

Ebitda down 87.7% at Rs 13.4 crore versus Rs 109 crore.

Margin contracted at 2% versus 9.1%

Net profit down 88.3% at Rs 11 crore versus Rs 94 crore

JBM Auto Q1 Highlights (Consolidated, YoY)

Revenue up 21% at Rs 1,145 crore versus Rs 946 crore.

Ebitda up 21.1% at Rs 140 crore versus Rs 115 crore.

Margin flat 12.21%

Net profit up 10.6% at Rs 33.5 crore versus Rs 30.3 crore

Asahi India Q1 Highlights (Consolidated, YoY)

Net profit down 25.4% at Rs 77 crore versus Rs 103 crore.

Revenue up 4% at Rs 1,133 crore versus Rs 1,089 crore

Ebitda down 13.1% at Rs 182 crore versus Rs 209 crore.

Margin at 16% versus 19.2%.

Mahindra & Mahindra Ltd. is on track to launch new electric vehicles in 2025, the management said in its post results briefing.

M&M on track to launch new EVs in 2025.

Auto margins of 9% plus show strong strength of the business.

As commodity prices came down the automaker passed on that to customers.

Services business impact on overall profits continues to grow.

The month of July has been a good month for monsoon as farm machinery margins especially core tractor margins grew well, according to Rajesh Jejurikar, chief executive officer of Mahindra Tractors.

Rajesh Jejurikar:

Farm machinery margins especially core tractor margins grew well.

Total volumes were up 14%, and SUV was up 24% in the quarter.

Increased capacity of XUV 7OO to 10,000 per month

Expects XUV 7OO discounts to have minimal financial impact.

Bookings were up 40% for XUV 7OO.

The logistics business is on better track now, but not completely out of the woods, according to Anish Shah, managing director. Listed 'growth gems' are on a strong footing, he said.

Rites Q1 Highlights (Consolidated, YoY)

Net profit down 24.4% at Rs 90.4 crore versus Rs 120 crore.

Revenue down 10.8% at Rs 486 crore versus Rs 544 crore.

Ebitda down 34.4% at Rs 106 crore versus Rs 161 crore.

Margin at 21.8% versus 29.7%

ZEE Q1 Highlights (Consolidated, YoY)

Net profit at Rs 118 crore versus loss of Rs 53.4 crore.

Revenue up 7.4% at Rs 2,131 crore versus Rs 1,984 crore.

Ebitda up 70% at Rs 271 crore versus Rs 159 crore

Margin at 12.7% versus 8%

Birlasoft Q1 Highlights (Consolidated, QoQ)

Revenue down 2.6% at Rs 1,327 crore versus Rs 1,363 crore.

Ebit down 13% at Rs 174 crore versus Rs 201 crore.

Ebit margin at 13.1% versus 14.7%.

Net profit down 16.6% at Rs 150 crore versus Rs 180 crore.

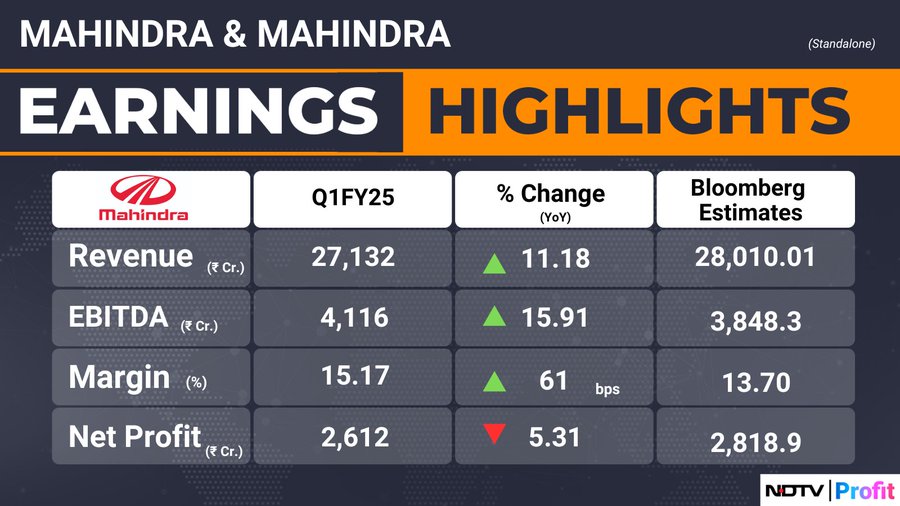

M&M Q1 Results: Profit Misses Estimates On Higher Raw Material Costs

M&M Q1 Highlights (standalone, YoY)

Revenue up 11.18% at Rs 27,132.76 crore versus Rs 24,402.85 crore.

Ebitda up 15.91% at Rs 4,116.19 crore versus Rs 3551.11 crore.

Margin up 61 bps at 15.17% versus 14.55%

Net profit down 5.31% at Rs 2,612.63 crore versus Rs 2,759.43 crore

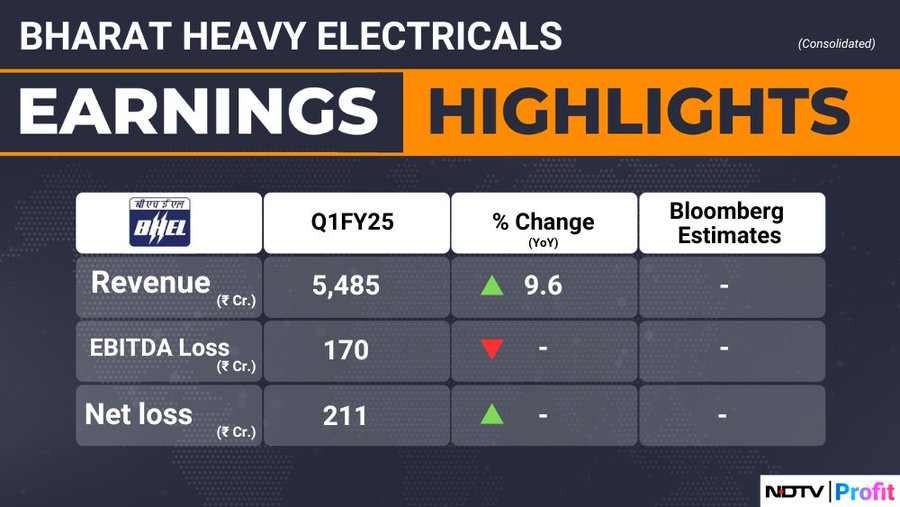

BHEL Q1 Results: Loss Widens To Rs 211 Crore On Rise Of Material Costs

ELGi Equipments Q1 Highlights (Consolidated, YoY)

Net profit up 20.4% at Rs 73 crore versus Rs 60 crore

Revenue up 10.7% at Rs 801 crore versus Rs 724 crore

Ebitda up 28.7% at Rs 114 crore versus Rs 88.5 crore

Margin at 14.2% versus 12.2%

The surprise jump in profit for the period came on the back of inflows from change in inventories, which led to a windfall of Rs 2,097 crore during the period under review, compared with Rs 440.4 crore in the year-ago period.

Pre-sales rose 283% to Rs 8,637 crore.

Customer collections rose 54% to Rs 3,012 crore.

Area sold up 299% at 8.99 million square feet.

Performance Against FY25 Guidance

Achieved 32% booking value guidance of Rs 27,000 crore

Achieved 20% cash collections guidance of Rs 15,000 crore

Achieved 18% delivery guidance of 15 million square feet

Achieved 15% business development guidance of 20,000 crore

Godrej Properties reported a net profit of Rs 519 crore, a surge of over 280%, for the first quarter of the current financial year. Analysts polled by Bloomberg had estimated the bottom line at Rs 377 crore

Q1 Highlights

Revenue down 21.1% at Rs 739 croire versus Rs 936 crore

Ebitda loss of Rs 125 crore versus loss of Rs 149 crore

Net profit at Rs 519 crore versus Rs 134 crore.

Other income in the first quarter was recorded at Rs 960 crore

Maruti Suzuki is expected to report mid-single-digit revenue growth with margins growing at 420 basis points to cross 13%, according to Bloomberg consensus. Profits are seen rising 36% to Rs 3,496 crore.

M&M is expected to see the highest revenue growth among passenger vehicle makers at 16% while maintaining stable margins and profitability. The operating margins are expected to expand by 30 basis points to 13.7%, as per Bloomberg estimates.

Tata Motors is expected to show strength led by margins and big beat on profitability compared to last year in the first quarter of fiscal 2025.

A Day Before Big Quarterly Results, Nifty Auto Hits All Time High, Again

India's share indices opened higher on Wednesday as ICICI Bank Ltd., Mahindra & Mahindra Ltd. rose.

At 9:16 a.m., the NSE Nifty 50 was trading 53.80 points, or 0.22%, higher at 24,911.10, and the S&P BSE Sensex gained 150.83 points, or 0.19%, to trade at 81,606.23.

On NSE, 10 sectors advanced and two declined. The NSE Nifty Metal rose the most, while the NSE Nifty PSU Bank declined the most.

Broader markets rose in line with the benchmark indices. The S&P BSE Midcap and S&P BSE Smallcap indices were trading 0.39% and 0.28% higher, respectively.

Tata Steel Ltd., Coal India Ltd., and Maruti Suzuki India Ltd. will be among the major companies to report their first-quarter earnings on Wednesday.

Tata Steel is expected to post a net profit of Rs 1,215 crore for the three months ended June 2024, according to analysts' estimates compiled by Bloomberg.

Coal India may post a profit of Rs 7,654 crore, while Maruti Suzuki's bottom line may be around Rs 3,272 crore.

Other companies that will be announcing their earnings include Mahindra & Mahindra Ltd., Redington Ltd., Ambuja Cements Ltd., Mankind Pharma Ltd., Nuvoco Vistas Corp., and TeamLease Services Ltd.