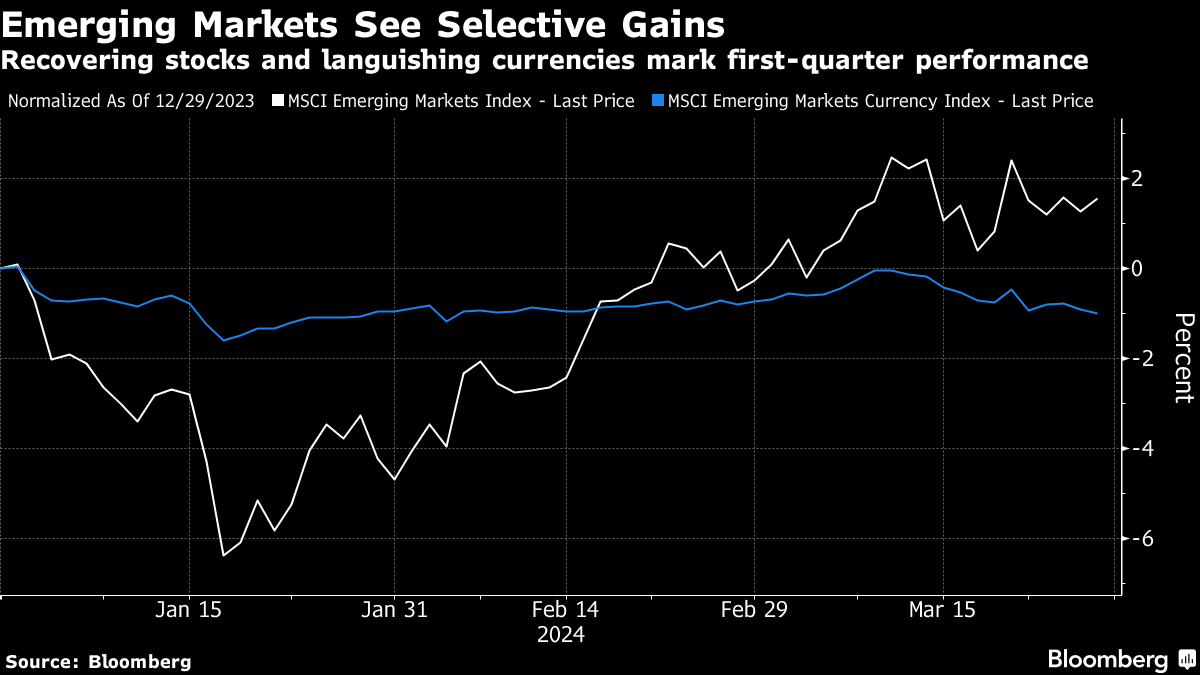

(Bloomberg) -- Emerging markets are closing the first quarter brimming with turnaround stories as investors in stocks and dollar bonds walk away with modest rewards, though a rally continues to elude local debt and currencies.

Some of the world's most vulnerable countries — including Egypt, Pakistan, Nigeria, Ecuador and Argentina — were the best performers across asset classes as they stepped up policy reforms or won billions in dollar flows. Thanks to those idiosyncratic stories, emerging markets moved past China's troubles even as investors pulled money from the world's second biggest economy amid policy and geopolitical risks.

All told, the benchmark MSCI Emerging Markets Index capped its second quarterly gain and third successive quarter of earnings upgrades. Sovereign-bond yields eased 7 basis points, which along with rising Treasury yields, helped to cut the risk premium for the developing world to the lowest since September 2021. A resilient dollar meant currencies were marginally down, hurting local bonds and carry-trade positions.

However, headline index numbers mask a dramatic improvement in investor sentiment toward developing economies during the quarter. Money managers as well as credit graders including S&P Global Ratings said the possibility of another default by a frontier nation has dimmed and monetary conditions have eased. Access to capital markets returned to previously troubled nations such as Kenya. By late March, interest-rate increases in Egypt, Turkey and Nigeria brought the carry trade back in the reckoning.

In the stock market, the star of the quarter was Taiwan Semiconductor Manufacturing Co., which accounted for most of the gains in the MSCI gauge amid demand for companies seen as riding the artificial-intelligence wave. It reentered the ranks of the 10 most valuable companies in the world.

Egypt, which bagged flows of $57 billion from bilateral partners as well as the International Monetary Fund, became a hot spot for interest-rate arbitrage, offering a return potential in excess of 20%. In the three weeks following its currency devaluation, investors committed at least $18.5 billion of funds to buy its local bonds — a signal the carry trade is about to revive.

Sri Lanka was on the verge of a deal with private creditors for a dollar-bond exchange, as it continued talks in London and invited banks to manage the transaction. That follows Zambia's deal to restructure $3 billion of Eurobonds, a rare victory for the Group of 20 Common Framework for resolving debt issues. Ghana is also on track to start negotiations with bondholders for a potential $13 billion restructuring.

On the last trading day before Easter holidays, Ukraine's dollar bonds posted the best performance in the developing world as investors awaited the latest economic-growth report.

Sentiment on Thursday was weighed down by a jump in Treasury yields following Federal Reserve Governor Christopher Waller's remark that there is no rush to lower interest rates at the US central bank.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.