Foreign portfolio investors offloaded stocks worth Rs 3,309.76 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors remained net buyers for the fifth day and mopped up equities worth Rs 3,764.87 crore, the NSE data showed

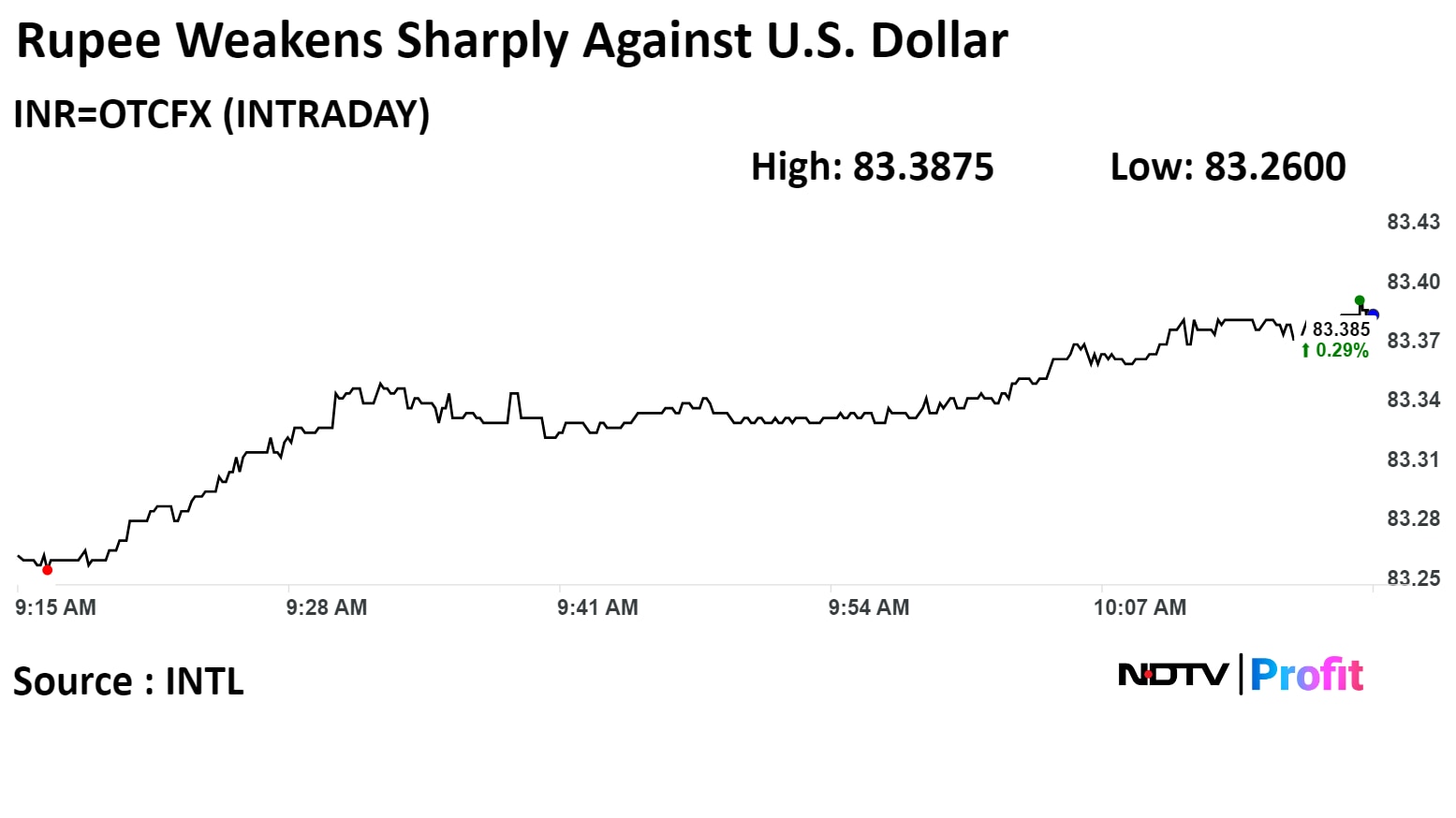

The local currency weakened by 28 paise to close at 83.43 against the U.S. Dollar.

It closed at 83.15 a dollar on Thursday.

Source: Bloomberg

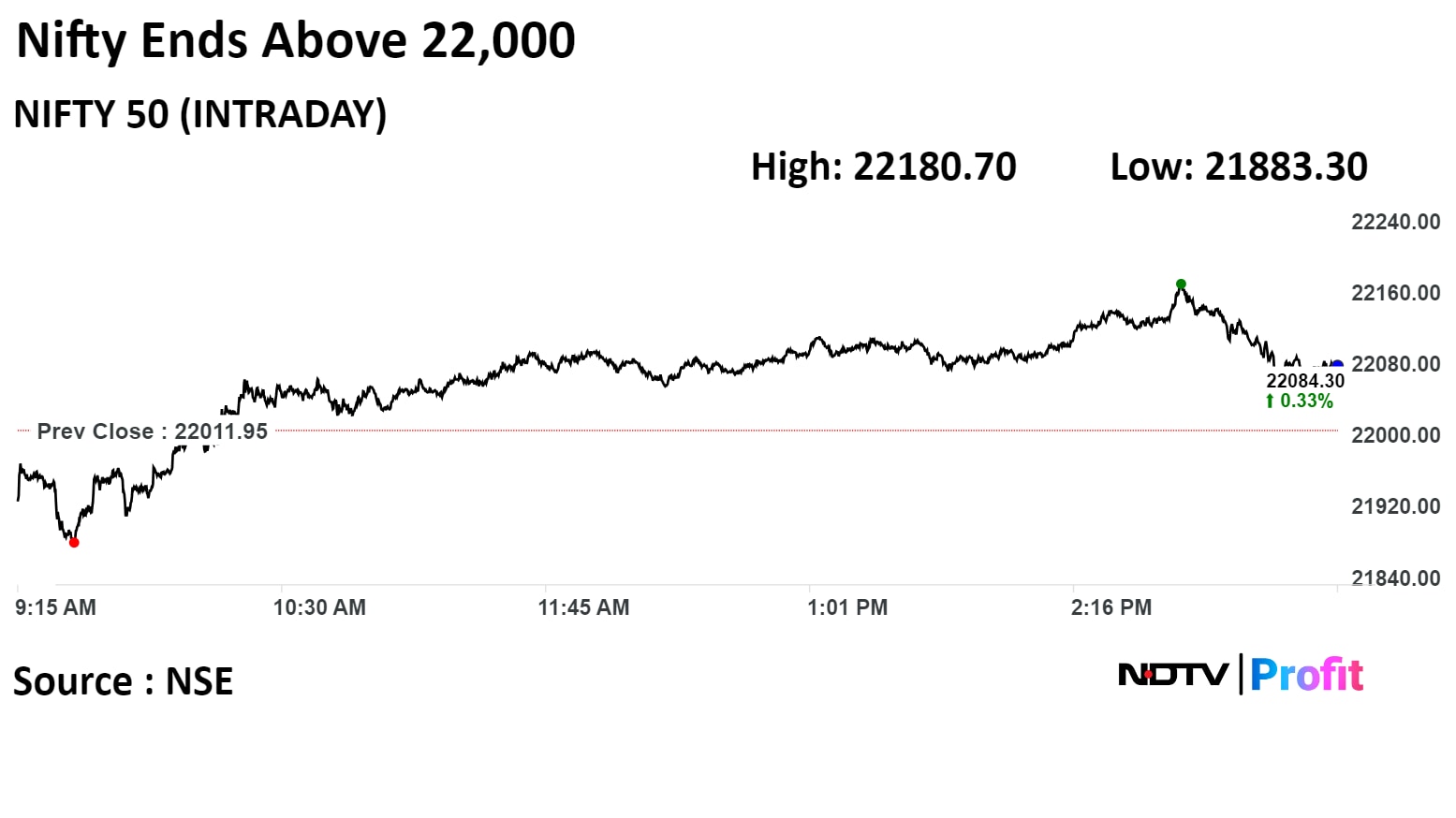

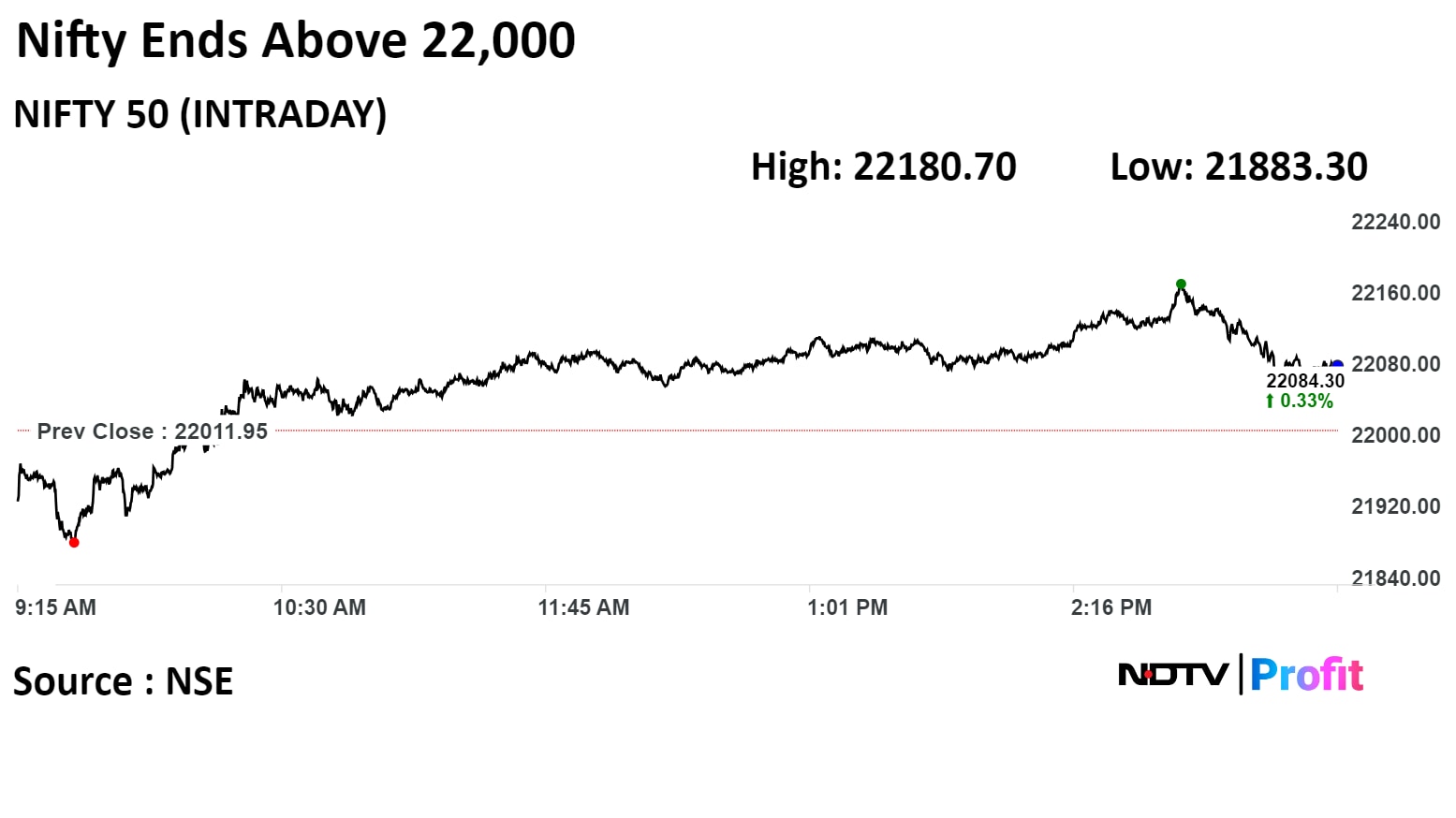

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

"During the week, the market slipped below 50 day Simple Moving Average but in last two days on the backdrop of strong global cues it bounced back sharply," said Shrikant Chouhan, head equity research, Kotak Securities.

Technically, the index has formed promising reversal formation and currently it is comfortably trading above 50 day SMA that is largely positive. For the traders now, as long as it is trading above 50 day SMA or 21950/72350 the positive momentum is likely to continue. Above the same, market could rally till 22220-22350/73100-73500. On the flip side, below 21950/72350 sentiment could change. Below 21950/72350, the market could slip till 21850-21800/72000-71800, he added.

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

India's benchmark indices ended higher on Friday, extending gains for a third day as ITC Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd. rose.

The NSE Nifty 50 ended 84.80 points or 0.39% higher at 22,096.75, and the S&P BSE Sensex 190.75 points or 0.26% higher at 72,831.94.

Intraday, the NSE Nifty 50 rose 0.77% higher to 22,180.70, and the S&P BSE Sensex rose 0.65% to 73,115.62.

"During the week, the market slipped below 50 day Simple Moving Average but in last two days on the backdrop of strong global cues it bounced back sharply," said Shrikant Chouhan, head equity research, Kotak Securities.

Technically, the index has formed promising reversal formation and currently it is comfortably trading above 50 day SMA that is largely positive. For the traders now, as long as it is trading above 50 day SMA or 21950/72350 the positive momentum is likely to continue. Above the same, market could rally till 22220-22350/73100-73500. On the flip side, below 21950/72350 sentiment could change. Below 21950/72350, the market could slip till 21850-21800/72000-71800, he added.

The benchmark indices reversed losses from past week with the Nifty 50 gaining 0.33%, The S&P BSE Sensex rose 0.26% in the week.

However, the NSE Nifty IT shed 6% due to sharp losses in company stocks after Accenture Plc lowered its growth forecast.

ITC Ltd., Larsen & Toubro Ltd., Sun Pharmaceutical Industries Ltd., ICICI Bank Ltd., and Maruti Suzuki India Ltd. added positively to the benchmark index.

Infosys Ltd., Tata Consultancy Services Ltd., HCL Technologies Ltd., and HDFC Bank Ltd. limited gains in the index.

On NSE, 10 sectors ended higher this week, and two declined. The Nifty IT index emerged as the worst performer with over 6% loss.

Broader markets ended higher, with the S&P BSE Midcap rising 0.38%, and the S&P BSE Smallcap rising 1.06%.

On BSE, 18 out of the 20 sectors ended higher. S&P BSE IT fell the most by 2%.

Market breadth was skewed in favour of buyers. Aroun 2,442 stocks rose, 1,363 stocks declined, and 101 stocks remained unchanged on BSE.

Mahindra Lifespace Developers Ltd. has started work on 4.25 acre Bengaluru Project.

Source: Exchange Filing

Century Textiles is to discontinue operation at Gujarat unit Birla Advanced Knits.

Alert: Birla Advanced Knits is a JV of co with Grasim Industries.

Source: Exchange Filing

Banks place bids worth Rs 1.32 lakh crore in 4-day VRR auction conducted today.

Notified amount for the auction was Rs 50,000 crore.

Auction cut-off was at 6.74%.

Source: RBI

Bajaj Auto to launch first-ever CNG motorcycle in June this year, MD Rajiv Bajaj says.

CNG powertrain to halve fuel expenses as compared to petrol

The motorcycle will compete with the likes of Hero Splendor, TVS Raider and Honda Shine

The motorcycle is likely to sport an ex-showroom price of Rs 80,000

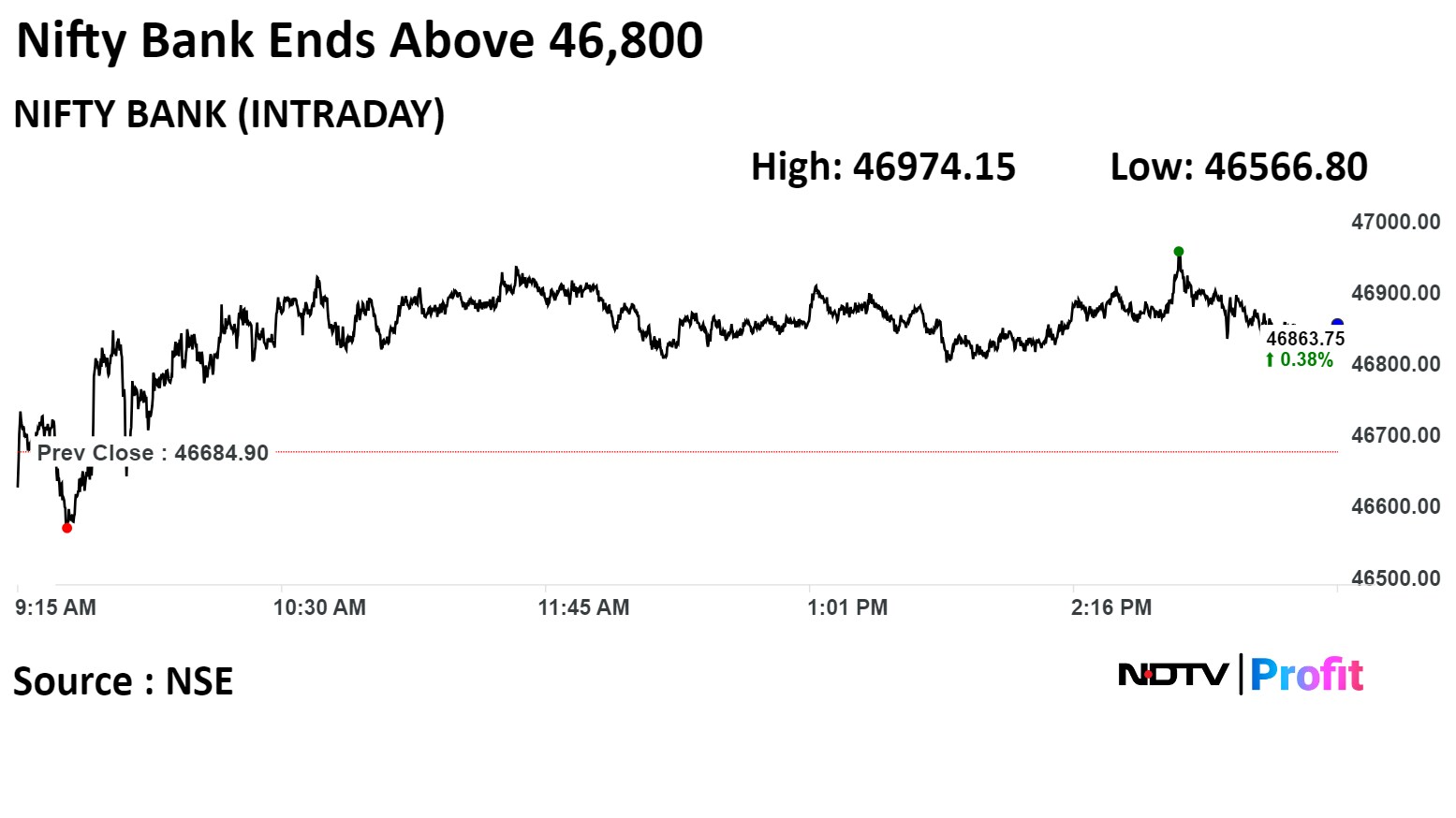

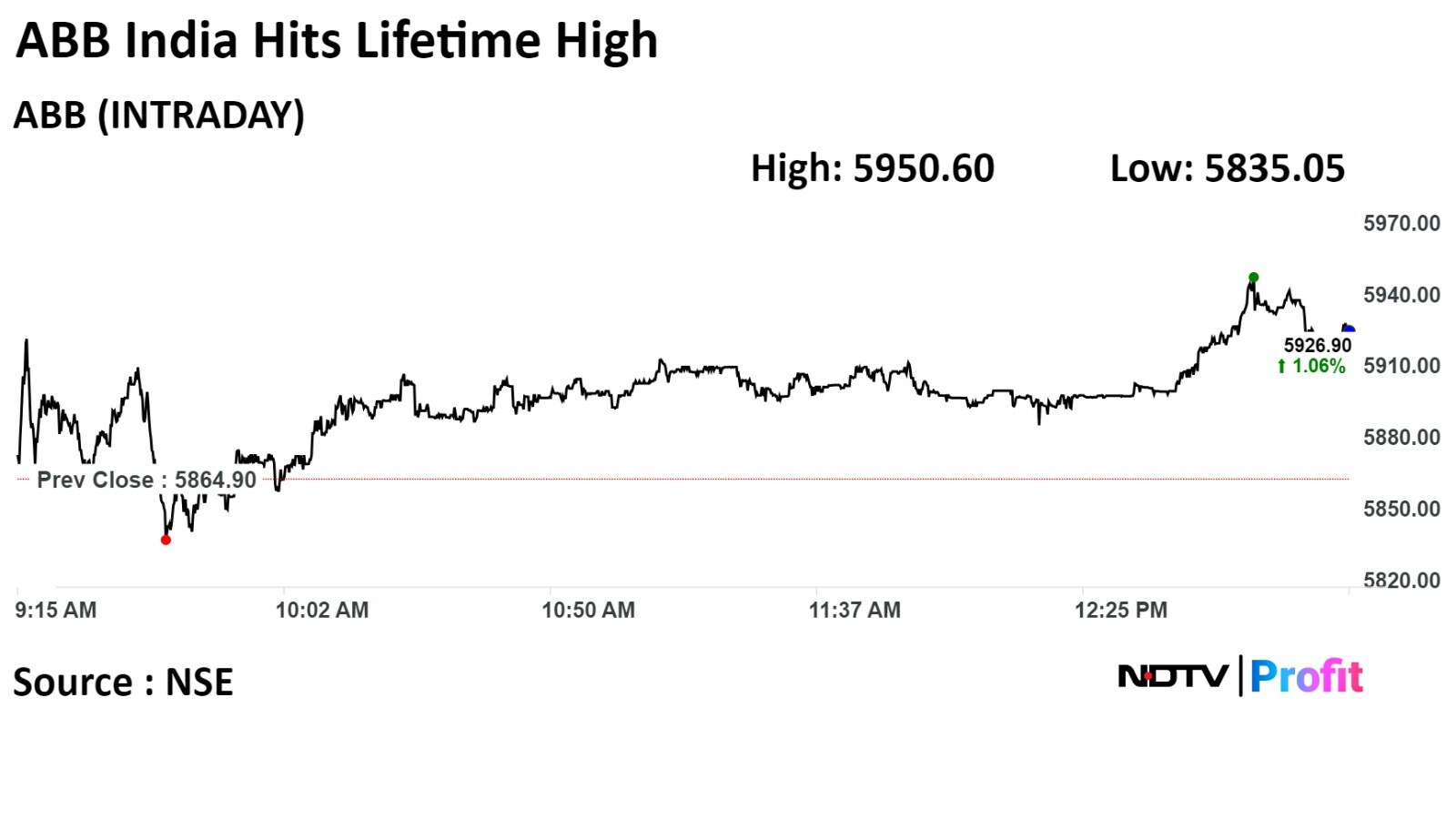

ABB India Ltd. rose 1.46% to Rs 5,950.60, highest level since its listing on exchange Feb 8, 1995. It was trading 1.26% higher at Rs 5,939.00, compared to 0.43% advance on NSE Nifty 50 index.

The scrip has risen 79.43% in 12 months. The relative strength index was at 69.82.

Out of 29 analysts tracking the company, 15 maintain a 'buy' rating, eight recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 12.6%.

ABB India Ltd. rose 1.46% to Rs 5,950.60, highest level since its listing on exchange Feb 8, 1995. It was trading 1.26% higher at Rs 5,939.00, compared to 0.43% advance on NSE Nifty 50 index.

The scrip has risen 79.43% in 12 months. The relative strength index was at 69.82.

Out of 29 analysts tracking the company, 15 maintain a 'buy' rating, eight recommend a 'hold,' and six suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 12.6%.

Hindustan Zinc received a GST demand worth Rs 183 crore including penalty and interest from Udaipur GST authority

Source: Exchange Filing

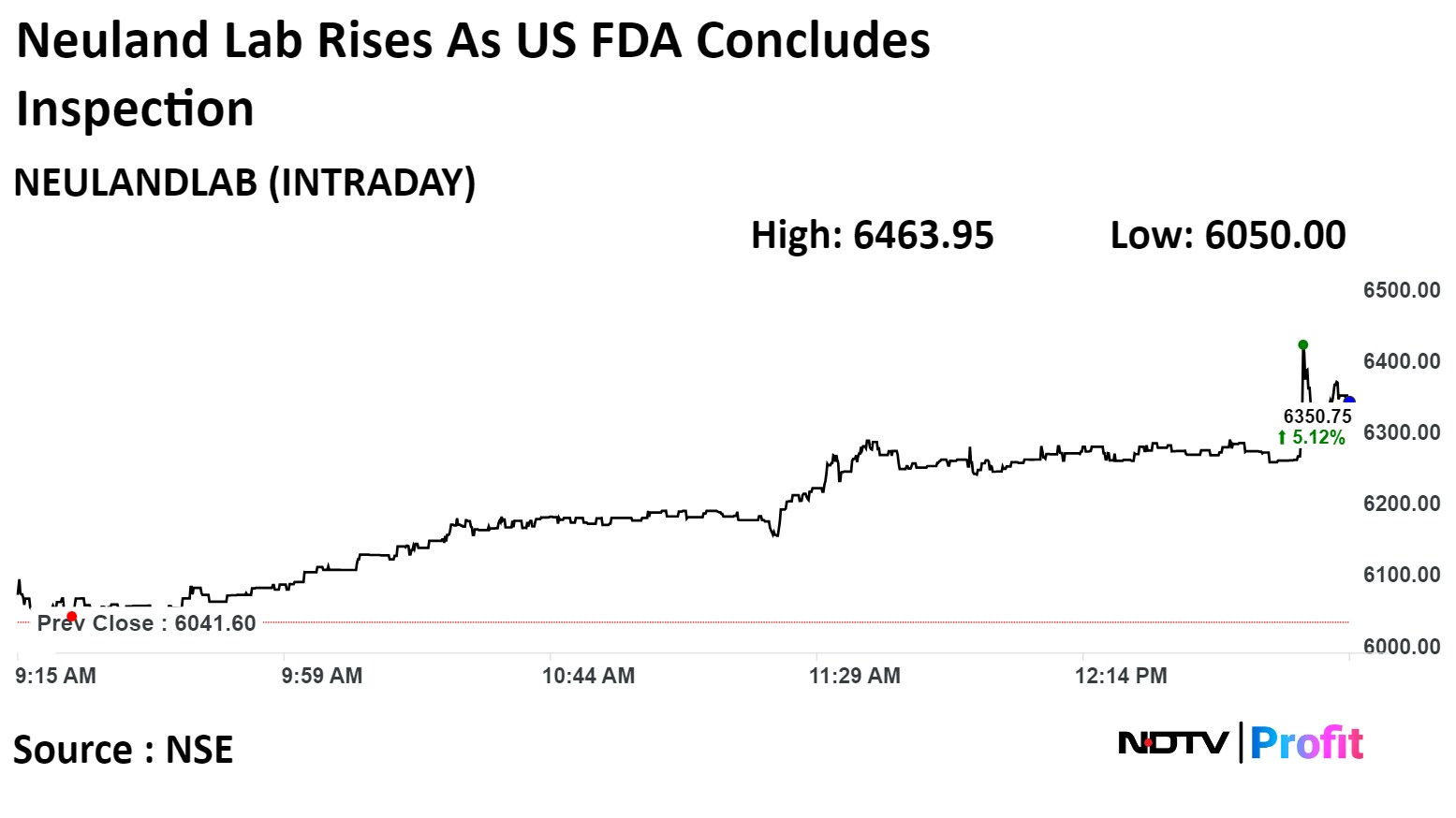

U.S. Food and Drug Adminstration has completeed inspection of Neuland Laboratories Ltd.'s manufacturing facility in Hyderabad with no observations.

Alert: U.S. FDA inspected the company's Unit 1 manufacturing facility at Hyderabad from March 18 to March 22.

Source: Exchange Filing

U.S. Food and Drug Adminstration has completeed inspection of Neuland Laboratories Ltd.'s manufacturing facility in Hyderabad with no observations.

Alert: U.S. FDA inspected the company's Unit 1 manufacturing facility at Hyderabad from March 18 to March 22.

Source: Exchange Filing

Happy Forgings Ltd. has incorporated HFL Tech as wholly owned unit.

Source: Exchange Filing

Supreme Court set aside trial court's order that directed removal of an article on Bloomberg news that alleged a $241 million financial irregularity at Zee.

Supreme Court directs trial court to hear the matter and pass a reasoned order.

Case to be heard by the trial court on March 26

Alert: On March 1, a trial court in Delhi directed the removal of a news report that alleged a $241 million accounting irregularity at Zee Entertainment was uncovered by SEBI.

Alert: Delhi HC upheld the trial court's order.

Source: Supreme Court Proceedings

KEC International Ltd. received new orders worth Rs 1,004 crore across various businesses verticals.

Source: Exchange Filing

KEC International Ltd. received new orders worth Rs 1,004 crore across various businesses verticals.

Source: Exchange Filing

Dhanlaxmi Bank has approved increase in proposed rights issue to Rs 300 crore.

Source: Exchange Filing

PM Surya Ghar Will empower people to generate and supply as well.

Help people to become perpetual money earners in rural areas.

Digital technology is becoming catalyst driving growth in semi urban areas

Tata Power MD and CEO Praveer Sinha at CII Western Region Event Mumbai

Goldman Sachs has initiated coverage on Metro Brands with a 'Buy' rating with a target price of Rs 1,450.

The brokerage has given 'Neutral' on Bata India with target price of Rs 1,470.

Multibrand footwear retailers best positioned.

Sports and athleisure category at inflection to be multi-decadal growth opportunity.

Metrobrands:

Goldman Sachs expect the company to successfully leverage on sports & athleisure opportunity.

It will start scaling up Fila in FY25.

MetroBrands is better positioned, said Goldman Sachs.

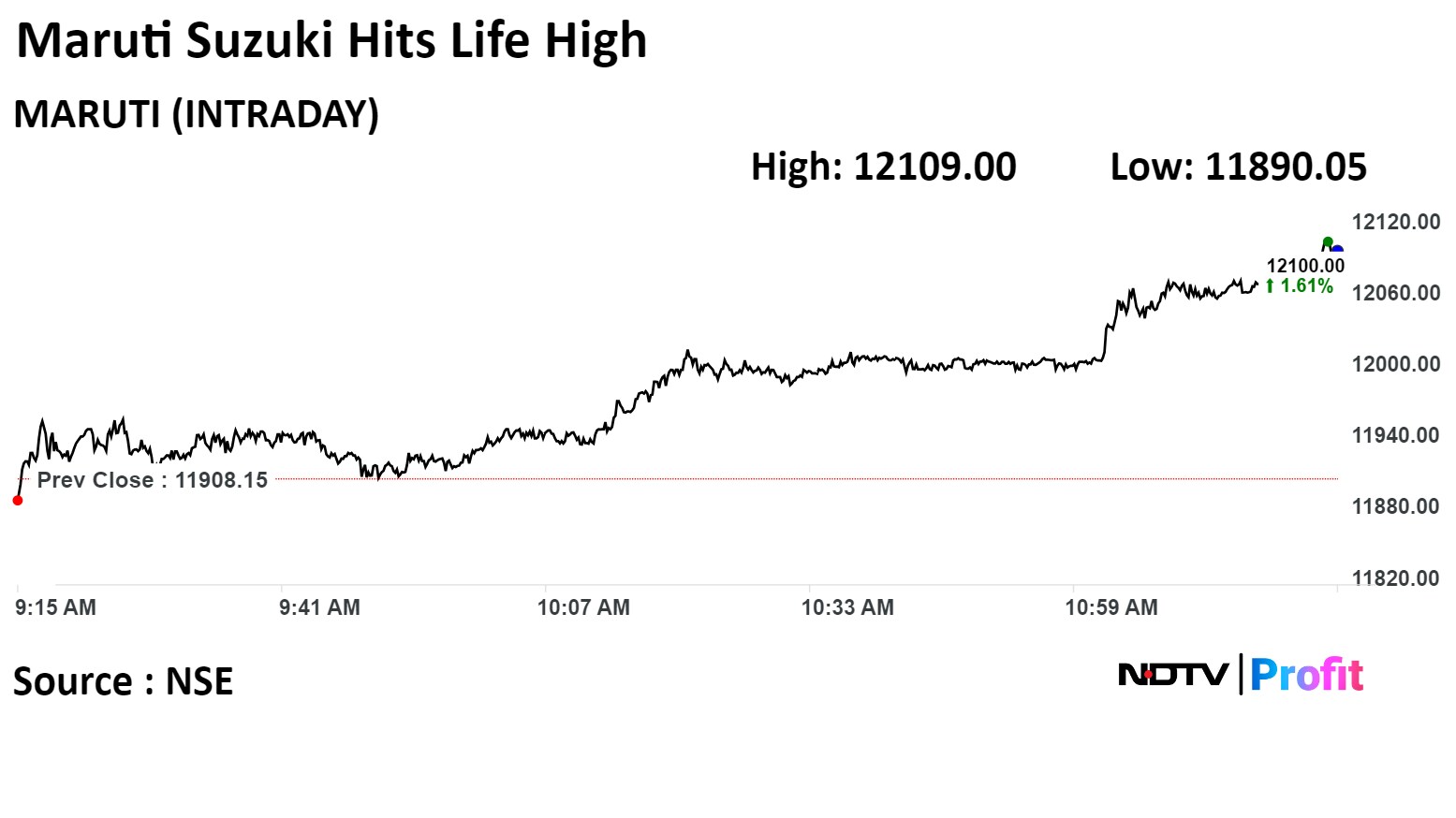

Maruti Suzuki India Ltd. rose 1.69% to Rs 12,109.90 apiece, the highest level since its listing on Jul 9, 2023. It was trading 1.61% higher at Rs 12,099.50 apiece, as of 11:28 a.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 46.62% in 12 months. Total traded volume so far in the day stood at 0.48 times its 30-day average. The relative strength index was at 70.35, which implied the stock is overbought.

Out of 50 analysts tracking the company, 41 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.3%.

Maruti Suzuki India Ltd. rose 1.69% to Rs 12,109.90 apiece, the highest level since its listing on Jul 9, 2023. It was trading 1.61% higher at Rs 12,099.50 apiece, as of 11:28 a.m. This compares to a 0.23% advance in the NSE Nifty 50 Index.

It has risen 46.62% in 12 months. Total traded volume so far in the day stood at 0.48 times its 30-day average. The relative strength index was at 70.35, which implied the stock is overbought.

Out of 50 analysts tracking the company, 41 maintain a 'buy' rating, six recommend a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.3%.

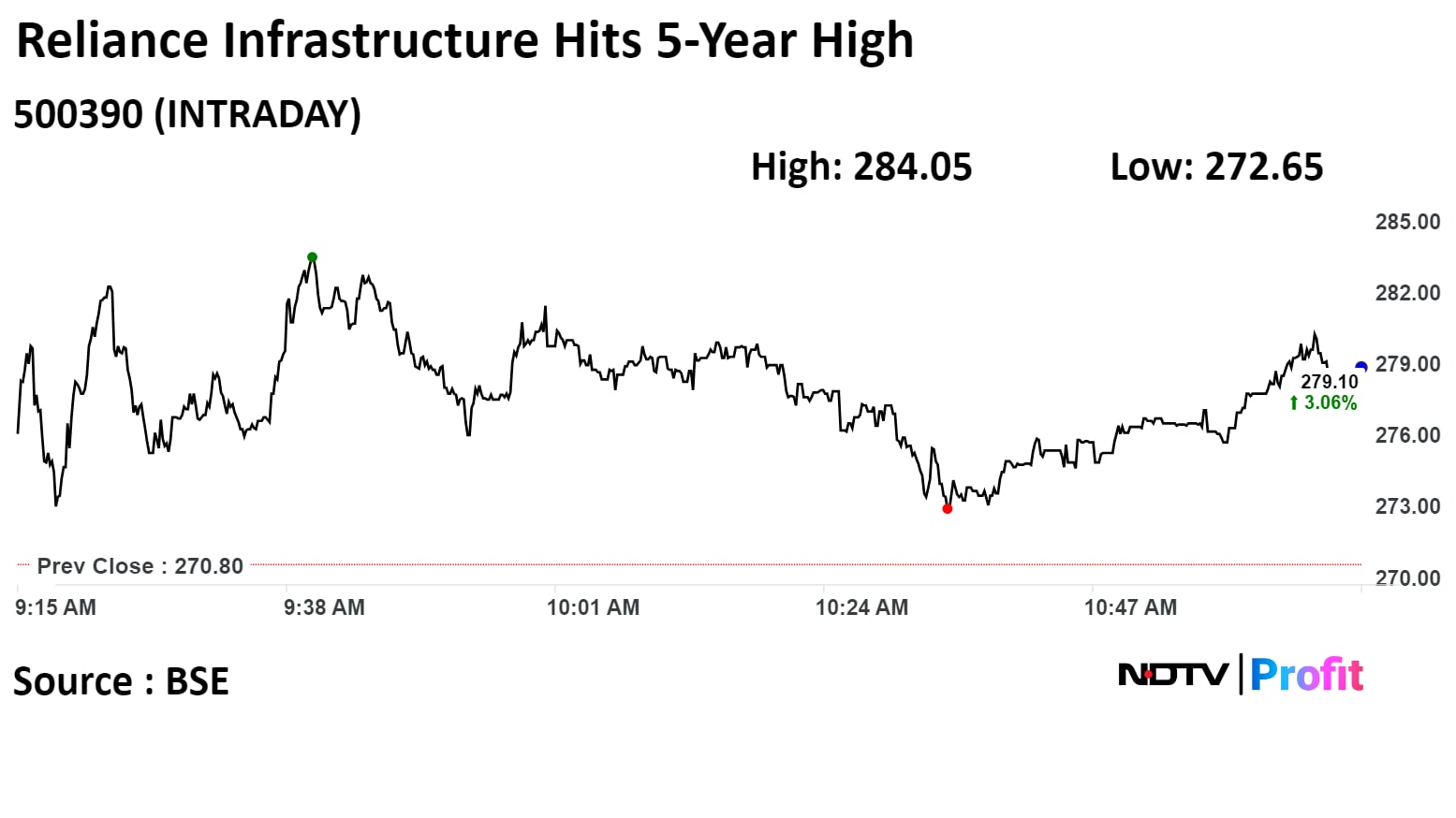

Reliance Infrastructure Ltd. rose as much as 4.68% to Rs 283.90 apiece, the highest level since Jan 25, 2019. It was trading 3.30% higher at Rs 280.15 apiece, as of 11:06 a.m. This compares o a 0.21% advance in the NSE Nifty 50 Index.

It has risen 88.15% in 12 months. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 65.92.

Reliance Infrastructure Ltd. rose as much as 4.68% to Rs 283.90 apiece, the highest level since Jan 25, 2019. It was trading 3.30% higher at Rs 280.15 apiece, as of 11:06 a.m. This compares o a 0.21% advance in the NSE Nifty 50 Index.

It has risen 88.15% in 12 months. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 65.92.

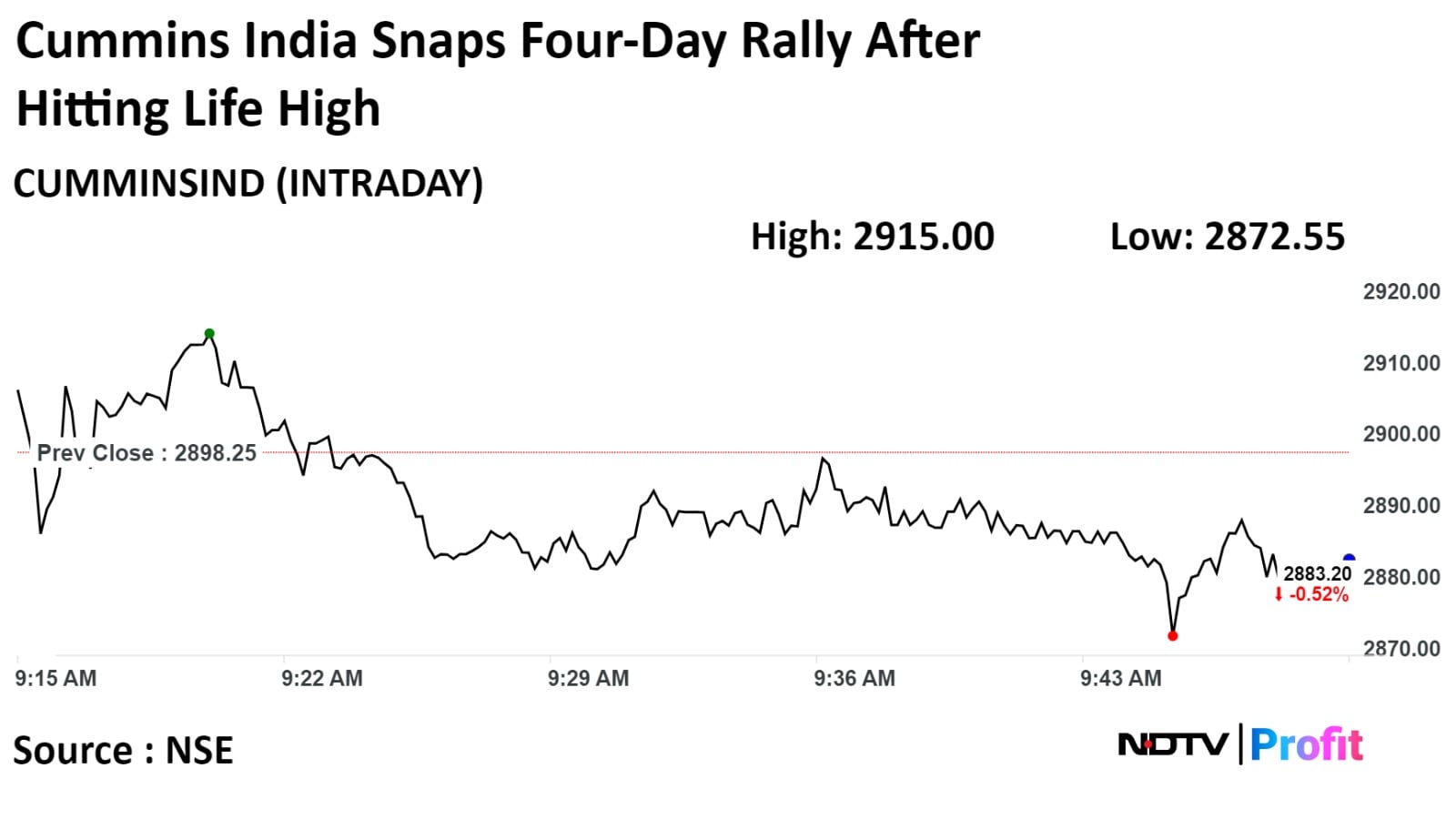

Cummins India Ltd. rose as much as 0.58% to Rs 2,915.00 apiece, the highest level since its listing on Mar 19, 1995. It pared gains to trade 0.06% lower at Rs 2,896.65 apiece, as of 10:55 a.m. This compares to a 0.19% advance in the NSE Nifty 50 Index.

It has risen 79.63% in 12 months. Total traded volume so far in the day stood at 0.24 times its 30-day average. The relative strength index was at 70.55.

Out of 25 analysts tracking the company, 11 maintain a 'buy' rating, seven recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 13.0%.

Cummins India Ltd. rose as much as 0.58% to Rs 2,915.00 apiece, the highest level since its listing on Mar 19, 1995. It pared gains to trade 0.06% lower at Rs 2,896.65 apiece, as of 10:55 a.m. This compares to a 0.19% advance in the NSE Nifty 50 Index.

It has risen 79.63% in 12 months. Total traded volume so far in the day stood at 0.24 times its 30-day average. The relative strength index was at 70.55.

Out of 25 analysts tracking the company, 11 maintain a 'buy' rating, seven recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 13.0%.

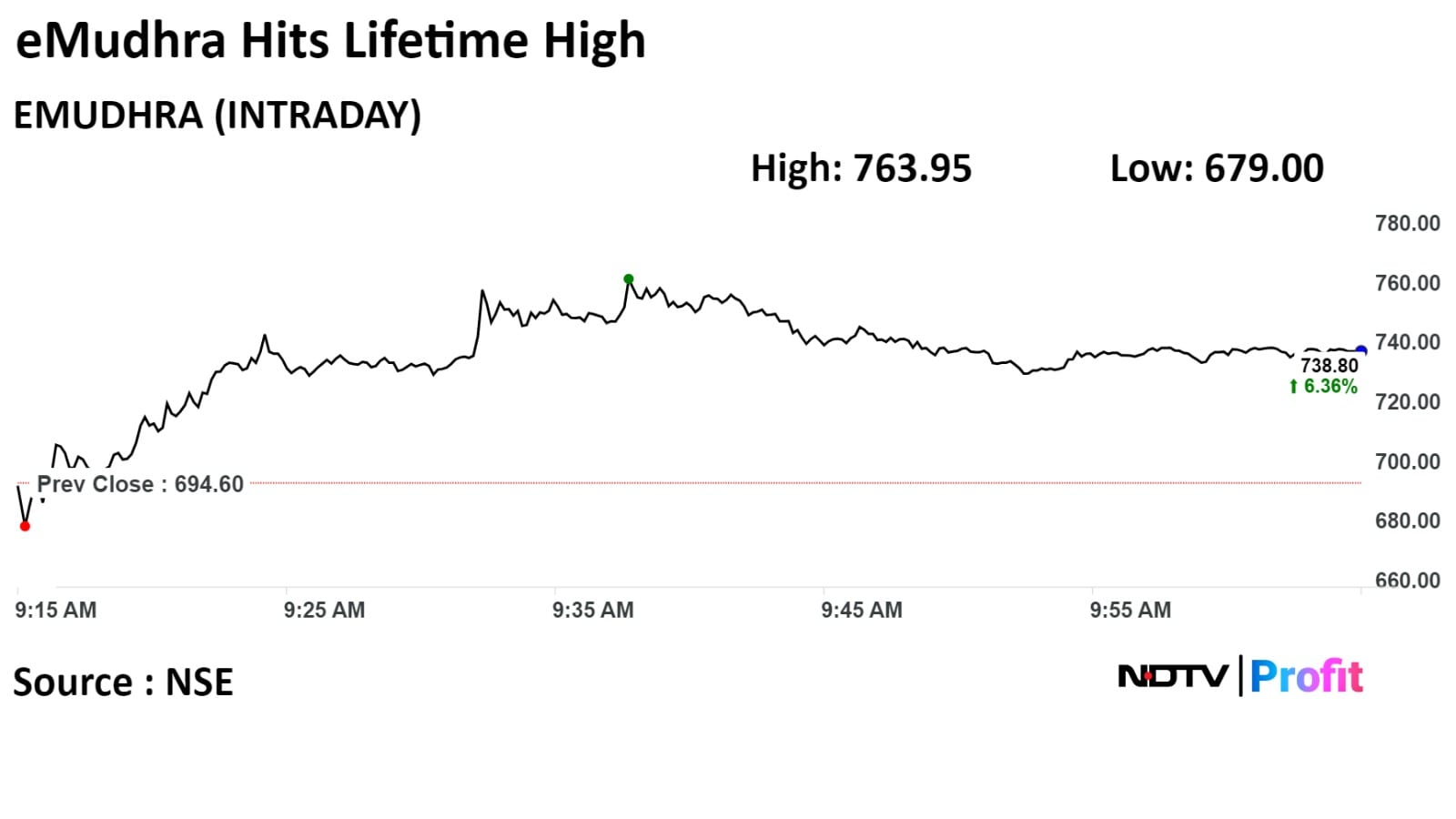

eMudhra Ltd. rose as much as 11.0% higher to Rs 773.80 apiece, the highest level since its listing on Jun 1, 2022. It pared gains to trade 7.53% higher at Rs 746.90 apiece, as of 10:49 a.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has risen 222.13% in 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 82.35.

One analyst tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.9%.

eMudhra Ltd. rose as much as 11.0% higher to Rs 773.80 apiece, the highest level since its listing on Jun 1, 2022. It pared gains to trade 7.53% higher at Rs 746.90 apiece, as of 10:49 a.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has risen 222.13% in 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 82.35.

One analyst tracking the company maintained a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 22.9%.

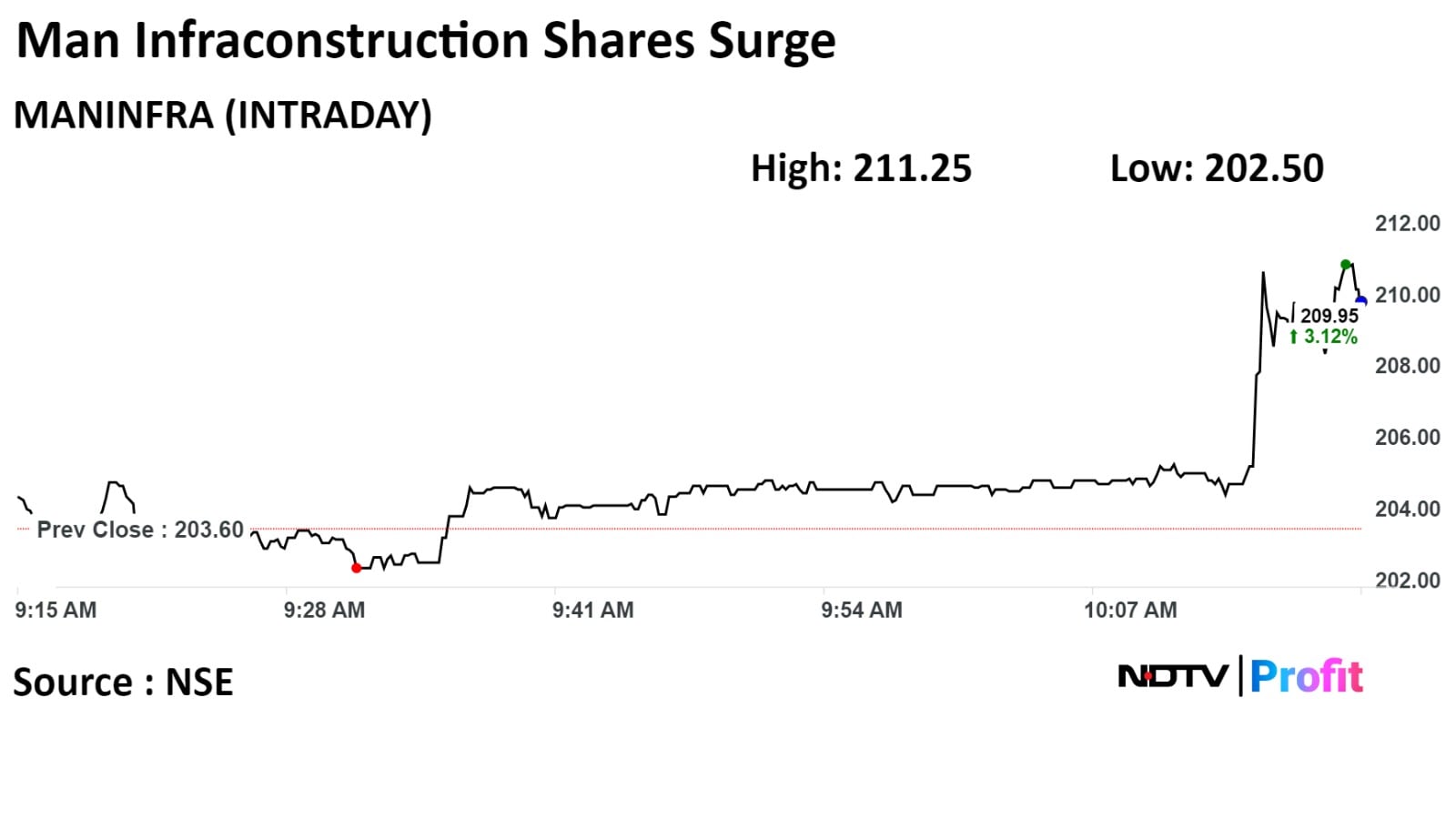

Man InfraConstruction Ltd.'s board approved merger of units Manaj Tollway Private and Man Projects with company.

Source: Exchange Filing

Shares of Man Infraconstruction Ltd. surged on Friday after the company acquired a residential luxury project in Marine Lines, with height of above 800 feet and expected revenue generation of above Rs 2,100 crore.

The total construction area, of approximately 22 lakh square feet, offers a RERA carpet area of around 5.3 lakh square feet for sale, an exchange filing said.

Man InfraConstruction Ltd.'s board approved merger of units Manaj Tollway Private and Man Projects with company.

Source: Exchange Filing

Shares of Man Infraconstruction Ltd. surged on Friday after the company acquired a residential luxury project in Marine Lines, with height of above 800 feet and expected revenue generation of above Rs 2,100 crore.

The total construction area, of approximately 22 lakh square feet, offers a RERA carpet area of around 5.3 lakh square feet for sale, an exchange filing said.

Hindustan Unilever Ltd. declined 0.46% to Rs 2,232.05 apiece, the lowest level since Jul 1, 2022. It pared losses to trade 0.41% higher at Rs 2,251.45 apiece, as of 10:38 a.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has declined 9.08% in 12 months. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 28.73, which implied the stock is oversold.

Out of 43 analysts tracking the company, 20 maintain a 'buy' rating, 16 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.0%.

Hindustan Unilever Ltd. declined 0.46% to Rs 2,232.05 apiece, the lowest level since Jul 1, 2022. It pared losses to trade 0.41% higher at Rs 2,251.45 apiece, as of 10:38 a.m. This compares to a 0.18% advance in the NSE Nifty 50 Index.

It has declined 9.08% in 12 months. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 28.73, which implied the stock is oversold.

Out of 43 analysts tracking the company, 20 maintain a 'buy' rating, 16 recommend a 'hold,' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.0%.

The local currency weakened by 22 paise to 83.39 against the U.S dollar, the lowest level since Dec 13, 2023.

It closed at 83.15 on Thursday.

Source: Bloomberg

The local currency weakened by 22 paise to 83.39 against the U.S dollar, the lowest level since Dec 13, 2023.

It closed at 83.15 on Thursday.

Source: Bloomberg

Man InfraConstruction Ltd. has acquired land parcel in Mumbai's Marine Lines having revenue potential of over Rs 2,100 crore.

Source: Exchange filing

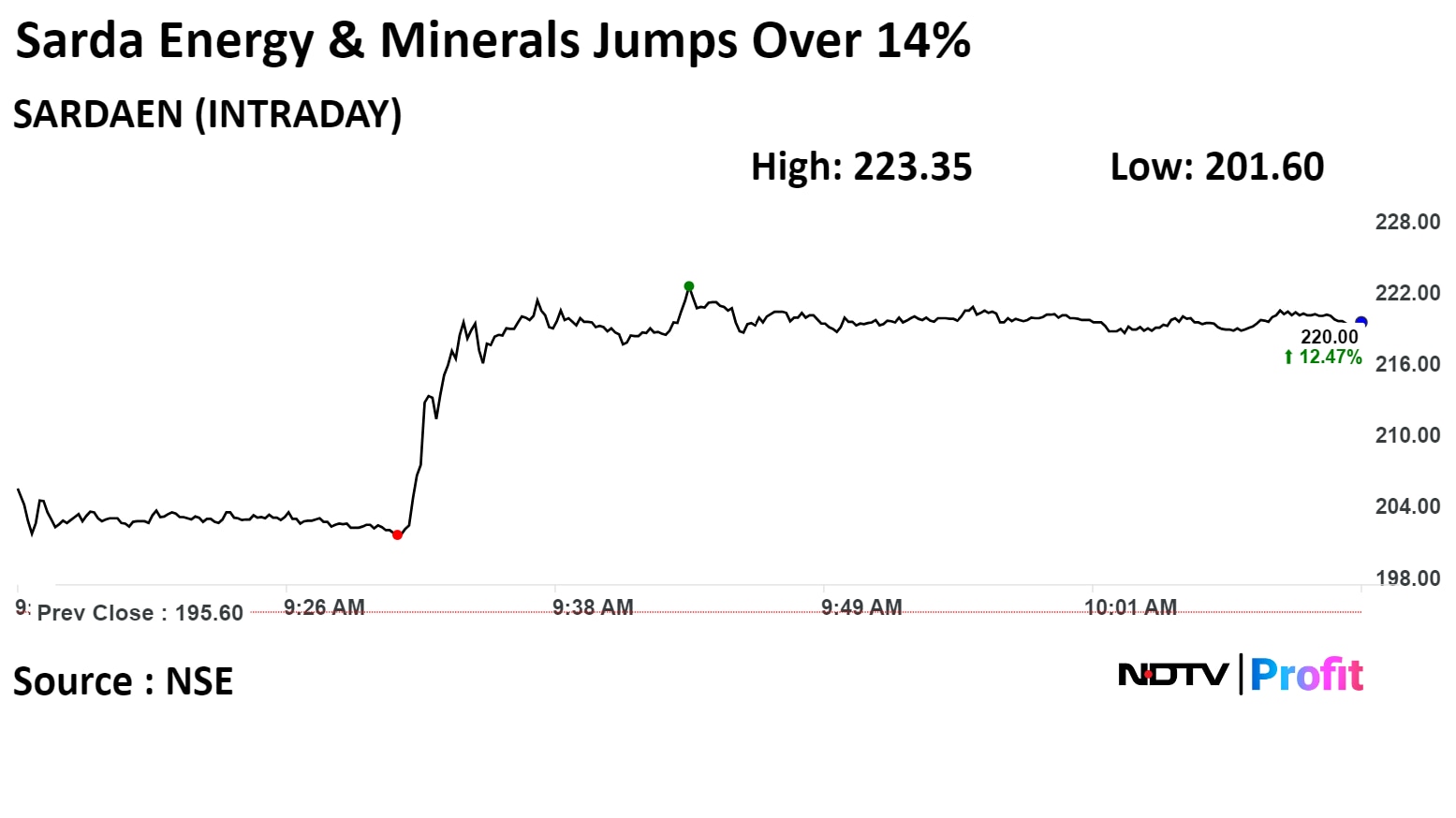

Sarda Energy & Minerals Ltd. has risen over 14% on NSE as it received an Letter of Intent for a license from the Maharashtra Government for an iron ore block.

Natural Resources Energy Pvt., the company's subsidiary joint venture, received the LoI from composite Licence from the Industry, Energy, Labour, and Mining Department, Maharashtra, for an iron one block in Surjagad, the exchange filing said.

Sarda Energy & Minerals Ltd. has risen over 14% on NSE as it received an Letter of Intent for a license from the Maharashtra Government for an iron ore block.

Natural Resources Energy Pvt., the company's subsidiary joint venture, received the LoI from composite Licence from the Industry, Energy, Labour, and Mining Department, Maharashtra, for an iron one block in Surjagad, the exchange filing said.

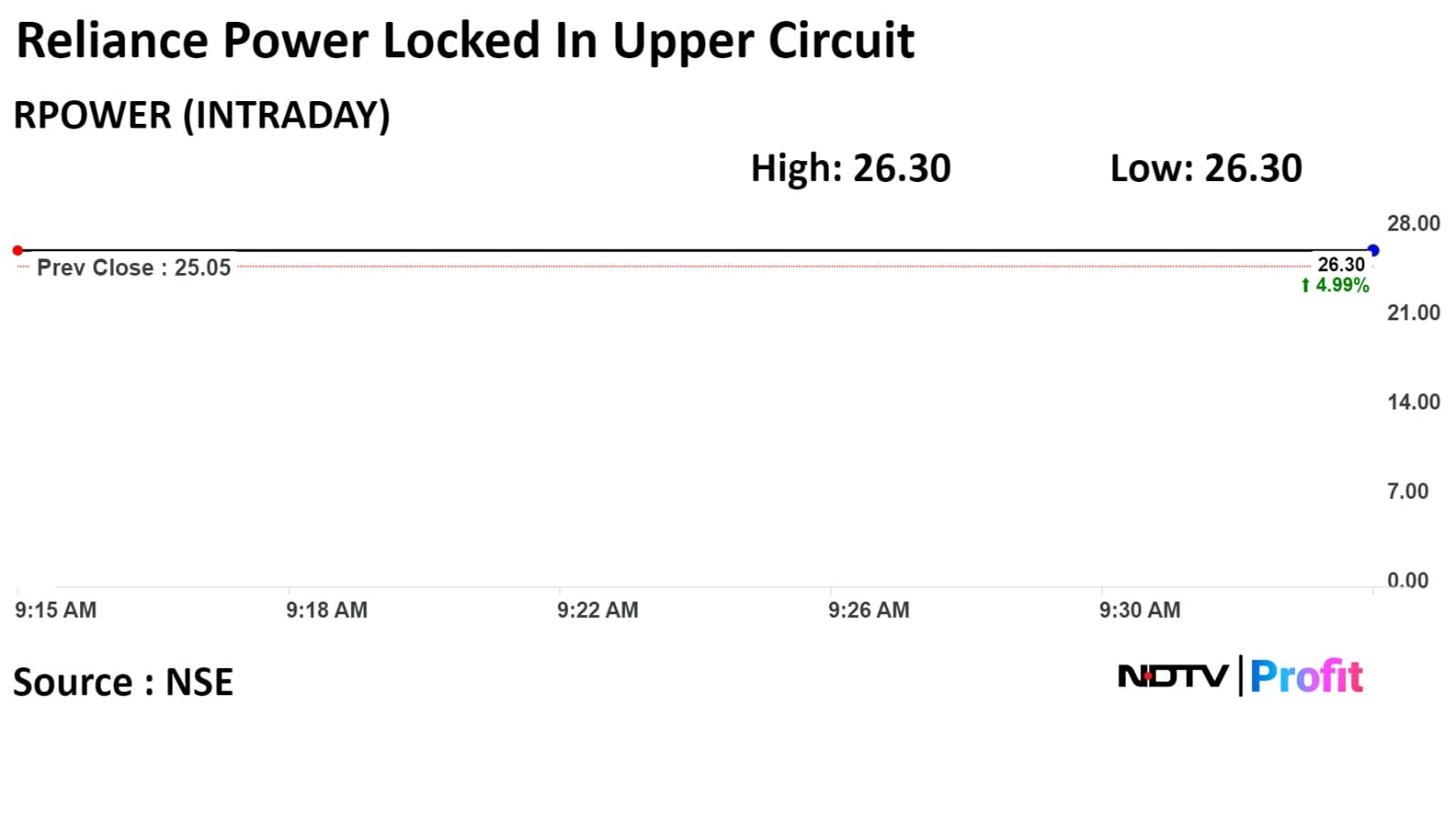

Shares of Reliance Power Ltd. were locked in their upper circuit on Friday after settling the entire obligations with respect to its borrowings from DBS Bank India Ltd.

As a result, its assets of 45-megawatt wind power project are free from encumbrance. The company had signed a debt-settlement agreement with DBS Bank on Jan. 5., according to an exchange filing.

Shares of Reliance Power Ltd. were locked in their upper circuit on Friday after settling the entire obligations with respect to its borrowings from DBS Bank India Ltd.

As a result, its assets of 45-megawatt wind power project are free from encumbrance. The company had signed a debt-settlement agreement with DBS Bank on Jan. 5., according to an exchange filing.

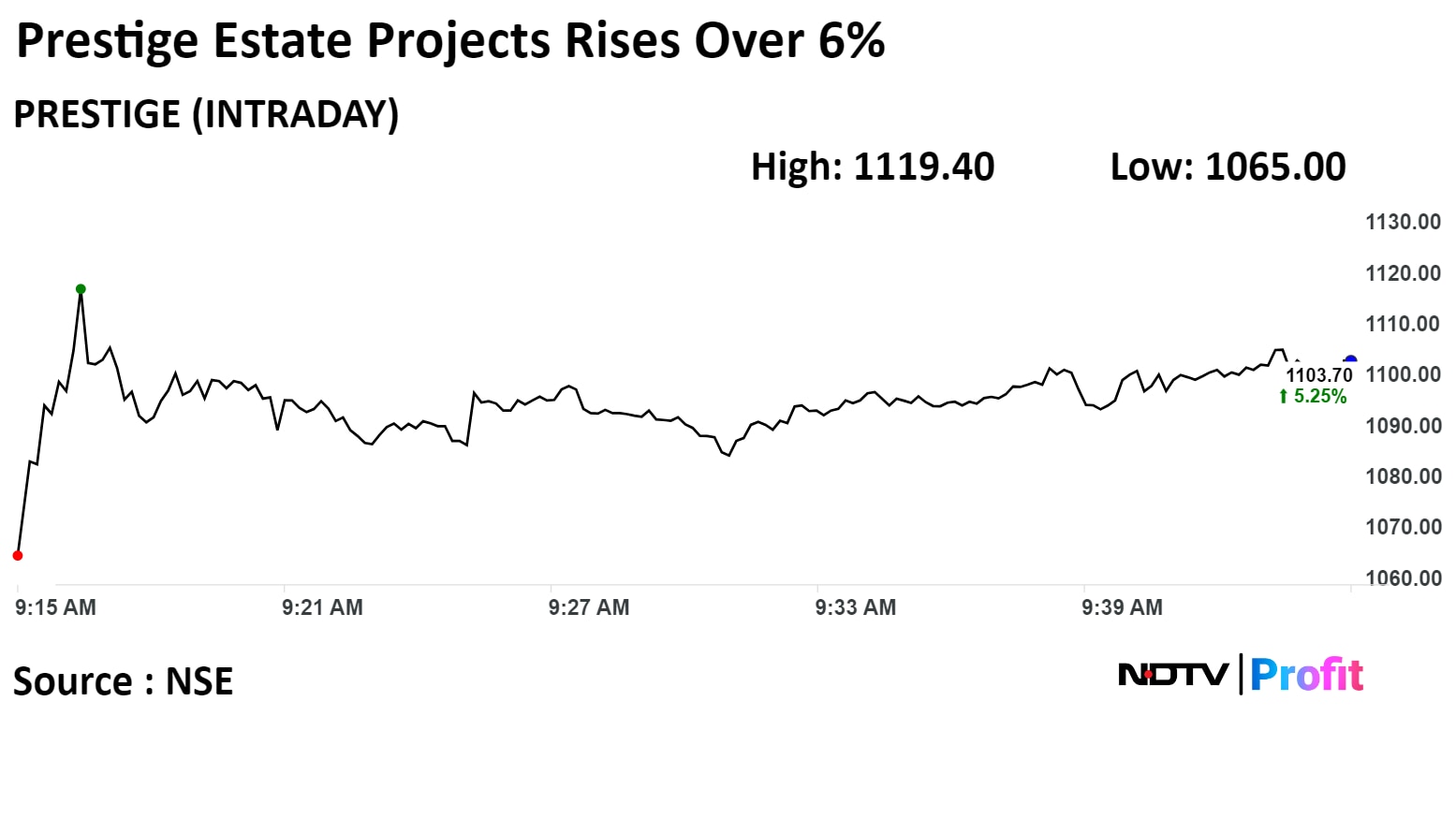

Prestige Estate Projects Ltd. rose to 6.75% to Rs 1,119.40, highest level since March 15 as the company has acquired land in India's National Capital Region.

The company’s unit acquired 62.5 acres land for Rs 468 crore in NCR for integrated township, the exchange filing said.

The scrip has risen 168.53% in 12 months. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 46.54.

Out of 19 analysts tracking the company, 15 maintain a 'buy' rating, one recommends a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.9%.

Prestige Estate Projects Ltd. rose to 6.75% to Rs 1,119.40, highest level since March 15 as the company has acquired land in India's National Capital Region.

The company’s unit acquired 62.5 acres land for Rs 468 crore in NCR for integrated township, the exchange filing said.

The scrip has risen 168.53% in 12 months. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 46.54.

Out of 19 analysts tracking the company, 15 maintain a 'buy' rating, one recommends a 'hold,' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.9%.

See capacity growth in early double digits

Look to add more than 1 aircraft per week to existing fleet

Passenger growth expected to increase by early double digits

Look to add around 10 destinations

Look to add 5,500-6,000 employees

Source: Investor Presentation

The yield on the 10-year bond opened flat at 7.06%.

It closed at 7.05% on Thursday.

Source: Bloomberg

The local currency weakened by 13 paise to 83.28 against the U.S dollar.

It closed at 83.15 on Thursday.

Source: Bloomberg

Shares of Indian Information Technologies tanked on Friday after global IT giant Accenture Plc lowered its revenue guidance for fiscal ending August 2024.

Piling on the troubles for India’s $250-billion IT services industry, Accenture sees its FY24 growth at 1-3% vs 2-5% previously estimated. The tech giant estimated its operating margin at 14.8% versus 14.8-15% earlier.

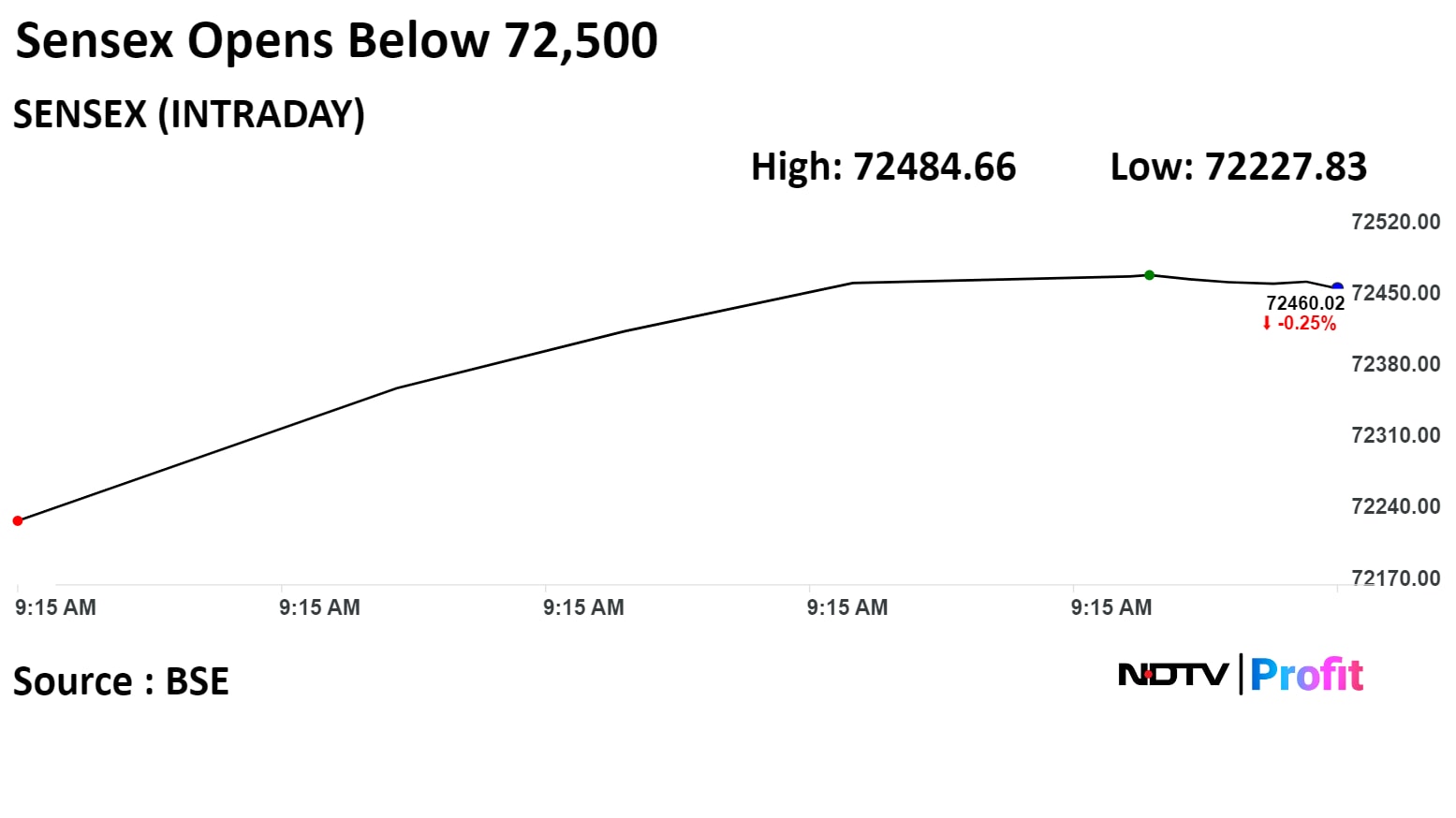

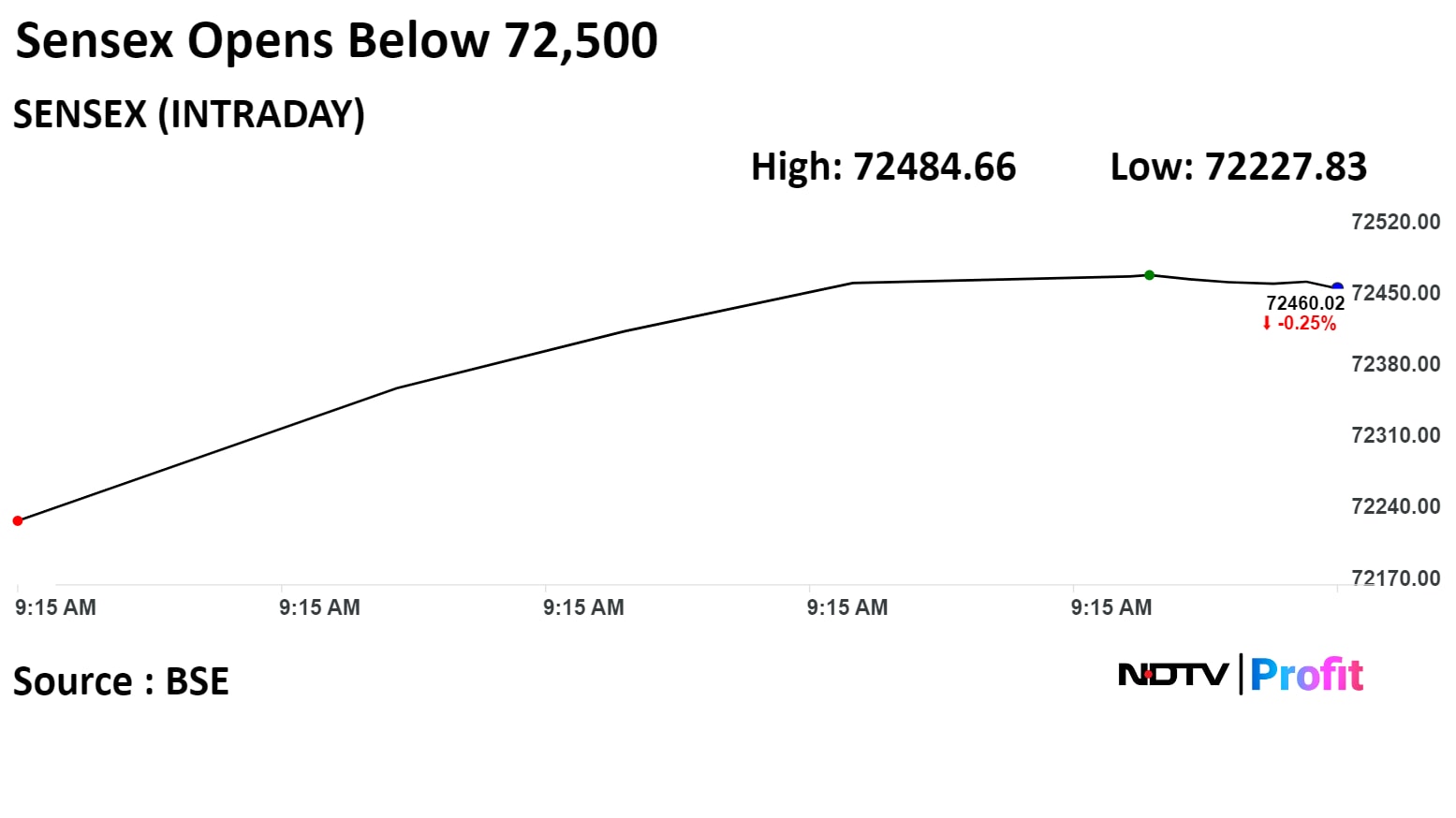

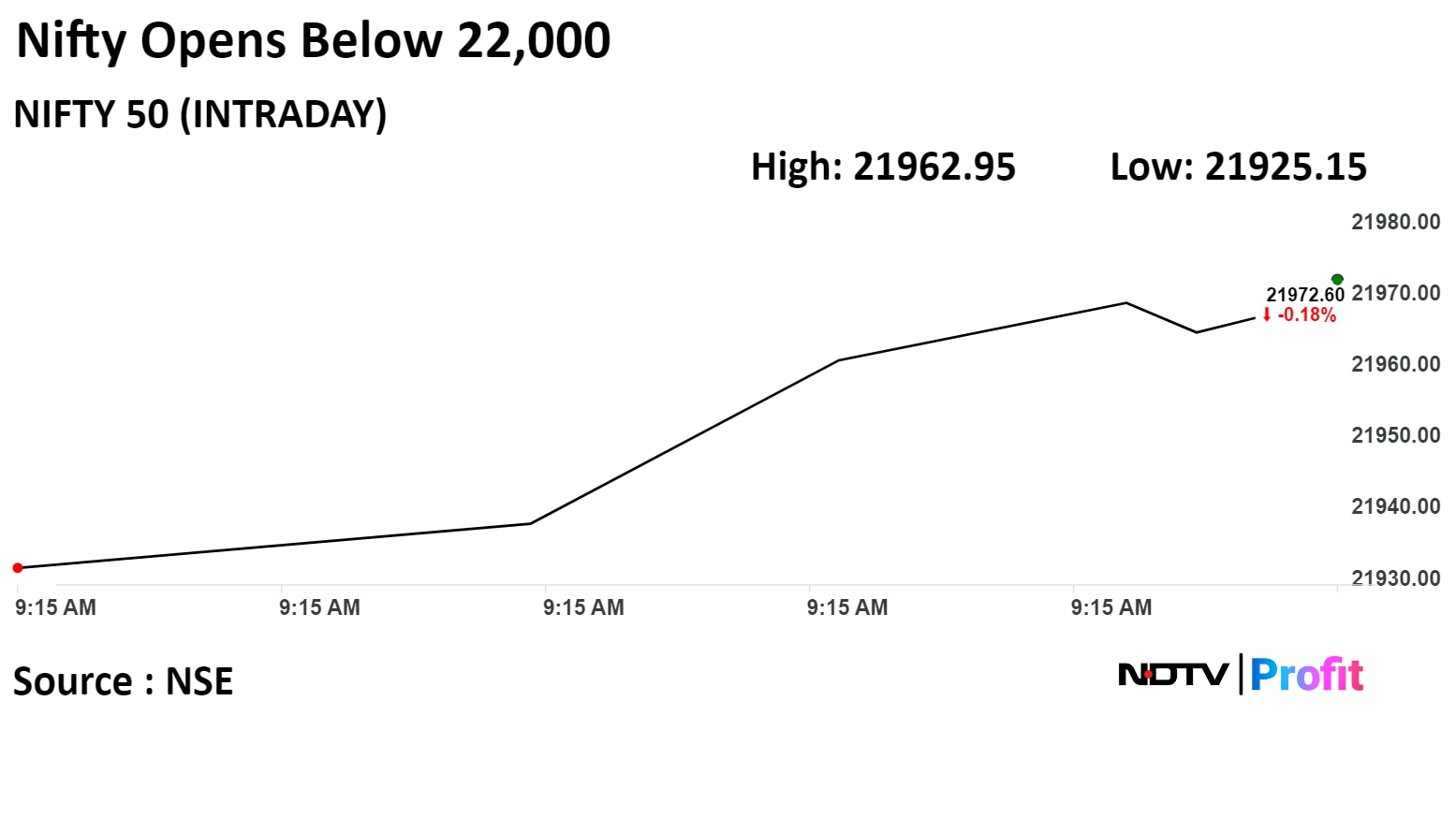

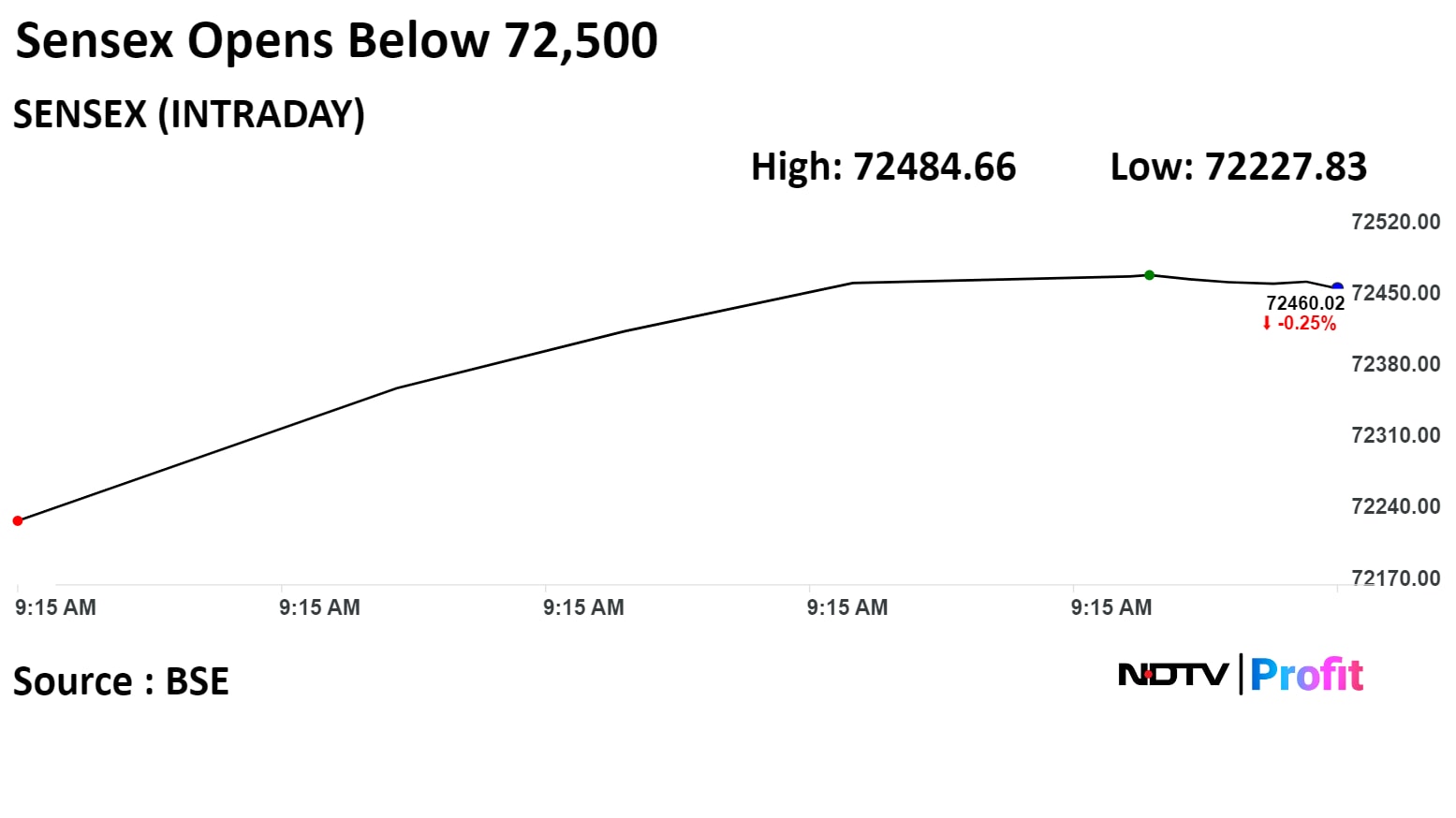

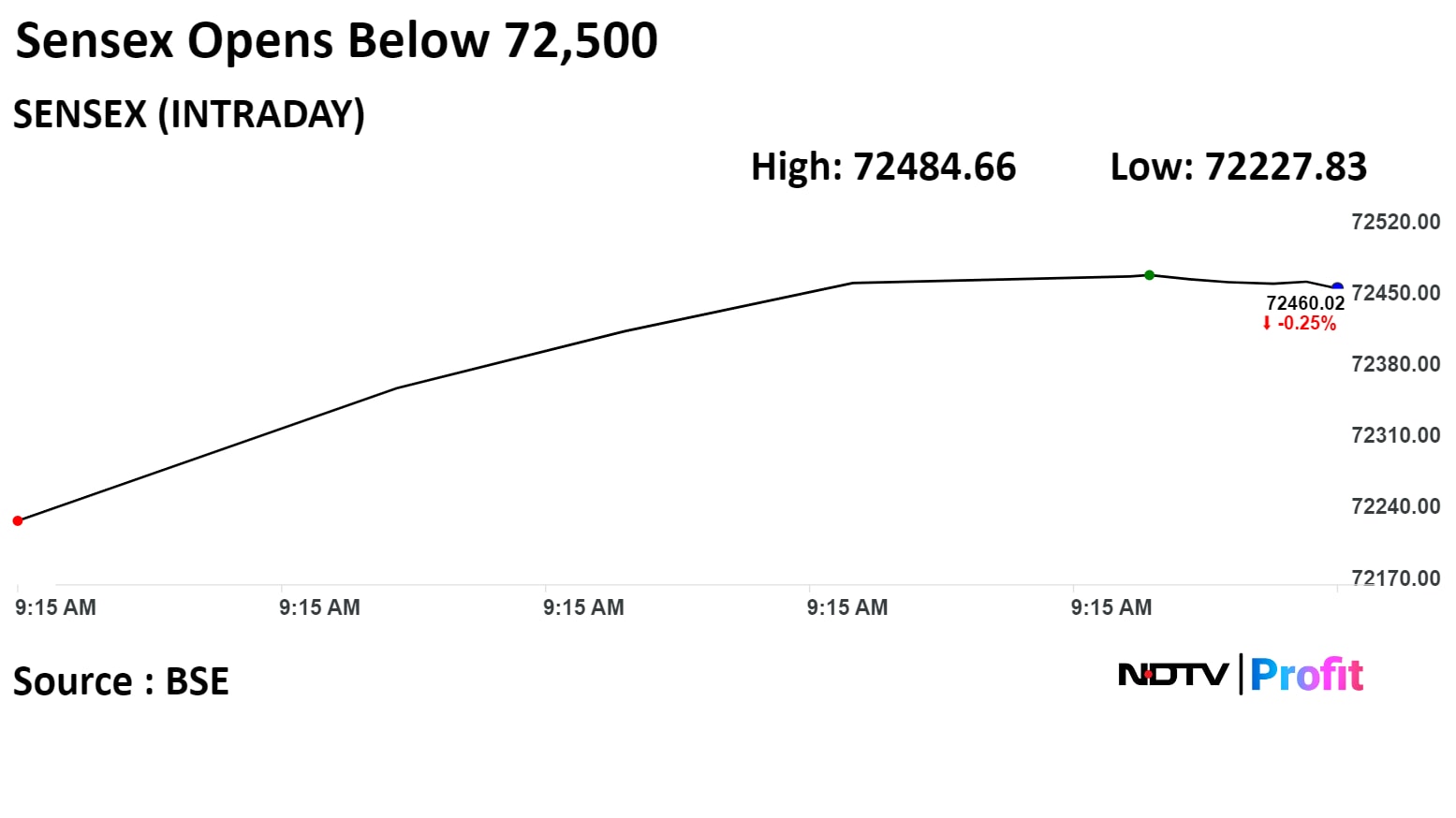

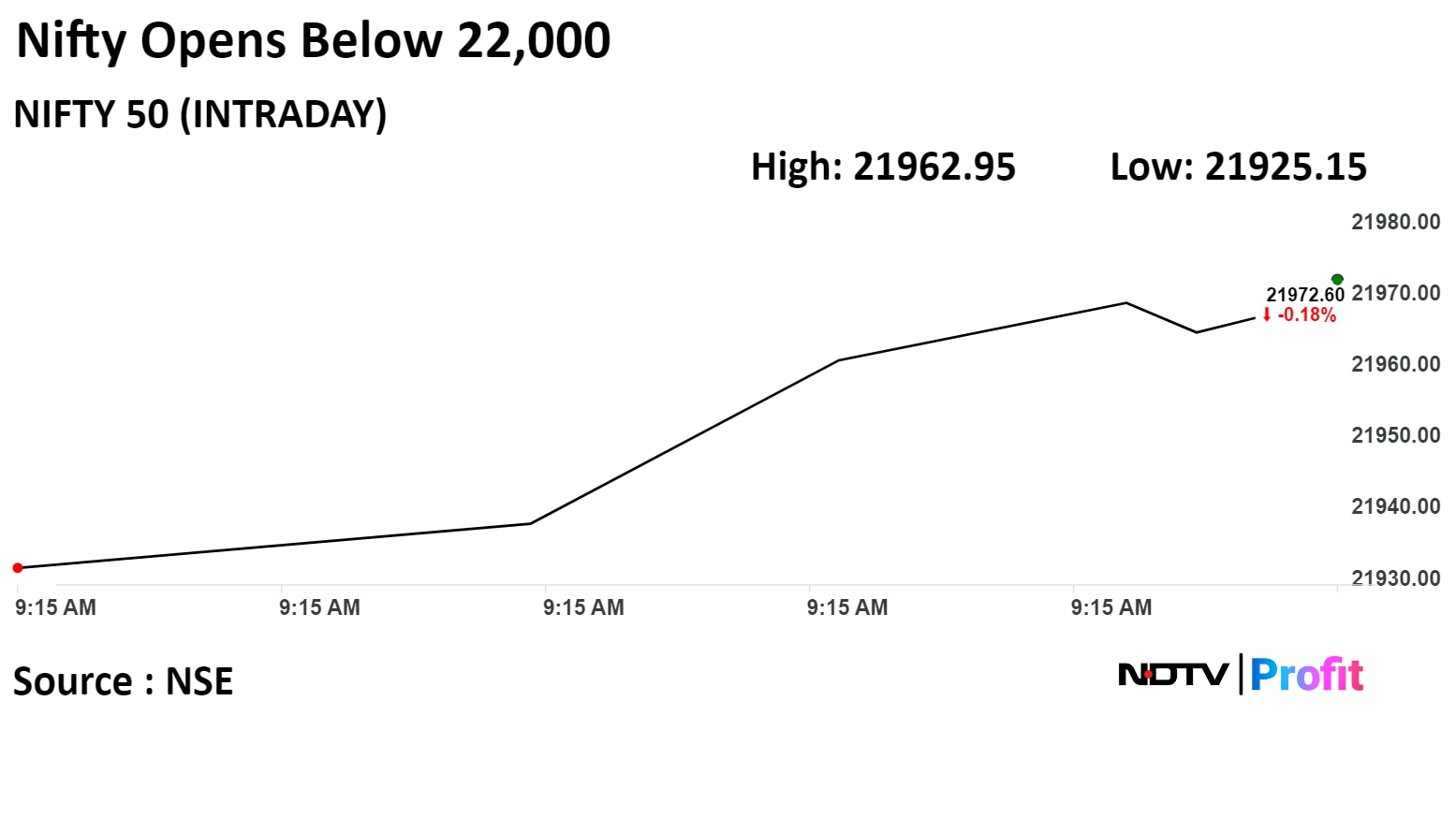

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

India's benchmark indices gave up gains from last session to open lower on Friday, dragged by sharp decline in IT stocks as Accenture cut its growth guidance.

As of 09:19 a.m., the NSE Nifty 50 was trading 51.30 points or 0.23% lower at 21,960.65, and the S&P BSE Sensex was trading 210.28 points or 0.29% down at 72,430.91.

"For the bulls, 21,900/72,300 should act as a trend-deciding level. Short-term resistance lies at 22,080 and 22,150/72,900-73,000 at higher levels. However, if the market falls below 21900/72300, traders may choose to exit long positions as the market could retest 21,850-21,800/72,100-72,000 levels," said Shrikant Chouhan, head equity research at Kotak Securities.

Infosys Ltd., Tata Consultancy Services Ltd., HCL Technologies Ltd., Tech Mahindra Ltd., and Wipro Ltd. weighed on the benchmark index.

Bharti Airtel Ltd., Larsen & Toubro Ltd., ITC Ltd., and Sun Pharmaceutical Industries Ltd. limited losses to the benchmark index.

On NSE, nine sectors advanced, two remained flat, and one sector declined. The Nifty Realty sector emerged as the top performer. The Nifty It sector plunged over 3% to become the worst performing sector.

Broader markets were trading on a mixed note on BSE. The S&P BSE Midcap was trading 0.32% lower, and the S&P BSE Smallcap was trading 0.23% higher.

Market breadth was skewed in favour of the buyers. Around 1,691 stocks rose, 1,023 stocks declined, and 115 stocks remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was trading 79.75 points or 0.36% lower at 21,932.20, and S&P BSE Sensex was trading 409.53 points or 0.56% lower at 72,231.66.

Morgan Stanley underweight on Torrent Power with a price target Rs 963.

Torrent Power has won a 300MW RE wind-solar hybrid project, cost Rs 3,650 crore, tariff of Rs3.65/unit.

The company has also won a TBCB project for cost of Rs 4,712 crore

Average levelized tariff of Rs 500 million per annum.

Both projects are to be completed in 24 months.

MS expects downside risk on both with mid-teens IRR.

FY27 EBITDA can see a 7-8% upside as both projects get commissioned.

Kotak upgrades Brigade to 'Add' rating kept its target price unchanged at Rs 1,025.

Stock has corrected 16% on concerns of ban on construction activity in Bengaluru

Strong prospects across development, leasing and hospitality

Bengaluru’s water crisis could get worse before it gets better

Currently trades at 6X adjusted EV/EBITDA on FY2026E earnings

Current weakness, an opportunity to add

Gensol Engineering Ltd. received an order for Rs 520 crore solar PV project in Maharashtra.

Order is for development of 100 MWAC/135 MWp solar PV power project across 500 acres.

Source: Exchange filing

Karnataka Bank Ltd. set floor price of QIP at Rs 231.43 per share

Floor price indicates a discount of 0.48% to the stock's previous close.

Source: Exchange filing

U.S. Dollar Index at 103.98

U.S. 10-year bond yield at 4.26%

Brent crude down 0.33% at $85.50 per barrel

Nymex crude down 0.35% at $80.79 per barrel

GIFT Nifty up 16.5 points or 0.07% at 22,058.50 as of 8:13 a.m

Bitcoin was up 0.23% at $65,619.31

Cut Accenture's revenue growth guidance for FY24(YE August) from 2-5% growth to 1-3%.

Inorganic growth component to 3% from 2%; organic revenue decline of 1%

Customers continue to be concerned about macro.

Global peers are guiding for a modestly weaker growth in 2024 vs 2023

The company's 4-7% revenue growth guidance range assumed for Infosys and HCL Technologies Ltd. for FY25 may be at risk.

Weak exit from FY24 for Indian IT companies and a possible weak start to FY25.

Maintain ‘underweight’ stance on the Indian IT Services sector.

Slower for longer’ phenomenon could lead to further downward earning revisions

Tier-2 pack has held out better than anticipated

Maintain TCS as our industry valuation benchmark

Accenture's growth was at midpoint of guided range, managed services slowed to decade low.

Tightening of client budgets, the company has cut FY24 guidance by 100-200 bps.

Weakness in EMEA, FS and communication verticals

Negative read through for Tech Mahindra Ltd., Tata Consultancy Services Ltd., Coforge Ltd.

Sector valuations rich, no recovery in sight

Nifty IT valuations at 26x PE, 13% premium to 5-year average, 29% premium to Nifty

Remain selective – Infosys, Coforge top picks

Jefferies maintains a 'buy' on Adani Enterprises Ltd. with a target price of Rs 3,800 apiece.

Management highlighted gradual rollout of GH2 ecosystem is to be most capex heavy and profitable venture.

The company's airports business to benefit from growth in traffic, non-aero trends.

NMIAL airport to commission by December 2024 or March 2025.

Copper facility to commission by March or April 2024.

Management denied receipt of any notice from DoJ of US reg investigaion into bribery allegations.

UBS maintains a 'buy' on Reliance Industries Ltd. and raised target price to Rs 3,420 apiece.

Believe earnings trajectory to reverse on better consumer business outlook.

Possible higher tariff hikes for Jio to help company.

Strong sub additions to drive 20% CAGR in Reliance Digital Ebitda over FY24-26

Raise FY25 retial revenue/ebitda estimates by 1%/4%

Reliance retail well placed to tap long term opportunity

Expect capex intensity to decline post FY24

Nuvama retains a 'buy' on Prince Pipes & Fittings Ltd., and raised target price to Rs 737 apiece from Rs 772 apiece earlier.

The acquisition valued at Rs 55 crore with revenue potential of Rs 100-120 crore at 13-15% margin.

No significant earnings expected from asset.

The company will need to free up bandwidth to revive the unit.

Flattish Q4, cut EPS by 9% in FY24, FY25 & FY26.

InterGlobe Aviation is said to be nearing decision on widebody jet order.

Indigo may look to order about 30 Airbus A350 planes.

The decision is likely to be announced in the next few weeks.

Source: Sources to Bloomberg

Remove Mahanagar Gas from midcap picks after rating downgrade

Sectoral preference and large-cap picks remain unchanged

India’s valuation premium vs EM/Bond Yields leave little upside

Large-cap valuations at >20x 1-year forward PE are >1 standard deviation above long term average

The Indian rupee strengthened by 2 paise to close at 83.15 against the U.S. dollar.

Nifty March futures up by 0.95% to 22,102.5 at a premium of 90.55 points.

Nifty March futures open interest down by 2.2%.

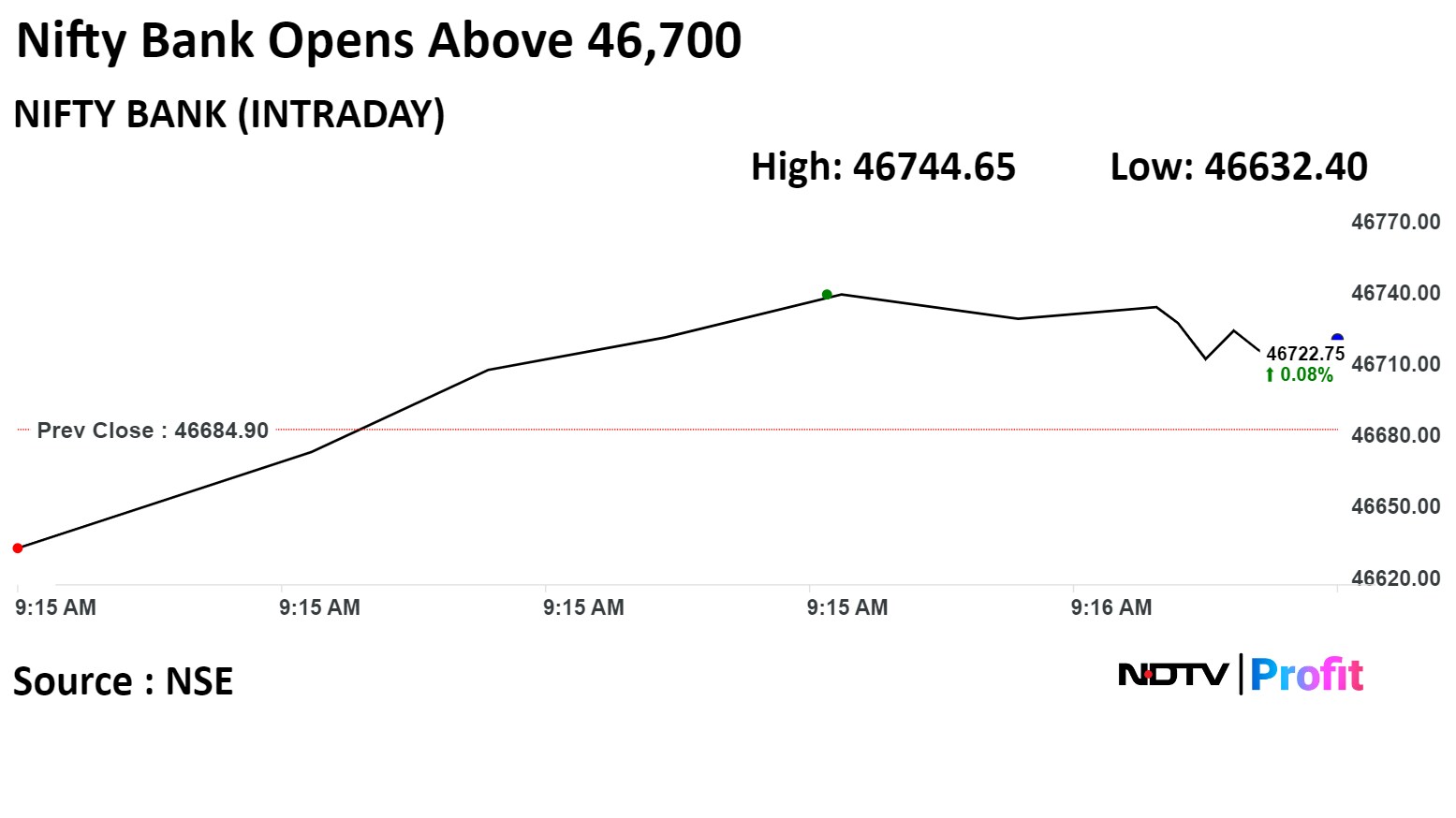

Nifty Bank March futures up by 0.77% to 46,794.65 at a premium of 109.75 points.

Nifty Bank March futures open interest down by 1.16%.

Nifty Options March 28 Expiry: Maximum Call open interest at 23,000 and Maximum Put open interest at 22,000.

Bank Nifty Options March 27 Expiry: Maximum Call Open Interest at 47,000 and Maximum Put open interest at 46,500.

Securities in ban period: Balrampur Chini Mills, Biocon, Indus Tower, Piramal Enterprise, SAIL, Tata Chemicals, Zee Entertainment Enterprise.

Nifty March futures up by 0.95% to 22,102.5 at a premium of 90.55 points.

Nifty March futures open interest down by 2.2%.

Nifty Bank March futures up by 0.77% to 46,794.65 at a premium of 109.75 points.

Nifty Bank March futures open interest down by 1.16%.

Nifty Options March 28 Expiry: Maximum Call open interest at 23,000 and Maximum Put open interest at 22,000.

Bank Nifty Options March 27 Expiry: Maximum Call Open Interest at 47,000 and Maximum Put open interest at 46,500.

Securities in ban period: Balrampur Chini Mills, Biocon, Indus Tower, Piramal Enterprise, SAIL, Tata Chemicals, Zee Entertainment Enterprise.

Price band revised from 5% to 20%: Mukka Proteins.

Ex/record dividend: Power Finance Corp, Mishra Dhatu Nigam, Bharat Electronics.

Ex/record Stock Split: Refex Industries.

Moved out into short-term ASM framework: Exicom Tele-Systems, Navkar Corporation, Reliance Infrastructure.

IEX: To meet analysts and investors on March 26.

Rhi Magnesita: To meet analysts and investors on March 27.

Indian Hotels: To meet analysts and investors on March 26.

Prataap Snacks: To meet analysts and investors on March 27.

GPT Healthcare: To meet analysts and investors on March 27.

Symphony: To meet analysts and investors on March 26.

Mangalore Chemicals and Fertilizers: Promoter Zuari Agro Chemicals created a pledge of 2.25 lakh shares on March 19.

Skipper: Promoter Ventex Trade acquired 66,000 shares on March 20.

Gokul Agro Resources: Promoter Ritika Infracon bought 92,500 on March 20.

IT Stocks: Indian information technology stocks are expected to fall, tracking a lowered revenue outlook for Accenture Plc.

Muthoot Finance: The company acquired an additional 4.48% stake in unit Belstar Microfinance for Rs 300 crore. The shareholding now stands at 63.50%.

Life Insurance Corp.: The company increased its stake in LTIMindtree from 4.99% to 5.03%.

Wipro: The company incorporated a new entity, 'SDVerse', with General Motors and Magna International.

Bharat Dynamics: The company approved the appointment of G. Gayatri Prasad as chief financial officer and approved the split of each share into two.

Reliance Power: The company has settled its entire obligations with respect to its borrowings from DBS Bank India. As a result, the assets of the 45 MW wind power project are free from encumbrance.

Mazagon Dock: The company accepted the Mumbai Port Authority's 29-year lease for the allotment of land and building on a long-term lease basis of 29 years. The total allotment costs Rs 354 crore.

Sarda Energy: The company’s unit received a letter of intent for a licence for an iron ore block in Maharashtra.

Tata Chemicals: The company received an order from the income tax department levying a penalty of Rs 103.6 crore.

Jindal Saw: NCLT-approved scheme of amalgamation among Jindal Quality Tubular, Jindal Tubular (India), Jindal Fittings and Company.

Tata Communications: The board approved an agreement to hive-off a new edged digital services business for Rs 458 crore.

Bank of India: The board will meet on March 27 to consider a proposal for fund raising through the issue of long-term (infra) bonds.

Azad Engineering: The company approved the incorporation of two subsidiaries.

Crompton Greaves Consumer Electricals: The company received notice from the income tax department for a tax demand of Rs 68 crore for AY23.

Prestige Estates: The company’s unit acquired 62.5 acres of land for Rs 468 crore in the NCR for an integrated township.

Samhi Hotels: The company invested Rs 5.55 crore in its subsidiaries, Duet India Hotels (Pune), and Rs 1.31 crore in Duet India Hotels (Ahmedabad).

Star Housing Finance: The company entered a co-lending partnership with Tata Capital Housing Finance S to service 5000 home buyers in the EWS/LIG segment in the first phase of engagement.

Lloyds Metals: The company will raise Rs 5,000 crore without resorting to debt.

Agro Tech Foods: Sachin Gopal resigned from the post of managing director.

Just Dial: The company received Rs 38.36 crore from Karnataka High Court after cancelling land allotment in Bengaluru Urban District.

Dhanuka Agritech: The company signed a memorandum of understanding with the Indian Council of Agricultural Research for scientific and technical cooperation.

Grauer & Weil (India): The company entered into a technology transfer and licence agreement with OTMK GmbH, which shall be valid for 10 years.

Japan's benchmark index, the Nikkei 225 index, hit a fresh high on Friday as data showed inflation in the region rose past the Bank of Japan's inflation target of 2% in February.

The Nikkei 225 was trading 0.40% higher at 40,978.26 as of 6:32 a.m. It rose to an all-time high of 41,087.75.

Japan's headline consumer price rose to 2.8% year-on-year in February from 2.2% in January, Bloomberg reported.

Other markets in the Asia-Pacific region were trading on a mixed note as investors assessed the Federal Reserve's policy outcome. The S&P ASX 200 was 0.30% down, and the KOSPI index was 0.22% higher as of 06:34 a.m.

The relentless rally in U.S. stocks powered ahead on optimism that the Fed will be able to engineer a soft landing, which would bolster the outlook for corporate earnings, according to Bloomberg.

The S&P 500 Index touched a fresh high on Thursday and settled 0.32% higher. The Nasdaq Composite and Dow Jones Industrial Average settled 0.20% and 0.68% higher, respectively.

Brent crude was trading 0.19% lower at $85.59 a barrel. Gold was higher by 0.18% at $2,185.27 an ounce.

The GIFT Nifty was trading 16.5 points, or 0.07%, higher at 22,058.50 as of 8:13 a.m.

India's benchmark equity indices gained for the second day, with financial services stocks contributing the most to advances following the U.S. Federal Reserve's decision to keep interest rates unchanged.

The NSE Nifty 50 ended 172.85 points, or 0.79%, higher at 22,011.95, while the S&P BSE Sensex was up 590.60 points, or 0.82%, at 72,692.29.

Overseas investors remained net sellers of Indian equities on Thursday.

Foreign portfolio investors offloaded stocks worth Rs 1,826.9 crore, and domestic institutional investors remained net buyers, mopping up equities worth Rs 3,208.9 crore, the NSE data showed.

The Indian rupee strengthened by 2 paise to close at 83.15 against the U.S. dollar.

Japan's benchmark index, the Nikkei 225 index, hit a fresh high on Friday as data showed inflation in the region rose past the Bank of Japan's inflation target of 2% in February.

The Nikkei 225 was trading 0.40% higher at 40,978.26 as of 6:32 a.m. It rose to an all-time high of 41,087.75.

Japan's headline consumer price rose to 2.8% year-on-year in February from 2.2% in January, Bloomberg reported.

Other markets in the Asia-Pacific region were trading on a mixed note as investors assessed the Federal Reserve's policy outcome. The S&P ASX 200 was 0.30% down, and the KOSPI index was 0.22% higher as of 06:34 a.m.

The relentless rally in U.S. stocks powered ahead on optimism that the Fed will be able to engineer a soft landing, which would bolster the outlook for corporate earnings, according to Bloomberg.

The S&P 500 Index touched a fresh high on Thursday and settled 0.32% higher. The Nasdaq Composite and Dow Jones Industrial Average settled 0.20% and 0.68% higher, respectively.

Brent crude was trading 0.19% lower at $85.59 a barrel. Gold was higher by 0.18% at $2,185.27 an ounce.

The GIFT Nifty was trading 16.5 points, or 0.07%, higher at 22,058.50 as of 8:13 a.m.

India's benchmark equity indices gained for the second day, with financial services stocks contributing the most to advances following the U.S. Federal Reserve's decision to keep interest rates unchanged.

The NSE Nifty 50 ended 172.85 points, or 0.79%, higher at 22,011.95, while the S&P BSE Sensex was up 590.60 points, or 0.82%, at 72,692.29.

Overseas investors remained net sellers of Indian equities on Thursday.

Foreign portfolio investors offloaded stocks worth Rs 1,826.9 crore, and domestic institutional investors remained net buyers, mopping up equities worth Rs 3,208.9 crore, the NSE data showed.

The Indian rupee strengthened by 2 paise to close at 83.15 against the U.S. dollar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.