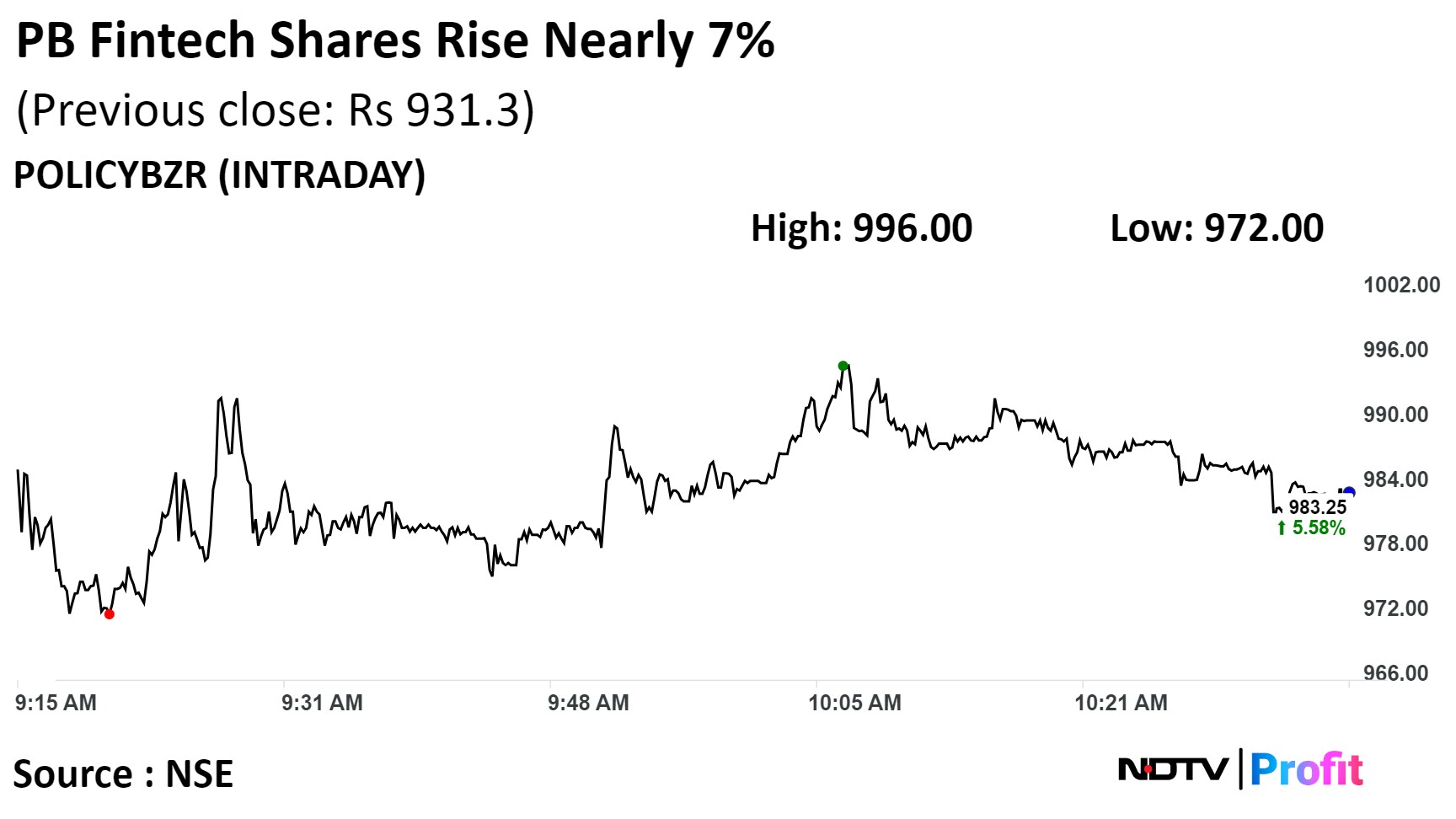

Shares of PB Fintech Ltd. rose nearly 7% after its unit, Policybazaar Insurance Brokers Pvt., received approval from the Insurance Regulatory and Development Authority for a licence upgrade.

Citi has retained a 'buy' rating on the stock, with a target price of Rs 1,150 per share, implying an upside of about 16.5% from its current market price.

The licence upgrade will allow the company to deepen its insurance penetration by bringing more technology, process control and data analytics-based innovation into reinsurance capacity, PB Fintech said in an exchange filing on Friday.

PB's deep domain understanding, rich customer data and robust data analytics engine will likely place it in a sweet spot within the reinsurance broking industry, Citi said in a note on Feb. 18.

"We expect PB's fresh business market share in existing businesses to increase multi-fold; PB Corporate is likely to benefit exponentially," it said.

The company's foray into reinsurance broking is likely to drive product innovation, market share gains and additional revenue streams, CIti said.

shares of PB Fintech rose as much as 6.95% during the day to Rs 996 apiece on the NSE. It was trading 5.78% higher at Rs 985.1 apiece, compared to a 0.23% advance in the benchmark Nifty 50 as of 10:40 a.m.

It has risen 100.86% in the past 12 months. The total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 64.3.

Twelve out of the 18 analysts tracking the company have a 'buy' rating on the stock, three recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.