(Bloomberg) -- The high tide for global interest rates has passed, but respite for the world economy may be limited as policymakers stay wary at the threat of inflation.

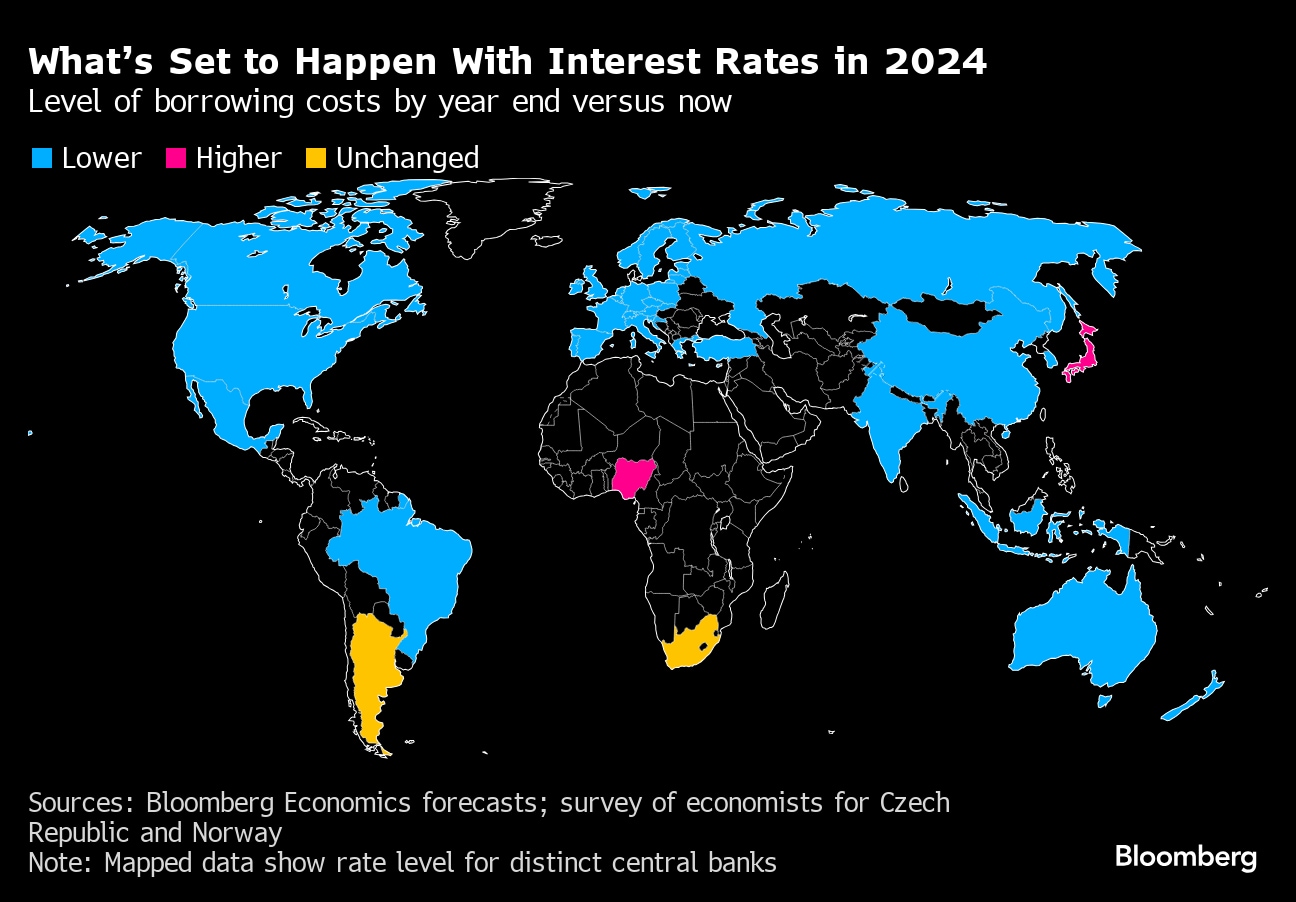

That's the dominant theme this year prevailing across 23 major central banks tracked by Bloomberg. All but three are seen set to reduce borrowing costs — but the pace of easing for many of them looks ever less likely to mirror the aggressive speed at which tightening first took hold.

Even if renewed US inflation concerns prove unfounded enough that the Federal Reserve can begin steady rate cutting, the grip of monetary policy on the world won't get markedly looser, according to Bloomberg Economics.

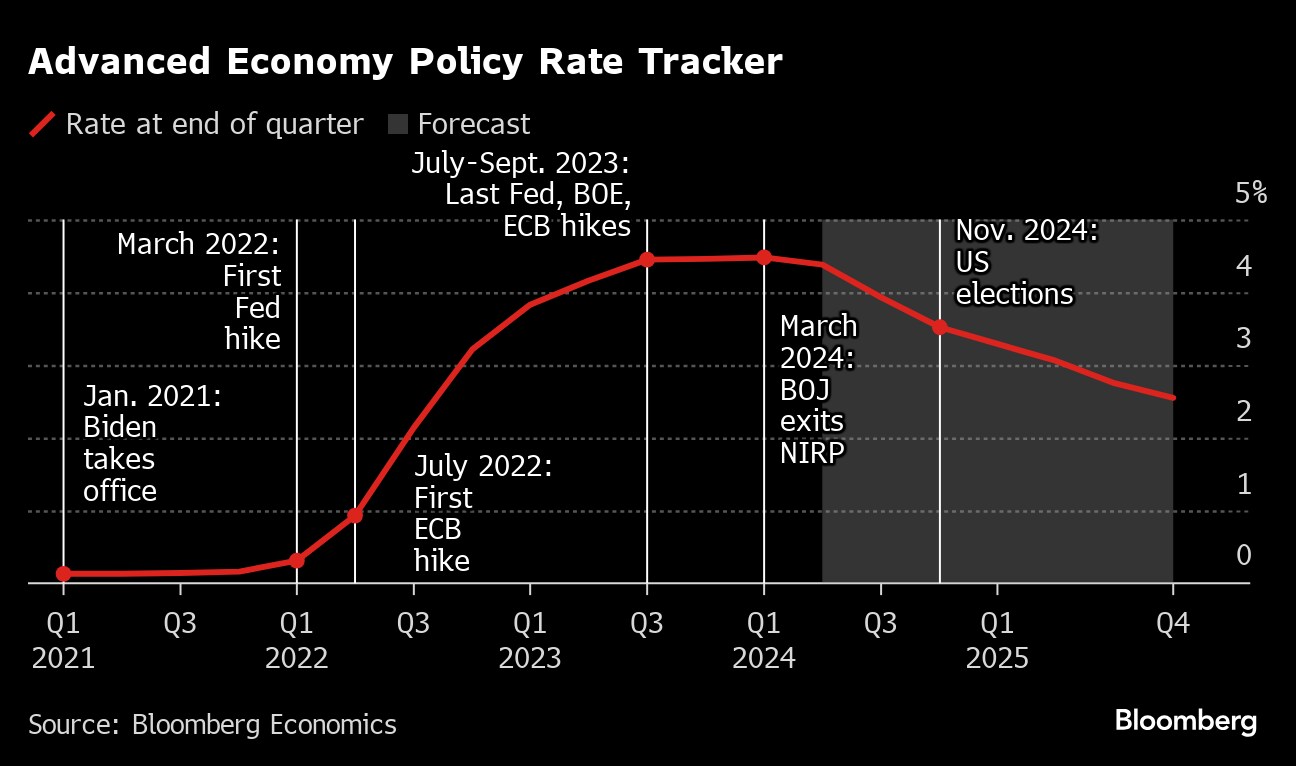

Its aggregate measure of borrowing costs across advanced economies is set to fall less than 100 basis points by the end of 2024. That's not as much as it rose last year, and just a fraction of the 435 basis-point increase seen since mid-2021. And the lag in transmission means easing effects will take more time to feed through.

Such a policy path reflects how central bankers are treading a fine line between aiding anemic economies and guarding against a resurgence in consumer-price growth, potentially aggravated by another energy shock. A cloudier outlook for the Fed and the shadow of US presidential elections won't help either.

Geopolitical tension, with conflict between Israel and Iran threatening conflagration in the Middle East, is an additional risk variable.

“Premature easing could see new inflation surprises that may even necessitate a further bout of monetary tightening,” International Monetary Fund chief Kristalina Georgieva said in a speech last Thursday heralding her institution's meetings in Washington this week. “On the other side, delaying too long could pour cold water on economic activity.”

Policy may remain constricted in South Africa and Argentina and even tighter in crisis-ridden Nigeria, while Japan is poised to continue its exit from ultra-loose settings. But for most of the world, rate-cutting cycles poised either to begin or advance may offer only mild relief to consumers and businesses.

What Bloomberg Economics Says:

—Tom Orlik, global chief economist

Here is Bloomberg's quarterly guide to the outlook for the world's top central banks, which set rate policy for a combined 90% of the global economy.

GROUP OF SEVEN

US Federal Reserve

- Current federal funds rate (upper bound): 5.5%

- Bloomberg Economics forecast for end of 2024: 4.5%

- Market pricing:

Fed officials will be watching for signs in the second quarter that inflation is still headed firmly toward their 2% target rate.

After easing rapidly last year, price pressures have picked back up in 2024. That's raised concerns about the inflation outlook and whether the figures are a mere blip — as Fed officials have long warned — or a more concerning sign that progress has stalled.

Recent consumer price data suggested the latter, with a key gauge of underlying inflation topping economists' expectations for a third-straight month in March. Investors now bet the US central bank will cut just twice this year, starting in September, according to futures markets as of April 11.

Much rests on the next few months of data — from the timing of the first rate cut to the total number of cuts this year. Most officials currently see two or three rate reductions in 2024, but an extended pause in inflation progress or an unexpected weakening in the labor market could very well alter the picture.

What Bloomberg Economics Says:

—Anna Wong

European Central Bank

- Current deposit rate: 4%

- Bloomberg Economics forecast for end of 2024: 3%

- Market pricing:

The ECB is on track to cut rates at its next meeting in June after President Christine Lagarde laid firmer groundwork for such a move at last week's press conference.

That would seal the euro zone's status as the first of the world's major economic jurisdictions to start easing. Some officials want the ECB to keep going after that, but Lagarde refuses to be drawn on any potential further steps.

With investors doubting the Fed's appetite to cut anytime soon, the ECB could find itself going it alone. While that would burnish a willingness not to follow the US lead, it also risks casting light on any difference that might emerge in the cost of borrowing on either side of the Atlantic.

Inflation threats posed by possible euro weakening that could result, or a potential surge in the oil price, might yet brake the ECB's efforts to reduce constriction on a tepid economy.

Lagarde insisted last week that her central bank is “not Fed dependent.” But she did acknowledge that the US is a “very sizable economy” and that any implications from there will feed its way into staff forecasts produced for the June 6 decision.

What Bloomberg Economics Says:

—David Powell

Bank of Japan

- Target rate (upper bound): 0.1%

- Bloomberg Economics forecast for end of 2024: 0.5%

- Market pricing:

The key question for the Bank of Japan is how fast it will continue normalizing policy after scrapping the world's last negative interest rate and calling time on its massive monetary easing program in March. Market players are keen for clarity on the timing of its next rate hike and the specifics of how it will unwind its gigantic balance sheet. The pace will depend on the central bank's confidence in a stable inflation path, with new quarterly economic projections in April likely to offer an important signal.

Most BOJ watchers expect the next rate hike by October with many of them warning of a possible earlier move with the feeble yen hovering around a 34-year low. If the government intervenes to try and stem the tide of currency weakness without success, the spotlight could quickly fall on Governor Kazuo Ueda to help out. Still, raising rates quickly would be a tough decision when the economy is still sputtering.

What Bloomberg Economics Says:

Taro Kimura

Bank of England

- Current bank rate: 5.25%

- Bloomberg Economics forecast for end of 2024: 4%

- Market pricing:

By the June decision, the Bank of England could be given confidence to cut by data that is likely to show headline inflation sinking below its 2% target, and the impact of wage settlements for the crucial month of April.

Governor Andrew Bailey has been guarded on the exact timing of a reduction but recently said the UK is “on the way” to cutting rates after a shift in tone from the central bank's rate-setters. While the next meeting in May, which includes a new round of forecasts, is seen as too soon for a pivot, the Monetary Policy Committee could use the decision to signal an imminent shift is ahead.

What Bloomberg Economics Says:

—Dan Hanson

Bank of Canada

- Current overnight lending rate: 5%

- Bloomberg Economics forecast for end of 2024: 4%

- Market pricing:

The Bank of Canada's governing council is actively debating when it can start to lower the benchmark from 5% after getting better-than-expected inflation prints to start the year. Still, economic growth is running hotter, and officials said they need to see more evidence to be confident price pressures are sustainably returning to the 2% target.

In a press conference after the April decision, Governor Tiff Macklem told reporters a June cut was “within the realm of possibilities.” Economists expect policymakers to ease monetary policy at that meeting, and the two inflation prints leading up to the decision are crucial guideposts in determining how much earlier the central bank will end up frontrunning the Fed.

What Bloomberg Economics Says:

—Stuart Paul

BRICS CENTRAL BANKS

People's Bank of China

- Current 1-year medium-term lending rate: 2.5%

- Bloomberg Economics forecast for end of 2024: 2.2%

China's first quarter growth might beat estimates, according to strong early data. But the PBOC is expected to stick to its easing path, given weak inflation, a sinking property market, and the relatively ambitious GDP growth target of around 5% for this year.

Worries about a weakening currency are weighing on Beijing's mind, limiting the chance of bold reductions to key landing rates before any Fed decision on easing. A cut to bank reserve requirements is likely to come first, with several economists expecting a 25-50bp reduction in the second quarter.

The PBOC is seen as likely to step up lending to policy banks to support housing and infrastructure projects. While excitement about new QE-like monetary tools is growing, such innovations appear to be a way off yet.

What Bloomberg Economics Says:

—David Qu

Reserve Bank of India

- Current RBI repurchase rate: 6.5%

- Bloomberg Economics forecast for end of 2024: 5.75%

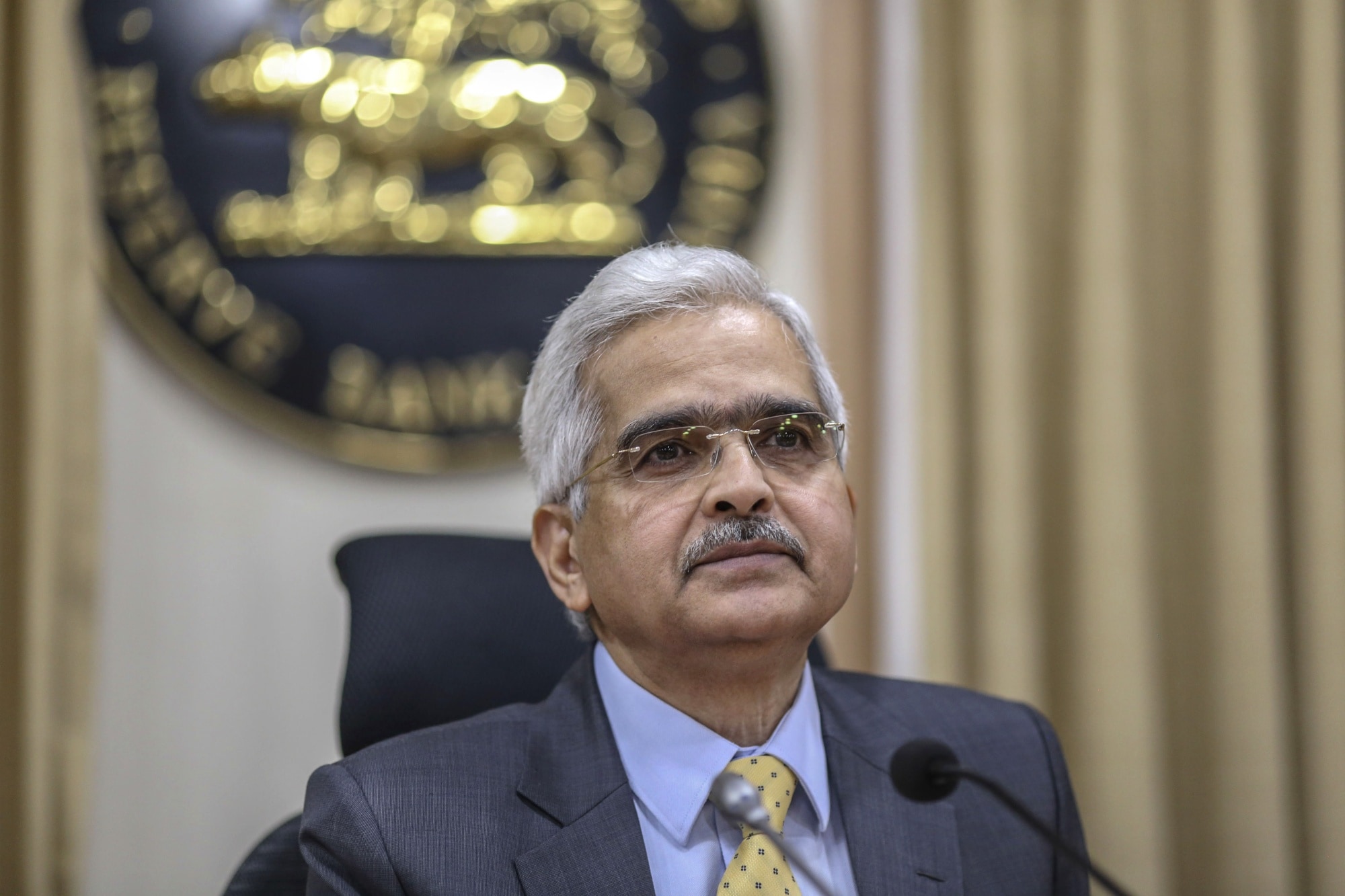

The Reserve Bank of India kept benchmark rate unchanged at 6.5% for the seventh straight review in April, while Governor Shaktikanta Das's hawkish tones dashed hopes of an early cut.

“We derive satisfaction from the progress made under disinflation, but the task is not yet finished,” Das said in his interaction with the media after the policy, vowing to maintain an unwavering focus on lowering the inflation near its target 4%. Inflation in March moderated for three straight months, but the print is still nearly a percentage point away from the target. Maintaining lower inflation is critical for Prime Minister Narendra Modi seeking a rare third term in elections starting next week.

Forecasts of high temperatures in April, May and June that could damage crops and push up food prices have also complicated the inflation management task for the central bank. For now, the RBI will watch out for the impact of an uncertain weather, and also wait to see the full transmission of its past 250 basis points rate increases getting fully transmitted through banking channels.

What Bloomberg Economics Says:

—Abhishek Gupta

Central Bank of Brazil

- Current Selic target rate: 10.75%

- Bloomberg Economics forecast for end of 2024: 9%

Brazil's central bank has signaled one more rate cut of 50 basis points at its next decision in May and opened the door to smaller reductions thereafter. Policymakers led by Roberto Campos Neto say heightened uncertainty forced them to change forward guidance that had previously indicated an easing path for two meetings ahead.

While annual inflation slowed more than expected in March, services costs remain elevated, prompting concerns about pressures from a tight labor market. Waning economic activity has pushed President Luiz Inacio Lula da Silva's government to increase spending, possibly leading to a more gradual consumer price slowdown toward target.

Doubts about the central bank's tolerance for inflation once Lula appoints a new governor later this year have also kept investors' consumer price estimates above the 3% target for months.

What Bloomberg Economics Says:

—Adriana Dupita

Bank of Russia

- Current key rate: 16%

- Bloomberg Economics forecast for end of 2024: 13%

After holding its key rate at 16% throughout the first quarter, the Bank of Russia signaled “a long period” of tight monetary conditions this year as it highlighted uncertainty over the economy amid persistent high inflation and worsening foreign trade due to sanctions over the war in Ukraine.

At their March 22 meeting, policymakers noted “proinflationary surprises” in data on a tightening labor market and consumer spending and lending that meant the risks underlying inflation would remain high “or go up are significant.”

Vladimir Putin's inauguration in May for a fifth term as president may be followed by a government shake-up that could impact policy as the state continues to spend heavily on the war including defense production.

What Bloomberg Economics Says:

—Alexander Isakov

South African Reserve Bank

- Current repo average rate: 8.25%

- Bloomberg Economics forecast for end of 2024: 8.25%

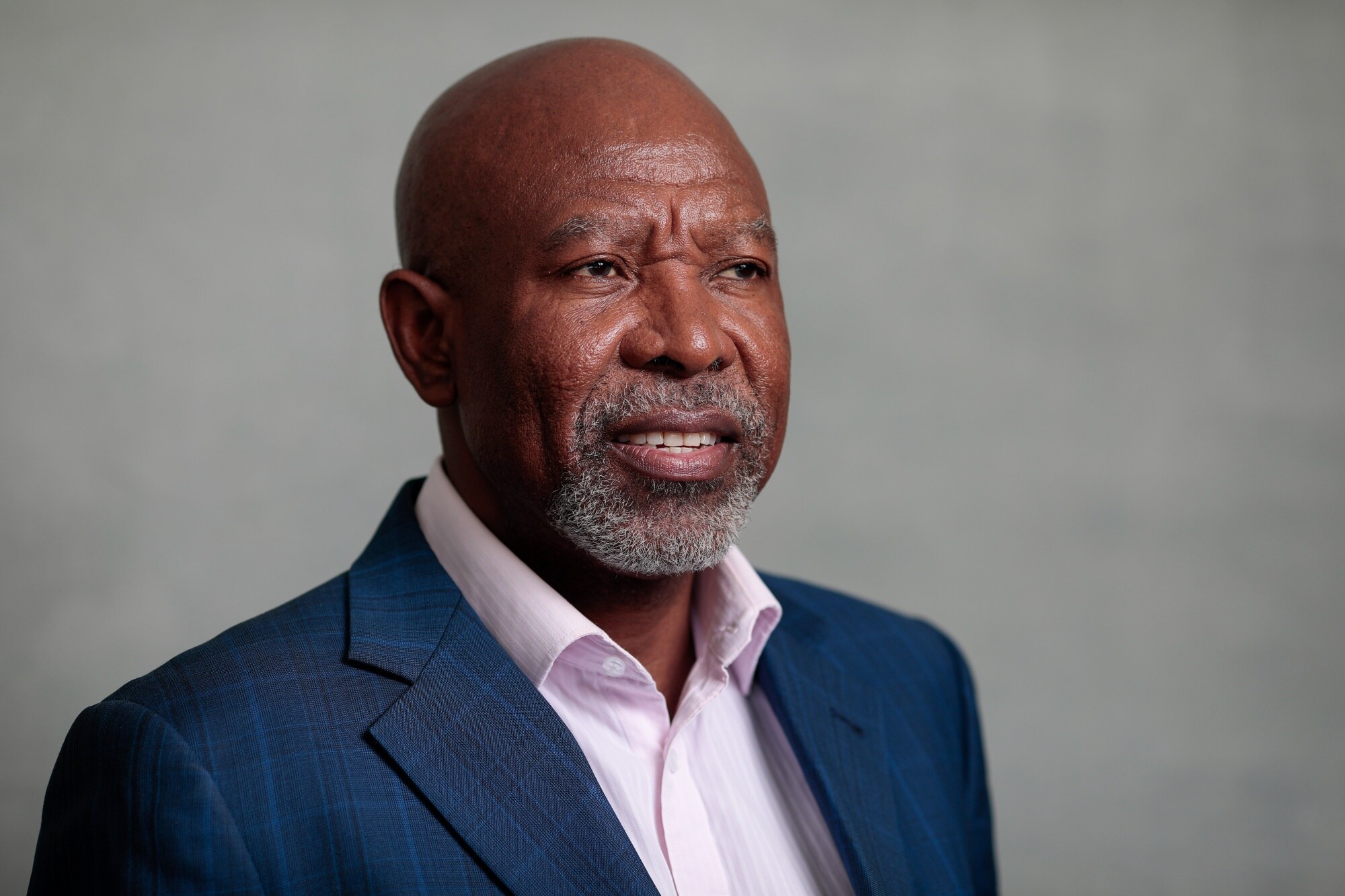

South Africa's central bank is set to maintain its key rate at a 15-year high this quarter as risks to its inflation outlook remain from higher oil prices, drought conditions and a resurgent dollar even as election uncertainty prevails. Governor Lesetja Kganyago and two of his deputies' terms were extended for another five years last month assuring policy continuity as the country prepares for elections on May 29 that could reshape its political landscape.

Opinion polls show that the ruling African National Congress may lose its majority for the first time since coming to power in 1994. “We deal with uncertainty all the time, elections are just one uncertainty we have to deal with,” Kganyago said recently. “We will still make decisions the same way.”

The central bank prefers to peg inflation expectations at the midpoint of its 3% to 6% target range. Kganyago has repeatedly said it will only lower rates once inflation retreats to the 4.5% midpoint and is sustained there.

What Bloomberg Economics Says:

—Yvonne Mhango

MINT CENTRAL BANKS

Banco de Mexico

- Current overnight rate: 11%

- Bloomberg Economics forecast for end of 2024: 10%

Mexico's central bank, known as Banxico, has promised that any further rate cuts after its initial reduction in March will be gradual. Latin America's second-largest economy has had robust domestic demand and sticky core inflation that has left some policymakers worried.

The bank has not ruled out further easing in coming meetings, with Governor Victoria Rodriguez saying they would have to decide “step-by-step.” Still, the five board members could remain split over the proper way to proceed. The one dissenting member in the last decision, in which the bank lowered the key rate to 11%, said she thought reductions were premature.

Mexico's inflation is expected to nearly reach the 3% target by the second quarter of 2025.

What Bloomberg Economics Says:

—Felipe Hernandez

Bank Indonesia

- Current 7-day reverse repo rate: 6%

- Bloomberg Economics forecast for end of 2024: 5.25%

Rupiah weakness will be top of mind for Bank Indonesia this quarter as the incoming government brings with it fresh fiscal risks that spurred heavy bond outflows. President-elect Prabowo Subianto's signature campaign pledge of free lunches for 80 million school children is expected to cost about 2% of GDP and has elicited warnings from credit raters.

Alongside a widening current-account deficit, declining foreign exchange reserves and stubbornly high food prices, Bank Indonesia will unlikely be in a rush to lower its policy rate until the second half of this year once there's greater clarity about the Fed's own easing path. It may look to lower reserve requirements, though, as a way to support bank lending in Southeast Asia's largest economy.

What Bloomberg Economics Says:

—Tamara Henderson

Central Bank of Turkey

- Current 1-week repo rate: 50%

- Bloomberg Economics forecast for end of 2024: 45%

Turkey's central bank is expected to hold its benchmark rate tight throughout the second quarter, with expectations that inflation will begin to slow as of June, after peaking above 70% in the coming months.

Policymakers have said the rates could be tightened further should the inflation outlook deteriorate. The central bank is likely to focus on sidesteps to cool demand and curb credit growth while trying to encourage savings in Turkish lira during this period. Risks to the inflation outlook include any potential interim hike to the minimum wage and the central bank has urged the to government to refrain from such a step.

What Bloomberg Economics Says:

—Selva Bahar Baziki

Central Bank of Nigeria

- Current central bank rate: 24.75%

- Bloomberg Economics forecast for end of 2024: 27.75%

Having delivered a combined 600 basis-point increase in the first quarter of the year, the risk of another rate hike in Nigeria has reduced. Its willingness to act has stabilized the naira, closed the gap with the parallel market rate and led to the return of foreign investors.

Key to what it does next will be the impact on inflation of a recent threefold increase in electricity tariffs that will affect millions of residents and businesses in the urban areas and talks of a new minimum wage in May. The inflation rate has been at more than triple the top end of the central bank's 6% to 9% target range since October.

What Bloomberg Economics Says:

Yvonne Mhango

OTHER G-20 CENTRAL BANKS

Bank of Korea

- Current base rate: 3.5%

- Bloomberg Economics forecast for end of 2024: 3%

Bank of Korea Governor Rhee Chang-yong set the scene for a potential policy pivot later this year as the board decided to keep the benchmark rate on hold for a 10th consecutive time on Friday. Revealing that no one in the board is ruling out the possibility of a rate cut if inflation decelerates to 2.3% in the second half as expected, Rhee said May will be an important month for the bank because that's when key economic and inflation data are due.

The change in his tone comes after in February he pushed back against speculation for an early policy pivot and sought to keep the focus on fighting inflation. While reiterating the bank prioritized helping to rein in prices, Rhee said the bank now wanted to create room for an eventual policy change. In a policy statement after the decision, the bank indeed removed “long” from its previous pledge to keep the rate restrictive “for sufficiently long.”

What Bloomberg Economics Says:

—Hyosung Kwon

Reserve Bank of Australia

- Current cash rate target: 4.35%

- Bloomberg Economics forecast for end of 2024: 3.6%

The RBA has signaled it's probably concluded an 18-month policy tightening campaign after taking borrowing costs to a 12-year high in an effort to quell inflation. Most economists expect the RBA's next move will be down, with an easing cycle expected to begin in earnest in the second half of the year.

Governor Michele Bullock has repeatedly highlighted that the rate path is uncertain. Just last month, she said the board can't rule “anything in or out,” indicating that she isn't yet ready to pivot to an easing stance, unlike counterparts in other developed markets. Australia's central bank meets next on May 6-7 and by then will have seen a key inflation reading for the first three months of 2024.

What Bloomberg Economics Says:

—James McIntyre

Central Bank of Argentina

- Current key rate: 70%

- Bloomberg Economics forecast for end of 2024: 70%

Annual inflation under President Javier Milei is running at a three-decade-high of 276%. Still, month-on-month price rises are dwindling, and Economy Minister Luis Caputo has said March's reading will come in at 10%. That's down from 26% in December, when Milei lifted price controls and devalued the currency.

Central Bank Chief Santiago Bausili has cut the benchmark rate from 133% to 80% since taking office in an aim to reduce interest payments on peso notes. Lower March inflation projections have fueled speculation of another reduction. However, the International Monetary Fund, which Argentina owes $44 billion, has laid out the expectation for rates to exceed inflation in order to encourage savings in pesos.

What Bloomberg Economics Says:

—Adriana Dupita

G-10 CURRENCIES AND EAST EUROPE ECONOMIES

Swiss National Bank

- Current policy rate: 1.5%

- Bloomberg Economics forecast for end of 2024: 1%

The Swiss National Bank surprised investors last month by delivering the first rate cut yet seen this cycle from one of the world's 10 most-traded currency jurisdictions.

Unexpectedly slow inflation data since then has so far vindicated that decision by policymakers including departing President Thomas Jordan.

Economists expect a slight acceleration in consumer-price growth over the coming months due to trickling down rent increases. But with inflation now at just 1%, that's unlikely to pose much of a worry. Two more cuts this year look probable.

What Bloomberg Economics Says:

—Maeva Cousin

Sveriges Riksbank

- Current policy rate: 4%

- Bloomberg Economics forecast for end of 2024: 3%

The world's oldest central bank has charted a path to easing that indicates it could announce a rate cut either May 8 or June 23, though a sharp depreciation of the Swedish krona that started in mid-March illustrates that currency moves remain a risk for Governor Erik Thedeen and his colleagues. Any further krona weakening that threatens to fuel import prices would lower policymakers appetite for moving ahead of the ECB's expected reduction in June.

Either way, the Riksbank has signaled that it plans to loosen monetary conditions at a modest pace after the initial move, allowing them to take stock of the impact of rate cuts before continuing to ease. The bank's current guidance indicates that its benchmark rate may be cut by 75 basis points, to 3.25%, by the end of this year.

What Bloomberg Economics Says:

—Selva Bahar Baziki

Norges Bank

- Current deposit rate: 4.5%

- Economist forecast for end of 2024: 3.75%

Norway's central bank is set to begin lowering borrowing costs from a 16-year high of 4.5% in the autumn, most likely in September, according to its latest outlook. Underlying inflation slowed last month more than forecast, countering recent signs of resilience to high credit costs in the energy-rich economy and suggesting the policymakers may not need to delay monetary easing to the end of the year.

Governor Ida Wolden Bache and other rate-setters have cited uncertainty on krone moves as another crucial factor that speaks in favor of a cautious stance. A wage deal between industrial unions and employers last weekend also signaled heightened risks for cost inflation as it secured somewhat bigger pay increases than expected. The central bank doesn't expect to reach its 2%-target on inflation on an average annual basis even by 2027, according to its latest economic projections last month.

Reserve Bank of New Zealand

- Current cash rate: 5.5%

- Bloomberg Economics forecast for end of 2024: 4.25%

The RBNZ is talking tough, saying it won't cut rates until 2025 in order to be sure that inflation, currently running at 4.7%, returns to its 2% target. Price pressures have been more persistent than policymakers would like as surging immigration swells the population and boosts costs such as rents. But with the economy in recession and expected to stay weak for much of this year, investors and most economists are picking a pivot to monetary easing sometime in the next six months. The RBNZ's chief economist has also acknowledged that if the Fed cuts

first, that may hasten New Zealand easing by driving up the exchange rate and damping imported inflation.

What Bloomberg Economics Says:

—James McIntyre

National Bank of Poland

- Current cash rate: 5.75%

- Bloomberg Economics forecast for end of 2024: 5.25%

Poland's central bank will likely hold off from cutting rates this year as policy makers expect inflation to flare up again as the government restores higher taxes on food and energy.

The administration of Prime Minister Donald Tusk is phasing out measures that the previous cabinet imposed in the wake of Russia's invasion of Ukraine to curb surging prices. Inflation is now back within the central bank's target for the first time in three years after peaking at 18.4% in February last year.

For Governor Adam Glapinski the outlook may worsen as government measures kick in and wages continue to grow rapidly. But he may have bigger concerns, too. The ruling coalition is planning to start a parliamentary probe after accusing Glapinski of political meddling before last year's election and other irregularities. The governor has denied any wrong doing.

What Bloomberg Economics Says:

—Alexander Isakov

Czech National Bank

- Current cash rate: 5.75%

- Median economist forecast for end of 2024: 3.65%

The Czechs have accelerated policy easing this year, delivering half-point cuts in February and March, as inflation hit the 2% target sooner than expected. The central bank signaled it will keep lowering borrowing costs, but less than implied in its forecast that sees the end-year level at 2.6%

Governor Ales Michl has warned that risks including rising costs for services and a weaker exchange rate could slow or halt rate cuts if they threaten to push inflation higher again. “That's why the bank board believes it's necessary to maintain a restrictive monetary policy and to keep approaching further rate cuts with caution,” he said after the March meeting.

--With assistance from Swati Pandey, Reade Pickert, Beril Akman, Tom Rees, Niclas Rolander, Piotr Skolimowski, Ntando Thukwana, Manuela Tobias, Ott Ummelas, Monique Vanek, Erik Hertzberg, Maya Averbuch, Bastian Benrath, Matthew Brockett, Maria Eloisa Capurro, Alice Gledhill, Tony Halpin, Tom Hancock, James Hirai, Claire Jiao, Scott Johnson (Economist), Sam Kim, Peter Laca, Matthew Malinowski and Nduka Orjinmo.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.